Editorial Note: While we adhere to strict

Editorial Integrity, this post may contain references to products from our partners. Here’s an explanation for

How We Make Money. None of the data and information on this webpage constitutes investment advice according to our

Disclaimer.

Social media has transformed Forex trading by offering real-time insights, global connectivity, and educational resources across platforms like Twitter, Instagram, and TradingView. However, it also presents risks such as misinformation and herd mentality. Traders should use social media as a complementary tool, balancing it with traditional analysis to make informed decisions in the market.

In the digital age, social media has evolved from a personal communication tool into a powerful force shaping industries across the globe and one sector experiencing significant transformation due to social media is Forex trading. Social media platforms, including mainstream giants like Instagram, Twitter (now X), Facebook, LinkedIn, and Telegram, alongside trader-specific networks such as TradingView and ZuluTrade, are increasingly becoming popular tools for traders. In this article, we explore the profound impact of social media on Forex trading, examine the advantages and risks of these platforms.

The influence of social media on Forex trading

Social media’s role in Forex trading extends far beyond casual interaction. Platforms like Twitter, Instagram, and Facebook are now central to how traders access real-time market data, share strategies, and analyze sentiment.

Twitter/X

Twitter has become an indispensable resource for Forex traders, providing immediate access to market-moving news and expert opinions. Hashtags like #ForexAnalysis and #CurrencyTrading are widely used to disseminate trading insights, enabling traders to respond to market changes swiftly. Influencers and analysts regularly share predictions and market trends, making Twitter a hub for real-time market sentiment.

- Real-time updates: Twitter provides immediate access to market news and expert opinions, allowing traders to respond quickly to market changes.

- Global reach: Hashtags like #ForexTrading connect traders worldwide, facilitating a global exchange of ideas and strategies.

- Noise and misinformation: The sheer volume of tweets can lead to information overload, and distinguishing credible sources from noise can be challenging.

- Herd mentality: Traders may fall prey to the bandwagon effect, making impulsive decisions based on trending tweets rather than solid analysis.

Initially known for lifestyle content, Instagram has also carved out a niche in the Forex community. Influencers use the platform to demystify complex trading concepts, share success stories, and provide educational content through posts and stories. On Instagram, many well-known Forex traders and coaches like Kathy Lien or Raghee Horner share valuable insights and strategies through their accounts. The visual nature of Instagram allows for engaging and accessible Forex-related content, making it a popular platform for novice traders.

- Visual appeal: Instagram’s visual platform makes it easier to digest complex trading concepts through infographics, charts, and videos.

- Engagement with younger traders: Instagram is particularly popular among younger traders, providing a gateway into the world of Forex.

- Surface-level content: The platform’s focus on visuals can sometimes lead to a lack of depth in the content provided.

- Misinformation risk: The influencer-driven nature of Instagram means that content is not always backed by credible analysis, increasing the risk of misinformation.

With its vast user base, Facebook remains a large part of social media’s influence on Forex trading. Forex groups and pages serve as communities where traders can share experiences, discuss strategies, and provide support. Facebook’s integration with news outlets also makes it a valuable tool for staying updated with global financial news.

- Community building: Facebook groups provide a platform for traders to share insights, discuss strategies, and support each other in a community setting.

- Educational content: Many trading groups offer resources for both novice and experienced traders, helping them to improve their skills.

- Privacy concerns: Discussions within groups may not be as secure or private as traders might prefer, potentially exposing sensitive trading information.

- Less professional Focus: Compared to LinkedIn, Facebook’s broader user base means that discussions can sometimes be less focused on professional trading insights.

LinkedIn, traditionally a professional networking platform, has also found its place in the Forex trading world. Traders use it to connect with industry professionals, join specialized groups, and access market insights shared by financial experts. LinkedIn’s focus on professional credibility makes it a trustworthy source for market analysis and trading strategies.

- Professional networking: LinkedIn connects traders with industry professionals, offering access to market insights shared by experts.

- Focused discussions: LinkedIn groups often focus on professional and business-related content, making it a valuable resource for traders seeking in-depth analysis.

- Limited real-time interaction: Unlike Twitter, LinkedIn is less geared toward real-time updates, which might delay critical market information.

- Narrow audience: The professional nature of LinkedIn may limit its appeal to only those already deeply involved in the financial sector.

