At the start of April, a veteran art advisor watched a major deal “disintegrate in real time.” On Monday, March 31, a married couple based in the U.S. expressed interest in purchasing a specific contemporary artwork (the advisor declined to provide specifics about the deal)—the same day financial markets began swinging wildly in anticipation of President Donald Trump’s so-called “Liberation Day,” when he promised to detail sweeping new tariffs.

“On Tuesday, they texted and said they’re just slightly ‘freaking out’ with the market tanking and said ‘we might have to cancel the sale’,” the advisor recalled. By Wednesday, after the markets had dropped further, the deal was off.

This wasn’t an isolated incident. The president’s economic strategies, often announced abruptly and enforced with little warning, are creating ripple effects across industries and the art market is no exception. From advisors and dealers to shippers and fair organizers, everyone is trying to navigate what Trump’s unpredictable second-term policies mean for their businesses.

“The stock market is going up and down in these very strong, unexpected moves,” said a major dealer with galleries in the U.K., France, and South Korea. “Collectors are cautious on certain purchases.”

“People are asking about the increased chance of a recession,” Nicholas Olney, president of Kasmin gallery, said. He noted that “what we’re seeing in the market isn’t the result of a systemic issue like in 2008 and 2009, or a global pandemic,” but the arbitrary nature of the tariffs and the volatile rollout means the industry is operating without a clear roadmap.

Borders Become Bottlenecks

One of the most immediate impacts of Trump’s policy upheavals has been on shipping and logistics—a crucial but often overlooked component of the art business.

At Expo Chicago, which closed April 27, nearly two dozen Korean galleries participated under a partnership with the Galleries Association of Korea and Kiaf, a Seoul-based event. The partnership represented a major international expansion for the event, which has been eager to grow out of its regional niche, especially since the global fair group Frieze acquired it two years ago. When news of the tariffs broke just weeks before the fair, panic set in.

Many were fearful, wondering if their art shipments would be impacted, according to a source familiar with the new cross-cultural initiative. In the end, most works arrived without incident, due in part to a temporary pause Trump placed on the implementation of reciprocal tariffs, with the exception of China.

Installation view of Expo Chicago 2025. Photo: Lucy Hewett/CKA. Courtesy of Expo Chicago

For now, artworks imported into the U.S. remain exempt from tariffs (unless they were made in China). Section 1702(b) of the International Emergency Economic Powers Act (IEEPA) explicitly protects artworks, books, films, photographs, and similar cultural materials from presidential trade restrictions, as part of a safeguard for freedom of speech under the First Amendment. Crucially, however, antiques and design objects are subject to the universal 10 percent import tax, which could not only affect dealers participating in upcoming fairs like TEFAF New York—which specializes in antiquities and design—but could also cause confusion for galleries and customs agents alike.

Trump’s 90-day delay on tariffs hasn’t prevented issues in the interim. One U.S. dealer reported that a long-planned shipment of artworks from Mexico unfortunately coincided with “Liberation Day.” The truck was caught in a crush of vehicles at the border, each trying to cross into the U.S. before new tariffs potentially went into effect.

Furthermore, new de minimis rules issued by the White House earlier in April have lowered the threshold for formal customs processing from $2,500 to $800, causing major delays and logistical headaches across industries, including the art trade. While many art-specific shippers have their own shuttles and freight services, for art sellers using services that broker with large global logistics firms, even shipments that aren’t being imported to the U.S. are facing delays due to backlogs at customs centers, according to an auctions shipping specialist.

DHL temporarily suspended shipments over $800 to the U.S. due to customs delays. Photo: Marc Lehmann / BDX Media / DHL Group.

Could these delays and the looming threat of tariffs affect major upcoming sales, like New York’s fairs and marquee auctions in May? Potentially.

“Uncertainty makes people skittish,” said Jonathan Schwartz, CEO of the shipping company Atelier 4. “There are always good works of art coming to market, but buyers and sellers count on economic certainty when it comes to planning all of those related art services.”

He added: “I have clients who say ‘Oh, we really want to get this thing in the country before there’s tariffs.’ Well, there’s likely not going to be a tariff on your Matisse coming in from Paris.”

Fair Friction

As shipping delays unfold, so too does a larger reevaluation of how and where galleries participate in international events. On average, the dealer with branches U.K., France, and South Korea., participates in roughly 14 international art fairs per year, and will be part of upcoming several major New York art fairs in less than two weeks.

