In 1977, a cardigan-clad President Jimmy Carter gave a fireside chat (how sweet, in retrospect) admonishing Americans to endure a measure of pain by lowering their thermostats—55 degrees at night, 65 during the day—amid an energy crisis. Today, we’ve been asked to buy fewer dolls in order to withstand the whipsawing Trumpian tumult of an ad hoc, anti-globalist tariff regime that is stoking unheralded fear and uncertainty. Glad I’m not a kid anymore.

The specter of ever-ballooning U.S. debt and deficits, the onset of tariff-tied price increases and a possible recession, compounded by plummeting consumer confidence, was recently accentuated by the downgrading of the country’s credit rating. The result being that the U.S. no longer holds a triple-A rating from at least one of the three big tracking agencies, an historical first for the world’s biggest economy. Let’s be clear, America is no more or less exceptional than any other country. Sounds like as a good time as any to move to Switzerland (which I’ve been looking into, part-time).

The Presidency is a great entrepreneurial gig, a surefire way to exponentially expand your wealth; umm, wasn’t quite always the case—but it is now!

The art-world equivalent of buying fewer toys has translated into auction bidders sitting on their paddles and spending less, like the zillionaire scion of a fashion and booze empire I spoke to who sat on theirs during last week’s sales. Granted, the $1.25 billion spent in the spring 2025 cycle is nothing to sneeze at, though it continues a decline from 2014’s peak market. The art economy has been going through a 10-plus-year colonic; if and when it will rebound is anybody’s guess.

People with spare dough—or the few without, sick enough to remain addicted to hoarding (ahem)—are still impulsively buying art, but at significantly lower prices, and more works are being transacted than ever before. Sellers of big-ticket items are stuck and buyers are biding their time. Meanwhile, Trump preaches austerity and radical cuts, yet continues to spend, spend, spend, beginning with turbocharged, permanent tax cuts (as proposed in his “Big, Beautiful Bill”).

Here we go… again. Hoarder #6, the latest in my series of no-reserve auctions, following a nearly 2-year hiatus. This may very well be your last chance. I am running out of stuff to sell, so don’t miss it, July 8–17 at Phillips this year.

Perhaps we don’t need 30 dolls. Then again, nor does Trump need 27 billion crypto tokens, self-issued on the eve of his inauguration. OK, to be exact, there were 1 billion minted, and 800 million(!) remain owned by him. It would be funny if it weren’t so disquieting: the President of the United States creating a parallel currency, operating his very own private printing press, dispensing a trove of $Trump-branded Monopoly money (though his are convertible into cash). Nice gig if you can get it.

As of Wednesday, Justin Sun, crypto “entrepreneur” and art “collector,” the owner of a certain banana who’s embroiled in a lawsuit with David Geffen over a $78 million Giacometti he sold to the legendary music mogul (not the brightest move), is the largest holder of $Trump. Did I mention that he’s being sued by the U.S. Securities and Exchange Commission for alleged fraud and market manipulation? Of course, there’s no connection whatsoever, and any notion he’s trying to curry favor is speculation. But do math. (Sun has denied any wrongdoing.)

Look, I hope Trump can help facilitate peace—there are far too many senseless wars raging and untold, needless deaths, especially of children—and I hope that he can increase prosperity for those who truly need it; but Christ, can’t he do so a wee bit more rationally? I admittedly watch cartoons on occasion (I never claimed to be mature), but I never imagined we’d be living smack in the middle of one. By the way, the Trump family’s business in the Middle East has mushroomed three-fold since his first term. Lord knows what’s next.

A quick word on Qatar, a country with a human-rights record stained by the longstanding mistreatment of gays and migrant workers that will welcome an Art Basel fair next February and that has offered a conflict-laden $400 million “gift” to Trump of a ginormous, well-kitted airplane (as prima facie wrong as it so obviously is): How come no one ever offers me anything a fraction as extravagant? Oh right, I’m not the leader of one of the most omnipotent superpowers, and I’m without ostensible reciprocal means to offer up in return.

Lots of hot air blowing at Frieze and worse… green slime.

