From the September 2024 issue of Apollo. Preview and subscribe here.

France is still basking in the feel-good factor of the Olympics and Paralympics, but it will soon be facing up to the mess caused by President Macron’s snap July election. Parliament returns in the first week of September and high on the agenda is the 2025 budget. It is set to go before the Senate and the National Assembly soon – and it won’t be an easy one.

At least €20bn of cuts are needed next year if France is to cut its annual deficit from 5.5 per cent to three per cent of GDP by 2027 in line with EU rules. National debt now totals 110 per cent of GDP and Christine Lagarde, president of the European Central Bank, has made it clear she expects overspending governments, of which France is projected to be the worst, to ‘bring down budget deficit and debt ratios on a sustained basis’.

Before the election Macron’s Ensemble coalition had 250 of 577 seats. Now it has only 168, while the leftist New Popular Front and the right-wing National Rally have 182 and 143 respectively. Ensemble will presumably vote for the reductions. But the New Popular Front campaigned on a splurge of spending, while National Rally promised huge unfunded tax cuts. The budget is the first big test and may confirm the fears of many that, until a new election, France is almost ungovernable. If so, it will be disruptive for France. But will it dent the country’s reinvigorated art market?

A century ago France was the undisputed centre of the art world, not just the market. In the 1950s it lost ground to New York and later London, Hong Kong and Shanghai. But in recent years some of the old sparkle has returned.

In the past five years major galleries including David Zwirner, White Cube and Hauser & Wirth have opened in Paris. Gagosian opened a third space in rue de Castiglione near the historic Place Vendôme in 2021 while Sotheby’s is moving to the prestigious rue du Faubourg Saint-Honoré next year.

Perhaps the biggest vote of confidence has come from Art Basel. In 2022 it nabbed the mid-October slot in the Grand Palais that had belonged to the Francocentric FIAC (Foire Internationale d’Art Contemporain) to launch a new art fair. That deal was brokered by former Tate Modern director Chris Dercon, who moved to Paris in 2019. At the launch he was photographed sauntering down the aisles with a delighted-looking Macron. Dercon later said dropping FIAC in favour of Art Basel was part of a plan ‘to enable Paris to be the culture capital of the world’.

Paris suddenly felt like the place to be, especially as London struggled with the fallout from Brexit – a decision the British art world had almost unanimously voted against.

‘A part of London’s attractiveness used to be its position at the centre of the European Union. The momentum is now with Paris,’ Guillaume Cerutti, CEO of Christie’s, told the Economist last year.

The arrival of Art Basel on the art fair scene in Paris seemed to herald a bright future. Photo: Luc Castel/Getty Images

Now France is wrestling with its own divided politics. Macron has made a sustained effort to make it much more business-friendly over the past seven years. He has cut business taxes, introduced a flat capital gains tax and swept away wealth taxes, making Paris a centre for tech businesses and the finance sector. The upside is an estimated two million extra jobs, six million start-ups and a much more art collector-friendly environment. The downside is that many in France believe Macron has governed primarily for the rich.

Anne-Claudie Coric, executive director at Galerie Templon, says the art market has benefited from Macron’s policies and the competitive advantage London lost to Brexit. ‘The growth of the French art market is due to our renewed economic dynamism,’ she says. ‘And also the reform of the wealth tax, which in the past drove French entrepreneurs into fiscal exile.’

Coric also points to the huge private cultural projects opened in recent years: the Fondation Louis Vuitton and the Bourse de commerce in Paris, and LUMA in Arles, paid for by billionaires Bernard Arnault, François Pinault and Maja Hoffman respectively. Next year the Fondation Cartier moves to a massive new Jean Nouvel-designed art gallery near the Louvre, while Laurent Dumas, owner of property developer Emerige, is nearing completion of a private art museum on Île Seguin in the Seine. ‘All these projects are thanks to the great profits [made by the people funding them] and generous tax incentives,’ Coric says.

Whether this will continue remains moot. ‘From a business point of view, France has avoided the two worst scenarios,’ says Hubert de Barochez, a senior economist at analysts Capital Economics. The most damaging, he says, would have been a National Rally victory. ‘Investors still remember NR’s plans to ditch the euro and call a referendum over EU membership. They abandoned those ideas in 2017, but the party is full of Eurosceptics. There was a risk that a victory for NR would not just have affected France but the whole Eurozone.’

There is little support in the markets for the New Popular Front either. ‘The NPF includes [Jean-Luc] Mélenchon’s France Insoumise and it has some really radical policies,’ de Barochez says. ‘Some economists actually argued an NPF victory would have been even more frightening than NR because of its anti-market policies.’

Nevertheless, the two populist groups now hold sway in the national assembly. They blame many of France’s ills on global elites and both have promised to reintroduce wealth taxes. In the case of NR, this could include a tax on assets, including art held for less than 10 years. The NPF, meanwhile, has called for an income tax of 90 per cent on earnings over €400,000.

Then there is the question of France’s cultural spending. The ministry of culture got a six per cent increase on 2024, but sceptics say this was a one-off boost to show off for the Olympics. There has also been a revolving door of culture ministers: five since Macron came to power in 2017. ‘This gives a nagging sense that culture is not a priority,’ Coric says. ‘The culture sector often feels there is a lack of policy continuity, a lack of vision and regulatory uncertainty.’

