Sotheby’s has insisted its finances are fine following claims that the world’s oldest auction house was experiencing cashflow problems and had even issued IOUs to senior executives.

The Wall Street Journal reported that Sotheby’s auction business had lost more than $100 million in the first six months of the year and that the wider company was carrying debts of $1.8 billion.

The newspaper also claimed that at a meeting this month Sotheby’s executives raised their worries about being able to pay employees on time. The auction house, founded in London 280 years ago and one of the “big two” in the global art market alongside Christie’s, denied any such meeting had taken place.

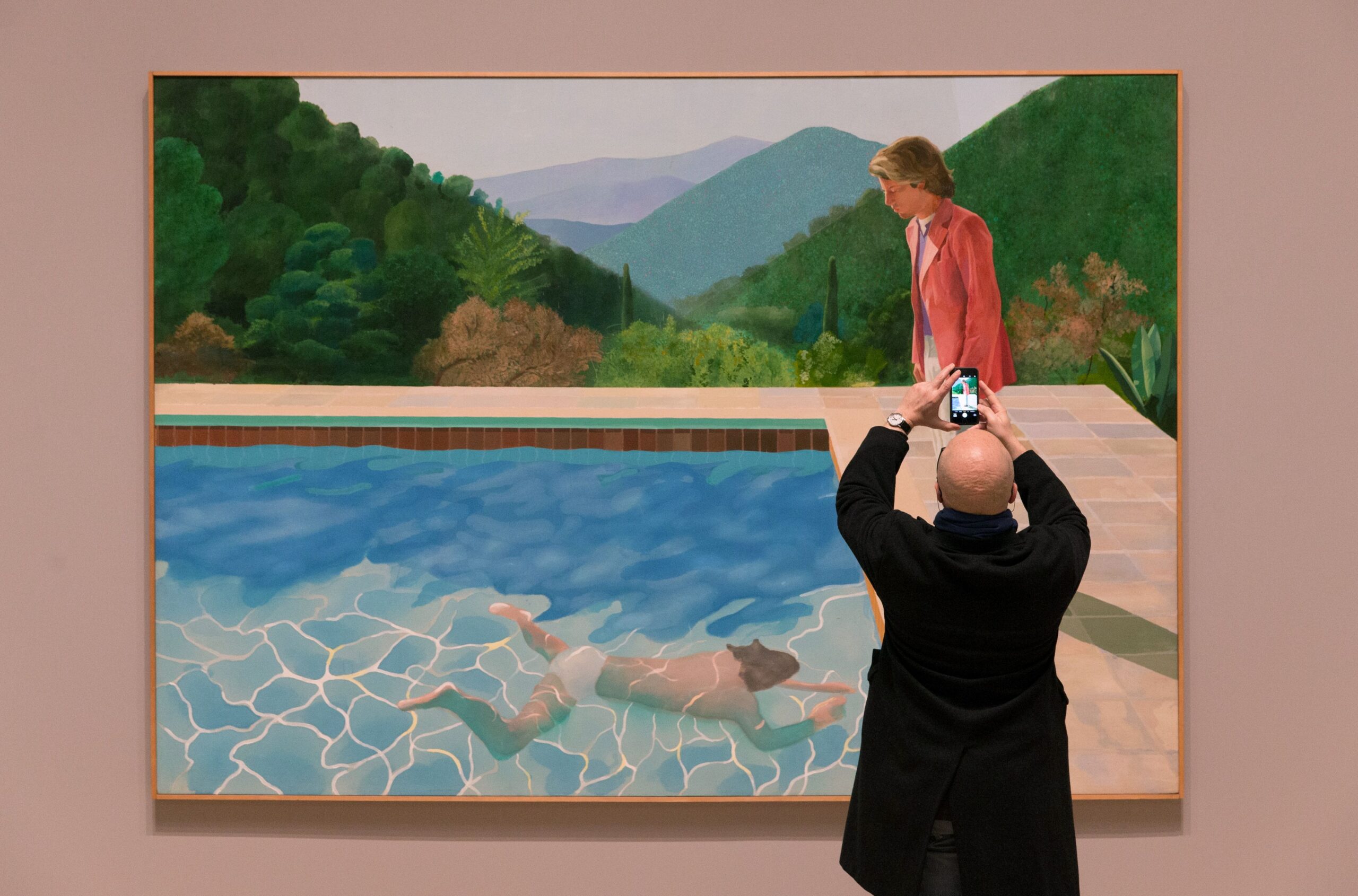

David Hockney’s 1972 painting Portrait of an Artist (Pool with Two Figures) fetched $90 million at auction