Meanwhile, other dealers said they are adopting a “wait and see” approach about which fairs to do or committing to in advance, even for fairs slated for this calendar year as retaliatory tariffs from other countries may also impact their decisions.

“It’s definitely a challenging time to be a border town,” said Olivia McManus, the director of Rivalry Projects in Buffalo, N.Y., which abuts the Canadian province of Ontario. “We work with a number of Canadian artists and collectors, and cross-border buying has slowed.”

The Canadian and American flags fly side-by-side outside in Thunder Bay, Ontario. Photo: Joey McLeister/Star Tribune via Getty Images.

Canada and China are among the countries that have already instituted retaliatory tariffs against the U.S., although other nations, like the U.K., have threatened their own. Canada put a 25 percent tax on C$30 billion ($21 billion) worth of U.S. goods in March, and that includes paintings, drawings, photographs, and other decorative works. Canadians have also led an increasingly widespread boycott of U.S.-made goods in protest of the Trump administration’s heavy-handed trade negotiations.

The threat if not the realization of a trade war—and the ensuing ill will from other nations—may push more U.S. dealers and collectors toward regional fairs and auctions.

“The Canadian attitude toward the U.S. is understandably tense,” McManus said, noting that her gallery, which just exhibited at Expo Chicago, decided to forgo Art Toronto this year because of concerns about import costs and the perception of American galleries abroad. Instead, Rivalry is exploring participating in a new Detroit-based art fair, Season, launching in September.

Goodbye Globalization?

One of Trump’s stated goals with the tariffs has been to boost American businesses, so could this trend toward regional trade be considered a win? Most dealers don’t think so in the long run.

“Everything is intertwined,” one dealer said. “[The tariffs] will affect every last part of the economy and the art market is part of it.” They were specifically concerned about China, which so far is apparently not making a distinction on artwork where tariffs are concerned. Meanwhile, the U.S.’s new 125 percent tariff applied to Chinese goods—which were not postponed by Trump—raises total duties on Chinese antiques to 152.5 percent, while contemporary artworks now face 27.5 percent duties (20 percent plus a preexisting 7.5 percent).

Guests view an artwork by Louise Bourgeois during Art Basel Hong Kong 2025 preview night at the Hong Kong Convention and Exhibition Center on March 27, 2025, in Hong Kong, China. Photo: Keith Tsuji/Getty Images.

“We do sell a lot of American art in China,” said the dealer. “This will definitely impact that. We will watch and see how this will play out and if it will become a big challenge to sell those artists in China.”

Edouard Gouin, CEO of art shipping firm Convelio, said that the tariffs could have a “Brexit-like” effect on the U.S. art trade and many clients are rethinking their involvement in U.S. fairs, as the financial risks now feel harder to justify, with some looking instead to Middle Eastern events. The United Arab Emirates, for instance, maintains a low 5 percent import tax and, last year, introduced new customs exemptions for art institutions.

Meanwhile, Christie’s and Sotheby’s are already planning to open new offices in Saudi Arabia and both just launched headquarters in Hong Kong last year. Though New York still reigns supreme when it comes to high-value auction sales—eight of the 10 most expensive artworks sold at auction last year were sold in the Big Apple, according to the Artnet Price Database—these new outposts could allow the big houses to route more material through other regions. American collectors buying abroad may choose to keep their purchases in freeports instead of importing them to the U.S. to avoid costly fees.

“The art market, like Wall Street, needs stability to thrive. When your financial portfolio is being whipsawed, you’re not likely to sell your condo just to buy a Condo,” said art law expert Thomas Danziger. But he noted that demand remains for exceptional works, despite the art market’s broader contraction over the last two years. We’ve assisted clients with several great contemporary works and a museum-quality Monet for the upcoming May auctions in New York. “There is always an appetite for terrific works when they come up for sale, whatever the Dow may be doing.”

Phyllis Kao at the rostrum during Sotheby’s Modern Evening Auction in New York on November 18, 2024. Courtesy of Sotheby’s.

Indeed, the Dow hasn’t been doing well. Earlier this month, Federal Reserve Chair Jerome Powell warned that tariffs could create a “challenging scenario” by putting the Fed’s two key goals—stable inflation and a strong labor market—at odds. Stocks and bonds fell and the dollar weakened further after Trump attacked Powell on social media, calling him “a major loser” and blaming him for a potential economic slowdown.

New Game Plan

Liz Parks, a contemporary art advisor based in New York, isn’t confident that things will turn around quickly. “Things had been pretty good up until this month. I think things are going to be chaotic for the foreseeable future, and you need to adjust the game plan completely.”

