Bank of America (BAC)’s latest Art Market Update offers a cautiously optimistic outlook for the November art auction sales, which are projected to generate $1.2 billion to $1.6 billion across houses. While this pre-sale estimate is slightly lower than last year, it remains substantial thanks to the high-profile estates secured by Christie’s and Sotheby’s this season. With the market continuing its correction, auction houses have sensibly adjusted their expectations, offering a tightly curated selection of blue-chip names alongside a few trophy works. These strategic moves aim to produce stronger-than-expected results in what many see as a crucial test of the market in the post-election period, especially with anticipated shifts in fiscal and monetary policy looming.

Drew Watson, Head of Art Services at Bank of America Private Bank, emphasized that the November auctions are happening at a pivotal moment for the market, potentially providing valuable insights into what’s next. “Since the last midseason auctions, we’ve seen significant changes in the financial landscape, most notably the announcement of interest rate cuts,” Watson told Observer. “Interest rates influence the art market even more than equities markets because they represent the opportunity cost of tying up capital in an illiquid asset that doesn’t generate any immediate or direct cash flow as art can be. Higher interest rates, therefore, tend to correlate to a softer art market. Conversely, lower interest rates tend to provide a tailwind to the art market.” With rate cuts now underway, alongside the price corrections of recent seasons and the return of high-end single-owner estates at Christie’s and Sotheby’s, Watson sees this week’s sales as a key test that could shape the market’s trajectory heading into May and next November.

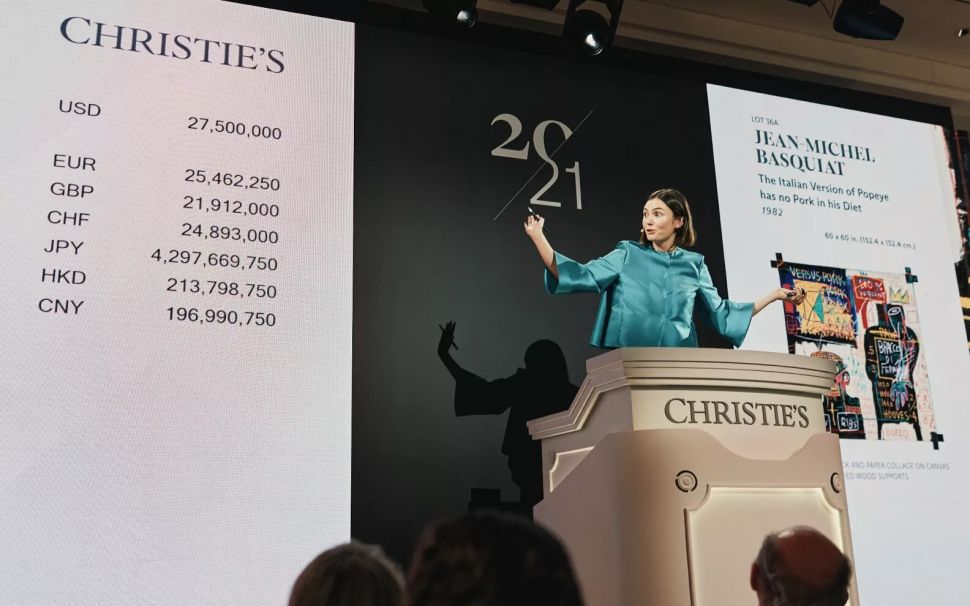

Watson’s overall outlook remains optimistic, suggesting the market may be poised for a rebound—albeit one characterized by a “new rhythm” and more “human” prices. “Our expectation is that the sales this week, for the supply represented, should perform relatively well,” he said, emphasizing the rarity and quality of the artworks on offer. Among the highlights: a Monet from Sydell Miller’s Collection at Sotheby’s and a $95 million Magritte from Mica Ertegun’s collection at Christie’s. “These are true masterpieces,” Watson added, “and they should perform fairly whether the current market cycle continues or we start to see things shift in the opposite direction.”