DANIEL LEAL-OLIVAS/AFP/GETTY IMAGES

Putting its debts at $1.65 billion, Sotheby’s reported “an upswing in great consignments” of artworks and said a $1 billion investment from Abu Dhabi’s sovereign wealth fund, ADQ, would strengthen its balance sheet. It did not dispute that IOUs had been issued but refused to comment on “executive renumeration”.

However, the report has further chilled an art market that, by common consensus, has felt a cold wind blowing through it for most of the year. “I had to fan myself when I read about the IOUs,” one British art market insider said this week. “It’s unheard of.”

Advertisement

“It’s not a great moment in the art market for anyone,” another said. “But these are bad numbers.”

Jitters over global conflict, elections, interest rates and unstable economies have been blamed for driving down in recent months the number of £10 million-plus sales — the marquee events on which Sotheby’s and its 258-year-old arch-rival thrive. Revenues from auction sales at both houses, which together dominate the global market, were down by as much as 25 per cent in the first six months of the year compared with 2023.

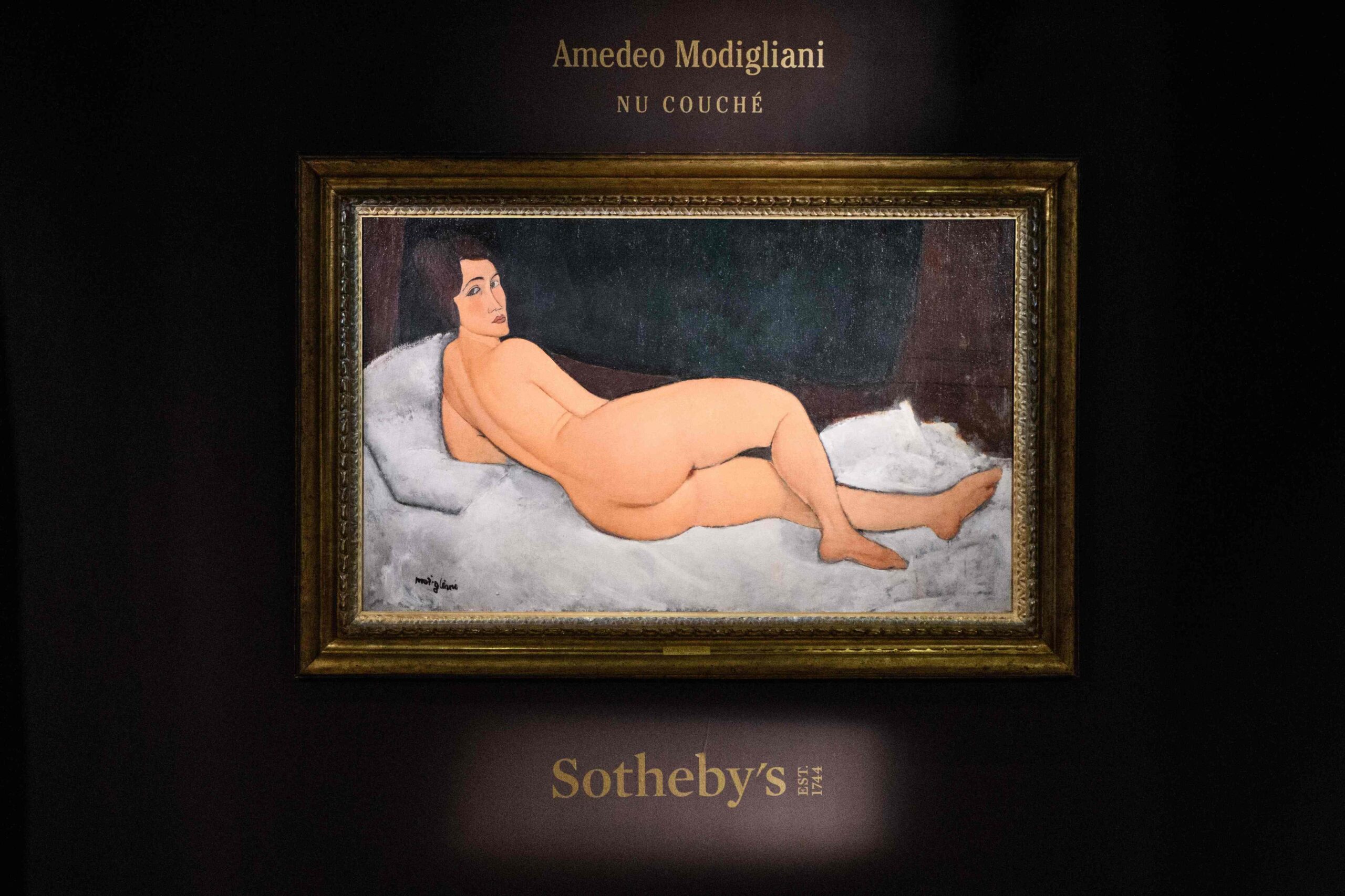

Amedeo Modigliani’s Nu Couché sold for $157 million in 2018 as the art market boomed

ANTHONY WALLACE/AFP/GETTY IMAGES

Amid fewer blue-riband artworks making it to market in recent months, those that have been sold have failed to achieve their estimates. In May, for example, the sale at Sotheby’s of a Francis Bacon portrait of his lover George Dyer missed its lower $30 million estimate.

The difficult year follows a hard 2023 when, according to the latest Art Basel and UBS Global Art Market Report, sales across the world dropped 4 per cent to an estimated $65 billion.

Anthony Browne, president of the British Art Market Federation, said the decline in “stratospheric” sales over £10 million had “a disproportionate affect on the value of the art market as a whole, because they account for a very small percentage of volume but a large percentage of overall value”. Christie’s and Sotheby’s, he added, were both left “hunting” for major sales.

Advertisement