As for the recent New York art fairs: Has their sell-by date expired? First, Frieze, which is located in the soulless Shed within the belly of the equally insipid Hudson Yards, an ersatz “neighborhood” as void of spirit as the row of three bombastic, hulking Jeff Koons Hulk sculptures at Gagosian. The collector interest (and energy) was as muted as the pair of Koons’s XXL-sized aluminum behemoths that were wielding oversized musical instruments (a tuba and an organ) that appeared to blow nothing but hot air (or worse).

Don’t open unsolicited Instagram ads, ever! Trust me, I clicked on one promoting a pair of socks and ever since, I’ve been bombarded by a never-ending stream of similar content, to the extent you’d think I was a sock.

Nevertheless, the spectacle of Larry G’s booth (as per usual) was immeasurably well-served to fulfill the seemingly insatiable appetite for social media selfies. I’m admittedly (guiltily) drawn to his magnetic charisma and fortitude, and we will all sorely miss him someday, I assure you. On the subject of Instagram, stay away from unsolicited ads popping up in your feed; I made the mistake of opening a sock offering, and the algorithm has me pegged as the garment incarnate.

TEFAF (the European Fine Art Foundation) was characterized by equal measures of resignation and anger that hung over the participating dealers like an ominous, stale cloud. Sales, according to a number of galleries, were thin on the ground. A few weeks prior, the Expo Chicago fair was far worse, by a long shot, with a handful of no-shows, as evinced by empty booths that were walled over (including Revolver Galería’s), like a quick fix to a missing tooth. That, I’ve never heard of!

Missing teeth. Expo Chicago uses band-aids (or extra sheet rock) to cover up the wounds left by galleries that signed up and dipped out before showtime. Tumbleweeds were rolling down the aisles at the anemic fair.

The only standout New York fair, bordering on exuberant, was Elizabeth Dee’s Independent, where there were sales aplenty, including a sold-out Jane Corrigan booth at L.A.’s Seaview Gallery, Laura Footes at New York’s Shrine, and Pope.L’s outing at Mitchell-Innes and Nash, an encyclopedic museum-worthy mini-survey. For the record, I count them all as friends, including the recently deceased Pope.L, and I own their works. The fact that Mitchell-Innes and Nash doesn’t have a physical space is a sign of things to come in this trying era for small-to-medium-sized venues. Complaints about Independent centered on booth fees, among the highest of all fairs extant and the lack of new clients this iteration.

Back to the auctions: What’s to come of Sotheby’s and Christie’s, the nearly 300-year-old stalwarts of the trade? If it was any gauge, the energy at the previews was like a leaky valve and translated to smaller volumes overall. Auctions seem to be fast on their way to returning to the days before the advent of conspicuous consumer consumption, when they were solely populated by art market professionals and less of a spectator sport.

There continues to be a dearth of big-ticket items at the top end, and most glaringly, the most expensive, the $70 million Giacometti bust at Sotheby’s, failed to garner a single bid. I can all but guarantee you (you’ll excuse me) that Christie’s lost money, or at best broke about even, on the guaranteed Leonard Riggio auction. So much for greed being good—it’s not. The day sales, the meat and potatoes of the houses, are integral to profitability but not enough alone to keep things afloat and sustain it all, particularly for Sotheby’s, which is facing (insurmountable?) mountains of impending debt obligations.

Oddly, when faced with a dire macro economy that is all but in the toilet, a flush away from calamity, we keep on keeping on. A recent Wall Street Journal headline blared: “Americans Are Downbeat on the Economy. They Keep Spending anyway. People are buying things at a steady clip, keeping the economy humming—for now.” Yes, collectors and speculators continue to engage, but the breadth is markedly diminished and of the multitude of sellers, how many in fact lost money during last week’s sales? A lot, trust me (present company included).

