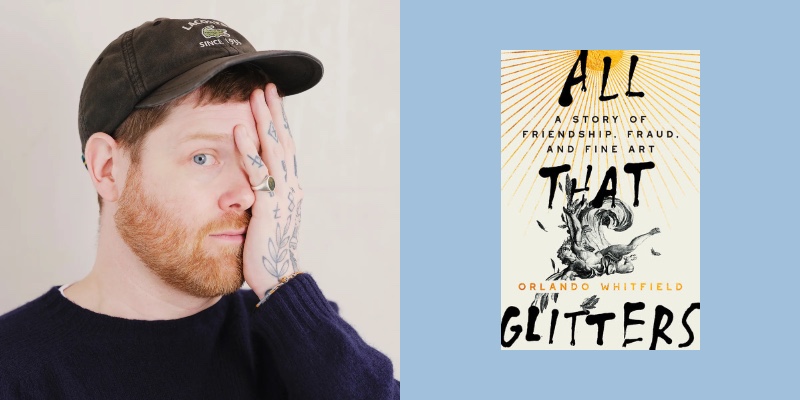

Orlando Whitfield’s All That Glitters: A Story of Friendship, Fraud, and Fine Art is a memoir that reserves a co-starring role for his erstwhile business partner, an ingratiating con artist whose $87 million fraud earned him a four-year prison term that ended in 2024. Inigo Philbrick’s misdeeds, which involved sham contracts, fake clients and works by well-known contemporary artists like Christopher Wool and Wade Guyton, confirmed that the contemporary art trade is a soft target for an urbane crook, ideally one whose clients include credulous mega-rich collectors willing to pay millions for the latest must-have canvas or sculpture or, God help us, generative AI video collage.

Whitfield’s book, which has been optioned by HBO, is based on documents Philbrick shared with Whitfield and phone calls between the men when Philbrick, prior to his arrest, was hiding out on a South Pacific island. Speaking from his home in London, the author talked about the art market’s veneer of respectability, his former friend’s creative bookkeeping and why, as he writes, selling fine art is “a business done really well by real bastards.”

Years before his crimes, you and Inigo Philbrick were briefly in business together as art dealers. How did I & O Fine Art get its start?

We’d met at college in the UK, and we both found ourselves having a lot of spare time. We both had backgrounds, via our families, in the art world. Inigo’s father was a curator and his mother was an artist, whereas my father worked in auction houses. Art dealing, the art market, had been present in both of our lives from an early age. Inigo suggested putting together a few art deals. I didn’t know what that meant, but Inigo knew exactly what that meant.

How long was this business partnership?

Two years, 18 months—not long at all. We did a few (Portuguese-British artist) Paula Rego deals. We tried to do some Banksy deals, neither of which ever came off.

One of the Banksy paintings was on a public-facing wall, which you considered removing.

The wall is still there, I pass it quite often. Having since spent some time working in conservation, I now understand that you’d have to get a buildings conservator in, whereas we were just bringing builders and structural engineers. A slightly ridiculous approach.

What did you learn during this time about how art-world reputations are made, how deals get made?

I learned a lot from Inigo, who understood all of those things, if not instinctively, then at least from having been in and around that world for a long time. But we were operating on the fringes of the art market, we weren’t really interacting that much with that many other dealers. Inigo did most of the talking.

Which, it seems, he was good at. How did his personality lend itself to this business where, as you write, “real bastards” can do well?

He’s not one to be deterred easily. He’s extremely determined, very hardworking and very clever, but unfortunately, at times willing to do things that should be avoided.

You describe the art market as “one of the last bastions of the handshake agreement.” Why is that? Is it considered gauche to talk too much about money?

To an extent, I guess. The art market is not far off from being a kind of aristocracy. No one tells you the rules until you’ve broken them. Art dealers are in it mostly to make money, but it’s nice to be selling something other than cattle futures or coal derivatives. What they’re selling is something which is so culturally sensitive. Regardless of who you ask, everyone has an opinion about art. Everyone will tell you, I hate Picasso, or, I think Jackon Pollock was a ripoff artist. It’s a very emotional sphere, and I think that people are wary about mixing money with culture in that way.

What were some some of Philbrick’s more outlandish crimes?

Say, for the sake of argument, he had a painting worth $10 million. He would sell 50 percent to you, 50 percent to me, 50 percent to another person and 50 percent to one other person—all of whom thought they owned half a share of the picture. Inigo maintained physical control of the artwork while raising money against it. You can’t sell more than 100 percent of a painting, and Inigo sold 200 percent of a painting. He was extremely adept at understanding what the art market has become. As it is now, it’s a highly financialized market.

I want to understand how something gets valued in the millions of dollars when there are relatively few people who are experts in contemporary art. It seems from reading your book that it’s a quite a rarefied, relatively sparsely populated place. How does this process work?

Let’s say Warren Buffett was buying shares in a company. Someone else might think, Oh, that’s great, so they pile in and the value of those shares would increase. The same thing is true of the art market. It’s just that there are only, let’s say, 100 decent works of art by a contemporary artist. And then, lets say, everyone in that market owns two pieces. So you have 50 people operating in the market, and all you is need is for two or three of those people to tell other people that this artist is hot and there’s going to be an exhibition at the Museum of Modern Art, which is going to travel to Tate (in London) and Pompidou (in Paris). It’s a mixture of institutional and curatorial backing that says, This is a really good artist. That then helps auction prices.

The book is based in part on your phone calls with Philbrick and documents he shared with you? Why did he send those to you?

He knew I was writing about my time in the art world, and he wanted me to write a magazine article.

Clearing him?

I think that was his intention. The spin that he put on his story was that this was a young man in over his head. But no one could possibly conclude that that was the case if you saw the documents that I’ve seen. This was someone who was making conscious choices to rip people off.

Were you hesitant to write this book, either because you’d once been close with Philbrick or were concerned about jeopardizing other relationships?

I think there’s hesitancy about putting one’s private thoughts into a public arena, but as to Inigo’s presence in the book, he was a public figure by the time I’d signed my book deal. Before he was even arrested I read a piece in the New York Times called “The Talented Mr. Philbrick.” It wasn’t something that I was afraid of in terms of Inigo’s privacy—that was something that he’d relinquished indirectly long before that. But I like to feel that he comes off not as the two-dimensional villain that he has been portrayed as in the press. Hopefully, I give him a fair hearing.

I think you do. I’m going to read you a quote from the book. “Inigo was brash and young and had made too much money too quickly…He was a rotten apple, his arrest and prosecution told the world, and there’s nothing more to see (at least not for a while). No one, of course, wants to acknowledge that the barrel itself is rotting.” This sounds like every so often, the art market needs a sacrificial lamb?

Yeah, I mean, without any concerted effort to regulate the art market, then of course there will always be people who understand its dark crevices as instinctively as Inigo did, and will get carried away.

The proceeds from Philbrick’s fraud ran to something like $80 million.

$86.7 million.

Does that number still surprise you?

It’s a completely unbelievable sum of money. I have no idea how you could look at that number and not just be terrified. Unless someone was giving you a check for that number, in which case I suspect you’d be looking at yachts.

This post was originally published on this site be sure to check out more of their content