A slow recovery through a market correction

According to the Bank of America report, the first half of 2024 saw auction prices land just 1 percent above their aggregated mid-estimates—a minuscule uptick, marking the most lackluster improvement in over seven years. Focusing on the marquee New York May auctions, 32 percent of lots ended up selling below their low estimates, generating an average annual return for sellers of only 4.6 percent—the weakest performance in at least five seasons.

The ultracontemporary and emerging art categories, once fueled by pandemic-era speculative frenzy, have taken the steepest hit. The report notes a staggering 55 percent drop in “Now” sales and a 26 percent decline in the price-to-estimate ratio. One striking example is the dramatic fall in market perception for María Berrío. Once heralded as a must-have name with primary prices around $400,000 to $500,000 and secondary market sales soaring into the millions, Berrío’s La Cena (2012) sold for $1.5 million at Sotheby’s in 2022 but fetched just $441,000 at Christie’s this year—within its estimate of $350,000–$450,000 but representing a staggering 71 percent decline in just two years. This sharp correction has rattled confidence among collectors who once viewed works by emerging artists as a lucrative investment.

The thinning representation of “wet paint” artists in this season’s auctions underscores the category’s softness. However, bright spots remain. Jadé Fadojutimi continues to break records, recently achieving £1.6 million ($2 million) at Christie’s London for The Woven Warped Garden of Ponder (2021), her third consecutive auction benchmark. Sotheby’s has a pink Fadojutimi estimated at $500,000–$600,000 in its Now and Contemporary Evening Auction, alongside other buzzy names like Luis Fratino ($100,000–$150,000), Pol Taburet ($100,000–$150,000) and Yu Nishimura, whose work—perpetually sold out at Sadie Coles HQ and Crevecoeur—is expected to soar past its $50,000–$70,000 estimate. Despite these headliners, the ultracontemporary roster is thin, with most auction houses leaning on more established blue-chip names. Notably, a Lucy Bull piece initially slated for the Evening Auction was relegated to the Contemporary Day Sale, estimated at $400,000–$600,000—despite her record-setting $1.8 million sale for 16:10 earlier this year.

SEE ALSO: Observer’s 2024 List of the Most Influential People in Art

Phillips, a frequent leader in launching ultracontemporary artists, has scaled back its offerings. This season, it’s presenting just $540,000 in estimates for the category—a sharp 50 percent drop from last year’s $1.12 million total for artists like Fadojutimi, Ambera Wellman and Christina Quarles. Meanwhile, Christie’s 21st Century Evening Sale includes just a handful of ultracontemporary lots, such as works by Firelei Báez ($100,000–$150,000), Lucy Bull ($600,000–$800,000), Stefanie Heinze ($70,000–$100,000) and Sasha Gordon ($80,000–$120,000), who recently joined David Zwirner’s roster.

Market feedback from recent auctions and fairs confirms a shift in collector behavior. Buyers are increasingly discerning, with a focus on acquiring “Triple A+” works while sidestepping gallery tactics like waiting lists and controversial “buy one, gift one” schemes. “Collectors are more discerning than ever,” Watson said. “They know galleries continue to sell A+ works but that terms are more negotiable on everything else, and they are using that knowledge to secure more favorable transaction terms.”

As the market adjusts to a slower (or more rational) pace, collectors are wielding greater leverage in negotiations, prioritizing quality and value. Auction houses have responded by lowering estimates to attract buyers, but primary market dealers face tougher constraints. Unable to slash prices, galleries are slowing their schedules, extending exhibitions, and reducing their participation in art fairs. More than ever, success in the primary market hinges on building stronger personal relationships with clients, balancing pricing strategies and adapting to the market’s shifting dynamics.

Latin American artists are gaining momentum in a market hungry for Female postwar artists and Surrealism

The report also highlighted how certain subcategories have not only remained resilient but also managed to grow, bucking broader market trends. A standout example is the Latin American and Latin diaspora market, which has experienced a remarkable surge in visibility and valuation over the past two years. Sotheby’s, for instance, reported that sales of works by Latin American artists—both historical and contemporary—have climbed more than 50 percent above pre-pandemic levels. A major milestone was reached this past May with the record-breaking sale of Leonora Carrington’s Surrealist masterpiece Les Distractions de Dagobert for $28.5 million. Acquired by Argentinian collector Eduardo Costantini, the painting’s sale underscored the rising prominence of the category. Just last night, Carrington’s haunting sculpture La Grande Dame (The Cat Woman) (1951) fetched $11.4 million, far exceeding its presale estimate of $5 million to $7 million, following a heated bidding war. Costantini, once again, emerged as the buyer. In the same evening, Carrington’s painting Temple of the Word (1954) realized $4.6 million, landing squarely within its presale range of $3-5 million.