Rashid Johnson, the subject of a comprehensive museum retrospective at the Guggenheim, is an example of the present market’s vicissitudes. Two Standing Broken Men (2018) healthily outperformed expectations at Sotheby’s, achieving $1,758,000 on an estimate of $800,000–$1,200,000. But another work, Phillips’s Untitled Escape Collage (2018), didn’t fare as well at first blush, failing to sell on an estimate of $300,000 to $500,000, and only subsequently recorded as sold at $292,100, after the proceedings (the mysterious ways of the market). I uncovered the very same piece having sold in 2022, also at Phillips, for $816,500 on an estimate of $200,000 to $300,000. Last week’s decline represented a loss of $524,400, just shy of 65 percent in all of three years. Johnson’s auction record is $3 million, recorded in 2022, the halcyon days of freespending on art, which, only recently past, seem a mirage from today’s vantage point.

Such shortfalls weren’t confined (and endemic) to Phillips. Visitation (2016) a work at Christie’s by Salman Toor, who presently has a pair of exhibitions at New York’s Luhring Augustine, sold under estimate ($180,000-$250,000) for $176,400. The same work sold in 2021 for £250,000, then the equivalent of $337,000, so last week’s sale represents a loss of nearly $200,000. Toor’s auction record, unsurprisingly also set in 2022, stands at $1,562,500, where it will, in all probability, remain for a chunk of time.

Spec-u-lectors (a term I coined in a 2014 column entitled “Of Spec-u-lectors and Drug-Dealing Art Advisers: Kenny Schachter at the New York Auctions”) are being walloped by a ton of reduced valuations on a who’s who of overinflated market darlings. People who bought high must be stinging from the reevaluations of a slew of favorites, including Marina Perez Simão, Rachel Jones, Leslie Martinez, Shara Hughes, and Lucy Bull, among too many others to recount.

