Good morning. Donald Trump represents a major challenge to Canadian policymakers and businesses. Today, we look at how they might approach a more protectionist United States as we move closer to renegotiating a free-trade agreement.

If you’re tired of reading about the U.S. election, that’s totally understandable. Scroll down about three thumb flicks for an expanded edition of The Outlook that features Trump-free business stories that caught my eye this week. But first:

In the news

TD’s new anti-money-laundering chief is urging the financial sector to learn from his bank’s failures: “I know we’re in the news today, but we’re not the last ones, unfortunately. There will be more.”

Alberta’s government has ousted the entire board of Alberta Investment Management Corp., promising “to restore confidence” in the provincial pension fund manager.

GFL Environmental Inc.’s chief executive acknowledged the string of shootings and arson attempts targeting the waste-management giant, reversing a previous position that the acts were unrelated incidents.

Barrick Gold Corp. says the Canadian gold miner is prepared to fork over to Mali more than half of its economic windfall from mining in the country.

The Competition Bureau has set its sights on Dye & Durham for alleged trade-restricting practices.

Happening today

- Statistics Canada releases job numbers for October.

- Earnings include Telus Corp., Sony Group Corp., and High Liner Foods.

- Email me: cws@globeandmail.com

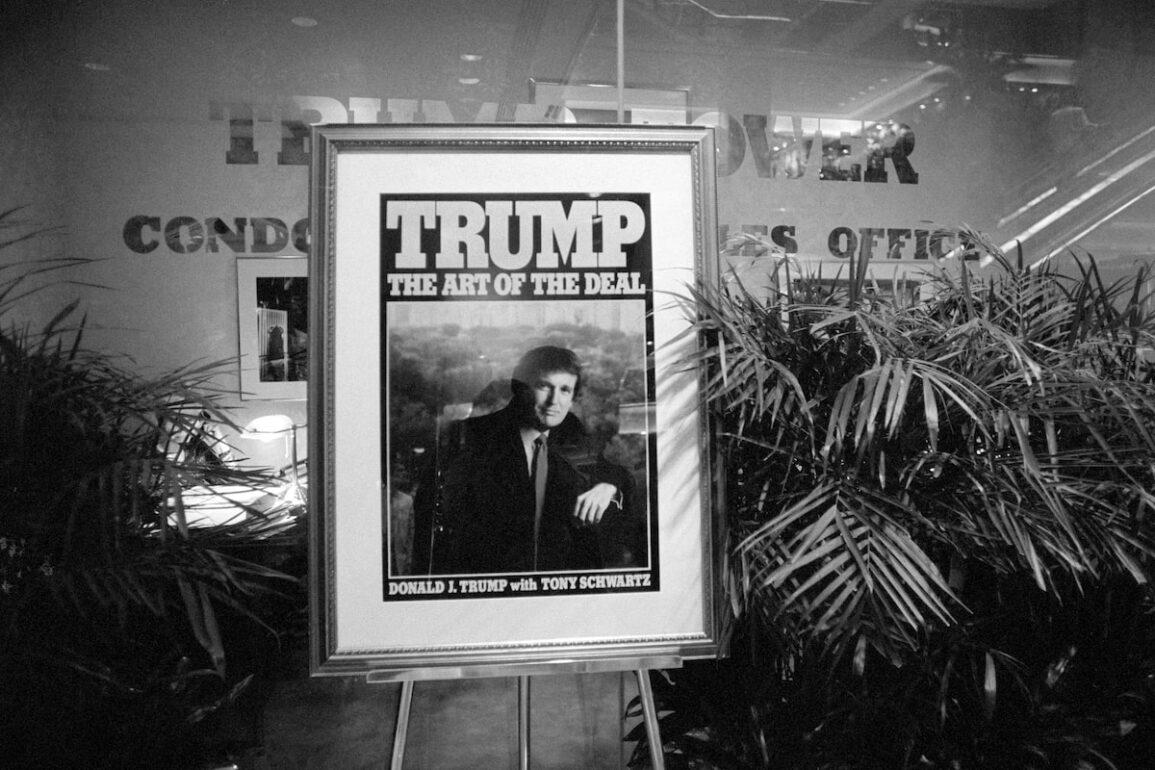

A poster at Trump Tower in Manhattan promoting “Trump: The Art of the Deal.”The New York Times News Service

In focus

Canada’s best shot? Finding common ground

That could be the path to stability, if not outright prosperity.

