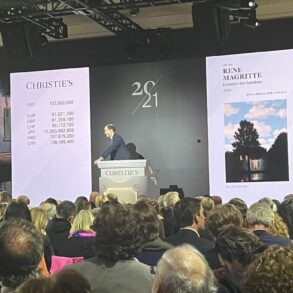

In October 2024, one of the highlights of the art season will take place at the Grand Palais: the first edition of Art Basel Paris. On this occasion, Christie’s will auction the contemporary art collection of Danuté and Alain Mallart, estimated at 9 million euros.

According to Paul Nyzam, Head of the Contemporary Art Department at Christie’s Paris: “ Market activity has slowed overall, but these estimates should attract buyers.

Indeed, the art market has fluctuated considerably in recent years, as highlighted by the Art Basel-UBS report. Despite a 4% drop in overall sales, the market remains robust at $65 billion in 2023, exceeding pre-pandemic figures ($64.4 billion in 2019). This resilience is attributable to several factors, including the continued commitment of collectors, the arrival of new buyers and the growing adoption of online purchasing platforms.

These elements indicate that the market is adapting to new economic and social realities, while preserving its dynamism. Collectors’ increased caution with regard to the quality and authenticity of works of art suggests a maturing of the market, which could foster long-term stability.

Market transformation

The art market is undergoing profound change. The first development is the closure of numerous galleries. Many have closed in New York, the world epicenter of art sales, due to the dramatic rise in rents that followed the Covid period. Recent data indicate that the average monthly rent in Manhattan has reached $5,058, marking an increase of almost 30% in one year. The aging of gallery directors is also contributing to the contraction of the art market. These factors combine to increase the pressure on smaller galleries, which are struggling to remain viable in this highly competitive environment.

The closure of iconic venues such as Marlborough Gallery and JTT marks the end of an era in the art world, but also the beginning of a transformation. These spaces have played a crucial role in promoting renowned and emerging artists, profoundly influencing the artistic landscape. The resilience and adaptability of art market players in the face of these changes are essential if we are to continue to support creation and discover the talents of tomorrow.

Secret auctions

The evolution of the art market requires constant adaptation of sales strategies, as illustrated by the example of the Lévy Gorvy Dayan gallery. By organizing private secret auctions, the gallery adopted an innovative approach to meet the needs of a seller who wanted a rapid transaction while preserving confidentiality.

The use of a renowned auctioneer and the careful selection of potential buyers demonstrate an in-depth knowledge of the market. Although financial details remain confidential, it is clear that this method offers an alternative to public auctions, with potentially lower commissions. This strategy may well reflect a growing trend in the sale of high-profile works of art, where discretion and exclusivity are highly valued.

Investing in art

Acquiring works of art through private transactions, or gré à gré, offers a more personal and direct approach, allowing buyers to negotiate with individual sellers or professionals. The latter are required by law to record detailed information on transactions, guaranteeing the transparency and traceability of works. In addition, public auctions remain a popular method, albeit subject to additional fees and the condition that the item reaches its reserve price. With the advent of digital technology, online auctions are gaining in popularity, offering increased accessibility and global reach, as evidenced by the impressive volume of transactions in 2023.

Investing in art can potentially prove profitable over the long term, with experts recommending a holding period of around twelve years to maximize capital gains. Although returns can vary, works of art have so far shown a remarkable ability to increase in value over time, even with market fluctuations.

Specialized art investment funds offer another potentially lucrative avenue. But they require a more substantial initial investment, and the investor does not physically own the work. Not forgetting the risks inherent in any type of investment, art continues to prove an option as a potential investment of choice for those seeking to diversify their portfolio.

Read also > Contemporary Art: Art Basel 2024, the tree that hides the forest?

Featured Photo: © Getty Images/Unsplash+