It’s been just two months since the new U.S. president was sworn into office, and already, the administration has made headlines by signing record-breaking executive orders—ranging from reversing DEI initiatives to banning paper straws.

While Bitcoin briefly surged to an all-time high of $108,000, it has since dipped as low as $79,000. And it’s not the only asset on a rollercoaster ride. Tesla’s share price surged by approximately 200 percent following the November 2024 election but has since returned to its previous levels. This has left the alliance between Elon Musk and the new president somewhat less than lucrative, at least on paper.

Adding to this is a dramatic plot twist from FTX, the crypto platform that went bankrupt in 2022 and was once dubbed the “scam of the century” (with its founder also named one of Time’s Most Influential People of the Year before the spectacular collapse). It has now begun repaying funds to its customers, offering 119 percent of the original claim. It turns out that having your money locked up on FTX has provided a better return than locking it up in a savings account.

David Sacks, Donald Trump’s A.I. and Crypto Czar, in Washington, D.C., 2025. Photo: Kayla Bartkowski / Getty Images.

This unexpected recovery underscores a broader shift in the industry. The appointment of David Sacks as the White House’s crypto czar, along with plans for a “Strategic Bitcoin Reserve,” has injected fresh optimism into the industry. The administration has vowed to make the U.S. the “crypto capital of the world,” an announcement that has sparked renewed energy and excitement within the space.

Given this context, will more institutional adoption and mainstream activity follow for NFTs? Or has the wind that once propelled the NFT boom shifted? The crypto industry seems to have moved on to a new thesis—just as it has in every prior cycle—arguably on meme coins this time, as the president even launched one himself ahead of being sworn in. Even the crypto billionaire who famously bought an NFT rock for $600,000, has turned to non-NFT art, with one recent purchase that consists of a real banana.

NFTs, still a major use case of cryptocurrency, have become somewhat inadvertently entangled with the political sentiments now dominating the crypto space.

To better understand the current state of affairs, we’ve rounded up thoughts from industry veterans on the recent shift in sentiment towards the crypto industry.

Not Everyone Is Enthusiastic About the New Administration

As expected, not everyone within the on-chain communities shares the same political views. It is widely known that largest stakeholders in NFTs are early crypto evangelists, and attempts to incorporate traditional art world into the digital art space have had limited success. In short, the NFT community is still a relatively small sub-group within the larger crypto ecosystem—distinct from, rather than overlapping with, the traditional art world.

However, it’s important to note that the crypto industry has also never aligned uniformly with a single political party or candidate.

In the 2024 election cycle, crypto donations exceeded $238 million—surpassing even traditional industries like oil and gas, pharmaceuticals, and Wall Street donors. Notably, both Trump and Harris received a combined total of at least $34 million in crypto donations for their respective campaigns. In the past, FTX founder Sam Bankman-Fried was a major Democratic donor, contributing around $40 million, according to public records.

In summary, the crypto industry banded together to push for a more favorable regulatory environment, regardless of one’s political spectrum.

However, the current administration has taken divisive stands on a range of issues, and cryptocurrency is just one of them. Unfortunately, NFTs—by association—have been lumped in with the broader crypto industry. This has certainly not helped a nascent industry that is still recovering from the reputational crisis it faced just a few years ago.

There’s a perception problem,” said a long-time anonymous collector. “The first thing Trump did after the election was issue his own coins and made hundreds of millions from it. It’s a bad look for the industry, and it made people see everyone in the space through the same lens.”