Telegram

Telegram has gained popularity among Forex traders for its flexible and secure communication features. It offers a platform for both trading signals and news dissemination. Verified channels, like those of FXStreet, have become essential for traders seeking reliable and timely market updates, although the platform also presents risks related to scams and misinformation.

- Secure communication: Telegram offers encrypted messaging, making it a safer choice for sharing sensitive trading information.

- Dedicated trading channels: Many traders follow channels that provide real-time signals and market updates, offering valuable insights for decision-making.

- Scams and misinformation: The anonymity of Telegram users can lead to the proliferation of scams and unverified information.

- Overwhelming volume of content: With so many channels and groups, it can be difficult to discern valuable content from noise.

Trader-specific social networks

In addition to mainstream social media, trader-specific social networks have emerged as critical resources for Forex traders. These platforms are designed to cater specifically to the needs of traders, offering advanced tools for market analysis, trading signals, and community engagement. Here’s a closer look at some of the leading platforms and their unique offerings:

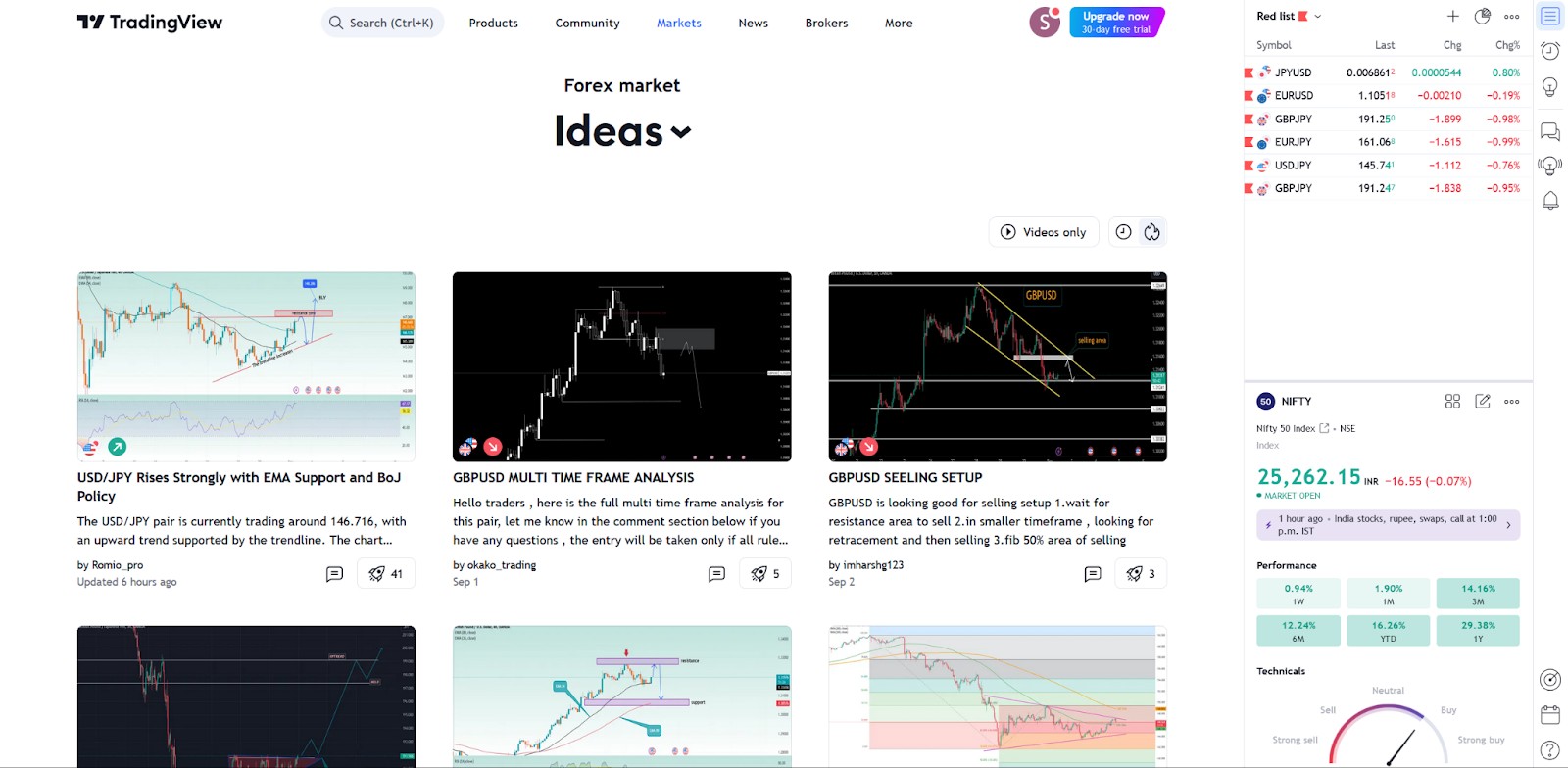

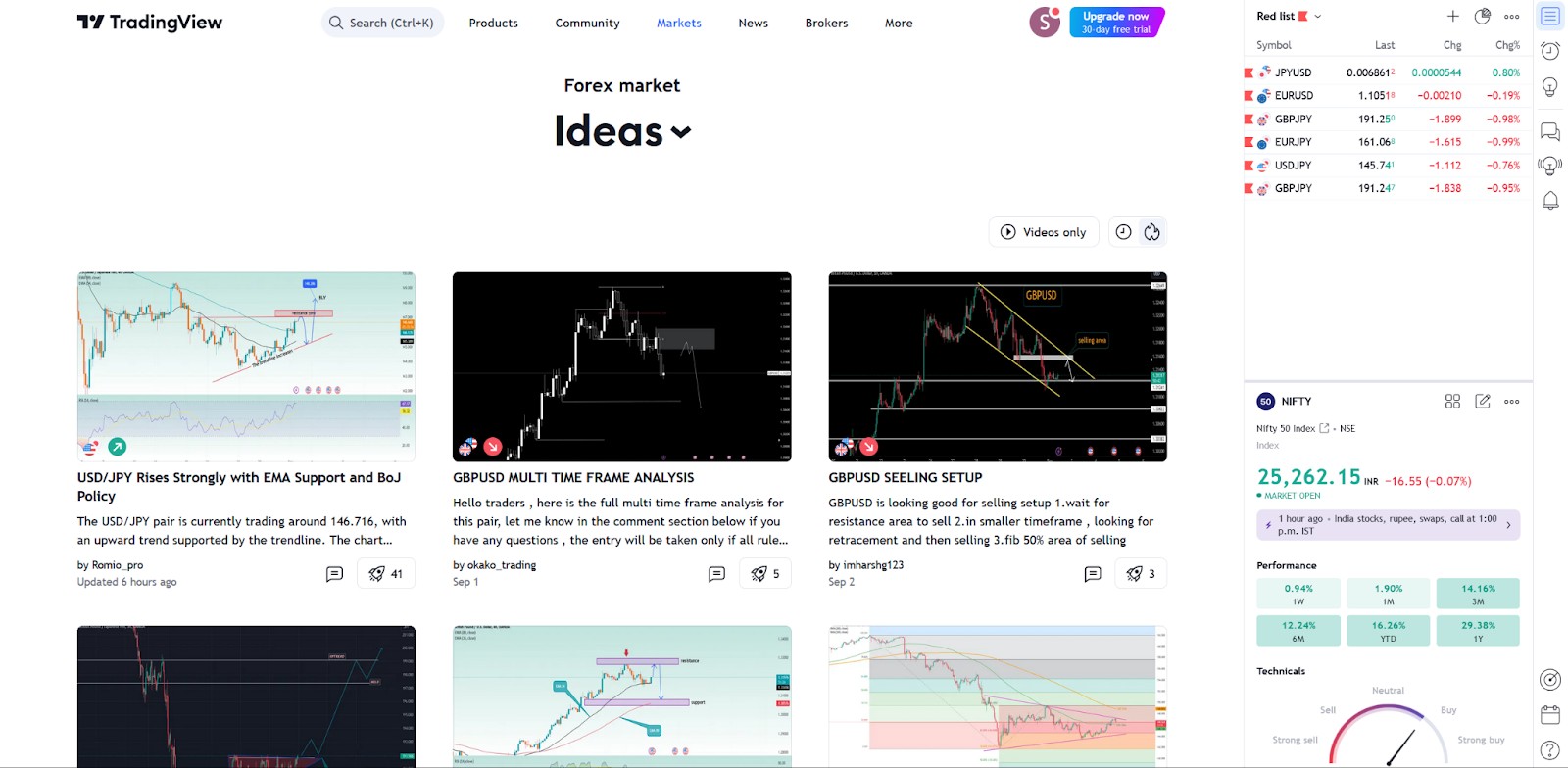

TradingView

TradingView has become one of the most popular platforms among Forex traders, blending social networking with powerful charting tools. It allows users to share and discuss trading ideas, providing a space for both novice and experienced traders to collaborate. The platform offers a comprehensive suite of tools for technical analysis, including customizable charts, indicators, and drawing tools.

