ART SG returned to Singapore’s Marina Bay Sands Resort and Convention Center this week while the global art market continues to deal with a sales slowdown and fragmentation, and several fires in Los Angeles devastated artists, art professionals, and galleries.

By the end of Thursday’s VIP Day, several galleries had reported works sold, and the exhibition floor was filled with people up until the 9 p.m. closing time. However, despite the strong attendance and a wave of inquiries, many galleries reported selling very few or no artworks by the end of the day Friday, further highlighting how different the local art market is compared to those in the US, Western Europe, and Hong Kong, as well as the ongoing uncertainty in the market.

Local collectors in attendance included Albert Lim and Linda Neo, Institutum founder Andreas Teoh, Tanoto Art Foundation founder Belinda Tanoto, Brewin Mesa founder Bill Cheng, Ho Bee Group chairman Chuy Thian Poh, Christine Pillsbury, Pierre Lorinet, COMO Group founder Christine Ong, Ronald Ooi & Erica Lai, as well as UOB Group CEO Wee Ee Cheong. Notable and institutional attendees included Delfina Foundation director Aaron Cezar, Alex and Johnny Turnbull of the Kim Lim Estate, Bangkok Art Biennale artistic director Apinan Poshyananda, Sydney Biennale artistic director Cosmin Costinas, architect Kulapat Yantrasast, the OHD Museum of Modern and Contemporary Indonesian Art Museum founder Oei Hong Djien, Museum MACAN Foundation chairwoman Fenessa Adikoesoemo, M Art Foundation co-founders Michael Li and Wu Meng, as well as artists Theaster Gates, Mandy El-Sayegh, and Korakrit Arunanondchai.

ARTnews spoke with a dozen gallerists and art dealers from around the world about their experience at the third edition of the fair. Many of them were strategic on the price points of works, with a few exceptions.

(All sales are in USD unless otherwise indicated. Sales information is provided voluntarily by galleries but does not include confirmation of transactions, discounts, or other fees.)

The top work sold was Pablo Picasso‘s colored pencil drawing Buste d’Homme à la pipe (1969)for $1.2 million at Cardi Gallery, which also brought the most expensive work to the fair: George Condo‘s Down in Chinatown (2010) with an asking price of $4.85 million.

Pablo Picasso’s Buste d’Homme à la pipe (1969). Photo by Karen K. Ho/ARTnews.

“We’re getting offers, but we’ve got to get the right one,” Joe La Placa, senior director of Cardi Gallery’s London location and once a writer for Artnet, told ARTnews. “It’s a lot of money. But usually these things close, I would say, during or after the fair. But it’s a museum piece.”

“We purposely brought more low cost material, but there were two exceptions because it’s not as if there are no major collectors here,” La Placa said. “There are people that can afford a painting of that magnitude. We wanted to bring something super high-quality. The Picasso sold, so hopefully this one will as well,” he added, referring to the Condo.

Cardi Gallery declined to disclose information on the buyer of the Picasso.

Lehmann Maupin reported that Teresita Fernandez’s Stella Maris(Net) 4 (2024) sold to a private collector based in Singapore for $120,000 to $125,000; Mandy El-Sayegh’s Net-Grid Study (Euro-Joy) (2024) sold to a collector based in Jakarta, Indonesia for $72,000; and Kim Yun Shin’s quebracho wood sculpture Add Two Add One Divide Two Divide One 2013-7 (2013) was acquired for the permanent collection of the Singapore Art Museum through the inaugural SAM ART SG Fund for an undisclosed amount.

White Cube reported that on the first and the second day of the fair, the two top works it sold were Georg Baselitz’s Mettere mano a – anfangen (2019) for €650,000 and Tunji Adeniyi-Jones’s Celestial Gathering (2024) for $350,000. It also sold two works by Minoru Nomata and Tiona Nekkia McClodden’s NEVER LET ME GO | XXII. drop (2024).

Georg Baselitz’s Mettere mano a – anfangen (2019). Photo by Karen K. Ho/ARTnews.

Ellen BoReum Lee, assistant director of Johyun Gallery from Busan, South Korea told ARTnews that seven works by Lee Bae from his “Issu de feu,” “Acrylic Medium,” and “Brushstroke” series were sold out and hyper-realistic paintings by Kang Kang Hoon also sold out. Works by Lee Bae ranged from $30,000 to $60,000, while the two paintings by Kang Kang Hoon were $25,000 each. All sold to private collectors or institutions in Asia. Lee Kwang Ho’s Untitled 4699 (2024) also sold for $33,000.

The only other gallery to report six-figure sales on VIP day was Galerie Gmurzynska for Roberto Matta’s oil painting Is thou so desired? (1957) which sold for $150,000 and Wifredo Lam‘s 1971 painting Personnage 21/24, which sold for $120,000. Both sold to private collections.

