In December 2023, it held an auction for bitcoin ordinals.

Launched by developer Casey Rodarmor on January 20, 2023, bitcoin ordinals is a protocol that allows owners to “inscribe” digital media files, such as images, videos and text, directly on individual satoshis, the smallest denomination of bitcoin.

If [bitcoin ordinals] continue to have the importance they’re getting today, this will probably be one of the most significant works ever inscribed

“Similar to Ethereum, bitcoin ordinals give this possibility to have a proof of ownership of digital assets,” says Michael Bouhanna, vice-president and head of digital art at Sotheby’s.

Traditional NFTs, mostly issued on the Ethereum blockchain, often use contracts linked to media files stored “off-chain” on a separate platform. OpenSea, the biggest NFT trading platform, allows users to create NFTs with files as large as 100MB.

While the size of files that can be inscribed on an ordinal is only 4MB, it is considered more secure because everything is stored directly on the bitcoin blockchain and therefore cannot be altered.

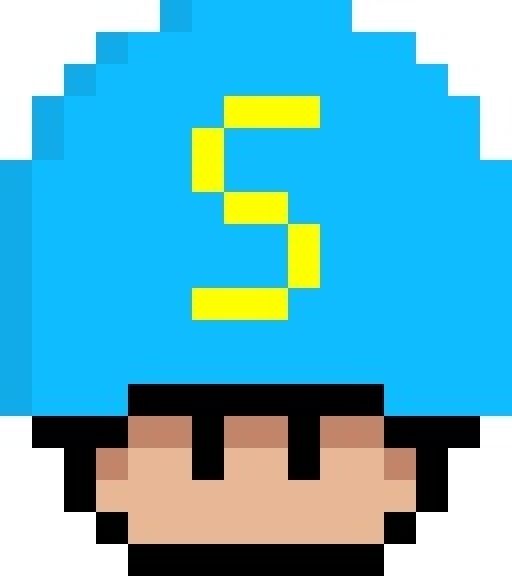

Over 200,000 ordinals have been minted since the launch of the protocol, and among them is one of the first stand-alone ordinal collections, called BitcoinShrooms by artist Shroomtoshi.

In December, three works from the collection were sold by Sotheby’s in an auction that achieved a total of US$450,850 with fees, over five times the sale’s high estimate of US$90,000. Bouhanna had been observing ordinals since their launch, and felt that by the end of the year, there was a strong enough ecosystem built around exchanging ordinals to warrant a sale.

Following the success of that auction, Sotheby’s launched its first curated sale of bitcoin ordinals this year, called “Natively Digital: An Ordinals Curated Sale”, which consisted of 19 lots and closed on January 22 with a total US$1,097,534 with fees – over twice its low estimate of US$412,000 (the high estimate was US$614,000).

As Bouhanna says, it was a “bigger educational sale that gives a horizontal view of what is existing in ordinals”, with examples of generative art, conceptual art and pop digital art.

Among the lots offered was Shroomtashi’s Inscription 21 (US$101,600), an early inscription and conceptual work that is a nod to the total number of bitcoin that can ever be mined – 21 million.

“Early inscriptions are some of the most sought after, because back then there were just a very few people who were inscribing, [and] not many of them were actual artists,” Bouhanna says. At the time, it was easy to predict the number of the next inscription because of the limited number of people doing it.

Web3 is confused for crypto, NFTs and the metaverse, but what is it really?

Web3 is confused for crypto, NFTs and the metaverse, but what is it really?

“[This piece] really tells the story of ordinals. If they continue to have the importance they’re getting today, this will probably be one of the most significant works ever inscribed,” he says.

Meanwhile, Genesis Cat by Far for Taproot Wizards sold for US$254,000 against an estimate of US$15,000 to US$20,000, while Black Rare Sat 20,159,999,999,999 (US$165,100) marked a world record for rare satoshis.

Rare satoshis are the first satoshis mined after a difficulty adjustment period, which occurs once every 2,016 blocks (about 14 days).

Looking to the future, Bouhanna is optimistic about the future of NFTs, and believes that they have longevity despite their volatility in 2021.

“There was our peak in the market, and value was not necessarily connected enough to quality. [That] caused the pushback we’ve seen in the market,” he says. “But then we started to see way more organic [growth] in 2022 and 2023, and a steady growth with new collectors coming in with a strong interest for digital arts – especially for some very specific works that, for them, were really reaching a certain level of quality.”

Participants in Sotheby’s digital art sales tend to be about 10 years younger than the average Sotheby’s client – with 75 per cent of all buyers in these sales being new to the auction house – and a number of them come with a technology background.

“We see a growth, but in a way more educated market,” Bouhanna says. “What is great about this market is that artists have to be very thoughtful of the project they bring to market, because it’s not selling just by being offered.

“That was something that was happening a lot in 2021 at the peak of the market – anything was finding its demand – but [now] quality needs to be there in order to be sold and to achieve good prices.”

He adds that in 2023, Sotheby’s made over 50 per cent more digital art and NFT sales than in 2022, and notes that traditional collectors are starting to gain more confidence in the market. That, coupled with the new collectors, bodes well for the future of NFTs.

“I keep seeing collectors, clients of mine, starting to set up their wallets in order to be able to interact with bitcoin and ordinals, and start to make purchases,” he says. “We’ve seen great excitement for some of the top collections. So I see longevity, [but] it’s important to remain selective.”

This post was originally published on this site be sure to check out more of their content