It’s telling that a number of sources contacted for this article, including major trade associations and leaders of art fairs, declined to comment at all given how tense and tenuous the situation is. One source suggested that speculating about concerns and potential scenarios under which business might have to be conducted could actually just make things worse.

Still, Parks sees an upside. Given the stock market jitters, “one could argue now is a great time to be collecting art. When the broader markets get shaky, art can become a place to anchor.”

Allie Card, senior director at Lehmann Maupin Gallery, which has branches in Hong Kong, London, New York, and Seoul, took a wider view, noting that many established galleries boast an international roster of artists and can continue to provide spaces for multicultural exchange. It’s an “antidote to the unbridled isolationism and cruelty that has now become the norm” under Trump, she said.

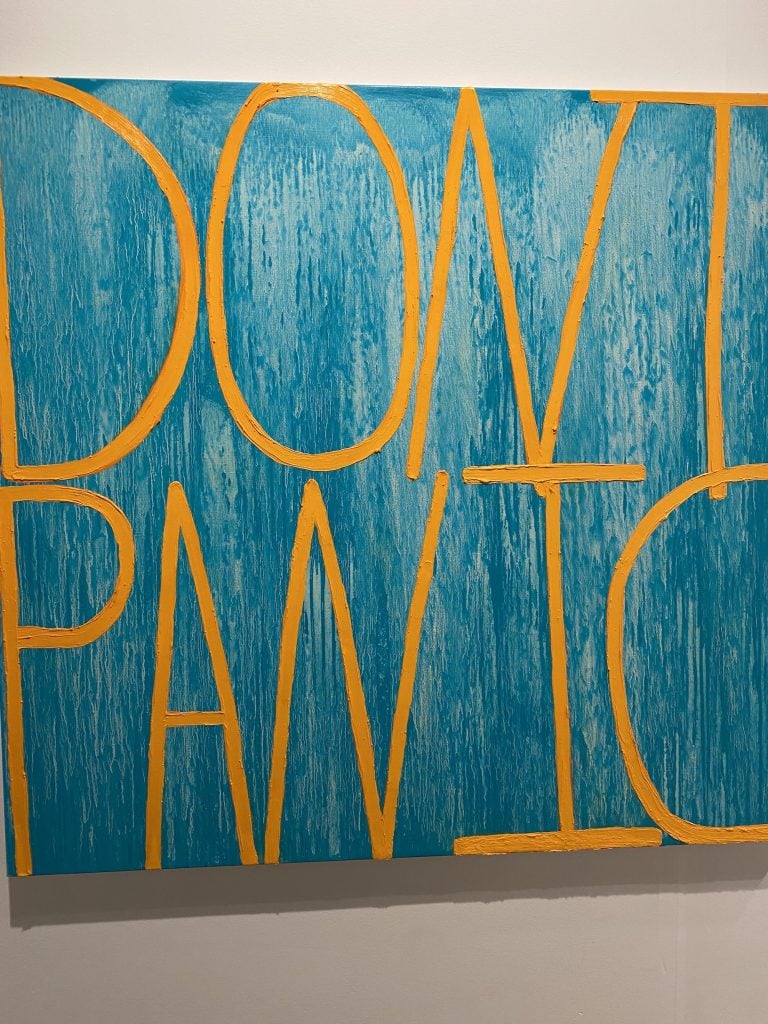

Sam Jablon, Don’t Panic (2025) at The Pit, Los Angeles booth at Expo Chicago. Photo: Eileen Kinsella.

Larger galleries, as well as ultra-wealthy art buyers, may be more insulated from the trade headwinds Trump has put into motion in the last 100 days and many have the luxury of taking a watch-and-wait stance. According to the latest Art Basel and UBS Art Market Report, the outlook for 2025 remains mixed: 33 percent of dealers expect improved sales (down from 2023), and 47 percent anticipate stability; 19 percent foresee further decline.

Optimism is strongest for the mid-market, where 51 percent of dealers expect growth for sales in the $500,000-to-$1-million range. Only 19 percent of the largest dealers (with turnover of $10 million-plus) thought sales would improve in 2025 although the majority felt sales would stabilize. Published just days after Trump’s “Liberation Day” on April 2, the report’s results do not account for any new tariff trauma among the trade, but it could point to post-tariff baseline.

“Uncertainty can create short-term paralysis,” Kasmin’s Olney said. “But there are certainly still deals being done.”

This post was originally published on this site be sure to check out more of their content