When Michael Findlay arrived in New York in 1968, as an aspiring art dealer aged 23, there was no such thing as an “art market”. The word wasn’t used at all. “The market meant a grocery store.”

Today the art market is a glittering international pageant, an endless parade of art fairs, openings, biennales, ever more eye-popping auction prices and galleries that drop their artists as soon as they fall out of fashion. Art is an asset, an investment and a security — and you might never hang it on the wall. It wasn’t always so mercenary. The Sixties art scene conjured up by Findlay in his memoir Portrait of the Art Dealer as a Young Man is maverick, experimental and far less bothered about the bottom line.

You should have been there, downtown, late at night, partying with Willem de Kooning, Andy Warhol, Yoko Ono and Yayoi Kusama, squiring the unknown David Hockney and Bridget Riley about Manhattan, sitting across from the poet Frank O’Hara at dinner, taking the aspiring singer Carly Simon out to the infamous speakeasy Marylou’s and celebrating the opening night of Studio 54 with Bianca Jagger and Liza Minnelli.

Portrait of Adele Bloch-Bauer I, 1907, by Gustav Klimt

ALAMY

Findlay was there, wearing Halston, dropping acid, modelling for Harper’s Bazaar, marrying Naomi Sims, the first black supermodel (their wedding appeared in People magazine alongside a photo of fellow newlyweds Ali MacGraw and Steve McQueen) and along the way learning everything there was to know about the contemporary art scene and picking up a thing or two about impressionist painting. After establishing his own gallery in SoHo, Findlay went on to be head of impressionist and modern paintings at Christie’s auction house and is now a director at Acquavella Galleries, selling modern and contemporary art, two blocks from the Metropolitan Museum.

Findlay, born in Scotland, raised in London and now at 79 a veteran of the New York art world, is talking to me from the study of his weekend house in the Hudson Valley. After five decades in the business, he remains boyishly enthusiastic about discovering and supporting young artists, while having reservations about what the art world has become. He talks of a time “BC” — before consultants — when deals were done between dealers and buyers who relied on their own taste and discernment and who bought for the pleasure of having a painting to hang on their walls.

Advertisement

Michael Findlay

Today the art world is an entire “universe” with art advisers, art fairs, banks (“in those days you couldn’t ‘leverage’ your collection”), lawyers (“there were no art lawyers until probably the Seventies or even into the Eighties”) and all sorts of people professing to “curate” things (“It would have been very pretentious,” Findlay writes, “for a dealer to say they ‘curated’ an exhibition”).

“We’re much more self-conscious today and we think much harder about what’s going to happen in the future,” he reckons. “I think primarily because people are money-orientated today, so they want to know that it’s going to be worth more tomorrow. But that wasn’t an issue in the art world [of the Sixties] because it wasn’t a money world.”

Certainly the recent case of the art trickster Inigo Philbrick, who is facing seven years in jail for $86 million worth of art fraud, shows the danger of an art market in thrall to works as flippable commodities that go on going up in value. Philbrick sold the same work to multiple buyers and even sold works he didn’t own. Philbrick’s lawyer submitted a letter to the judge stating that this was “how art deals are done”. Not in Findlay’s day.

Then, dealers and buyers met face-to-face, looked at works IRL — in real life — and knew each other’s tastes. In the book, Findlay tells the story of showing a Clyfford Still painting to the prominent collectors Burton and Emily Tremaine in the Sixties. They were after a suitable Still for their house in Connecticut and came to the gallery to take a look. Emily was full of questions. “What is the size?” “Do you have a tape measure?” Then: “Can you take two inches off the top? It simply won’t fit.” Findlay was dumbstruck. You don’t just lop a bit off an abstract expressionist masterpiece to make it fit above the mantelpiece. “Michael, I was joking,” Emily said. “I love it. But it’s too big.”