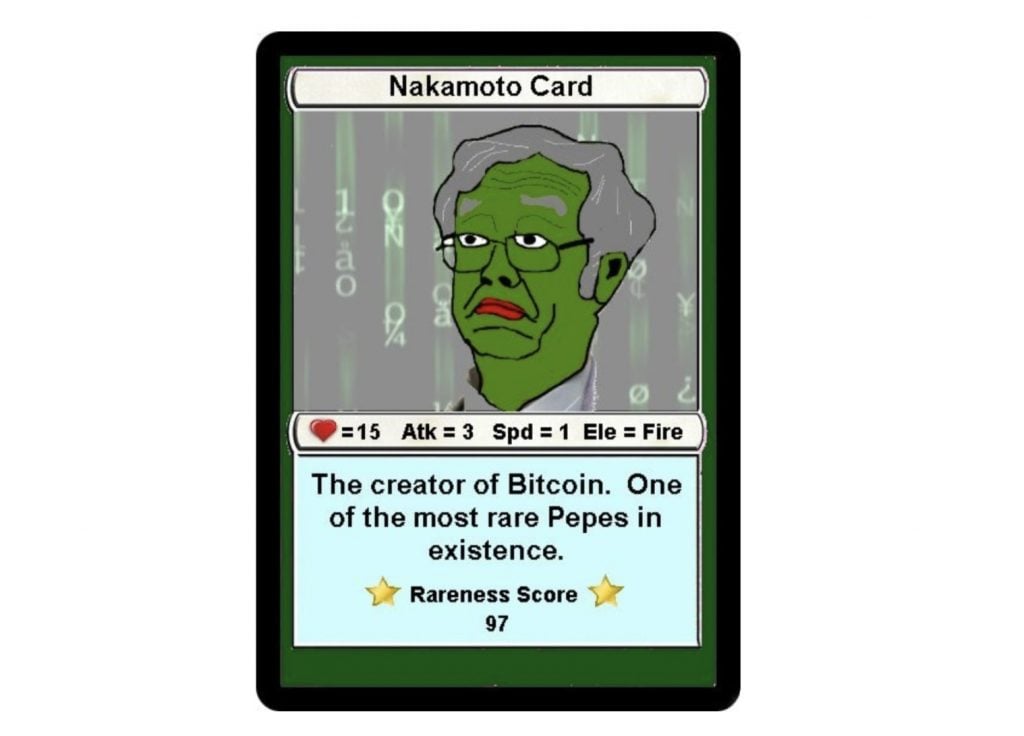

Others have pointed out the differences between “shitcoins” and meme coins. Meme coins, they argue, are part of long-standing internet subcultures like Rare Pepe, whereas the new “pump-and-dump” coins gaining traction now are not comparable. As @mannay put it: “Let’s set the record straight from the beginning. On one side, meme coins—irreverent, born from the collective heartbeat of internet culture. On the other, shitcoins—transient, opportunistic, devoid of soul.”

The Recent Resurgence of Activity

During market downturn, many major NFT platforms had either drastically downsized or shut down entirely, and many artists also took a step back to protect their market value. However, a surge in crypto prices has recently sparked a cautious revival, with both collectors and institutions reengaging with digital art.

In February 2025, Sam Spratt’s artwork X.Masquerade sold for $3 million, marking the largest NFT sale in three years. The following month, Christie’s all-A.I. auction, Augmented Intelligence, brought in $728,784, with many lots surpassing their high estimates. The auction house reported that 37 percent of the bidders were first-timers, and nearly half of the participants were Millennials and Gen Z.