- Extensive tools for technical analysis.

- Active community of traders sharing ideas and strategies.

- Customizable charts and indicators.

- The advanced tool set can be overwhelming for new traders.

- Subscription fees for premium features.

ZuluTrade

ZuluTrade offers a unique approach by connecting traders with signal providers, enabling users to follow and replicate the trades of more experienced traders. This platform is particularly popular among those looking to automate their trading strategies, as it allows users to create a portfolio based on the performance of top traders.

- Enables automated trading by following top traders.

- User-friendly interface for managing portfolios.

- Transparent performance metrics for signal providers.

- Reliance on signal providers can lead to losses if their performance declines.

- Limited control over individual trades once automation is enabled.

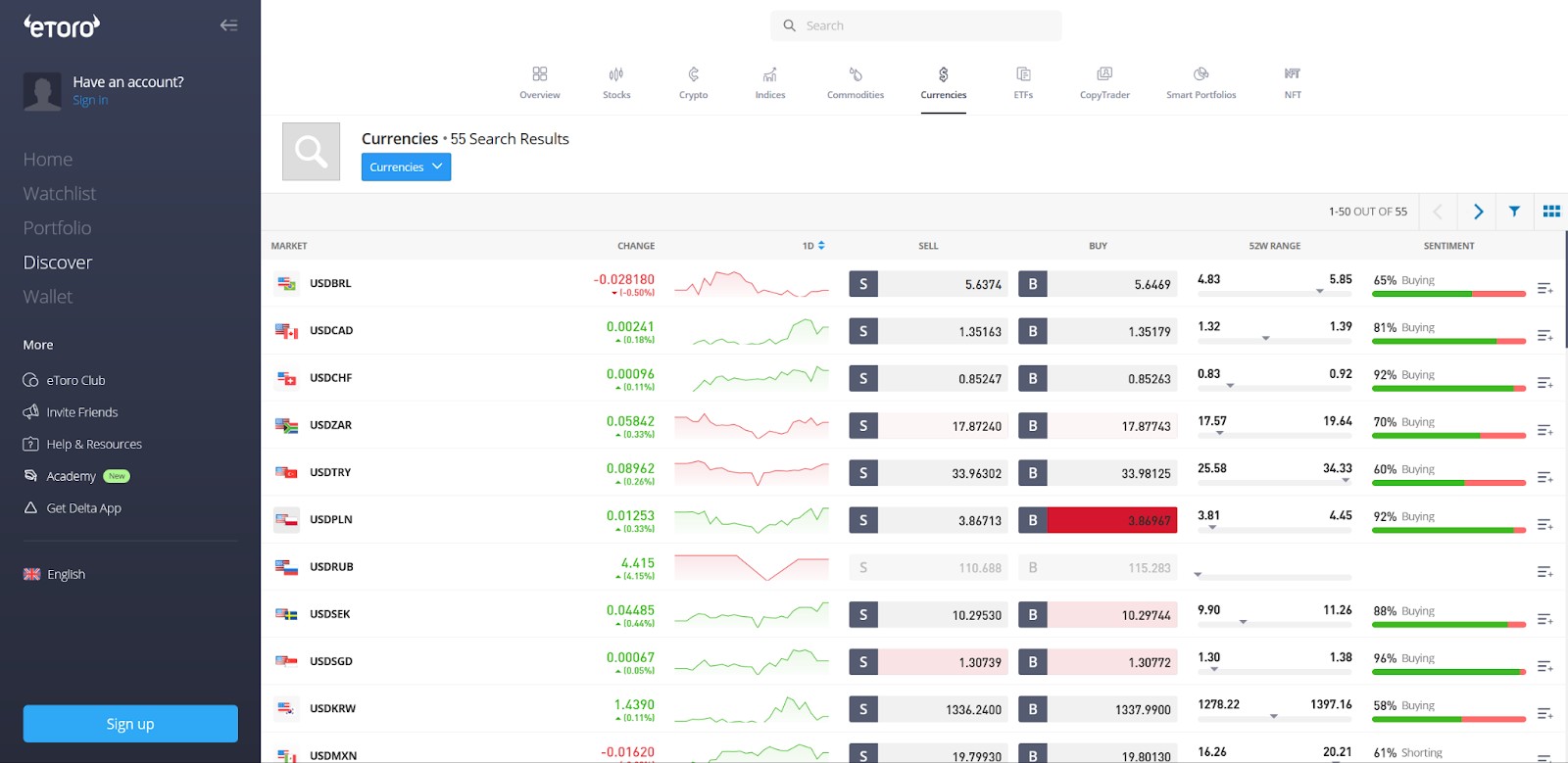

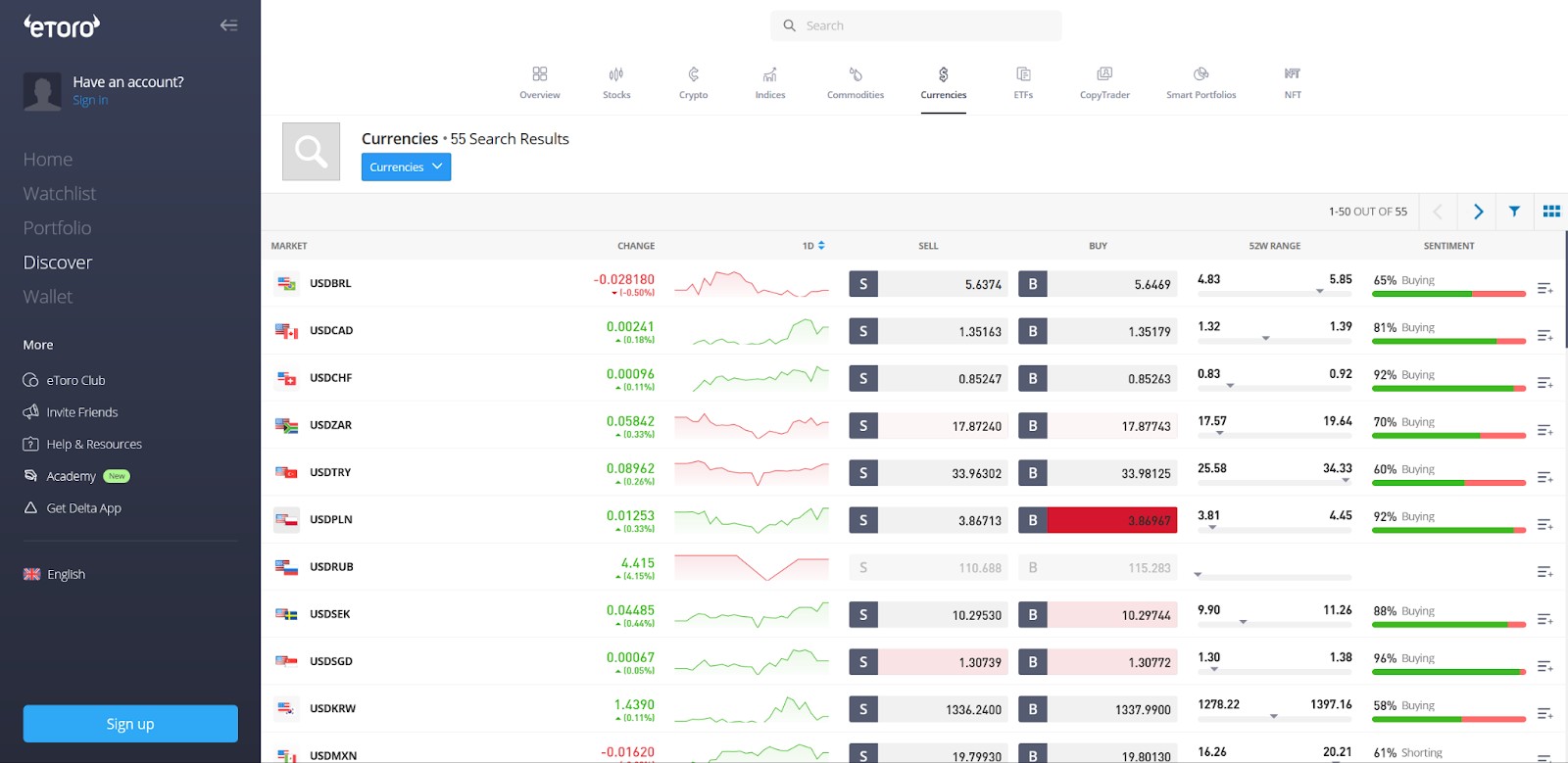

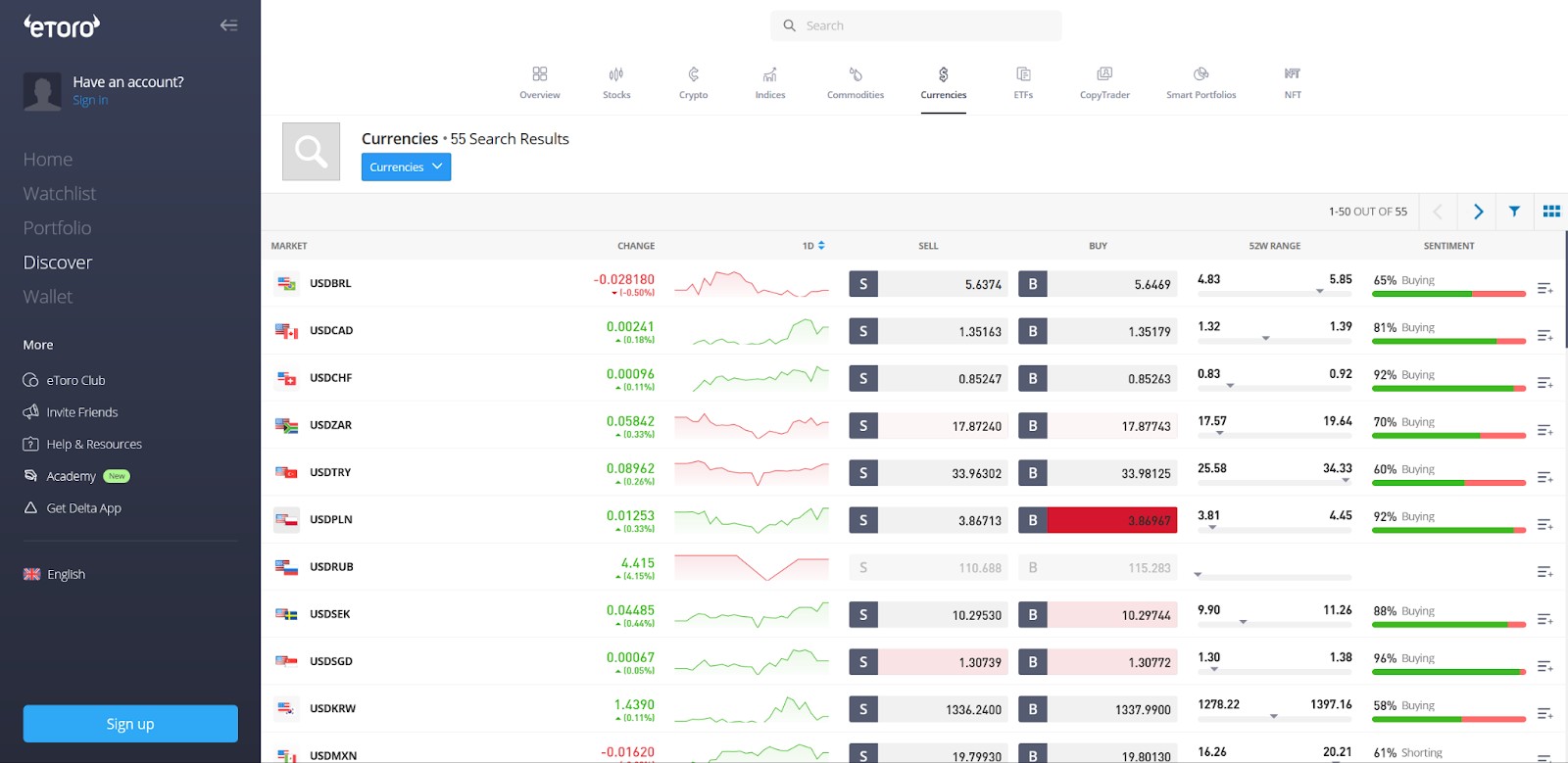

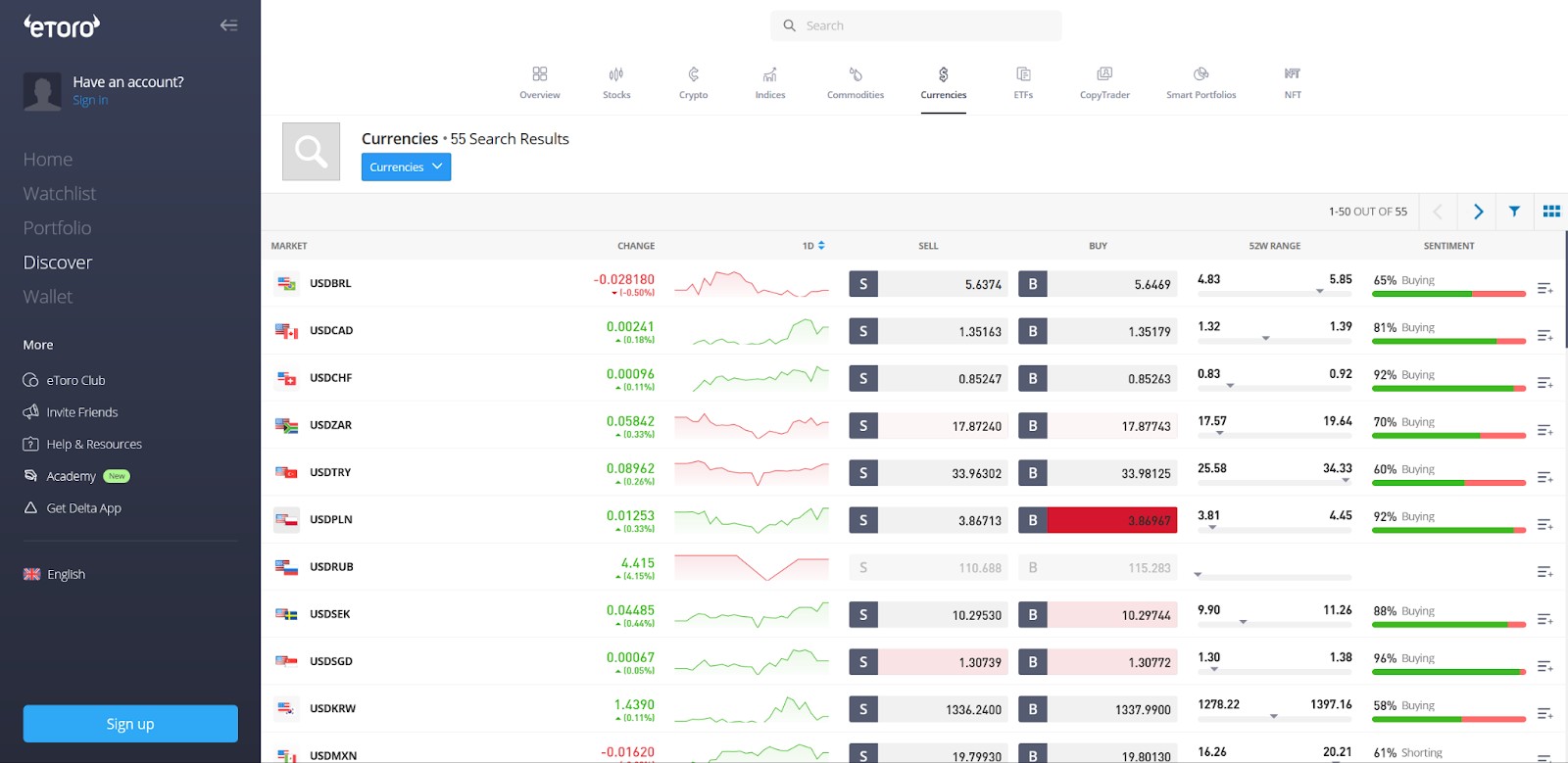

eToro

eToro is a social trading platform that combines traditional trading with the ability to follow and copy the trades of other users. It’s particularly popular for its CopyTrader feature, which allows users to mirror the trading activities of top-performing investors. eToro also supports a wide range of assets, including Forex, stocks, and cryptocurrencies, making it a versatile platform for traders interested in diversifying their portfolios.

- CopyTrader feature for mirroring trades.

- Supports a wide range of assets beyond Forex.