Yet paintings today are bought to order. Findlay describes a typical phone call. “An art adviser will call me with a specific request like a pastrami on rye toasted with mayonnaise: a work of art by an artist in a certain colour.” If Findlay has something he thinks will fit the bill, the art adviser will ask for a high-resolution image. They’ll ask him to take a video. “A moving video of a still painting,” he says with some exasperation. They’ll ask for a condition report. The adviser then forwards these to the prospective buyer. For a fortnight they go back and forth. “Is it that red? Does it look that red? There seems to be a spot on the edge, what’s that?”

Advertisement

“Their client is four blocks from where I’m sitting in my gallery,” Findlay says. “I’m tempted to say why doesn’t your client put a pair of shoes on? People used to do this. Titans of industry did this.” He mentions the collector, major museum donor and uranium-mining magnate Joseph Hirshhorn who used to come to a gallery with his family. “They enjoyed it. It was fun.” In the early days of Findlay’s career even the busiest plutocrats would come in, ask to see a Dubuffet and end up buying a Miró. In the meantime, they’d have spent two hours chatting. “They’ve educated themselves. I’ve educated myself about their taste. That’s how it used to work.”

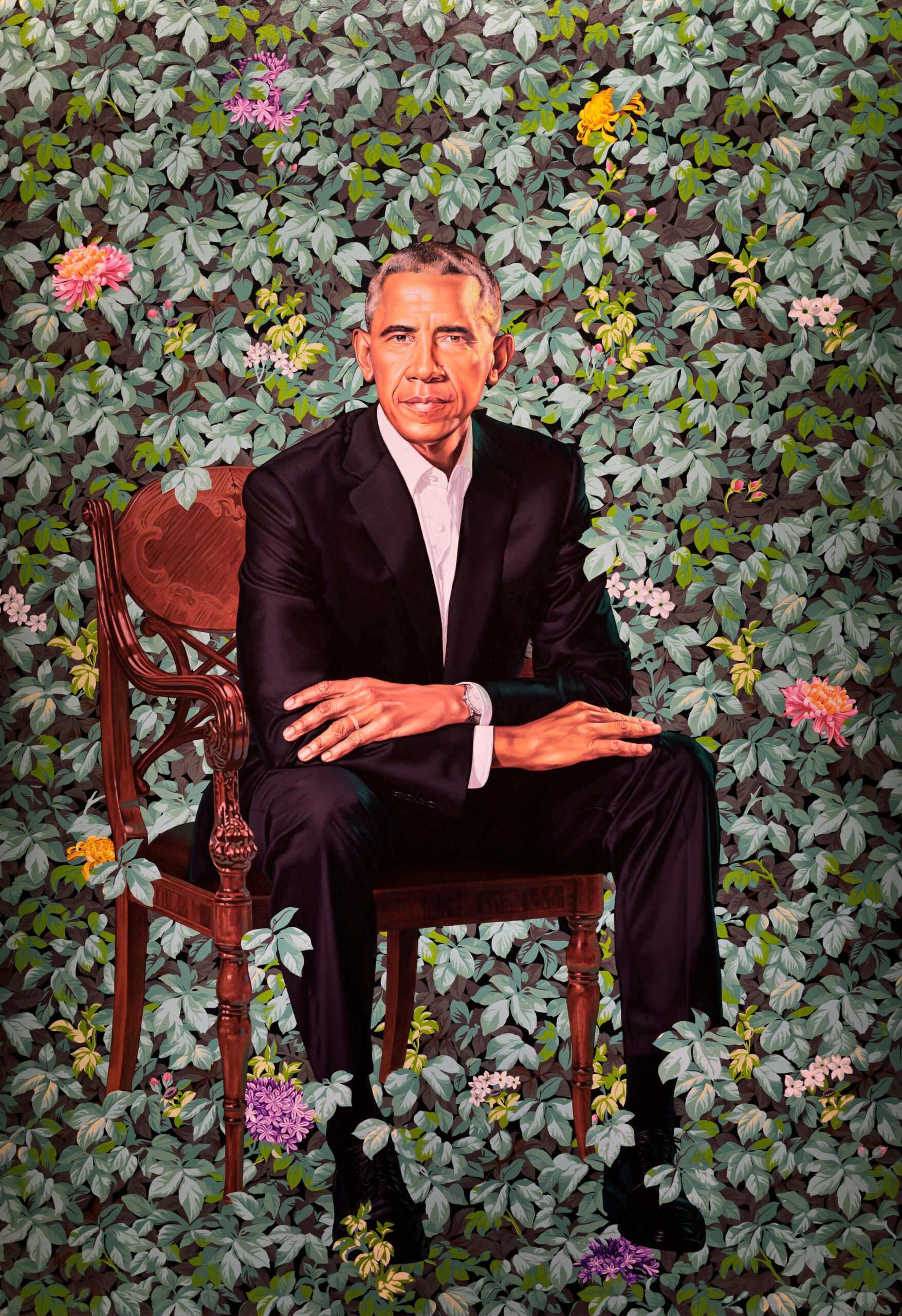

Kehinde Wiley’s 2018 portrait of Barack Obama

ALAMY

Even odder than not seeing a painting in the flesh before you buy it is what super-rich buyers do with paintings once they’ve bought them. Suppose I buy a Jackson Pollock or a painting by a hot and covetable artist such as Sarah Sze or Jadé Fadojutimi, I’d want to hang it above the sofa in my hypothetical Park Avenue apartment. Findlay says there are plenty of buyers who send their prize paintings straight to storage and only show their friends a jpeg. “So when they go out to dinner and they sit next to like-minded collectors, they compare collections on their phones. ‘I just bought this … I only paid that …’”

• This £100m gift is a lifeline for the arts. Can Labour learn to love the rich?

