In recent years, auction houses have increasingly withdrawn lots right before, or even during, sales, when staffers sense that they are unlikely to find buyers, or when offers of irrevocable bids are too low. As a result, they can report higher sell-throughs, managing their reputations. The Artnet Pro team has been monitoring this trend in our coverage and post-sale number crunches.

Earlier this month in New York, at the $1.4 billion semi-annual sales of modern and contemporary art, several key pieces were once again yanked by Christie’s, Sotheby’s, and Phillips just before the action got underway. And of all withdrawals this season, Brice Marden’s Event (2004–07) at Christie’s was the priciest, carrying an estimate of $30 million to $50 million.

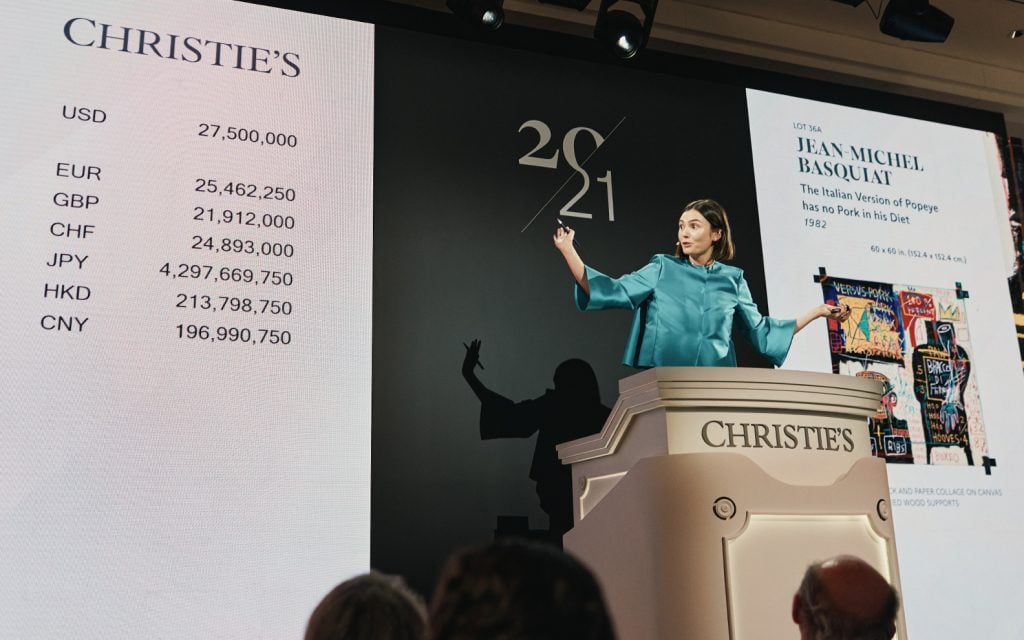

Christie’s auctioneer Georgina Hilton sells the top lot of the house’s 21st-century evening sale, Basquiat’s The Italian Version of Popeye has no Pork in his Diet, (1982) for $32 million. Courtesy of Christie’s.

The Marden had been marketed by the house for two months, so its withdrawal came as a shock. The Art Detective previously identified the consignor as Richard Schlagman, a Brit who made a fortune selling Phaidon Press to billionaire Leon Black in 2012. Despite the withdrawal, he made out O.K., thanks to a Christie’s guarantee, but the auction house is now stuck with that pricey work on its balance sheet.

Now, to be fair, there are worse things to be stuck with than a gorgeous and rare Brice Marden.

“I believe in this painting,” Alex Rotter, Christie’s chairman of 20th- and 21st-century art, told me this week. “We did get an offer. It was too low for me. I didn’t want to undersell it.”