Watson pointed out that this growth can partly be attributed to demographic shifts and the redistribution of wealth. In particular, there’s been a notable accumulation of wealth in the Latin American region and within the Latino diaspora. Many from these communities are now ascending to prominent roles in financial institutions and corporations, particularly in the U.S., yet their collecting preferences often reflect a desire to stay connected to their cultural roots. Among recent triumphs in this category, Christie’s May sale of the Rosa de la Cruz collection stands out, bringing in over $34 million. The auction set new records for Cuban artists Ana Mendieta and Félix González-Torres, including the $13.6 million sale of González-Torres’s museum-quality sculpture Untitled (America #3) to the Pola Museum in Japan. Market demand remains robust for other figures in the category, including Leonor Fini, Rufino Tamayo, Remedios Varo and Wifredo Lam, whose works continue to attract attention from collectors and institutions alike.

The current enthusiasm for Latin American art is further fueled by a broader rediscovery of overlooked categories and artists. This trend has drawn international buyers eager to explore “fresh markets” with untapped potential. At the same time, institutions are increasingly focused on diversifying their collections with works of historical and cultural significance. The renewed interest in Latin American art often intersects with the rise of postwar female artists and Surrealism, two categories identified by Watson as similarly benefiting from a surge in interest and sustained growth. “I think backing up this rise, there’s been a real interest in artists who have not been historically central to the art historical canon,” he said.

These patterns are echoed in broader market analyses. The 2024 Art Basel and UBS Global Collecting Survey revealed that works by female artists now account for 44 percent of pieces in HNWI collections, the highest share in seven years, up from 33 percent in 2018. Similarly, Artnet’s Mid-Year Review, released in September, noted that ten women ranked among the top 100 fine artists at auction in the first half of 2024—two more than the previous year. Three women made it into the top 20, with Yayoi Kusama claiming the third spot among the top-searched artists, trailing only Picasso and Warhol. Kusama’s meteoric rise reflects her growing market dominance and cultural cachet. Postwar art has also seen strong results, with two paintings by Joan Mitchell ranking among the top ten for the category in the past year.

