Sotheby’s unveils its brand-new Paris headquarters this week in the city’s Matignon Saint-Honoré district, where a growing contingent of major galleries have set up shop. Though just down the road from its previous location, the move garners the auction house 30 percent more square footage while also bringing street-view visibility to its sales room. The expansion is one of several major real estate shifts Sotheby’s has made over the last year to increase its luxury retail offerings, even as rumors of debt woes plague the firm.

Sotheby’s France president, Mario Tavella, said the move reflects the growing importance of Paris as an art market hub. Since 2019, major international outfits such as Gagosian, White Cube, and Hauser and Wirth have all opened new spaces in Paris. Meanwhile, Art Basel Paris, which launched as Paris+ Art Basel in 2021, will open its largest edition yet at the Grand Palais this week, just after Frieze London. Following Brexit, the increased interest in the City of Light has dimmed London’s reputation as Europe’s art market capital even if it hasn’t unseated the U.K. as the third-largest art market globally.

René Magritte, L’Incendie, estimated to fetch at least $3.2 million at Sotheby’s Surrealism sale. © Marc Domage.

Tavella noted, however, that Paris and London remain “complementary” rather than in competition when it comes to art sales.

“France is full of art collections, but we are also seeing more single-owner collections coming from other European countries,” he said, adding that “in the past 10 years, we have doubled our turnover.” This figure, however, isn’t limited to art sales. He also cites growth in the categories of wine and jewels, as well as design (especially Les Lalannes).

The inaugural art auctions, beginning this week, include an homage to Surrealism, which celebrates its centenary this year, a Modern sale led by a portrait of the French poet Francis Ponge by Jean Dubuffet (estimated at $5.4 million to $7.6 million), and a dedicated sale of works by Joseph Beuys. All told, the week of sales is estimated to bring in roughly $327 million. An exhibition, “Excellence à la Française,” showcases French finery of all sorts, from a painting by Élisabeth Vigée Le Brun to the first-ever prototype of a Hermès Birkin bag, owned by Jane Birkin.

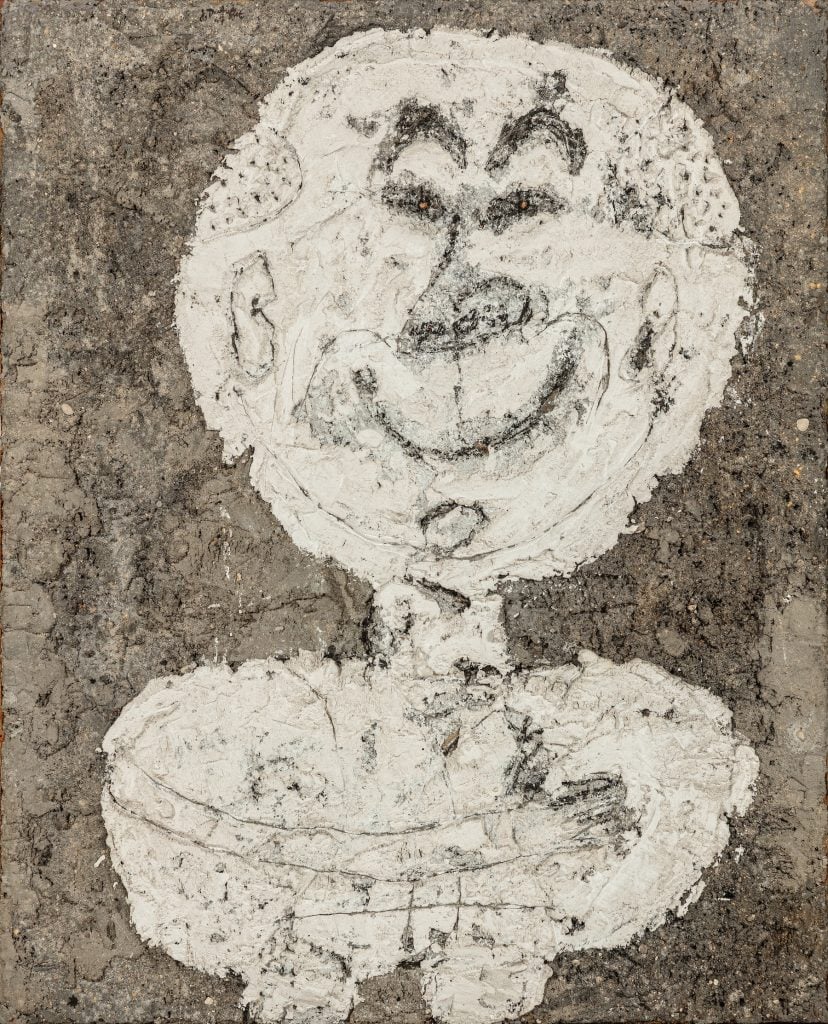

Jean Dubuffet, Francis Ponge Jubilation, (1947). Courtesy of Sotheby’s.

Luxury goods and collectibles are at the core of Sotheby’s Paris’s new strategy, of which the historic corner building at 83 rue du Faubourg Saint-Honoré is a part. The five-story Art Deco gem—previously home to the esteemed Galerie Bernheim-Jeune, which closed in 2019—will feature a second floor “Salon,” a retail space featuring luxury handbags and watches. There is a cellar downstairs for wine tastings.

Meanwhile, the sale room on the ground floor will be visible to street traffic thanks to 12 large windows, “if you also count the glass door,” Tavella said. He believes the transparency may demystify the auction-buying experience: “It can be intimidating [for new buyers].” He admits, however, that it “might not transform the average passerby into a bidder,” but it may encourage some to come in and browse another time.

The original Hermès Birkin bag, owned by Jane Birkin. Courtesy of Sotheby’s.

There’s good reason for the house to invest in the luxury retail space, not least the constricted art market of the last year and a half. (France’s fine art sales at auction are down 13.5 percent in the first half of 2024 versus the same period last year, according to the Artnet Price Database.) Marie-Anne Ginoux, the managing director of Sotheby’s Paris, said 25 percent of new bidders at auction in the last four years are luxury buyers, and 60 percent of those come from across Europe. Moreover, Paris as a whole is riding the “Olympic wave,” she said, noting that investment into the city’s infrastructure, from transportation to hotels and attractions, for the summer games this year would continue to bring more tourists.

Despite macroeconomic challenges, Sotheby’s has been doggedly expanding in other regions as well. The Paris relocation follows the launch of Sotheby’s new Hong Kong headquarters this summer, where the Salon concept was initially launched. In 2025, the auction house is also planning a move into New York’s Breuer Building, the former Madison Avenue home of the Whitney Museum for which it paid $100 million. It has also announced plans for a new space in Zurich.

Exterior Detail, Sotheby’s 83 Faubourg Saint-Honoré, October 2024 © Marc Domage.

While the growth trajectory seems impressive, the auction house’s finances are facing especially close scrutiny because of the well-known debts of its majority owner, French telecom scion Patrick Drahi. The Wall Street Journal recently reported that the auction house was “pushing off” payments to its art shippers and conservators by as much as six months while giving senior staffers IOUs instead of their incentive pay this spring, while rumors swirled about potential layoffs. A Sotheby’s spokesperson said these claims are “inaccurate.” In August, the house struck a $1 billion deal with Abu Dhabi’s sovereign wealth fund and it’s unclear how this may further shape the auction house’s operations going forward.

Tavella said that many of these strategic decisions were made five years ago, before the current economic downturn. But, “the market has had rough spots before,” he said. “We are building something that can accommodate what we want to do in the future, and I believe it will bear fruit.”