1. A Trump presidency is broadly bad news for Canada …

There’s no way to sugarcoat the largest takeaway for this country. A cornerstone of Trump’s campaign was a promise to impose a universal set of tariffs on all imports into the country. But even as his levies would be shouldered by importers of companies that do business with any country in the world, Canada stands to feel the pain more acutely. Billions of dollars in Canadian goods and services cross the border every day, accounting for roughly three-quarters of the country’s exports.

2 … but there is a road to (a version of) success

The free-trade agreement that Canada and Mexico were able to salvage with Trump in his first presidency is up for renegotiation in 2026. He’s protectionist like I’m a Jays fan: when I want to be. That gives Canada an opportunity to craft an artful appeal to his hunt for a good deal.

Finance Minister Chrystia Freeland has been put in charge of a revived cabinet committee on Canada-U.S. relations in the election’s wake. Its strongest selling point could be Canada’s ability to support the U.S. in its breakup from China on security and protectionist grounds: If security over energy, over supply-chain safety, over keeping costs down for consumers is your problem, Canada is your solution.

While risks to Canada’s economy and businesses abound, there are opportunities as well. A strong U.S. economy, boosted by tax cuts, usually increases demand for Canadian exports, said Stuart Bergman, chief economist at Export Development Canada. And a weaker Canadian dollar compared with the U.S. currency should make Canadian exports more competitive.

“That takes a little bit of the sting away from the negative impact of what would come from tariffs,” he told The Globe.

3. That changes Canada’s course, whether we like it or not

To pull a deal off, Canada will be expected to fall in line with the U.S. on immigration, defence spending and sharper tariffs against China.

On immigration, the federal government has already drastically reduced its targets to a degree that has left many business leaders uncomfortable.

On defence spending, Canada is the only member of NATO that hasn’t shared a plan to reach 2 per cent of gross domestic product. Prime Minister Justin Trudeau has set a goal of reaching that target “clearly and naturally” by 2032, but a report from Canada’s Parliamentary Budget Officer said that timeline would require defence spending to double to $81.9-billion. That feels a bit beyond natural.

Another problem with that: 2032 isn’t good enough. Those are the words of former U.S. ambassador to Canada Kelly Craft, who served under Trump in his first term.

On tariffs against China, we’ve already seen what can happen when we follow in Washington’s path. The announcement this summer of a 100-per-cent tariff on imports of Chinese-made electric vehicles was swiftly met with the threat of a devastating suspension of imports of Canada’s rapeseed.

All of which is to say: We don’t seem to have much choice in the matter. Falling in line with America’s trade tactics means “Canada will have to pick a lane and be unequivocal in promoting North America and that may put us at odds with other trading partners,” Dennis Darby, chief executive of the Canadian Manufacturers & Exporters trade group, told The Globe. “Mr. Trump is always about making a deal and this is how we can do that.”

4. We don’t yet know which Trump we’re dealing with

When Trump was elected in 2016, he imposed 25-per-cent tariffs on Canadian steel and aluminum and held the North American free-trade agreement over a fire. Canada and Mexico managed to salvage much of the trade deal, which became the United States-Mexico-Canada Agreement.

This time around, a lot will depend on who is advising Trump on trade and other economic issues.

Bergman shared a common sentiment among analysts who have been trying to get their heads around the effects Donald Trump might have on Canada’s economy: It depends on what kind of Donald Trump we get. Is it a repeat of Trump’s first presidency, “or is it more of a Trump unchained?” Bergman asked.

And David MacNaughton, a former Canadian ambassador to the U.S., wondered: “Is his tariff going to be a universal tariff? Or will it be universal for all those who in his mind behave badly? We’ll see. I mean, what is said on the campaign trail and what actually ends up being implemented are sometimes different.”

