Abstraktes Bild, Gerhard Richter, 1986. Sotheby’s

On March 13, 2024, Art Basel and UBS released their annual art market report authored by cultural economist Dr. Clare McAndrew of Arts Economics. The Art Market Report 2024 is the eighth edition of the report which was previously published by TEFAF, before being sponsored by Art Basel and UBS in 2017. It offers a comprehensive data-first representation of the art market over the span of 2023 and is certainly an indispensable resource for market participants to assess economic trends and transformations in the art world. The report also makes a concerted effort to find a silver lining around the art market’s lack of growth. A closer look at the Art Market 2024 will highlight its key findings and reframe them within a broader macroeconomic context. When viewed in this light, the art market’s extended period of severe stagnation justifies an aura of concern which is noticeably absent from the report.

Real Figures Depict Bleak Outlook

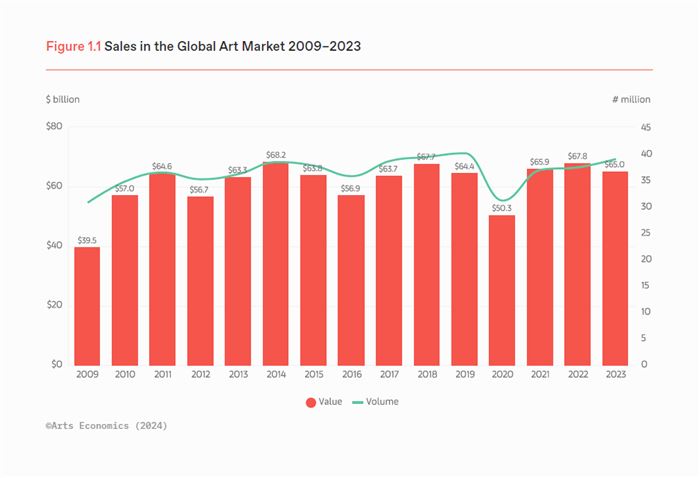

The document’s principal finding is that “Following two years of growth, sales in the art market slowed in 2023, falling by 4% year-on-year to an estimated $65 billion.” McAndrew is quick to find consolation in the decline, however, stating, “Although sales were down year-on-year, values remained above the pre-pandemic 2019 level of $64.4 billion.”

In pointing out that 2023’s sales surpassed their previous level from before the economic damage caused by the lockdowns, McAndrew puts forward the idea that the art market has “recovered” from the pandemic. However, one of the main issues with the Art Market Report is that it deliberately uses nominal rather than real financial figures to present a more favorable picture of the market.

A startling rise in inflation has taken place from 2021 until now, with year-over-year inflation prints reaching higher than they had since the early 1980s. When the compound effect of inflation is taken into account, the total inflation over the period of 2019 – 2023 in the US is above 22%. This number could in fact be a conservative figure. In the United Kingdom, the world’s third-largest art market, inflation has been even higher over the past five years. When presented in real terms which register the 22% inflation rate the art market’s 2023 performance of $65 billion in sales is in fact dramatically below its 2019 level of $64.4 billion.

The nominal figures presented in the Art Market Report gloss over the post-lockdown economic reality and how the art market has actually failed to recover.

Zooming Out

The Art Market Report’s rosy depiction of the market situation also avoids coming to terms with an undeniable degree of stagnation over the past ten years. As the chart below from McAndrew’s report clearly shows, global art market sales have not surpassed their high watermark of $68.2 billion from 2014. That marks a decade of stagnation in nominal terms, and a major decline in real terms. The chart also shows that art market sales reached $64.6 billion as far back as 2011. 2023’s sales totals represent less than a percentage point increase over the art market’s 2011 performance, again, without taking inflation into account. In real terms, the art market’s annual sales have shrunk since 2011.

The Art Basel & UBS Art Market Report 2024

The Art Basel & UBS Art Market Report 2024

The real contraction in the art market is especially concerning in light of the performance of key indexes. At the beginning of 2011, the S&P500 was at about 1250 points. Today, it is at all-time highs above 5237, or a percentage increase of about 318%. In 2011, the NASDAQ sat at 2300 points. Today it is at all-time highs of 18254. That marks an increase of about 693%. The growth of these indexes is tempered by inflation, but the multiples that they have delivered have at least offset inflation in the case of the S&P500, and outpaced it in the case of the NASDAQ.

This post was originally published on this site be sure to check out more of their content