Shortly after the opening of the Venice Biennale in April, many members of the art tribe flocked from La Serenissima to Le Sirenuse, a posh hotel on the Amalfi Coast. It’s the kind of a place where you can spend $10,000 a night on a suite overlooking the azure expanse of the Tyrrhenian Sea.

It’s also a type of a place that likes to collaborate with artists represented by mega galleries, and it has tapped Alex Israel, Rita Ackermann, and Stanley Whitney for projects. Its latest is with Nicolas Party, an emerging star whose prices have exploded since the pandemic. Party created a mosaic floor for a long swimming pool that depicts fluid shapes in various shades of blue, suggesting the sky above, the depths of the sea below, and the coastal cliffs all around the resort.

It was a characteristically ambitious effort from the Swiss-born, New York-based artist, who often works at an institutional scale, transforming museums, galleries, and on one occasion, a 207-foot hallway in a children’s hospital. In the past four years, his neon-colored landscapes, slightly surreal still lifes, and orange- or green-faced portraits have generated frenzied demand, making the 44-year-old the top millennial at auction in 2023, according to Artnet Price Database.

Museum curators can’t get enough of the environments that Party creates for his exhibitions, and the Frick Collection, the Hirshhorn, and the Montreal Museum of Art have all worked with him. His work is currently on view in a group show at Kunsthaus Zurich, just in time for Art Basel. Up next: an exhibition at the Hoam Museum of Art in South Korea in September that will open alongside Frieze Seoul.

An installation view of “Nicolas Party and Rosalba Carriera” at the Frick Madison. Photo: Joseph Coscia Jr. Courtesy of the Frick.

Party’s is ambitious when it comes to business, too: He works with six galleries, including the international powerhouse Hauser and Wirth, where prices for his new works can now surpass $1 million. His record at auction, set in 2022, is $6.7 million.

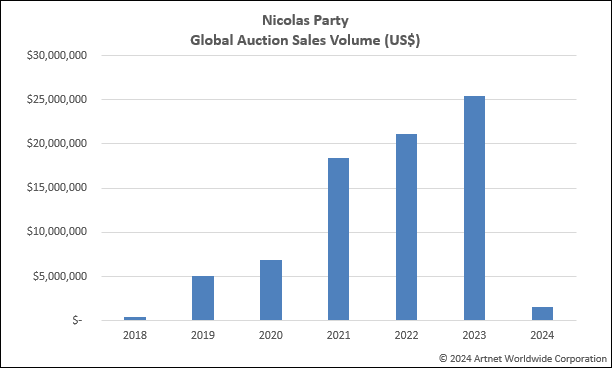

Asian collectors and the fractional-ownership company Masterworks have been major forces in Party’s market. The artist’s annual auction sales soared to $25.4 million last year, from just $369,000 in 2018, according to the Artnet Price Database. That places him ahead of older star artists like Mark Bradford (with $22 million in auction sales in 2023), Jenny Saville ($20.5 million), and Jonas Wood ($16.1 million).

But cracks have started to appear amid a broader correction in the art market.

Several high-priced pieces by the artist, who is best known for working with pastel on card or linen, failed to sell at recent auctions in New York and Hong Kong. Several others were withdrawn due to a lack of interest.