“I have worked in the art market for 50 years and I have seen things go down, moments when things are looking pretty gloomy and times when people have overplayed how bright it all looks,” he added. “I think we are just in a moment when there is so much uncertainty in the world: the American elections, the war in Ukraine, the actions of autocracies, the war in Gaza. It is not a good background.”

Patrick Drahi took Sotheby’s private in 2019

CHRISTOPHE MORIN/IP3/GETTY IMAGES

There is another complication for Sotheby’s: the debt pile of its owner. Patrick Drahi, a Franco-Israeli billionaire who made his fortune with a telecoms company, Altice, took Sotheby’s private in 2019 in a $3.7 billion deal. The art market was then riding high with a series of giant sales, including the 2017 world record $450 million purchase of Leonardo da Vinci’s Salvator Mundi, the 2018 sale of Amedeo Modigliani’s Nu Couché (sur le côté gauche) for $157 million and the $90 million sale of David Hockney’s Portrait of an Artist (Pool with Two Figures).

Drahi issued around $1 billion in new bonds and loans to finance the deal for Sotheby’s, taking it private again after 30 years listed on the New York Stock Exchange. Drahi had built Altice through a mountain of debt, typically borrowing when interest rates were low.

Now his conglomerate’s French arm is in restructuring talks with creditors, with its American operations expected to follow soon — while Altice UK this year sold a 24.5 per cent stake in BT Group.

Meanwhile, the credit rating firms Moody’s and S&P this year both moved their ratings of Sotheby’s bonds further into junk territory. Sotheby’s chief executive Charles Stewart told the WSJ that bond prices had rebounded since this summer’s announcement of the $1 billion investment from ADQ. He said it was a “massive credit positive”.

Advertisement

A Sotheby’s spokeswoman said this week it had been a difficult period for all auction houses but insisted that other parts of its business, such as the financial services arm, were thriving. “Under Patrick Drahi’s ownership, Sotheby’s has become significantly larger, more diversified and more profitable than ever before,” she said. “During this period, we have invested hundreds of millions to enhance our facilities, technology and expand our offerings to clients.”

This post was originally published on this site be sure to check out more of their content