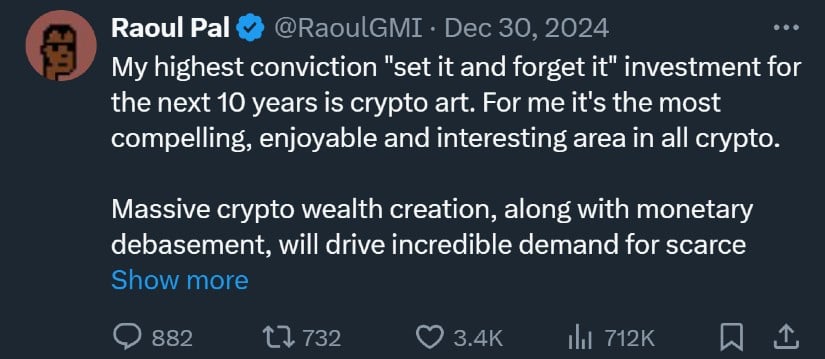

Real Vision CEO and co-founder Raoul Pal has boldly endorsed the growing crypto art market, calling it his top “set it and forget it” investment choice for the next decade.

Pal, a prominent macroeconomic expert, and former Goldman Sachs executive, shared his optimistic outlook on social media, highlighting the unique potential of non-fungible tokens (NFTs) to transform art, investment, and digital culture.

A New Digital Renaissance

Pal argues that the NFT sector, particularly crypto art, stands to gain immensely from key macroeconomic and generational trends. “Massive crypto wealth creation, along with monetary debasement, will drive incredible demand for scarce desirable assets like digital real estate or digital art,” Pal wrote. He also underscored the increasing preference for digital assets among younger generations, who find them more appealing than traditional physical investments.

Source: Raoul Pal via X

Drawing a parallel with physical real estate, Pal noted, “If, as [MicroStrategy founder Michael] Saylor says, BTC is Manhattan real estate, then the best crypto art, or NFTs, are the scarcest, most desirable block space of all.”

Advantages of Crypto Art Over Traditional Investments

Pal extolled the efficiency of NFTs as investment vehicles. Unlike physical property, which incurs significant maintenance and storage costs, crypto art is comparatively inexpensive to hold. Additionally, NFTs can serve as collateral, similar to traditional assets, enhancing their appeal to investors.

Source: X

“Physical property is expensive to hold as an investment and better suited as a lifestyle asset,” Pal said. “Art fills that gap, and crypto art is ultra-cheap to custody for extended periods.”

He also pointed out the cultural value embedded in crypto art, emphasizing its ability to tokenize cultural and communal experiences. This makes it not just an investment but also a transformative way to preserve and engage with digital culture.

The Shift to Long-Term Holding

The NFT market has evolved significantly since its initial boom, with Pal observing a move away from speculative trading toward long-term ownership. “The days of flipping art NFTs are largely over,” he stated. “The game now is to buy and hold the best artists—new or older. Demand will only grow over time while supply gets taken off the market for decades.”

According to Pal, this scarcity-driven market dynamic is amplified by the quality of crypto art pieces, many of which are denominated in Ether (ETH). He noted that premium artworks, such as those by celebrated NFT artist Beeple, have consistently outperformed Ethereum itself.

Resilience in the NFT Market

Despite challenges in 2024, the NFT market demonstrated resilience, with global sales volumes reaching $8.8 billion, up slightly from $8.7 billion the previous year, according to CryptoSlam. Active buyers surged by 69% year-over-year, with the number of sellers also growing by 7%. Notable projects like Pudgy Penguins, Azuki, and Lil Pudgys recorded exponential growth in sales volumes.

This activity underscores a broader trend: NFTs, particularly high-quality crypto art, are becoming entrenched as a legitimate asset class. Pal cited iconic collections like CryptoPunks, Bored Apes, and Grifters as examples of projects that continue to captivate both collectors and investors.

The Next Chapter in Crypto Art

Pal encourages new entrants to approach the crypto art market with curiosity and an open mind. “The mediums will change massively over time as holograms and holodecks become the dominant substrate for digital life,” he noted, alluding to the evolving nature of digital art and technology.

As the new year begins, Pal’s enthusiastic endorsement highlights a growing consensus: crypto art and NFTs are no longer fringe novelties but a transformative force reshaping the art and investment landscapes. With a blend of cultural significance, technological innovation, and investment potential, crypto art appears poised to redefine how value is perceived and preserved in the digital age.

This post was originally published on this site be sure to check out more of their content