5. Canadian businesses are not a monolith

There is a massive role for policymakers to ensure that Canadian businesses have every chance to succeed in a strained environment. But Canadian businesses aren’t holding their breath, and have already begun the work of inoculating themselves as best they can from a U.S. trading partner that was becoming more protectionist anyway.

The chairman of Sucro Sourcing, a company with refineries in both Hamilton and upstate New York, told me this week about how his company made virtue of what each plant brought to the supply chain, and made each plant more successful by sharing staff, expertise and resources.

A growing number of Canadian companies are looking to upstate New York, where they’re finding an affordable entry point to the U.S. market – either by expanding their presence or setting up American outposts.

That won’t work for everybody, and for a country that depends so much on its trade relationship with the U.S., not nearly on the scale to make up for the losses the broader economy faces.

5(a) A federal election could collide with USMCA negotiations

But solutions like that bear spotlighting more and more at this moment. If the USMCA renegotiations weren’t already an urgent concern, the growing possibility of a federal election just ahead of those talks make for a troublesome dynamic. Can we count on policymakers to run for office – which some have already done, if unofficially – while simultaneously pulling out all the stops to ensure a good deal for Canada in a renewed trade agreement?

With reports from Matt Lundy, Mark Rendell, Jason Kirby, Marie Woolf, Stephanie Levitz, Steven Chase and likely many more reporters whose work is essential to my brain and this newsletter.

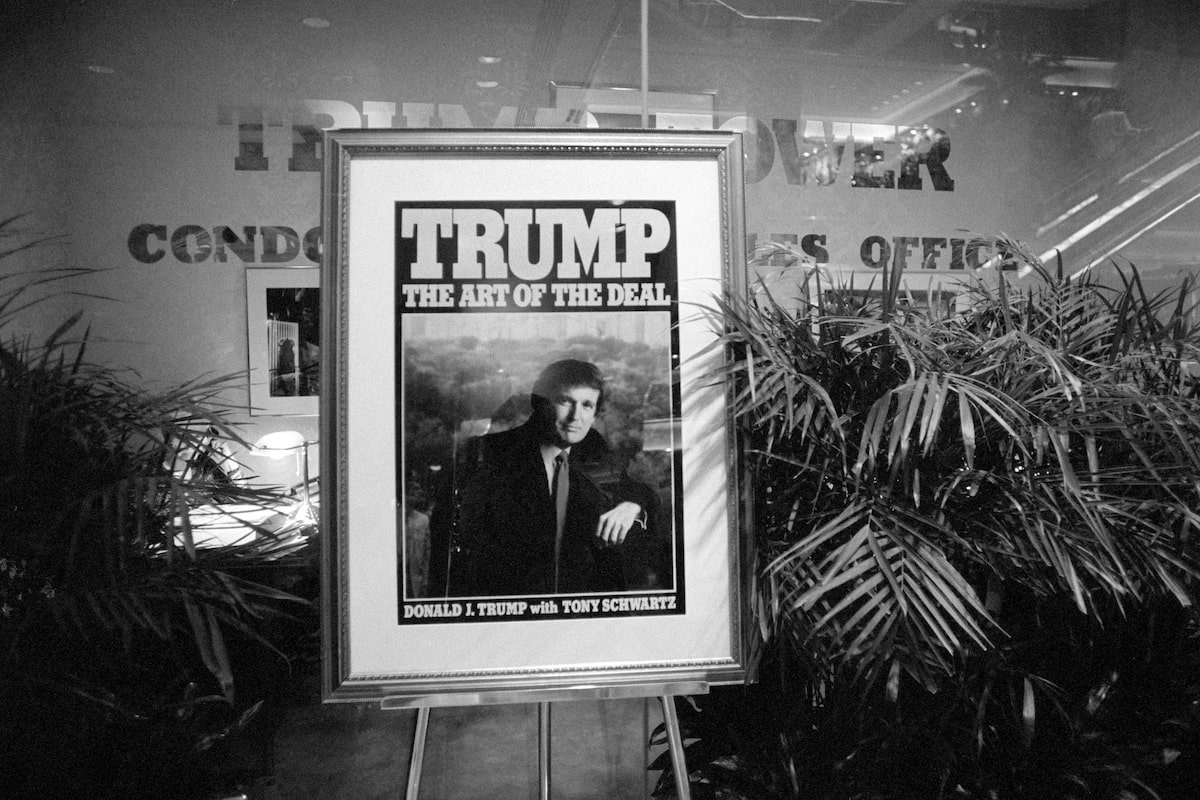

A gorilla at Virunga national park in the eastern part of the Democratic Republic of the Congo.