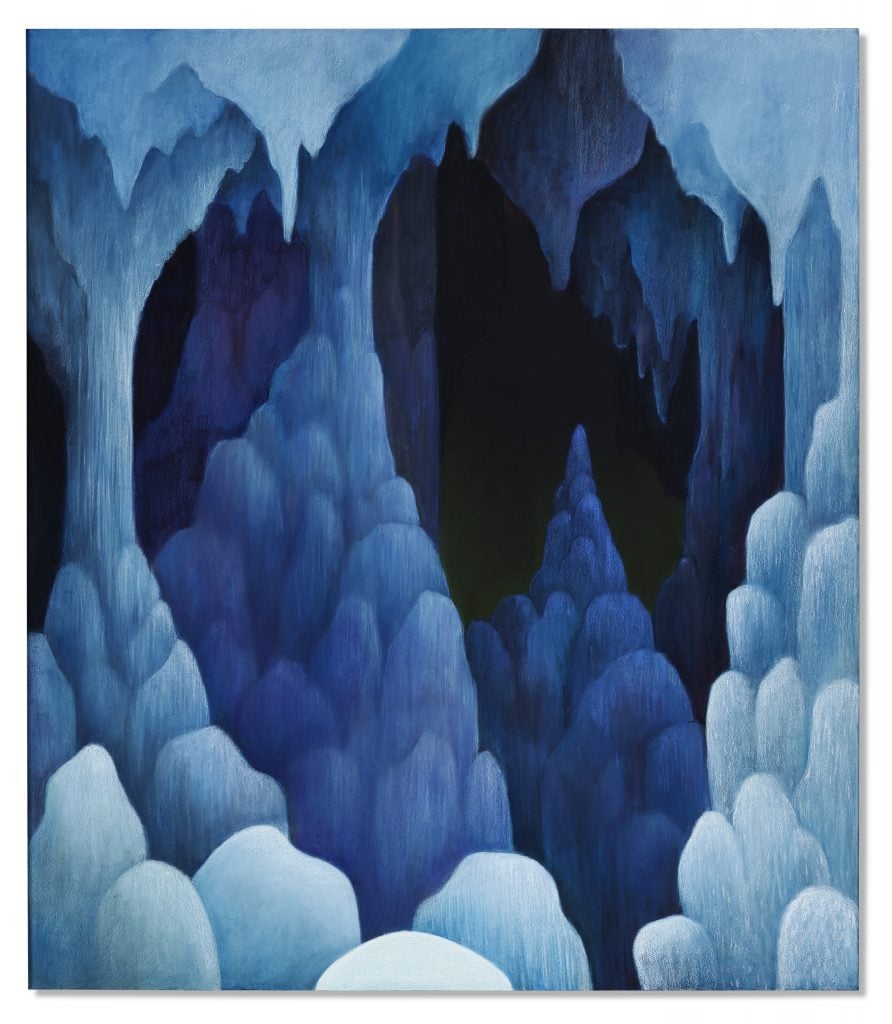

Nicolas Party, Grotto (2019) with withdrawn from Christie’s auction on May 14. Photo by Christie’s.

“Party was a flash in the pan,” Belgian collector Alain Servais told me by email this week. “There were thousands like him before and there are thousands like him after. He enjoyed his place in the sun. Happy for him.”

While Party’s top 10 lots at auction in 2023 generated $24.6 million, the top 10 this year have brought just $1.5 million so far.