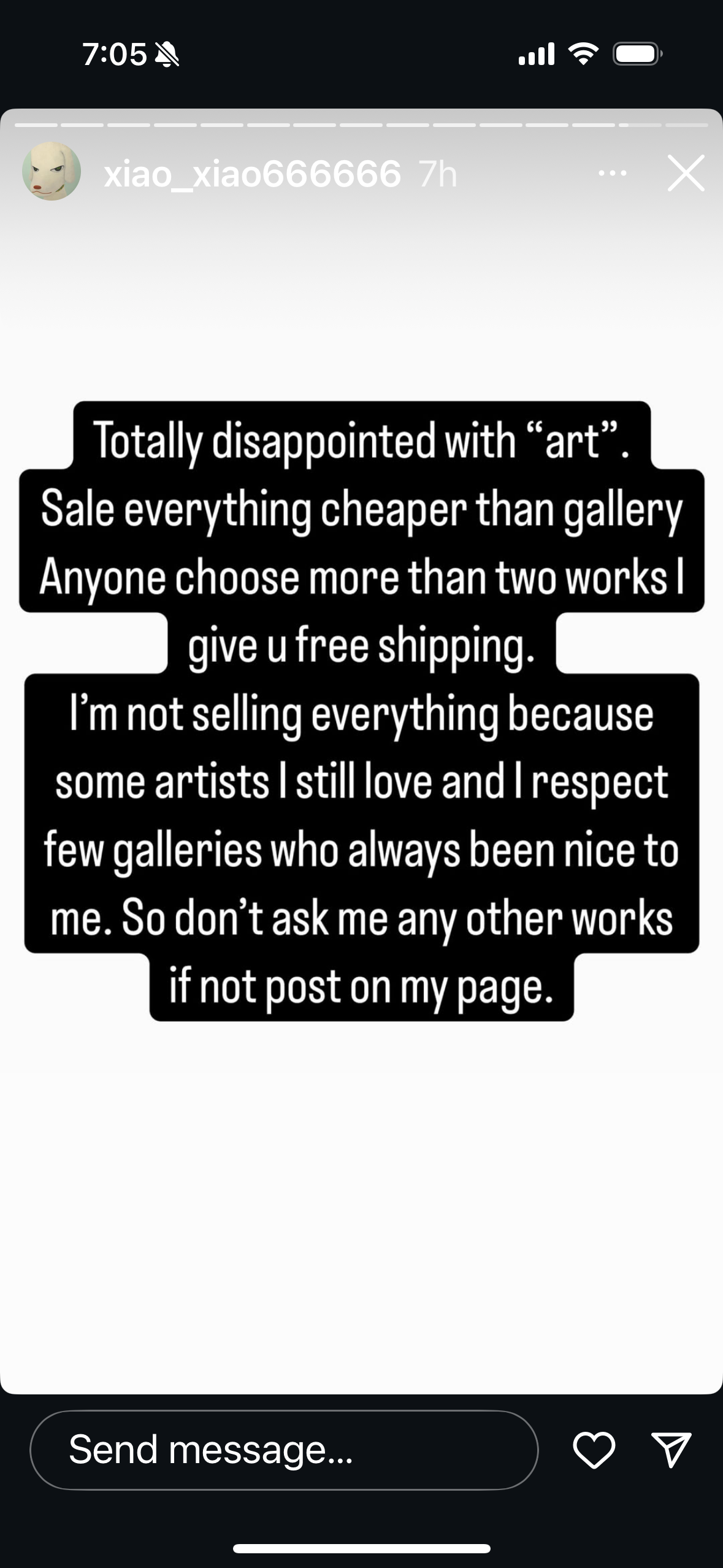

Guys gone wild! Note to self: Don’t post crazy shit if you don’t want it to resurface someplace you might come to regret, like in my column. Xiao gives new meaning to exit strategy in flaming art market retreat.

There were already red flags about a young Chinese spec-u-lector who was as busy buying as selling from the get-go, often allegedly not satisfying his commitments on outstanding deals with galleries and auction houses alike. Ding Yixiao, known as Xiao, his Instagram tag, was already in the midst of freefall when he appeared in a 2023 story by my colleague Eileen Kinsella (I’m a huge fan): “…sources said Xiao’s business dealings with the house (Phillips) have become so problematic that he is now banned from doing business with the auction house altogether.” Even back then, he was blacklisted from more than a few galleries, according to Kinsella.

