A 39-year-old company employee received a message from his “mentor” on the Line messaging app that sounded too good to be true.

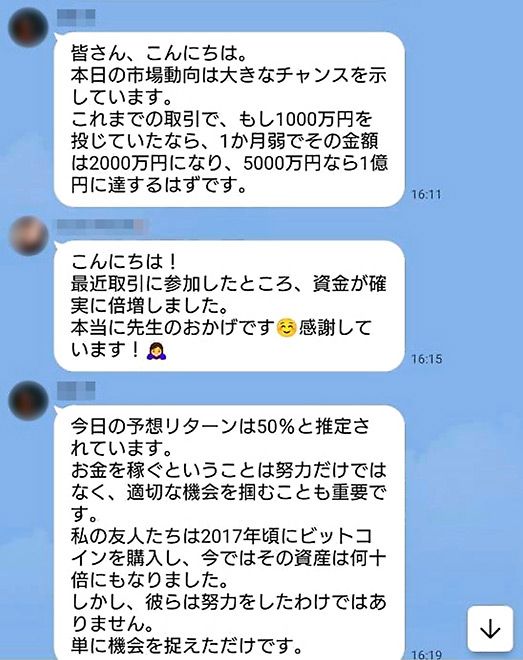

“Those investing 10 million yen ($61,800) can make 20 million yen,” it said.

The self-described instructor continued, “For those putting up 50 million yen, they will be getting back 100 million yen.”

Deceived by this post, the man living in Sendai’s Izumi Ward was defrauded of upward of 1.6 million yen.

He said he had been convinced that his investment had grown more than tenfold.

All details from the man’s accounts of the con job vividly illustrate the tactics employed by fraudsters. It’s typical of investment scams that are rapidly spreading on social media sites throughout Japan.

‘MENTOR’ ON LINE GROUP CHAT

One day in early January, the corporate worker heard from a senior colleague about an “investment program that can generate a profit as long as you simply follow the mentor’s advice.”

When the man asked if “you are doing well in your own personal investments,” the senior staffer proudly showed a smartphone’s screen. Displayed on it was the transaction history and the investment return at the time.

Listening to the colleague confidently say that the “knowledgeable mentor offers guidance,” the man became interested in trying it on his own.

A week later, the company employee was invited by the co-worker to a Line group chat set up for “investment” purposes. About 70 to 80 people, including the colleague, were registered on the chat space.

The “mentor” for the individual investors posted a message at 8 p.m. almost every day under the kanji name typically reading “Takashi Kato” or “Taka Kato.”

He commented mainly on trends in economic markets in and outside Japan.

The teacher held quizzes for chat members three times a week, asking them, for example, “whether you should now sell or buy yen” and “which currency should be exchanged for the yen: the euro or the dollar?”

Participants were supposed to send their answers to “Inoue,” the customer support clerk. Those delivering correct answers three times in a row were eligible for an Amazon gift card code worth 2,000 yen.

The victim received the prize from Inoue on several occasions like other members and confirmed that the codes were valid. Repeated rounds of this process made him increasingly less suspicious of the mentor.

Inoue recommended the man install a brokerage firm’s “investment app,” in which the operator’s corporate site could be reached. The app itself appeared among search results on the Android software store. Given all that, he felt safe to download the application.

In February, the company worker transferred 800,000 yen to the bank account specified by Inoue so he could conduct transactions on the app multiple times.

He considered himself to be actively involved in currency trades, as the app monitor indicated he had earned $69,601, or approximately 10 million yen, within two months.

SCAM FINALLY REVEALED

In mid-April, the chat group members were abruptly greeted with a message from Inoue titled the “discontinuation of our guidance.”

The notification urged participants to pay 8 percent of their gains via the investment app to the account designated by Inoue as a fee toward the end of the consultation service.

With this, they expected to be able to withdraw their cash minus the costs.

The man was initially hesitant. But he transferred 812,051 yen five days later because the 8-percent charge appeared to be “dwarfed” by his earnings on the app of 10 million yen.

However, a comment he later sent to Inoue was never read. This made the man finally realize that he “had been cheated.”

The victim had at least initially had some doubts about the scheme. He had watched TV news stories about investment frauds and had spoken with a co-worker, trying to ascertain if the service “is really genuine.”

However, seeing the steadily increasing return on the app, the man could not help but hope that “this large sum will dramatically change my life.”

The company employee reported the incident to Miyagi prefectural police. The police have opened an investigation into possible fraud, with the possibility of the application utilized as a deceptive tool.

Data compiled by the National Police Agency on investor swindles on social media show the damage from that type of crime totaled 43.02 billion yen in a total of 3,049 cases nationwide between January and May.

Victims were often led to Line chat groups and other platforms after they accessed online advertisements or responded to direct messages with invitations on social networking sites.

This post was originally published on this site be sure to check out more of their content