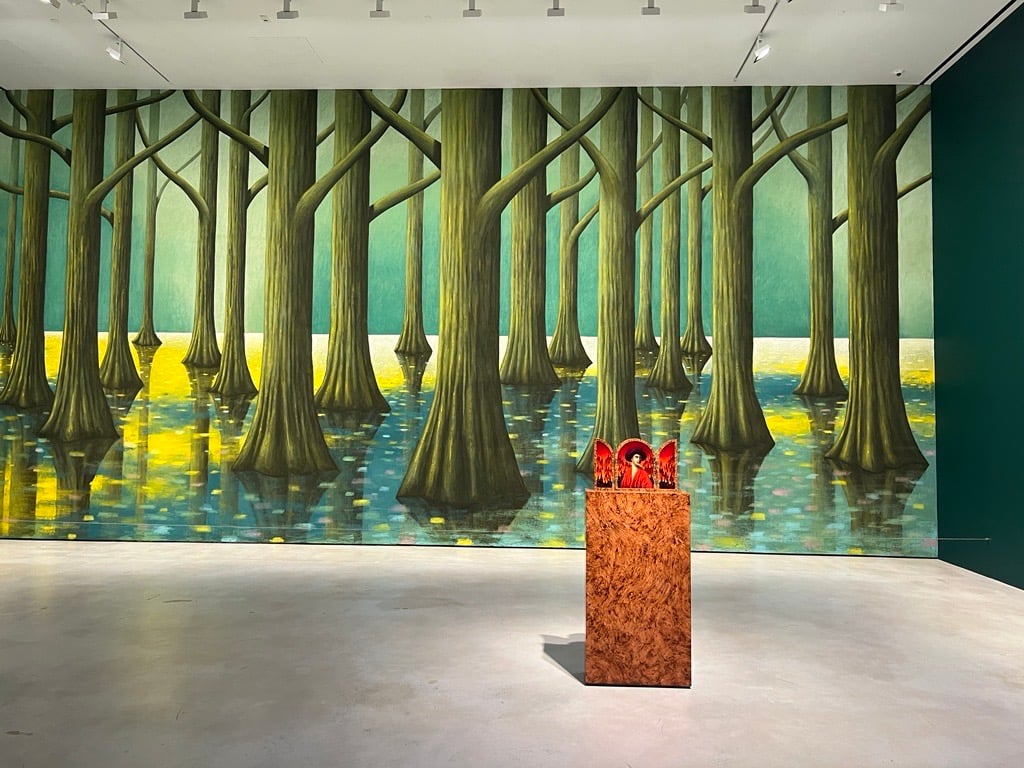

The works presented by his galleries are also shrinking. Next week, Hauser and Wirth will display a 4-by-4-foot painting of a little octopus by Party at Art Basel, priced at $525,000. At the fair’s 2023 edition, the gallery sold a much larger tableau of a heroic mountain range that was priced at $820,000. At Frieze New York in May, the gallery sold a tiny, foldable triptych on a pedestal for $350,000.

“The market is not where it was,” one art advisor told me. “Everything is down 30 percent. I don’t think it’s about Nicolas Party specifically, but I do know that many people see art as an investment and the time to sell is not now.”

That tracks.

Global auction sales of art by Nicolas Party. Source: Artnet Price Database

On May 14, Party’s 6-foot-tall painting Grotto (2019) was withdrawn from an evening sale of 21st-century at Christie’s, which had estimated it at $2 million to $3 million. It belonged to the New York collector Dow Kim, who, I heard, bought it fairly recently for $2.4 million. The word on the street is that he received lower offers, which he declined.

Two weeks later in Hong Kong, Still Life with a Ribbon (2011–12), an early oil on canvas (not a coveted format) failed to sell at Christie’s, which thought it could make $2.8 million to $3.6 million. The seller was lucky: the auction house had guaranteed the work and is now stuck with it.

In the same Christie’s Hong Kong auction, another Party painting, Two Portraits (2016), estimated at about $640,000 to $896,000, flopped as well. That one is a soft pastel on linen, which is good, but it was a quick resell, which is bad. The consignor bought the work just two years ago for $833,000 at Phillips Hong Kong.

Nicolas Party, Portrait (2015). Courtesy of Sotheby’s.

Even Party’s top auction lot this year—a more attractive 2015 Portrait with three birds, offered at Christie’s New York in May—was not a home run for its consignor, who purchased it for some $726,000 at Sotheby’s Hong Kong in 2019. Its final price in May, $794,000, included Christie’s fees, though sellers typically get just the hammer price, which was $630,000 (a 13-percent loss over five years). You could certainly do worse, but those are not the kind of returns that inspire investors.

“Asia pumped up prices,” a New York–based adviser who believes that Party’s work will stand the test of time told me. “It’s a mass movement into one artist. Then a parallel mass pull back. It hurts the market.”

This is a risky dynamic for buyers. You can get into a bad spot by paying secondary market prices for late-emerging and mid-career artists.

“It’s been happening over and over and over again, for at least 45 years, and people never seem to recognize where they are in the cycle in real time,” a private dealer said.

An installation view of Nicolas Party’s exhibition, “Swamp,” at Hauser & Wirth in 2023. Photo: Katya Kazakina

I contacted the half-dozen galleries that represent Party—Hauser and Wirth, Xavier Hufkens in Brussels, Kaufmann Repetto in Milan, the Modern Institute in Glasgow, Galerie Gregor Staiger in Zurich, and Karma in New York—to get a sense of the artist’s primary market, what he has in the pipeline, and whether they have concerns about a contraction in his secondary market.

Regrettably, there has been radio silence, with one exception: a Kaufmann Repetto rep declined to comment. (Let’s hope they are all busy pre-selling Party’s works ahead of Art Basel.)

Hauser and Wirth had been successfully finding homes for new paintings by the artist as recently as last fall. Solo shows it held in Hong Kong in 2022 and New York in 2023 sold out, with prices for most works at $550,000 to $900,000, according to a person familiar with the matter.