Money certainly doesn’t guarantee taste or even a passing interest in art. Early in his career, Findlay went to meet a prospective client roughly his own age at the Palm Court of the Plaza Hotel. He was a self-proclaimed billionaire with abundant blond hair. Over an awkward, charmless tea it emerged that the young Donald Trump had no interest whatsoever in art and was only too happy to go on insisting that his reproduction Renoirs, recognisable from major museums, were the real deal and not fake art news. Why buy an original when you can get the same picture cheaper?

Findlay reflects on the irony that many of the titans of the New York real-estate industry — Trump’s peers — are major collectors. “Yet they will not cede an inch or a square foot of empty space, which for tax reasons, they like to keep empty, to give artists of any kind — painters, dancers, poets — a space to live.”

Advertisement

In the Sixties, a young artist with no family money, working as a waiter or waitress, could get a cold-water loft in Soho. It might not have had a bathroom but it was “a place to work, crash, live. That doesn’t exist now.” Artists moved on to Brooklyn, which is now “very fancy”. Today “New York” artists have studios in Detroit, a post-industrial city with a surplus of disused warehouse space.

It is not entirely true that no collector of the Sixties or Seventies thought of art as an investment. When Andy Warhol’s Campbell’s Soup Can with Peeling Label sold at Sotheby’s for $60,000 in May 1970, it set an auction record for a living artist on the same day that the stock market hit its lowest point in seven years. The director of Sotheby’s, Peregrine Pollen, published a post-sale statement that quipped: “Good art holds up even in a bad market.” You might add that good art looks even better on the wall and like nothing much at all in a vault.

I ask Findlay if he has even considered retiring. “What would I do? I don’t play golf. Art dealers tend to go on dealing.” When it comes to the art of the deal, it’s not the deals that keep you going, it’s the art.

Portrait of the Art Dealer as a Young Man: New York in the Sixties by Michael Findlay is published on September 3 (Prestel, £24.99). To order a copy go to timesbookshop.co.uk or call 020 3176 2935. Free UK standard P&P on online orders over £25. Special discount available for Times+ members