Christie’s has invested in Art Money, a US lender that launched in 2016, and will offer a buy now, pay later scheme on art bought in its sales for less than $1mn. Would-be buyers receive a preapproved limit to bid from the lender and, if successful, can pay in instalments over a maximum of 10 months. Art Money takes a fee from the buyer of up to 10 per cent of Christie’s total invoice, including its buyer’s premium (26 per cent at that level).

As with all payment plans, it increases the overall cost of buying, but the point, says Art Money’s founder and chief executive Paul Becker, is that “there is so much friction around buying art, we just want to apply current business practices [from other industries] to help grow the market”. He notes that most of the existing loans available against art, including through the auction houses, start at $1mn.

The Christie’s partnership launches at its prints and multiples auction in New York on April 16. All 173 works, with estimates ranging from $800-$1,200 for a print by Ann Hamilton to $600,000-$800,000 for an edition of Henri Matisse’s “Jazz” portfolio (1947), are eligible for Art Money.

Christie’s has made the investment through its Ventures fund, headed by Devang Thakkar. He says the company has invested in 10 businesses since 2022 and, while its financial commitment is not disclosed, this was set between $250,000 and $2mn per company at launch. Becker describes Christie’s stake in Art Money as “minority, non-controlling and non-exclusive”.

For now, the initiative is only available to buyers in the US and Australia, but Becker says Art Money is working towards regulatory approval across all countries. Thakkar says the April 16 auction will provide “a road map to understand consumer appetite” and he hopes to roll out the offering to more sales and buyers, particularly in the UK.

Frieze’s owner Endeavor remains tight-lipped on its plans for the fair group and other companies in the entertainment conglomerate since it agreed to be taken private by the investment company Silver Lake on April 2. The transaction, which at $27.50 per share, valued the group at $13bn ($25bn including debt), marks one of the biggest private equity deals in the past decade.

While the overall strategy points to slimming down an unwieldy group of companies and events, which range from the fairs to sports tournaments and a global marketing company, as well as its core talent agency business, a source briefed on the Silver Lake acquisition says that “there are no decisions or announcements with regard to businesses within the Endeavor network”. The deal is expected to complete in the first quarter of next year.

In a statement, Ari Emanuel, who stays on as chief executive of Endeavor, said: “We are excited to continue to unlock and invest in the growth opportunities ahead as a private company.” He is in line for a $25mn “asset sale transaction bonus”, payable once certain, unspecified businesses are sold, according to a regulatory filing.

This week is the first edition of Expo Chicago under Frieze’s ownership (April 11-14, Navy Pier) while the 12th in-person edition of Frieze New York runs next month (May 1-5, The Shed).

The art world moves to Venice next week for the opening of the Biennale. Beyond the formal programme and national pavilions are plenty of gallery shows, taking advantage of the number of art-hungry visitors in town. At one end of the contemporary art spectrum is Marisa Bellani, whose gallery Roman Road now runs exhibitions nomadically. She brings a show of eight works by the self-taught Thai painter Channatip Chanvipava, now studying at London’s Royal College of Art.

The artist investigates queer sensibilities including, in his painting “Future Fertile” (2024), parenthood in the gay community. The works, which Bellani says chime with the Biennale’s theme of “Foreigners Everywhere”, are priced at between £3,500 and £30,000. She adds, though, that the showing is less about sales and “more about creating visibility” while the art world’s luminaries are in town (Dimora Ai Santi, April 17-May 27).

Another adviser-curator, Max Levai, who runs The Ranch art space in Montauk, Long Island, New York, brings a show of 11 paintings by Frank Auerbach, winner of the Biennale’s Golden Lion prize in 1986. The works, which span 1969-2016, are conceived as a “succinct survey”, Levai says, and take on a range of subjects. Like Bellani, Levai plays down any commercial goals — something of a Biennale tradition — though he concedes that “when you bring pictures together and create moments like this, opportunities might be pursued” (Palazzo da Mosto, April 18-June 28).

Levai says the title of the Venice show, Starting Again, refers to the artist’s process and in no way relates to his own experience at Marlborough Gallery, which was co-founded by his father’s uncle, Frank Lloyd. Levai worked there and was briefly its president until, in 2020, he said he was “effectively terminated”. (Marlborough’s trustees disagreed with his representation of events.) Last week, the board of the 78-year old gallery announced that it was closing for good.

Healthy sales, made mostly under $100,000, were reported from the 16th edition of the Dallas Art Fair (April 4-7). As at other such events this year, the mood was “a bit more subdued than in previous editions”, says Texas-based Nick Campbell, founder of Campbell Art Advisory.

A loyal base of wealthy local collectors has long supported this fair and, says its director Kelly Cornell, the next generation is gradually continuing their passion. “We have an established community, which are big shoes to fill, but people are stepping up to the plate,” she says. Campbell agrees that “the younger generation is interested and engaged and is continuing Dallas’s rich collecting tradition”.

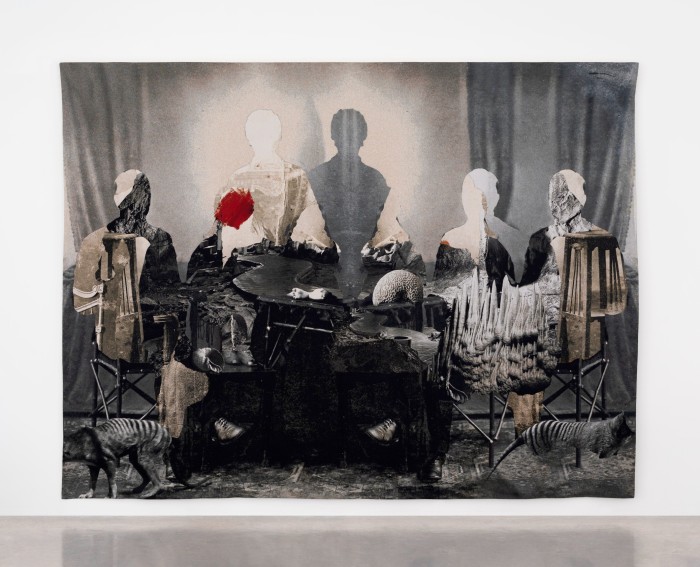

Sales reported from the 91 exhibitors included to the Dallas Museum of Art, through an acquisition fund organised with the fair since 2016. This year, the museum spent its $100,000 grant on three large-scale works for its collection: a tapestry by Ailbhe Ní Bhriain (Kerlin Gallery), a painting by JooYoung Choi (Inman) and an embroidery by Thania Petersen (Nicodim).

Find out about our latest stories first — follow FTWeekend on Instagram and X, and subscribe to our podcast Life and Art wherever you listen

This post was originally published on this site be sure to check out more of their content