The outlook

On our radar and reading list

We’re giving animals spending power: At least that’s one solution being put forward to save the planet by Jonathan Ledgard, the founder of a company called Tehanu, “the first interspecies money protocol.”

If the potential demise of the human species amid the worsening climate crisis isn’t enough to entice developed countries and investment funds to move more urgently on spending to save nature, Ledgard’s idea is to meet them on the money markets. Writing recently in the Financial Times, Ledgard outlined how a return on investment might work:

“We recently applied a digital identity to a family of mountain gorillas in the wild, spun up digital wallets for them, and successfully executed mobile money payments from the gorillas (or their computational proxies) to human agents according to the AI-inferred interests of the gorillas, such as for the removal of poachers’ snares.”

Ledgard’s proposal might sound fantastical, but a market for “nature-based” finance solutions is emerging alongside the rise of artificial intelligence and innovations around blockchain.

- Tired: Saving animals.

- Wired: Giving animals the ability to take part in a monetary protocol and saving the planet as a byproduct of revenue generation.

Walmart is locking up deodorant: I’m not personally shocked to learn this. Police in Guelph, Ont., reported earlier this year that a thief made off with 14 packages of Native brand deodorant – carrying a value north of $200. (To be honest, the reason I remember this is mostly because of the headline: “Suspect described as 6′1″, tanned skin and smelling good.”)

But apparently stealing deodorant is a thing. I suppose that’s no wonder as consumers continue to face high prices for basic essentials. In a bid to counter increasing theft, Walmart Inc. and other retailers began locking up more products in recent years.

- “Some operators have reported higher incidents of shoplifting and have locked up more items that could be stolen. Products that are frequently targeted include cold medicine, cosmetics and detergent.”

But Bloomberg reports that Walmart is now testing technology in stores that would “let people open security locks for products from their cellphones.”

A team of scientists worked with logging company Sumitomo Forestry to develop a satellite made of wood.AFP/Getty Images

The future of satellites might be wooden: A satellite the size of a box of tissues arrived at the International Space Station on Tuesday. It’s a tiny little wooden contraption that could represent a big part in keeping space exploration sustainable, Space.com reports.

Conventional satellites are mostly made of aluminum. When they burn up in the Earth’s atmosphere at the end of their lives, Space.com reports, they generate ozone-damaging aluminum oxides.

- “These impacts are becoming more of a concern as the orbital population grows, thanks to the rise of mega-constellations like SpaceX’s ever-growing Starlink broadband network, which currently consists of about 6,500 active satellites.”

I don’t know if two stories about analog approaches to space explorations makes for a trend, but it nevertheless reminded me of the company working on a newfangled “catapult” technology that could fling satellites into orbit without the need for fuel.

Morning markets

Global stocks edged lower after rallies this week, with sentiment underpinned by Donald Trump’s decisive U.S. election victory, while China unveiled measures to support its flagging economy. Wall Street futures were little changed and TSX futures were in negative territory as crude prices slumped.

Overseas, the pan-European STOXX 600 was down 0.6 per cent in morning trading. Britain’s FTSE 100 slid 0.78 per cent, Germany’s DAX dropped 0.76 per cent and France’s CAC 40 retreated 0.76 per cent.

In Asia, Japan’s Nikkei closed 0.3 per cent higher, while Hong Kong’s Hang Seng gave back 1.07 per cent.

The Canadian dollar traded at 71.91 U.S. cents.

This post was originally published on this site be sure to check out more of their content