Key Takeaways

- Friend.Tech’s admin team has transferred its smart contracts to Ethereum’s null address.

- The team claimed that the platform’s smart contracts were locked to prevent changes.

- Friend.Tech’s token, FRIEND, has dropped over 21% in the last 24 hours to $0.061.

Friend.Tech, one of the most popular crypto social media platforms, has shocked users by transferring the ownership of its smart contracts to Ethereum’s void only a year after launch.

The drastic move, which permanently removes control from its team, comes after months of stagnant growth on the platform.

Friend.Tech Sent to Slaughter

The Friend.Tech team transferred control of their smart contracts to Ethereum’s null address , a known burn address, on Sept. 8.

Once transferred to the burn address, tokens cannot be recovered, effectively destroying everything sent there.

In a post on X , the team claimed that the platform’s smart contracts were locked to “prevent any changes to their fees or functionality in the future.”

Although Friend.Tech will continue to operate; the team has given up its option to make any new updates or bug fixes.

FRIEND Token Plummets

Following the burn, the platform’s token, FRIEND, dropped over 36% in the last 24 hours to $0.061, according to CoinGecko.

Just days after its launch in August 2023, Friend.Tech’s FRIEND token reached a market cap of $233.6 million.

However, the market cap has since crashed to $6 million at the time of reporting.

The Rise and Fall of friend.tech

Friend.Tech was one of the most talked about launches in the crypto space last year.

The blockchain-based platform enables users to purchase and trade digital tokens closely associated with an X, formerly Twitter, influencer.

Users can purchase a “key” from their preferred influencers to access the benefits associated with that account—whether it be private chats, giveaways, or advice.

The value of each key depends on its creator’s influence, reach, and demand—the more people holding a key, the more expensive it will be.

Just a month after its August 2023 launch, the decentralized Web3 social networking platform was processing around $10 million in daily trade volume.

The platform attracted crypto enthusiasts and non-crypto influencers, including YouTuber Faze Banks and Russian protest group Pussy Riot.

However, the platform could not keep its momentum for very long. In December, the platform’s revenue was just around $1 million, a 90% fall from its September highs.

Shortly after launch, the platform’s privacy was called into question when an anonymous contributor to Yearn Finance shared a leaked database of over 100,000 wallet addresses connected to Friend.Tech.

The leaked database also revealed how users had given Friend.Tech permission to post as them on X.

Although the platform continued for a whole year after the leak, many believe it dampened its initial hype and success.

Friend.Tech Inspired a Wave of SocialFi

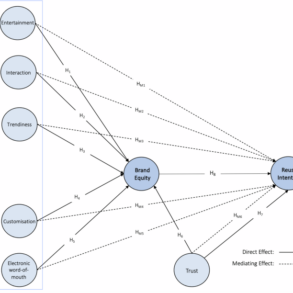

When Friend.Tech launched to great success, it inspired a wave of new SocialFi platforms to launch across the industry.

SocialFi platforms, a blend of social media and finance, aim to aid the monetization of engagements – such as exchanging currency for advice.

Unlike traditional social media platforms, such as Facebook and X, which companies centrally control, SocialFi platforms are decentralized. Users own and control their data, content, and interactions.

Despite promising beginnings, however, SocialFi usage has arguably slowed down. Outside of Friend.Tech, other Web3 social media platforms are hemorrhaging users and struggling.

BitClout, launched in 2021 to mix of “speculation and social media,” faced controversy from the beginning due to accounts being created on the platform without users’ consent.

At the end of July this year, BitClout’s founder, Nader Al-Naji, was charged by the US Securities and Exchange Commission (SEC) with selling unregistered securities and wire fraud.

Farcaster, another Web3 social media network, has seen its daily active users fall to 43,000 from a peak of 104,000 in July, according to Dune Analytics .

However, as traditional social media platforms such as X face increased regulatory scrutiny and interest in Web3 continues to grow—a potential market for SocialFi platforms to thrive could be around the corner.

Was this Article helpful?