- Engaged community with transparent performance records.

- Success depends on the traders being followed.

- Fees and spreads can be higher compared to other platforms.

The role of influencers in Forex trading

influencers have become key players, shaping market opinions and driving trading trends. These individuals, who often command large followings on platforms like Instagram, YouTube, and Twitter (now X), have a significant impact on how retail traders approach the Forex market. Their role extends beyond mere endorsements; they often provide educational content, market analysis, and trading signals, which can directly influence the decisions of their followers.

Influence on retail traders

A study by Deloitte revealed that 45% of retail Forex traders follow at least one financial influencer, and 28% of them admit to making trading decisions based on the advice or signals provided by these influencers. This demonstrates the power that influencers hold over retail traders, particularly those who are new to the market and rely on more experienced traders for guidance.

Instagram and YouTube influencers

Platforms like Instagram and YouTube are popular among Forex influencers who create content ranging from market analysis to tutorials on trading strategies. For example, a prominent Forex influencer on YouTube, who goes by the alias “PipMaster,” has over 500,000 subscribers and generates millions of views on his videos, which include daily market analyses and trading tips. According to a survey conducted by ForexLive, 35% of retail traders who follow “PipMaster” have reported making trades based on his analysis, with a reported success rate of 62% on those trades. This underscores the tangible impact influencers can have on trading outcomes.

Risks and сhallenges

While influencers can provide valuable insights, there are inherent risks associated with following their advice. Not all influencers have formal financial education or professional trading experience, which can lead to the dissemination of inaccurate or overly optimistic information. A 2024 report by the Financial Conduct Authority (FCA) highlighted that 22% of retail traders who follow influencers experienced significant losses, often due to taking high-risk trades recommended by individuals without proper credentials.

Regulation and accountability

The growing influence of social media personalities in Forex trading has attracted regulatory attention. In 2024, the European Securities and Markets Authority (ESMA) introduced guidelines requiring financial influencers to disclose their trading credentials and any potential conflicts of interest, such as paid promotions. This move aims to protect retail traders from being misled by unqualified individuals and to increase transparency in the industry.

Look for those who disagree with you

Social media is not just a place to check what others think about the market; it can deeply influence how you think as a trader. One big but rarely talked about issue is the echo chamber effect.

Many beginners stick to following influencers or groups that always agree with their own ideas, which only makes their biases stronger. This can give a false feeling of being right, especially when lots of people seem to agree with a trade idea. To really get the most out of social media, follow a mix of people who think differently from you, even if it feels uncomfortable.

Another thing to watch out for is how social media feeds are designed to keep you hooked. Platforms like Twitter and Reddit show you content that gets your heart racing — whether it’s shocking news or big market moves. This can push you into making trades out of fear of missing out rather than sticking to your plan.

As a beginner, it’s really important to notice when your emotions are being played with by what you see online. One way to deal with this is to set strict limits on how much time you spend on social media during trading hours and stick to your trading plan no matter what.

Conclusion

Social media has become an integral part of the Forex trading landscape, offering both opportunities and challenges. By leveraging platforms like Twitter, Instagram, Facebook, LinkedIn, and Telegram, traders can access real-time data, engage with a global community, and enhance their market analysis. However, the risks of misinformation and herd behavior underscore the importance of using social media judiciously.

FAQs

Social media is a valuable tool for real-time insights but should be used with caution. Always cross-reference information with credible sources.

It depends on your needs — Twitter is great for real-time news, while Telegram is popular for trading signals. LinkedIn is preferred for professional networking.

Social media can influence short-term market sentiment but should be complemented with traditional analysis for long-term predictions.

Yes, the primary risks include misinformation, scams, and the potential for herd behavior. Traders should verify information and use critical judgment.

Related Articles

Team that worked on the article

Igor is an experienced finance professional with expertise across various domains, including banking, financial analysis, trading, marketing, and business development. Over the course of his career spanning more than 18 years, he has acquired a diverse skill set that encompasses a wide range of responsibilities. As an author at Traders Union, he leverages his extensive knowledge and experience to create valuable content for the trading community.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

In the Forex market, a “trend” is the label used to describe the general direction that the prices of currency pairs are moving in, over a specific period of time. Trends are basically the pattern that a currency pair appears to be following and can help traders determine when to enter and exit a trade.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

This post was originally published on this site be sure to check out more of their content