Wolf Kahn, Pink Light on the Sea, 1999. Courtesy of Bonhams.

The Art Basel and UBS Survey of Global Collecting offers a comprehensive look into the behaviors and perspectives of high-net-worth individuals (HNWIs) in the art market. Amid economic uncertainties and evolving market conditions, this report sheds light on the spending habits, preferences, and outlook of art collectors across the globe.

A Shifting Economic Landscape

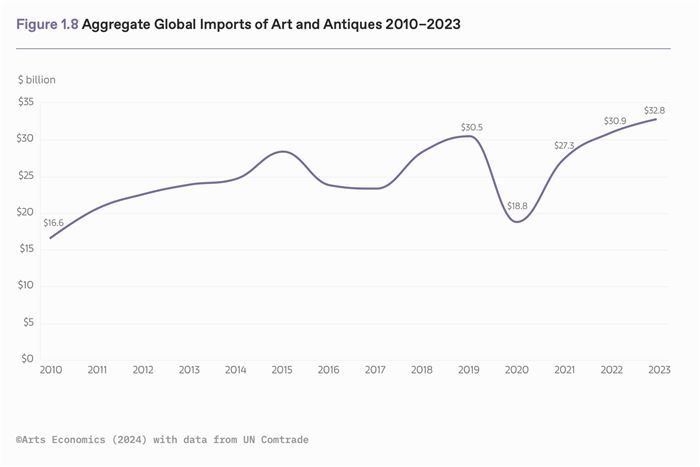

The global economy has faced challenges in recent years, with inflationary pressures, geopolitical tensions, and trade fragmentation impacting many sectors, including the art market. Despite these obstacles, the 2024 survey highlights resilience in global art collecting. While public auction sales have slowed, down by 26% at major houses like Christie’s, Sotheby’s, Phillips, and Bonhams, the cross-border trade of art has remained robust. Imports of art and antiques grew by 6% in 2023, reaching $33 billion – showing that demand, particularly in major hubs like Hong Kong, remains strong. However, the high end of the art market has seen a contraction, with fewer sales of works priced over $10 million. This decline has been one of the key factors contributing to the overall slowdown in market growth. Still, lower-priced segments have shown more resilience, suggesting that while ultra-high-end sales are slowing, broader participation in the market remains steady.

Global Art Collectors: Who Are They?

The survey delves into the demographics and behaviors of HNWIs who are active in the art market. It highlights that despite the ongoing economic pressures, collectors remain passionate and committed to their collections. The report draws on a sample of over 3,660 HNWIs from 14 key regions, making it the most extensive survey of its kind to date. These collectors are predominantly based in the United States, Mainland China, Hong Kong, and the United Kingdom – regions that account for the majority of global art market activity. Notably, collectors from Mainland China had the highest median spending on art and antiques in both 2023 and the first half of 2024, with a median expenditure of $97,000. This figure is more than double that of any other region, underscoring the continued strength of the Chinese market despite broader economic concerns.

Generational Shifts and Inheritance

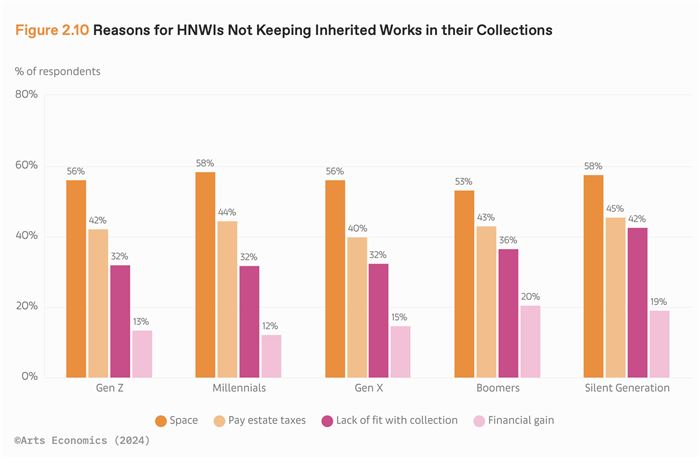

A key theme explored in the survey is the intergenerational transfer of wealth and its impact on art collecting. As the wealthiest individuals age, the next few decades will see an unprecedented transfer of assets – estimated at over $6 trillion – from one generation to the next. This transfer is likely to have profound effects on the art market. Already, 91% of HNWIs surveyed in 2024 reported that they held works in their collections that were either inherited or gifted. While many have chosen to retain these works, a significant portion have sold or donated them, with practical concerns like estate taxes and lack of space being key drivers for divestment. Importantly, the much-discussed notion that younger generations are significantly changing the tastes of art collections appears less significant, as only about one-third of millennial and Gen Z collectors cited a lack of fit with their collections as a reason for selling inherited art.

A key theme explored in the survey is the intergenerational transfer of wealth and its impact on art collecting. As the wealthiest individuals age, the next few decades will see an unprecedented transfer of assets – estimated at over $6 trillion – from one generation to the next. This transfer is likely to have profound effects on the art market. Already, 91% of HNWIs surveyed in 2024 reported that they held works in their collections that were either inherited or gifted. While many have chosen to retain these works, a significant portion have sold or donated them, with practical concerns like estate taxes and lack of space being key drivers for divestment. Importantly, the much-discussed notion that younger generations are significantly changing the tastes of art collections appears less significant, as only about one-third of millennial and Gen Z collectors cited a lack of fit with their collections as a reason for selling inherited art.