“My understanding is that people are scouting a lot the first day and coming back between today and Sunday,” Christian Baert told ARTnews, noting that his eponymous Los Angeles gallery had brought a total of 10 new works by painters Sophie Birch and Melinda Braathen; and that he had attended Frieze LA in 2023. “In LA, the base is so different. People want the work, they ask you for the price; if they can afford it, they buy it. I know whenever I do a fair abroad, I know it just takes more time.”

Several galleries with works priced under $50,000—many of them attending for the first time and/or in the Futures section for young galleries—told ARTnews they had sold very few to no works on the first day. Only two of those galleries expressed optimism about sales activity during the rest of the weekend and the likelihood they would return to Singapore for a future edition of the fair. Most gallerists and art dealers were only willing to give honest comments to ARTnews anonymously due to the sensitive nature of the industry.

“There’s people coming all the time but it just hasn’t translated [into sales],” one gallerist said. “I’m not sure what it is.”

One of the paintings by Stan Burnside at ART SG 2025. Photo by Karen K. Ho/ARTnews.

Mestre Projects, a gallery from Nassau, Bahamas, brought a solo presentation of works by established Caribbean artist Stan Burnside with no prior expectations before coming to Singapore. “You don’t know how people are going to react,” founder Jose Mestre told ARTnews. “It’s kind of tricky to bring someone from the Caribbean to Asia, but the artist is an important one historically. He’s in his late 70s and he’s kind of the godfather for all the Caribbean and Bahamian artists. We want to bring something special for the first time.”

Mestre laughed when asked if he would return to ART SG. “Why not?” he said. “Hopefully we can come back. We like Asia. We like Singapore. I think it’s a very strategic place, it could be like a hub, connecting Indonesia, India, and Asia.”

“Doing art fairs is always more like a marketing thing,” another gallerist said. “My expectations are not very high but I expect to sell some; not everything. I’m happy if I cover the costs.”

“At this rate it’s going to be hard to recoup our investment,” one gallerist in the Futures section told ARTnews, confirming the cost of the booth was around $30,000 to $40,000 before other expenses.

One gallery pre-sold about half of its booth’s offerings in order to help it manage the high cost of attendance, but still only sold one work by the middle of the second day. “They’ve really created a division between top-tier galleries and this [other] level,” the gallerist in the Futures section said. “We pay the same square meterage, we get in on the same application process.”

One European gallery told ARTnews the response on the first day of ART SG led to 30 leads, but only two sales on the first day, including one to a collector they knew prior to the fair.

It’s often hard to measure the benefit of showing artists and increasing awareness of a gallery to a new group of collectors, a marketing aspect of art fairs that multiple gallerists acknowledged was part of their expectations for participating in ART SG for the first time.

“I think this is what we wanted,” the gallerist said, noting the inquiries came from Indonesia, Australia, Sri Lanka, Singapore, and other parts of Southeast Asia. “Here it’s nice to see the local crowd and interact with them.”

Waddington Custot brought works by Kenia Almaraz Murillo, Peter Blake, Fernando Botero, Ian Davenport, Robert Indiana, and Sean Scully; selling two paintings by March Avery for an undisclosed amount.

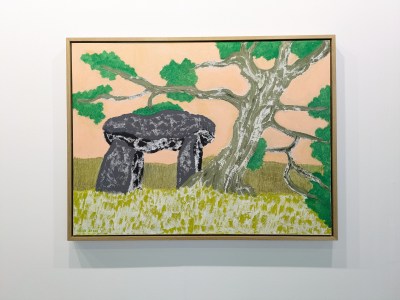

March Avery, Dolman, 2013. Photo by Karen K. Ho/ARTnews

Senior director Jacob Twyford noted there were larger economic factors affecting the global art market, not just the sales activity at this year’s edition of ART SG. A decade ago, the gallery would attend seven or eight art fairs a year, and sell works of art priced between $500,000 and $1 million at five or six of those fairs.

Waddington Custot will attend the same number of fairs each year now but only sell a work in that price bracket maybe twice a year. “I don’t think people spending big bucks go necessarily to art fairs to spend them in the way they used to,” Twyford said. “Art fairs have become difficult and tricky and hard to predict internationally. It doesn’t matter whether they’re in Europe or America.

The art market has also been described as a “vibe economy“, and those vibes continue to be off due to geopolitical conflicts in the Middle East, South Korea, Ukraine, the re-election of President Donald Trump, as well as the ongoing devastation of the fires in Los Angeles due to climate change.

“I think when people feel uneasy, unsettled, unsure of the world, it’s hard to do things like collect art, even if you’re wealthy,” Twyford said. “Wealthy people still suffer from insecurity. It think it is difficult. All those things do have an impact.”

This post was originally published on this site be sure to check out more of their content