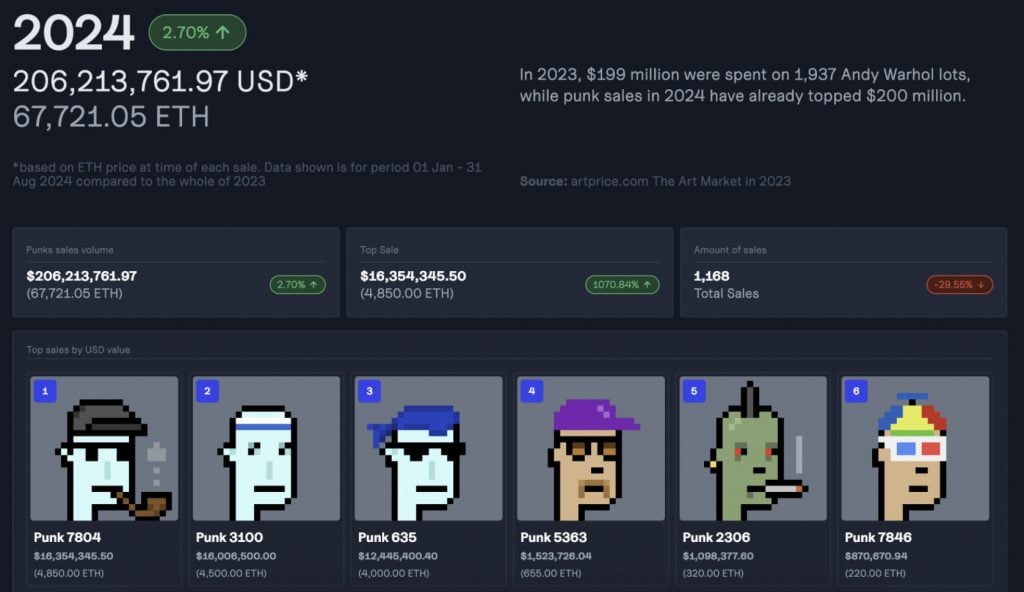

Despite the broader slowdown, long-established NFT communities like CryptoPunks have remained active, continuing to build and expand. Over the past year, the CryptoPunks community launched multiple initiatives, including a book published by Phaidon, CryptoPunks: Free to Claim, and a documentary, What The Punk!, co-produced by anonymous collector TokenAngels, which premiered last year.

Punks.wtf, an interactive platform for Punk data, was created by Niftynaut, an OG collector who claimed multiple punks in 2017. He mentioned the continued growth of the community: what began with 267 wallets in 2017 now includes more than 3,860 wallets holding at least one Punk. Even in a relatively quiet year like 2024, Punk sales topped $200 million in trading volume.

When asked whether other PFP (profile picture) projects will retain long-term value, Niftynaut was blunt: “Most projects are destined for irrelevance. Outside of the true innovators, what we saw was an endless parade of derivative cash-grabs with no meaningful innovation, purpose, or creativity.”

Photo: @punk.wtf.

Beyond the market, institutions are also engaging in partnerships in hopes of drawing attention to blockchain technology and the artists experimenting with it. The Metropolitan Museum of Art recently launched a new online game called Art Links. Tate Modern opened a new exhibition, “Electric Dreams: Art and Technology Before the Internet,” showcasing early generative art. In Tokyo, the Mori Art Museum unveiled “Machine Love: Video Game, A.I., and Contemporary Art,” featuring works from multiple digital artists.

There is also revived interest from the financial world. Hivemind Capital, founded by a former Citibank veteran, launched its Digital Culture Fund last year with the goal of raising $50 million. Its investment thesis includes categories such as Generative Art, Glitch Art, A.I. Art, and Crypto Culture. It appears to be the only one standing in this cycle, compared to a crowded market a few years back.

“The challenge is that while digital art has gained mainstream recognition, there hasn’t been a structured way for serious collectors and institutions to engage with it at scale,” said Matt Zhang, the founder. While Zhang admits that the fund has attracted more crypto investors than traditional art collectors, he remains optimistic about the eventual shift in attitudes toward collecting digitally.

His belief is not unfounded, as economists forecast that $84 trillion in assets will change hands over the next 20 years, with many betting on how a new generation of art patrons will reshape the market.

“Over time, we expect digital art to become less tied to crypto cycles—especially as more collectors, museums, and institutions treat it as part of fine art. At a certain point, NFTs won’t just be ‘crypto assets’; they’ll be historical and artistic assets, valued independently of market swings,” Zhang added.

Technological Challenges and the Road Ahead

Despite the renewed interest, the NFT ecosystem still faces significant challenges. Infrastructure advancements—critical to ensuring the longevity and security of digital art—have stalled as venture capital funding has dried up, with investor attention shifting toward A.I.

Nonetheless, according to research, approximately 4 percent of the global population holds Bitcoin, either directly or indirectly. This explains why companies like Ledger, a crypto hardware wallet maker, achieved a valuation of $1.4 billion, even amid a bear market. In the same light, major crypto exchange Coinbase has a market cap exceeding $45 billion; it is reasonable to expect that some capital may eventually flow back into the NFT infrastructure to address critical technological challenges. After all, NFTs remain one of the most prominent use cases for blockchain technology.