Perspectives and trends in a post-election world

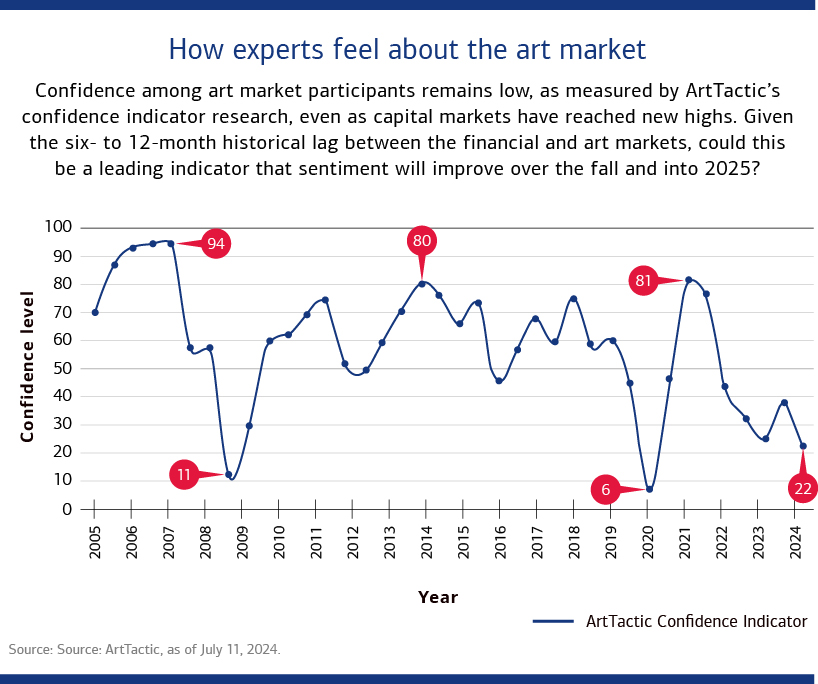

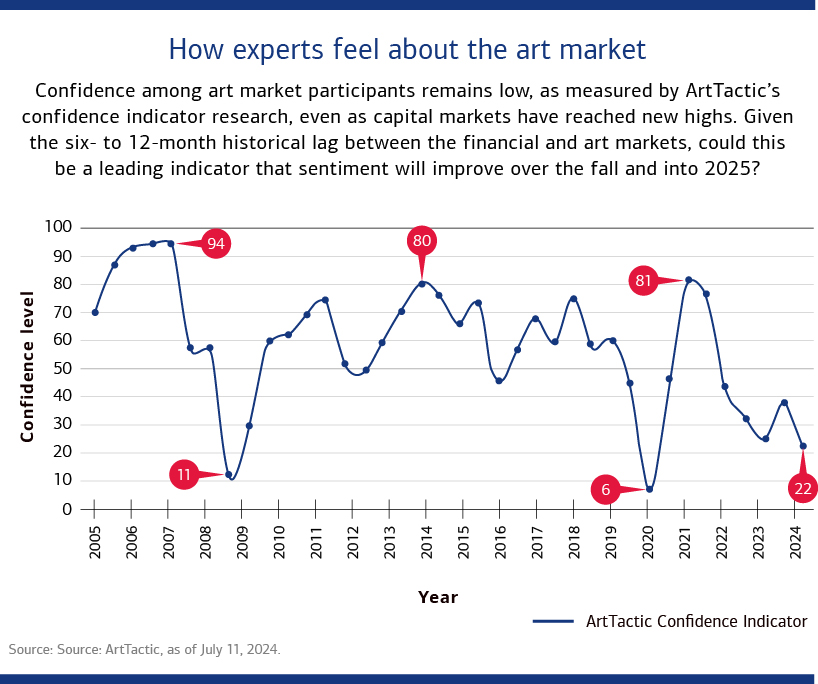

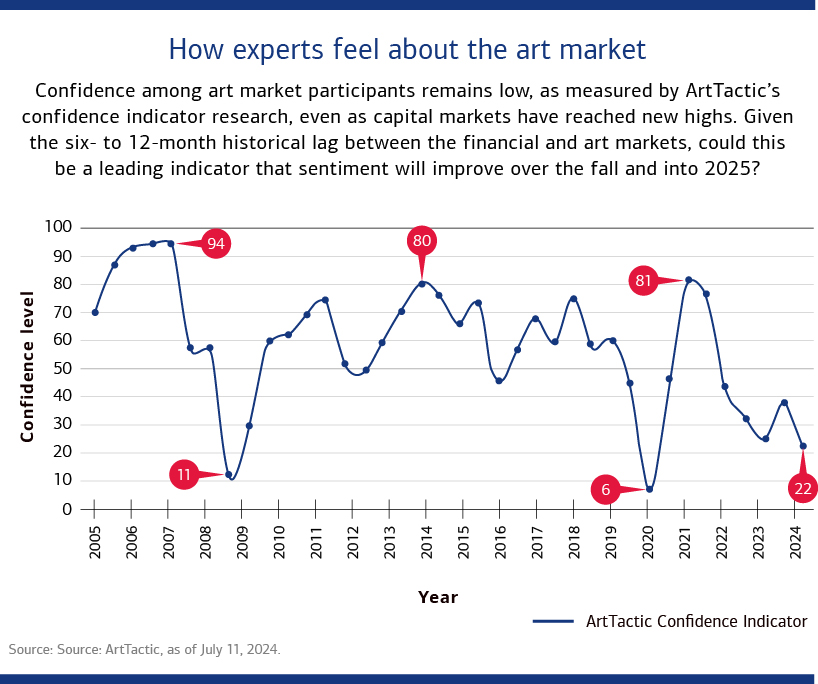

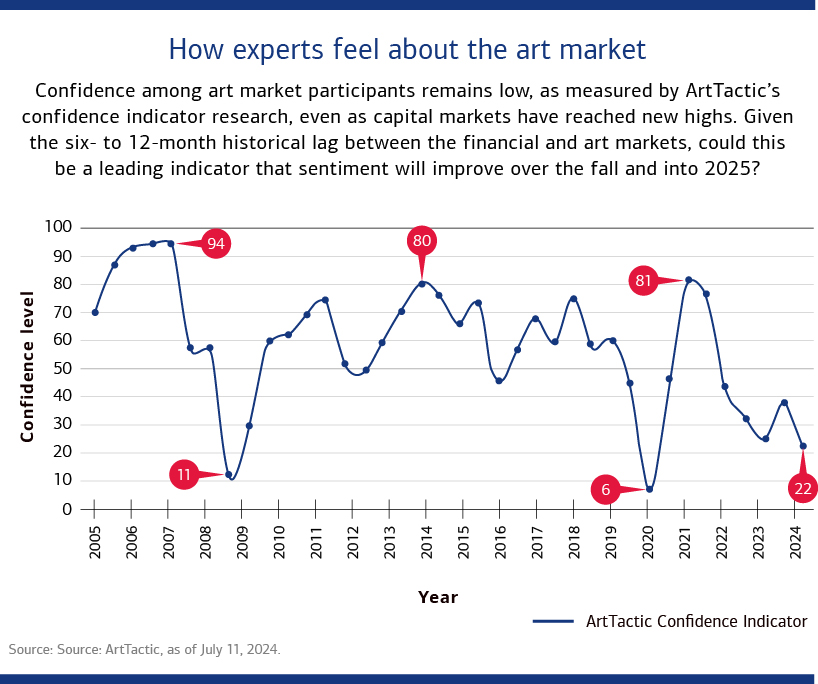

According to Bank of America, after a period of sluggishness and recalibration, the art market appears poised to enter a “new normal” defined by steady, perhaps even healthier, activity. While speculation swirled weeks ago about how the melodrama of the U.S. elections might prompt collectors to tighten their purse strings, the results now seem less consequential than initially feared. Instead, the report shifts focus to the financial and monetary policies, as well as geopolitical decisions, that will shape the months ahead. Though ongoing uncertainty about these policies may cast a shadow over this week’s sales, the report underscores that broader macroeconomic factors—not electoral theatrics—are the true culprits behind waning buyer confidence.

The market index has risen in four of the past six U.S. election years, with the U.S.-specific index outperforming the global index in five of those six years. Historical trends also provide a reassuring precedent: while both the COVID-19 pandemic and the Great Recession triggered sharp declines in the art market in 2020 and 2008, both downturns were followed by vibrant cycles of recovery and growth.

The success of November’s sales may very well hinge on collector sentiment and the opportunities presented. On a brighter note, Bank of America’s report highlights a growing optimism among collectors, many of whom are increasingly treating art as a cornerstone of their wealth management strategies. The 2024 Private Bank Study of Wealthy Americans reveals that 56 percent of collectors now consider art integral to their financial planning. Notably, 98 percent of younger collectors—Millennials and Gen Z—are incorporating art into strategies like charitable giving (52 percent), tax planning (48 percent) and liquidity management (28 percent). “They’re looking at their art not only as a lifestyle interest but also as part of their overall wealth,” Watson said. “It’s also interesting to note that these younger generations may be less confident in traditional investing models like stocks and bonds and are, instead, increasingly interested in alternative ones, including tangibles, which would include art and collectibles. This tells a broader story about where millennials and Gen Z confidence lies and how this differs from prior generations.”

With this new generation of collectors embracing a wealth-planning and long-term perspective, the art market’s future in the Americas may be more optimistic than it has been in recent years. This shift in approach, coupled with enduring enthusiasm among collectors, suggests a market ready to evolve in ways that align with changing economic realities and generational priorities.