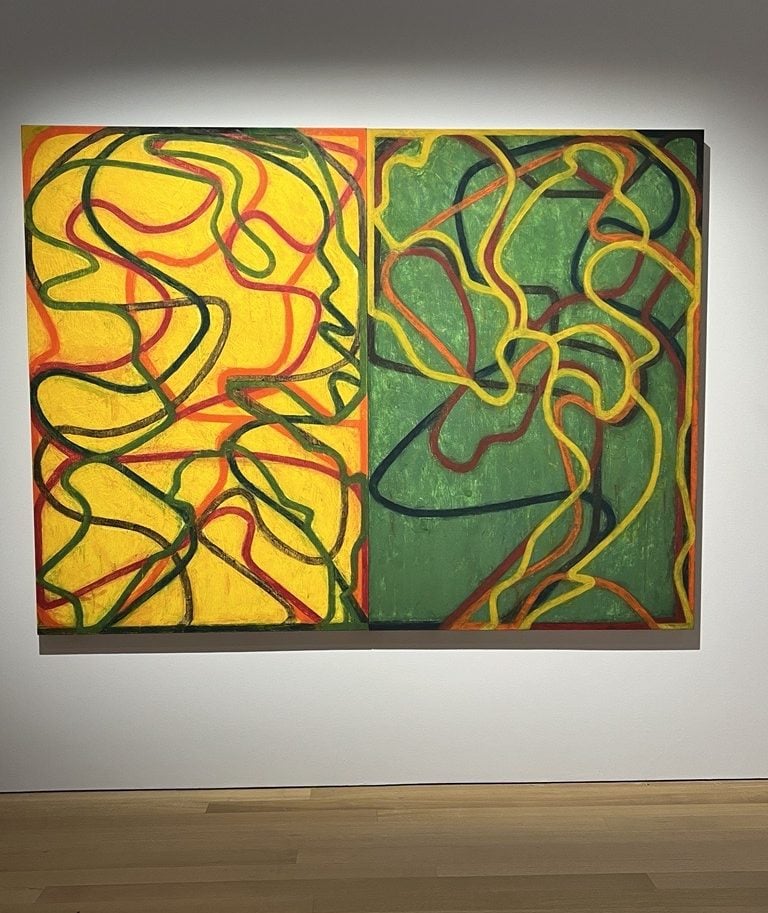

Brice Marden’s Event (2004-07) at Christie’s earlier this month. Photo: Katya Kazakina

While Event awaits its day, it’s worth unpacking what led to this outcome. The tale reveals a lot about current market conditions, including the risk of third-party guarantees and the cut-throat battles that take place over coveted consignments.

One thing that is certain: Representational genres are ruling the day, while abstraction is not as desirable. The top lots of all but one of the marquee May sales featured figures (Kerry James Marshall), a landscape (Claude Monet), or flowers (Andy Warhol). The best performer of the season was Jean-Michel Basquiat’s 1982 Untitled (ELMAR), which has a skeletal figure at its center; it went for $46.5 million at Phillips. The lone exception was a string of lights descending from the ceiling by Felix Gonzalez-Torres; the 1992 work, Untitled (America #3), led the Rosa de la Cruz Collection at Christie’s, selling for a record $13.6 million.

But back to Marden. His Event was part of a consignment that included works by Robert Mangold and Vija Celmins. Thanks to its guarantee, Christie’s was in control in terms of which irrevocable bids to accept. Since it received no attractive offers prior to the auction, the house decided to withdraw the lot instead of risking that it would go unsold on the block.

Brice Marden in 2017. Photo courtesy of Gagosian.

Why wasn’t there interest? Marden, who died last year at 84, was one of the most revered and successful painters of our time, honored with a prestigious Museum of Modern Art retrospective in 2006 and represented by the powerful Gagosian gallery—which, we hear, charged $10 million for the master’s new paintings in 2022.

“Nobody knows the right price,” a major art advisor told me about Mardens on the secondary, or resale, market. That is not uncommon after the death of an artist, as his or her estate is being settled. “If a catalogue raisonné comes out, people will realize that the work is pretty finite,” the advisor said.

Christie’s $30 million–$50 million estimate was surely aspirational, given that the biggest prices for Marden have not been achieved at auction. Until a Marden sold at auction for $30.9 million in 2020, his record on the block was $10.9 million, according to the Artnet Price Database. Since then, $16.9 million is the most anyone has paid publicly. However, a couple of paintings traded privately for about $50 million in recent years, Rotter said.