No great interest in culture has been displayed by the NPF or NR either. Nevertheless, France’s cultural spending is eyed enviously elsewhere. Organisation for Economic Co-operation and Development (OECD) figures show French authorities spend 0.7 per cent of GDP on culture, $400 a head, one of the highest amounts in Europe (the UK spends just 0.3 per cent, or $141). It is hard to imagine any French government imposing the sort of swingeing cuts made in the UK since 2010.

More of a risk are rules emerging from the European Commission that affect the art market, particularly its plans to harmonise VAT across the bloc. That directive caused art dealers great consternation when they learned about it in 2023. By then, the key points had already been adopted by the Commission, but directives allow some flexibility in the way nation states pass rules into law. The Commission’s plans, if adopted wholesale, ‘would be fatal for the French art market’, Thaddaeus Ropac, a dealer with two large galleries in the city, said at the time. It would have raised the VAT on art imported from outside the EU from 5.5 per cent to 20 per cent, while galleries would have had to charge 20 per cent of the full sale price on art sold to EU clients.

It wasn’t long before French galleries were lobbying the government to grant art a reduced VAT rate – the new rules allow each member state to grant these rates to up to seven of 24 named categories. Without it, they said, the beneficiaries would not be the wider EU art market but France’s main non-EU competitors: the US, UK, Switzerland and Hong Kong.

Macron’s government appeared to agree. ‘We spoke to the finance minister, who understood us perfectly – that if we didn’t do something we would lose all the advantage we have gained since the UK left the EU,’ says Franck Prazan, owner of 20th-century gallery Applicat-Prazan. The resulting agreement, he adds, sets up France not only as the leader in the European market ‘but the biggest potential competitor of the United States in the Western world’. Now, however, he says he has ‘no clue’ if parliament will honour the deal. That matters more as it starts to appear that the roaring Parisian market may have been overstated.

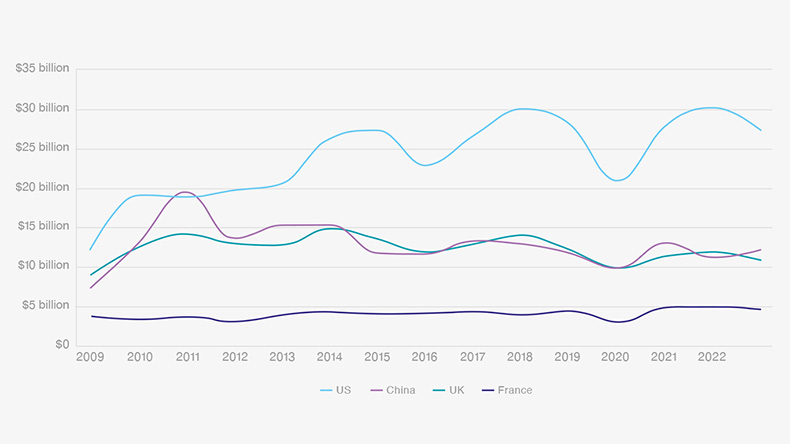

Graph showing the value of international art markets. The French art market has remained remarkably consistent over the past 15 years (information: Arts Economics). © Arts Economics

The boom narrative dates back to the post-lockdown period, which coincided with the implementation of Brexit. Estimated sales in France grew by 62 per cent between 2020 and the end of 2022, to an all-time high of €5bn, a performance the annual Art Basel & UBS Global Art Market Report described as a ‘phenomenal recovery’ (the report is considered the most reliable, basing its figures on auction data and a survey of 1,600 commercial galleries). But that was partly because the French market had dropped sharply between 2019 and 2020. France now accounts for 7 per cent of international art sales, the fourth largest in the world – but roughly the same market share it has held for 15 years.

Meanwhile, the same cool winds are blowing through its elegant boulevards as the international art market as a whole. Half-year auction results of fine art in France are down for the second year in a row (by 16 per cent on 2023), when the once-in-a-lifetime sale of the Barbier-Mueller collection of African and Oceanic art at Christie’s Paris, which made €73.1m, is discounted. ‘What we’re seeing it Paris is quite standard across the global market,’ says Lindsay Dewar, head analyst at ArtTactic. ‘There is activity, but once you strip out the trophy sales it is obvious volumes are down.’

Galleries also report that sales dropped in 2023 and again in the first half of 2024. ‘There’s no doubt that Paris has become more exciting for contemporary art, with good galleries and museums and a lot of artists moving here,’ says Philippe Joppin, co-founder of High Art gallery. ‘But we need more collectors. Everyone is telling me takings are down on last year.’ None of this quite matches the glossy story some are keen to promote. Things may get harder still if, as many fear, the National Rally leader Marine Le Pen finally secures the presidency in 2027.

You might think this not-so-rosy outlook would be greeted with Schadenfreude in London, but that is not the case. Since 2021 London has lost market share mostly to New York. The UK art world is lobbying the Labour government for tax breaks for the art market but so far its interest in culture appears limited – new secretary of state for culture Lisa Nandy caused consternation when she referred to her brief as ‘the ministry for fun’.

Still, a lot can happen in a year, the time France might have to wait to call a new national assembly election. And there is plenty of time, as Kamala Harris’s surprise US candidacy shows, for a moderate to emerge to take on Macron’s presidential mantle. France’s art market may not be sprinting ahead of the field as the boosters claim but it is still very much in the race.

From the September 2024 issue of Apollo. Preview and subscribe here.