(Bloomberg) — The rookie music group XG drew a huge roar at the KCON LA festival, a gathering of Korean pop music fans, with a cover of I Am the Best, a 2011 hit from the group 2NE1.

The seven young women in skeleton-print costumes and tank tops heated up the stage like all K-pop ensembles, with vocal harmonies and synchronized dance moves. But none of the XG members singing in Los Angeles to the tens of thousands of fans last August was in fact Korean — they’re all Japanese.

The two-year-old group is on the verge gaining global popularity by emulating the K-pop system. Led by a producer who was born in Seattle between a Korean father and a Japanese mother, XG’s young stars went through extensive training for more than three years before they debuted with an English song Tippy Toes and took the stage in Seoul. Since then, they’ve been traveling to festivals in New York and Abu Dhabi and selling out their first showcase in Japan. They plan a global tour starting in May.

“It’s really about spreading XG all around the world to where the fans are,” Simon Park, the group’s producer, said in an interview. “Our music is spreading in a really interesting way that we haven’t seen before.”

XG is one of a growing number of Japanese acts traveling outside their home country to America and Europe. While XG has adopted K-pop’s playbook, other J-pop stars such as the duo Yoasobi and singer Ado are tapping into another Japanese cultural export, anime, and licensing their music to animated TV shows.

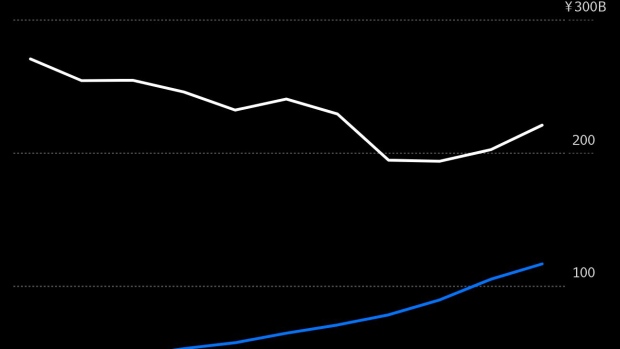

It’s a dramatic shift for the country, which had relied heavily on domestic audiences for decades. At $2.2 billion, Japan is the world’s second largest music market after the US. But it’s evolving. Revenue from digital sources rose to 35% last year, from about 21% in 2018, according to the Recording Industry Association of Japan.

XG’s breakthrough has been aided by the transition to streaming, which helps J-pop songs travel more broadly. The country’s share of the top 10,000 tracks played worldwide grew by more than half to 2.1% last year, according to researcher Luminate Data. While still small, it’s approaching the size of Korean-language songs, which had about a 2.4% share in 2023.

Although K-pop became the first Asian music genre to successfully crack the US market in a major way, J-pop has a longer history.

Japanese pop music sprouted a century ago, inspired by Western jazz and blues. The music evolved into folk and rock in the mid 20th century and incorporated electric sounds and jazz fusion, creating a “City Pop” genre in the 1980s.

J-pop started to gain global fame under Johnny Kitagawa, a powerful music mogul who paved the way for idol groups and controlled the Japanese industry for decades.

Kitagawa, who grew up in LA and was mesmerized by the musical West Side Story, formed boy bands in Japan with his production company Johnny & Associates. The genre thrived with the popularity of acts like SMAP and Arashi.

The music mogul built almost monopolistic power in the industry, as well as the media landscape, by controlling the artists’ copyrights. But by forcing bands to limit their activities to Japan and shunning social media and streaming platforms, he missed the chance to create a larger phenomenon.

That opened the door for BTS, the K-pop group that finally infiltrated the US by using sites like YouTube and X, the social media service formerly known as Twitter, to communicate directly with fans.

Read More: The K-Pop Mogul Behind BTS Is Building the Next BTS in LA

Johnny & Associates, which recently renamed as Smile-Up, belatedly opened its first social media channel on YouTube in 2018. But its founder died soon after, and the agency was toppled last year by what could be the biggest scandal in Japan’s entertainment industry — allegations that Kitagawa had sexually abused artists and trainees since the 1970s.

In the wake of the scandal, advertisers and broadcasters have been boycotting Johnny & Associates’ bands, creating a void in the market. The immediate winners have been K-pop groups and new Japanese artists who have been gradually gaining popularity through social media and streaming platforms.

XG, for example, has a bigger following on YouTube than King & Prince, a Johnny & Associates group that debuted in 2018. Yoasobi has more than 9 million followers on Spotify, while the solo artist Imase’s Night Dancer went viral on TikTok.

Sony Group, Japan’s largest media conglomerate, is riding the momentum by maximizing the country’s strongest cultural asset: anime. Backed by Sony Music, Yoasobi’s Japanese and English songs for anime shows on Netflix, such as Oshi no Ko’s opening number Idol, have become massive hits across Asia and the US. The duo will perform at the Coachella Valley Music & Arts Festival this year.

The singer Ado, who hides her face by appearing only in silhouette, has been topping charts with the theme song New Genesis for the manga movie One Piece Film: Red. It became the first Japanese song to reach No. 1 on Apple’s global 100 chart. Ado is on her first global tour of Asia, the US and Europe with support from Universal Music and Sony’s Crunchyroll, the world’s biggest anime streaming platform. The hip-hop duo Creepy Nuts’ Bling-Bang-Bang-Born, the opening theme for season two of the TV anime show Mashle: Magic & Muscles, is the biggest hit among J-pop songs so far this year.

About 20% of Gen Z music listeners in the US and South Korea are discovering Japanese music through anime, according to Luminate.

“Generations that discover music through anime are also most likely to be high streamers of music,” the research firm said.

As the J-pop industry evolves, so does the music. New Japanese artists and duos are creating music mixing electropop and hip-hop. XG’s songs don’t perfectly fit into typical J-pop or K-pop music. The members call their genre X-pop.

Creating a concept and genre that didn’t exist before is what XG wants to do, the group’s producer said. And they’re not the only ones.

Lapone, a joint venture between South Korea’s CJ ENM Co. and Yoshimoto Kogyo Holdings Co., a 111-year old Japanese entertainment company, was established a few years ago in Japan to adopt the K-pop idol system. XG’s company, XGALX, started with support from Avex Inc., the Japanese media group behind legendary singer Ayumi Hamasaki. Founded in 2017 by Park, the chief executive officer who goes by Jakops when working as a producer, the Seoul-based XGALX is growing fast as one of the music labels that’s targeting for the global pop market.

“I am telling our artists that we were born to make a new genre, even though our Japanese artists are singing K-pop style songs,” said Choi Shinwha, Lapone’s chief executive officer. “We would like to eventually make a new genre and make it mainstream.”

Meanwhile, South Korea’s K-pop giants, Hybe Co. and SM Entertainment Co., have set up offices in Tokyo, taking prime spots once occupied by Johnny & Associates’ boy bands at the Tokyo Dome and on Japan’s biggest TV shows.

XG members, for their part, have set their sights on the US, and beyond.

“We are dreaming of doing a halftime show at the Super Bowl or topping the Billboard charts or performing at Coachella, and of course performing in space would be amazing,” said Chisa, a 21-year-old XG vocalist.

–With assistance from Momoka Yokoyama, Min Jeong Lee and Takashi Mochizuki.

(Updates with additional context on XG’s company in 23th paragraph)

©2024 Bloomberg L.P.