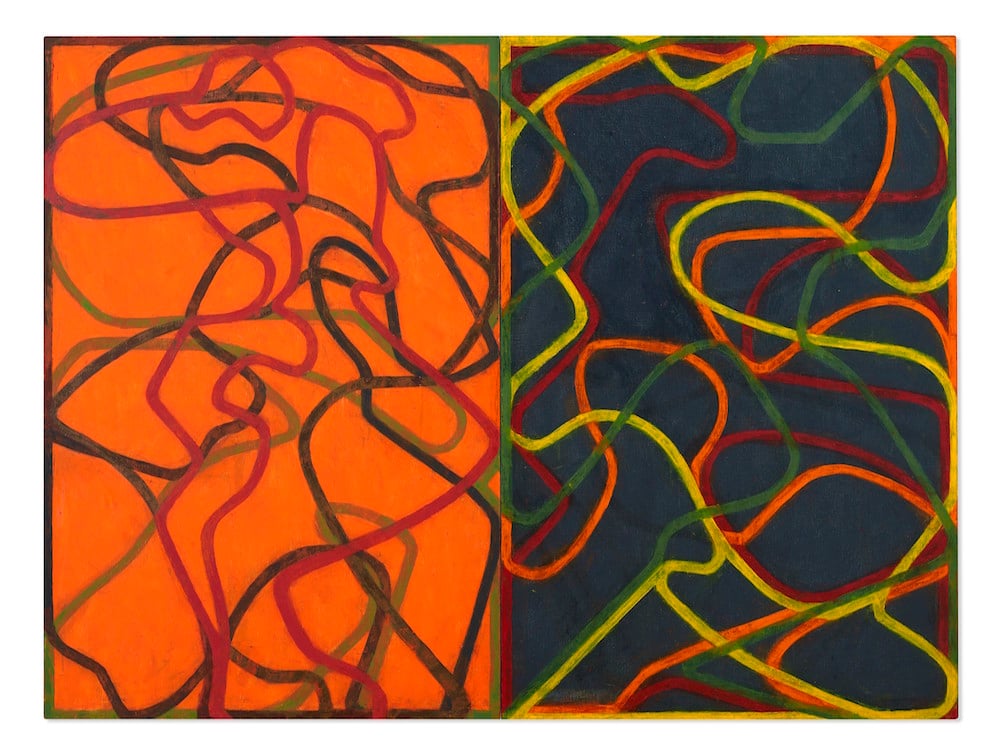

In a sense, Christie’s had little choice with its estimates for Event. In 2020, the house sold another work from the same series for that record-setting $30.9 million. Titled Complements (2004–07), that piece originally belonged to collector Don Marron. After his death in December 2019, a troika of powerful galleries—Acquavella, Gagosian, and Pace—won the financier’s art trove. Complements was among its blue-chip treasures. Many of the top works sold quickly, and not a moment too soon, given the rapidly approaching pandemic.

Brice Marden, Complements (2004–07). Image courtesy Christie’s

Complements wasn’t among those quick sales. And along with other unsold works, it was weighing down the balance sheet of the three dealers, who were on the hook to pay the Marron family.

Marron’s art was estimated at more than $300 million, and the dealers sought institutional financing to outbid Sotheby’s and Christie’s, who were also competing for the collection.

“We just bid more than the other people did,” Bill Acquavella told me when I asked how they locked in the collection.

The dealers secured financing from J.P. Morgan, according to Evan Beard, who was head of art services at Bank of America at the time, and competed for the deal. “I thought it was a very creative deal structure,” said Beard, who is now head of Level & Co., an Upper East Side secondary market gallery operated by Masterworks.

At one point, the dealers sought a letter of credit from a major bank, which could be tapped in case the sales fell short of what they had guaranteed the Marrons, according to a person familiar with the matter.

Such loans are not interest-free, which is why the dealers jumped on the opportunity to consign Complements to Christie’s for its first live-streamed auction in July 2020.

From left to right: Arne Glimcher, Bill Acquavella, Larry Gagosian, and Marc Glimcher. Photo © Axel Depuex.

(The trio later sold the remaining, lower-value artworks from the Marron collection at other auctions. In the end, “the venture was successful,” Acquavella said this week. “Everybody made money. Everybody is happy.”)

“I knew that their ass was on fire with the money,” Rotter told me this week. He had a client interested in the painting and he offered the dealers a guarantee.

The client agreed to place an irrevocable bid. During the sale, no other bidders materialized, and he ended up with the work. Perhaps this wasn’t his desired outcome: Less than a year later, people began putting out feelers on behalf of that buyer to see if someone else would acquire Complements, according to a person who was approached in January of 2021.

“I knew he wanted to get out, but he wanted to get out of everything,” Rotter said. “As far as I know, the painting has never moved anywhere from Switzerland. It wasn’t actively on the market until we publicized ours.”

Come May, there were suddenly two competing high-value Marden paintings from the same series on the market—one offered privately, one at auction. (A third remains in the collection of the Centre Pompidou in Paris.)

A combination of “the old one coming back and the market being where it is, very binary, very figurative, very fantasy oriented,” led Rotter to withdraw Event, he said.

This was not what he had hoped for. Nevertheless, he sounded confident about the work’s long-term prospects.

“Brice Marden is coming into the category of de Kooning in the 1970s,” Rotter said. “This will be established the next time the market goes higher.”

Follow Artnet News on Facebook:

Want to stay ahead of the art world? Subscribe to our newsletter to get the breaking news, eye-opening interviews, and incisive critical takes that drive the conversation forward.

This post was originally published on this site be sure to check out more of their content