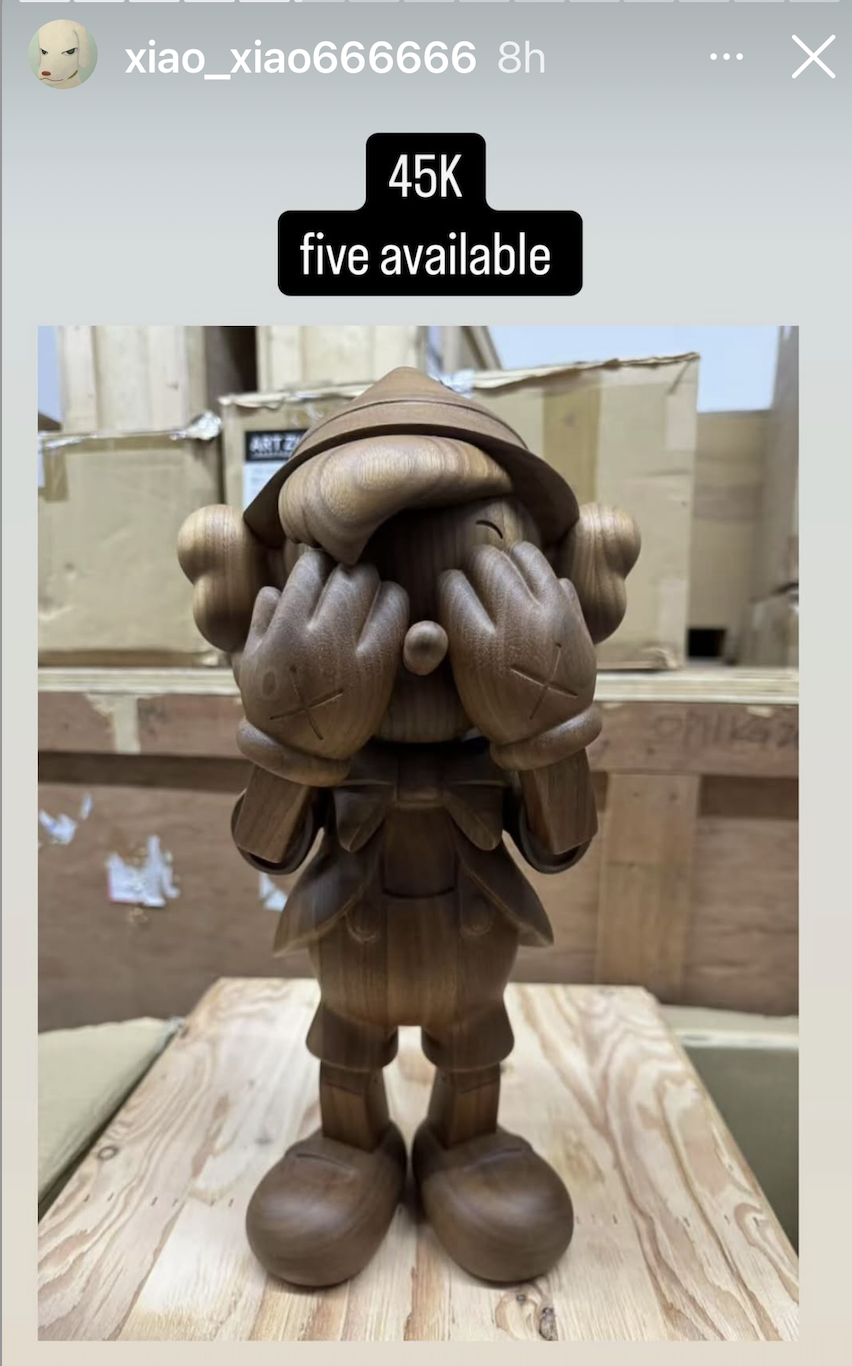

Cheap KAWS anyone? I didn’t think so. Only five left, and everything must go!