At auctions in 2023, one work sold for within that range and eight fetched more; the top price of the year was $4.9 million. So far this year, just two works by Party sold within the range, and none exceeded it.

Who’s been buying these works by Party on the secondary market?

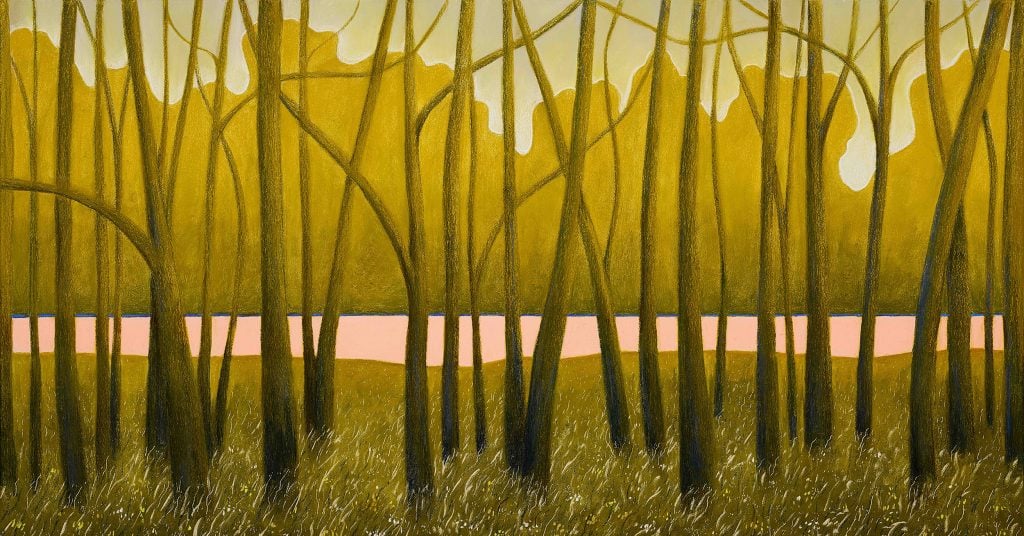

Nicolas Party’s Trees (2019) was acquired by Masterworks in 2023. © Nicolas Party, Courtesy the artist & Hauser & Wirth.

Masterworks has been one significant player, spending $9.7 million on five paintings by Party between December 2022 and December 2023, according to regulatory filings reviewed by the Art Detective.

I asked Masterworks about its outlook on the Party market, and its CEO Scott Lynn sent me a chart showing an upward green line, representing the artist’s prices over time. “We are very bullish,” he said.

Evan Beard, who runs a private gallery for Masterworks on Manhattan’s Upper East Side (he is involved in sales, but not acquisitions), told me that the current cooling off in Party’s secondary market is not an indicator of the artist’s future performance.

“By no choice of the artist, there are moments in time when both speculation and status come to an artist’s market, and when they leave, it doesn’t mean that the long-term prospects of the artist’s market aren’t great,” Beard said.

Nicolas Party, Still Life (2015) was the top lot by the artist at auction in 2023. Courtesy of Christie’s.

To assess those long-term prospects, Beard suggested looking at curatorial support, whether serious collectors own work, the health of their primary market, and museum exhibitions.

“I believe he’s an innovative, influential artist,” Beard said of Party.

But when a young or mid-career artist reaches a certain lofty price point, one may be tempted to ask: What else can you buy for the same amount of money?

At Christie’s in Hong Kong last month, Party’s still life with fruits and vegetables immediately followed still lifes by Yayoi Kusama and Roy Lichtenstein. All three works were about the same size and were estimated at around $2 million. Is it possible that the sequence brought into focus, for some, the weirdness of a market where the works of relative newcomers are valued similarly to those of canonical artists? The Party was the only one of the three that didn’t sell.

I asked Alex Rotter, Christie’s chairman of 20th-century and 21st-century art, what he thought.

“People are looking again,” he said. “The hype is out. But the real art remains.”

Follow Artnet News on Facebook:

Want to stay ahead of the art world? Subscribe to our newsletter to get the breaking news, eye-opening interviews, and incisive critical takes that drive the conversation forward.

This post was originally published on this site be sure to check out more of their content