10th October 2024 – (Hong Kong) The story of Hong Kong’s meteoric rise in the art world is nothing short of remarkable. In just 15 years, it established itself as a formidable force on the international art scene, particularly in the Modern and Contemporary segments. Its dazzling sales often outshone those in New York, long considered the bastion of the prestige art market. However, as we look towards 2025, the question on everyone’s lips is: Is the party over in Hong Kong?

The numbers paint a sobering picture. The first half of 2024 saw a staggering 56% drop in Hong Kong’s auction revenue compared to the same period in 2021. This decline was particularly pronounced in the upper echelons of the market, with lots priced over $10 million experiencing a jaw-dropping 90% decrease. These figures have sent ripples through the art world, prompting a re-evaluation of Hong Kong’s position as a global art hub.

Yet, despite these challenges, Hong Kong’s art ecosystem continues to evolve and adapt. Western players are making bold moves, with auction houses and galleries doubling down on their presence in the city. Hauser & Wirth, for instance, unveiled a larger gallery space in January, while Sotheby’s, Phillips, Bonhams, and Christie’s have all upgraded their local facilities.

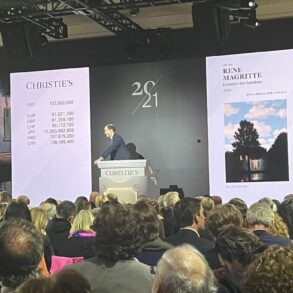

Christie’s, in particular, has made a significant statement with its move to a new ultra-modern headquarters in a skyscraper designed by Zaha Hadid Architects. This 50,000-square-foot space, opened in September 2024, represents a clear vote of confidence in Hong Kong’s future as an art market powerhouse. Francis Belin, Christie’s president for Asia, remains optimistic, focusing on the ultra-high-end segment of the market which he believes is largely insulated from broader economic headwinds.

However, the market dynamics are shifting. The works of major artists like Jean-Michel Basquiat and Zao Wou-Ki, once the darlings of Hong Kong auctions, have become less visible. In the first half of 2021, these two artists alone generated $192 million, accounting for 20% of the total results for the semester. Fast forward to 2024, and their reduced presence explains a $149 million shortfall in the market.

The contraction is not limited to established names. Young stars who had been propelled to unprecedented heights by Asian enthusiasm are now facing a cooler reception. Artists like Amoako Boafo, Loie Hollowell, and Nicolas Party, who had seen their works fetch seven-figure sums in Hong Kong, are now experiencing a significant market correction.

This shift is perhaps most starkly illustrated by the case of Nicolas Party. In 2023, Hong Kong was his primary market, generating nearly $15 million in sales, equivalent to 72% of his global annual auction turnover. In 2024, all three of his works put up for sale in Hong Kong failed to find buyers, a scenario that would have been unthinkable just months earlier.

The Ultra-Contemporary art segment has been hit particularly hard. Christie’s Hong Kong saw disappointing results for works by artists like Madsaki, Genieve Figgis, and Daniel Arsham in March 2024, with pieces selling well below their low estimates. This cooling of enthusiasm for emerging artists suggests a recalibration of the market, with buyers becoming more discerning and perhaps more risk-averse.

Yet, it’s not all doom and gloom. The Hong Kong market appears to be undergoing a process of maturation rather than decline. While the frenzied speculation on young artists may be subsiding, there remains a strong appetite for quality works by established names. Zao Wou-Ki, for instance, continues to command robust prices, with an exceptional sales rate of 83% in 2024.

Looking ahead to 2025, industry insiders predict a period of consolidation rather than contraction. The market is expected to become more selective, with a renewed focus on artistic merit and long-term value rather than short-term speculation. This shift could actually strengthen Hong Kong’s position as a serious art market, shedding its image as a playground for speculative buying.

Auction houses are adapting their strategies accordingly. Sotheby’s, for example, has expanded into the retail space, opening a two-story “maison” in Hong Kong’s Central district in 2024. This move aims to capture a broader segment of the market, offering works ranging from HK$5,000 to HK$50 million.

In conclusion, while Hong Kong’s art market may be facing headwinds, it’s far from a doomsday scenario. The city’s unique position as a bridge between East and West, coupled with its robust financial infrastructure and growing cultural ecosystem, suggests that it will remain a key player in the global art market. The party in Hong Kong may have changed its tune, but it’s certainly not over. As we look towards 2025, the city’s art market appears poised for a more measured, mature phase of growth – one that may ultimately prove more sustainable and rewarding for collectors, artists, and institutions alike.