The current decline of prices is due to changing market conditions — it is not a reflection on any given artist.

The contemporary art market poses one of the great chicken-egg questions in all of economics: If the thing for sale has no objective value, do prices need to be manipulated? Or is value meaningless because prices are being manipulated in the first place?

This question applies to other markets too (private equity, for one), but it is more apparent in the market for contemporary art — art by living artists, especially emerging artists, whose work sells for between $50,000 and say $300,000. The entire art market is slowing down, but that is particularly true for younger artists, also known as “ultra-contemporary.” In some cases, prices are collapsing, risking many careers.

Traditionally, most contemporary art is sold in the primary market through galleries. Art is inherently difficult to put a value on, because its intrinsic value — that is, paint and canvas — is worth not nearly as much as its value as a piece of art — that is, its aesthetic, the statement it makes, or its scarcity. The work of long-dead artists is easier to value, because it has a price history and there is a finite number of works. With younger, living artists, it is hard to say whether their work will stand the test of time, or how their future work will affect the value of their current work.

Continue reading the entire piece here at Bloomberg Opinion (paywall)

___________________

Allison Schrager is a senior fellow at the Manhattan Institute and a contributing editor of City Journal.

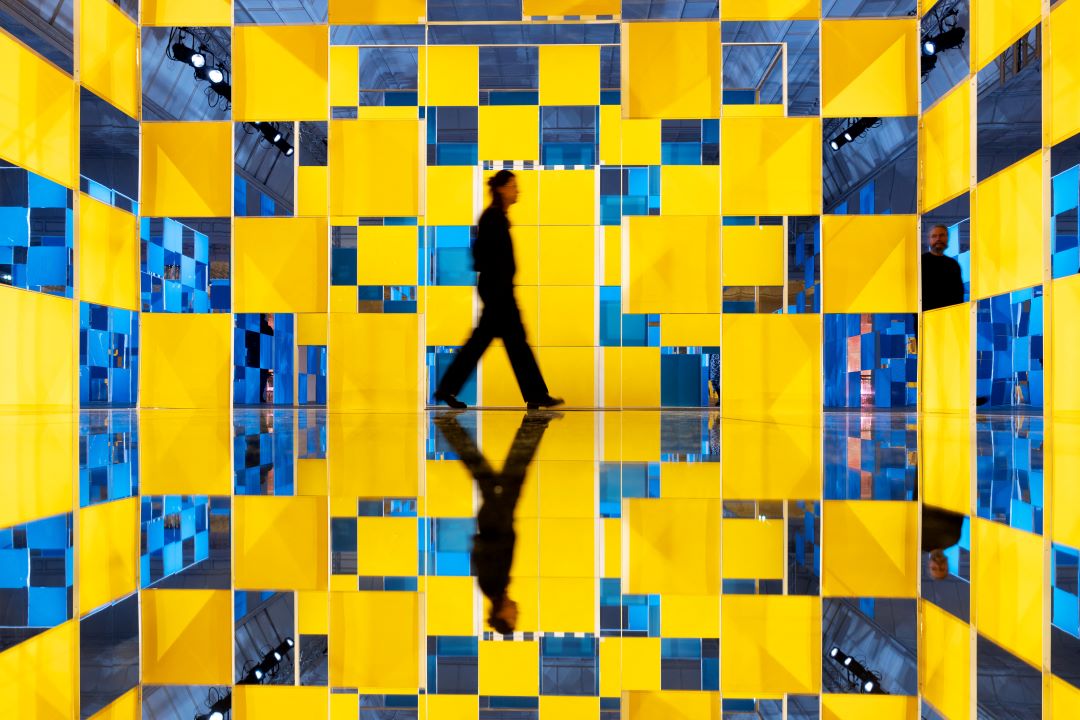

Photo by JOEL SAGET/AFP via Getty Images

This post was originally published on this site be sure to check out more of their content