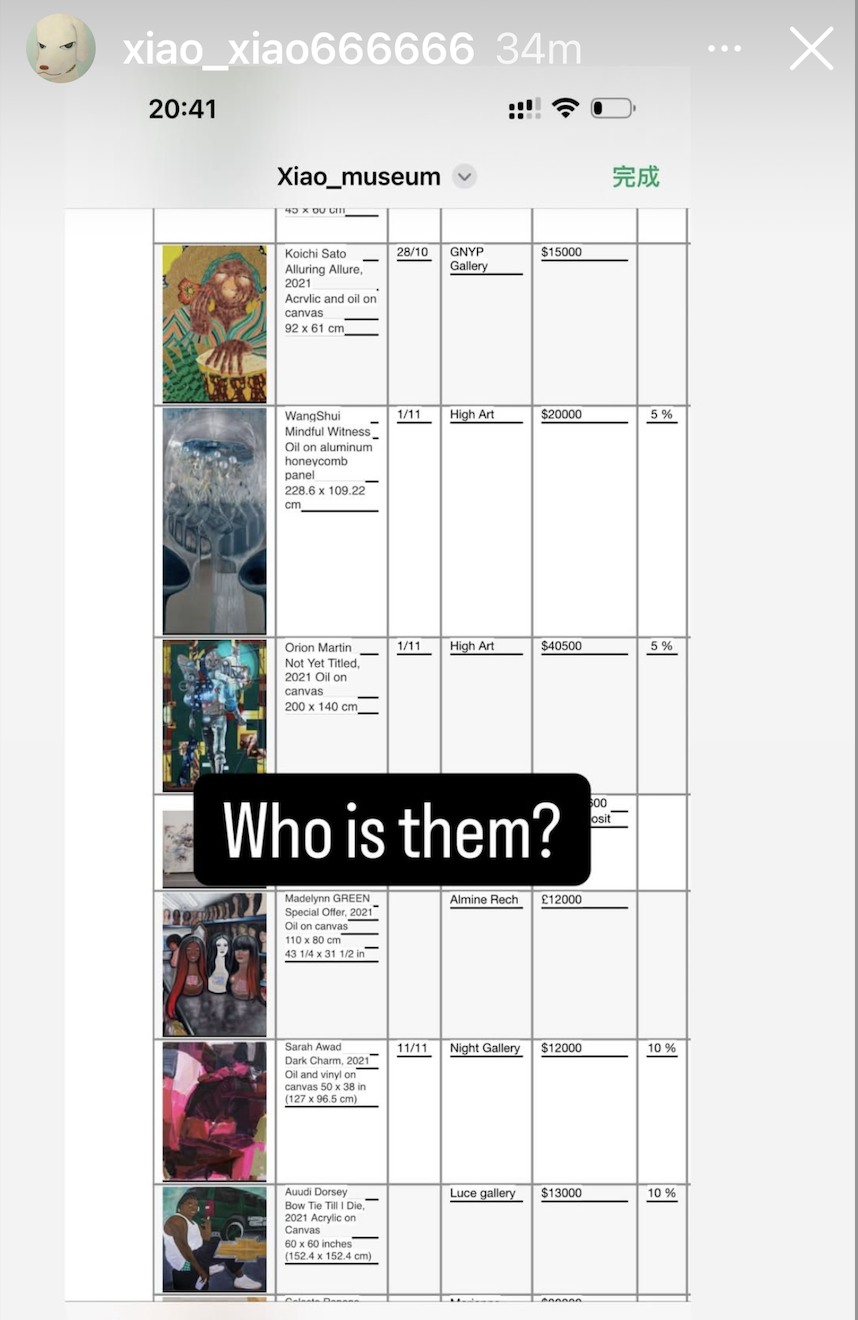

Things took a bizarre turn last week, after a series of rash, impulsive posts by Xiao listing hundreds (and hundreds) of artworks by both ultra-contemporary and more established artists, some so freshly made you could practically smell the paint, all of which he vastly overpaid for. He has no one to blame but himself, which he appears rather incapable of acknowledging (to put it mildly). Among the artists whose work he was accepting offers for were Issy Wood, Louise Bonnet, Robert Nava, Yoshitoma Nara, Basquiat, Louisa Gagliardo, Anna Park, KAWS, Emily Mae Smith, Salman Toor, André Butzer, Scott Kahn, Invader, Louis Fratino, and scores of others. I have 50-plus screenshots from a matter of days.

Accompanying the smorgasbord of artists up for grabs were rants that reached a fevered pitch, culminating in the following: “…seems people are also tired of buying from galleries because of the fucking package deal (buy one, give one to museum I assume) and fucking non-resale. And auction house taking the fucking 26% commission and fucking expensive shipping fee all the time. And they don’t even care about artists market only thing they care about is don’t get passed so they can get commission part.” Like I’ve said, the art world has its own brand of hypocrisy and this unhinged maniac sits atop the leaderboard.

Said an acquaintance of Xiao: “He’s going crazy lol. But a lot of ppl bought from him before and never received the goods. So, this could be his hidden agenda.” I pinged Ding (sorry) on Instagram for a comment, and he did not reply.

Last week I saw septuagenarians Roberta Smith (god, why did she have to retire?) and Jerry Saltz speak uptown about a documentary that Alison Chernick is directing about them; I only wish there were more opportunities to listen. To paraphrase the only human who has continued to render me speechless throughout the 35 years I’ve known her, Roberta said that art is thought embedded into material that needs to be looked at with our entire being. My body has not flagged in enthusiasm since I could recognize an image—even before I knew what art was.

