The past year was undoubtedly difficult for the digital art world, but there appears to be reason for optimism in 2024.

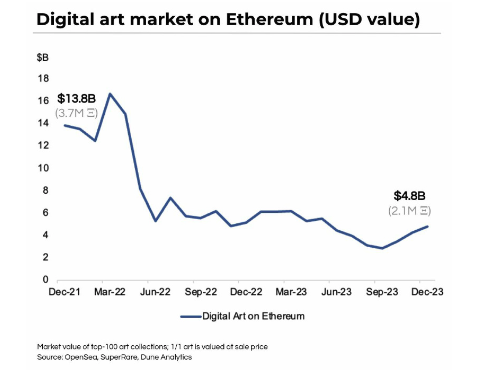

According to a recent report by digital art fund Grail Capital, the digital art market on the Ethereum blockchain closed out 2023 with $5 billion in market value.

While the valuation is still significantly down from its $13.8 billion high in spring 2022, it represents a promising 65 percent rise from its low of $3 billion in late August 2023. As the year ended positively, with major cryptocurrencies rallying, several pivotal trends emerged that indicate a bullish trajectory for the digital art ecosystem in 2024.

Founded by Jean-Michel Pailhon, a former Ledger executive and co-founder of NFT Factory Paris, and Tim Salikhov, who headed up technology investments at American Express and Lazard, Grail Capital was created to introduce digital art as an investment class to investment advisors.

Market Trends

The influx of institutional capital into the space appears to be a significant catalyst for this growth. According to the report, private banks, notable venture capitalists, and family offices have collectively invested $300 million in digital artwork, signaling a growing confidence in the potential of blockchain-based art.

Pailhon points to high-networth individuals like billionaire hedge fund manager Alan Howard investing in the digital art market.

“Educational efforts by teams like Grail Capital are starting to bear fruit,” Salikhov told nft now. “High-networth customers themselves are requesting that their fund managers include digital assets in their portfolios. VCs, especially crypto, are finding that digital assets have a better risk-reward than traditional venture in today’s environment.”

“High networth customers themselves are requesting that their fund managers include digital assets in their portfolios.”

Tim Salikhov

In a perhaps surprising statistic, the report notes that more individuals have collected digital art than all previous movements combined over the past century. Salikhov explains: “There have been 50,000 to 250,000 individual art collectors over the past century. The number of digital art collectors is more than 500,000.”

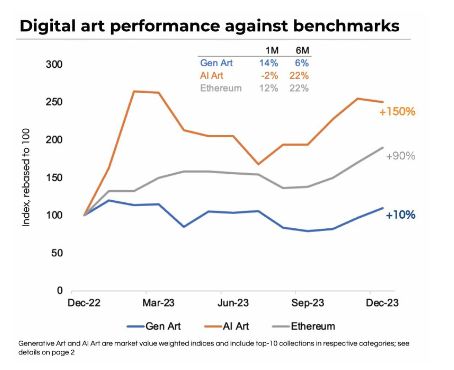

The report also indicates a discernible shift towards quality in the market dynamics. As 95 percent of NFT prices witness declines, prompting a surge in demand for the top 5 percent of artworks with pronounced cultural significance, such as Art Blocks blue-chips Fidenzas and Chromie Squiggles. This trend reflects a growing appreciation for digital art with enduring value, showcasing a nuanced understanding of the market by both collectors and investors.

Grail Capital also notes that technological advancements have significantly transformed the landscape of digital art, with blockchains like Solana, Base, and other Layer 2 solutions dismantling barriers to minting and collecting art.

“As per Q3, Ordinals and Solana brought two different categories of new collectors.”

Jean-Michel Pailhon

“As per Q3, Ordinals and Solana brought two different categories of new collectors,” Pailhon told nft now. “First, bitcoin maximalists for the former and for the latter newcomers who either could not afford to collect on ETH either for gas fees or grail prices (Solana art is more affordable). Second, new collectors who probably experienced wealth effect because of the price appreciation of SOL, and it previously happened in 2021 for Ethereum: they started collected on the chain that improved their digital wealth.”

While the report notes that digital art prices have experienced a slight decoupling from the broader cryptocurrency market, the overarching influence of the blockchain ecosystem on digital art remains robust. Grail Capital projects that Ethereum will rise to $5,000 by year-end, bringing an estimated infusion of over $500 million in capital to the digital art ecosystem.

The scarcity of available artworks is becoming increasingly pronounced, with the supply across the top 20 collections remaining below 5 percent, reaching an all-time low. The rarest artworks are now virtually unattainable, contributing to rapidly rising floor prices and creating additional barriers to entry, favoring those willing to take bold investment positions.

“Both GenArt and AI art are set to continue to outperform collectibles,” says Salikhov. “We’re just as bullish on Ethereum as we are on digital art in 2024. Favorable crypto environment will drive capital to digital art. Scarce collections like Fidenza and Squiggles have thin floors and might rally as collectors flock to grails. I’m certain both assets will post strong absolute returns.”

“Favorable crypto environment will drive capital to digital art. Scarce collections like Fidenza and Squiggles have thin floors and might rally as collectors flock to grails.”

TIM SALIKHOV

In response to the growing demand from professional and institutional investors seeking to capitalize on this fast-growing market, Grail Capital has launched three new investment vehicles in 2024.

These vehicles aim to provide investors with diverse exposures to the digital art on blockchain market, encompassing artistic genres (GenArt, Glitch, AI Art, etc.), varied investment horizons (from 12-18 months to 7 years), and distinct investment strategies, including discretionary, opportunistic, and buy-and-hold approaches.

This post was originally published on this site be sure to check out more of their content