Rare Pepe Nakamoto Card. Photo: OpenSea.

Artnome (Jason Bailey), a longtime collector, is emphasizing the importance of preserving digital art files, even if they’re on a blockchain. His company focuses on building a file-preserving tool.

“Every single image from those 1990s websites is broken because over time, people stop paying for storage, and then you can’t get those images back. The same thing could happen with NFTs—if companies in Web3 go out of business, the images could break, and you’ll end up with links to nothing,” he explained. “Additionally, people tend to think everything should be on-chain, but that’s not realistic and limits what artists could do.”

Conclusion

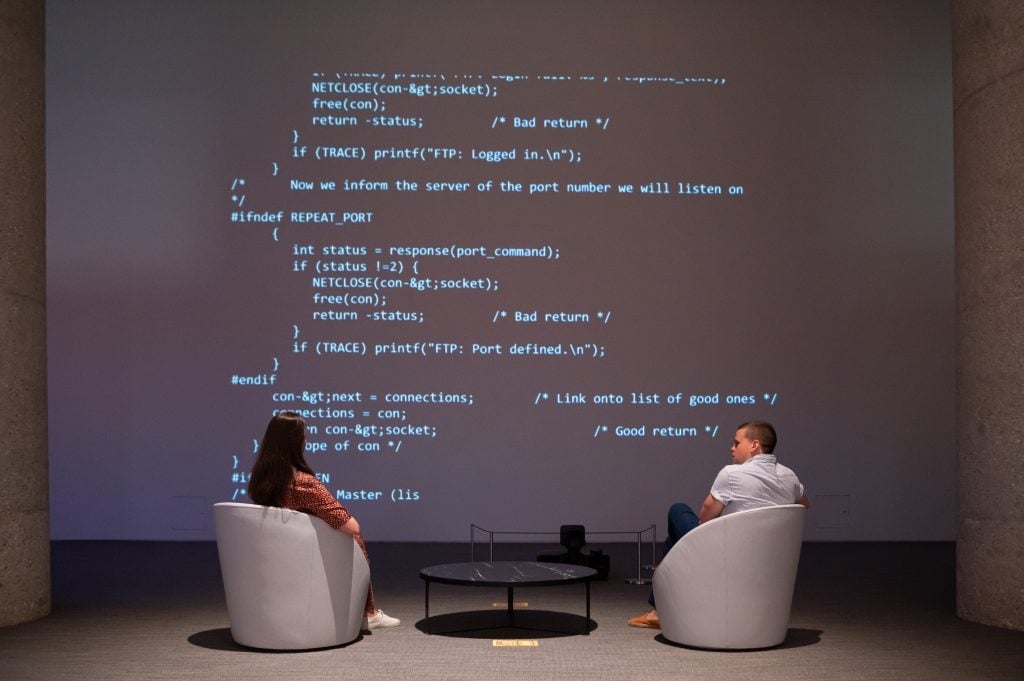

The NFT of Sir Tim Berners-Lee’s source code for the World Wide Web on view at Sotheby’s New York City, 2021. Photo: Noam Galai / Getty Images.

The new White House Crypto Czar defined non-fungible tokens as neither securities nor commodities. Instead, he classified them as “collectibles” and placed regulatory authority under the Commodity Futures Trading Commission (CFTC), which is generally viewed as more industry-friendly. However, the impact of the incoming administration on the crypto and digital art markets remains to be seen.

“Right now, with heightened global instability and volatility, markets in general are reacting cautiously. However, there is also potential for progress—this administration could provide clearer regulations that support responsible innovation and make it easier for builders in the space,” said Jason Bailey.

For those looking to seize and profit from the momentum, Matt Zhang remains confident. He noted that their NFT fund is relatively small compared to other funds in their portfolio, but it provides great publicity and brand visibility, attracting ultra-high-net-worth clients. “We believe we entered at the bottom of the market (in 2023). If we can’t make money, no one else will,” he said.

This post was originally published on this site be sure to check out more of their content