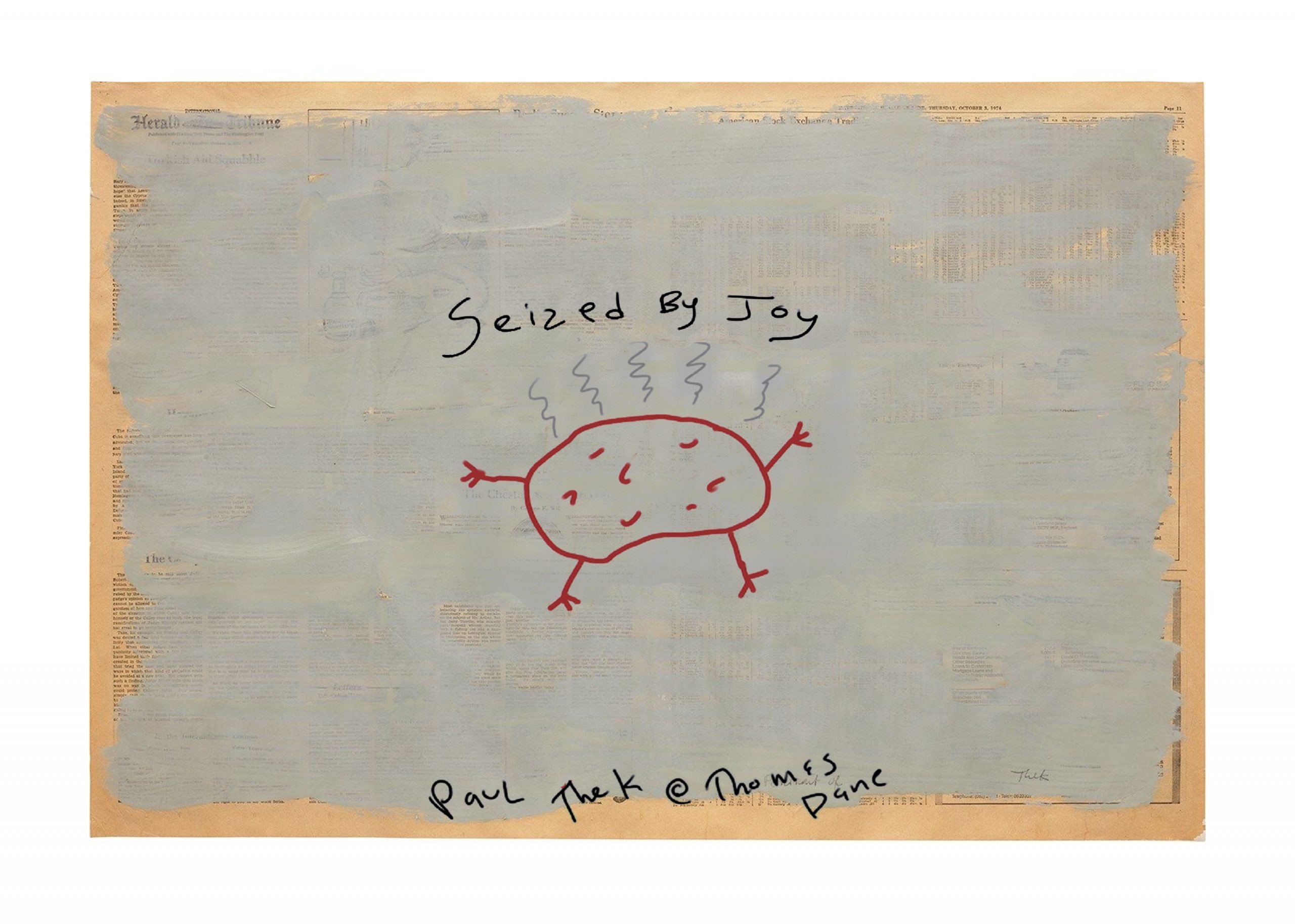

I modified my favorite sad potato drawing by Paul Thek for the exhibition I am curating with J.W. Anderson, running May 29 to August 2 at Thomas Dane Gallery in London. Please come!

On a closing note (you’ll be relieved to know), I have spent nearly all of my 35-year career writing (contributing to Artist’s Artist, published by MIT Press), curating (Pace, London, 2013), collecting, and thinking about the artist Paul Thek, who tragically and prematurely died of AIDS in 1988 at the age of 53. The apotheosis of these efforts will be the exhibition “Seized by Joy” that I am curating with J.W. Anderson at London’s esteemed Thomas Dane Gallery, running from May 29 to August 2. I am touched, honored, and appreciative, beyond measure, for this opportunity.

This post was originally published on this site be sure to check out more of their content