In a world where cryptocurrencies and blockchain technology are redefining financial markets, Grail Capital is establishing digital art, powered by Non-Fungible Tokens (NFTs), as a new asset class.

Founded in February 2023, Grail Capital has embarked on a mission to make the digital art market investable. It promises to simplify, secure, and make more profitable the collecting of digital artworks over the next ten years. The company is at the forefront of a market aiming to reach a volume of one trillion dollars within a decade. But how secure is this new asset class, closely tied to the volatile crypto market?

Distinctive Features

Non-fungible tokens (NFTs) are digital certificates based on blockchain technology that represent unique, non-interchangeable attributes of assets. They have fundamentally changed the way art can be owned in the digital space.

NFTs offer uniqueness, ownership rights, and proof of authenticity in a way that was previously impossible. This has led to the emergence of a new asset class – digital art, created, immortalized, and traded on the blockchain.

Jean-Michel Pailhon and Tim Salikhov, the founders of Grail Capital. (Image: Dave Krugman)

Investing in NFT-based Art

Grail Capital derives its name from the concept of the Holy Grail, referring in the context of digital art to high-quality artworks or masterpieces, which are referred to as the «Grail» in the digital collector’s scene.

The startup, founded by Jean-Michel Pailhon and Tim Salikhov, who both have extensive expertise and deep roots in the finance, trading, and fintech world, positions itself as a pioneer in the field of NFT-based art investments.

Pailhon, a longtime collector of art – initially of street art in his early years – experienced a transformation with the first NFTs he acquired, as he explained in a conversation with finews.ch: «The discovery of digital art has changed my life. I am a so-called compulsive collector. The thrill of being the first to own an artwork in my wallet drives me. And with digital art, everything is much faster, more cost-efficient, and transparent.»

CryptoPunk #1283 by Larva Labs from the Grail Capital collection. CryptoPunks are one of the first and best-known types of NFTs on the Ethereum blockchain.

Historical Opportunity

Digital art, supported by NFT technology, has created the possibility to certify uniqueness and ownership rights in the digital world. This digital revolution has not only changed the way art is created and perceived but also how it is considered as an investment.

Grail Capital sees a historical opportunity to expand access to the digital art market and aims to attract a million new collectors over the next ten years. Moreover, the company promises the necessary expertise in the digital art world.

Passion for Art and Crypto Assets

Grail Capital’s target audience includes ultra-high-net-worth individuals, family offices, hedge fund managers, and investors from all industries who have an affinity for technological innovations and a passion for art and investment.

These investors should be willing to invest at least 100’000 US-Dollars for a long-term perspective of five to six years. A positive attitude towards crypto assets as an integral part of the investment process is a prerequisite.

How Stable is the Investment?

Through an SPV structure (Special Purpose Vehicle), the company collects investor funds and invests them in selected digital artworks. Grail acts as a curator, selecting the artworks with the best possible price, and takes care of the technical side such as the storage and management of the works on the blockchain.

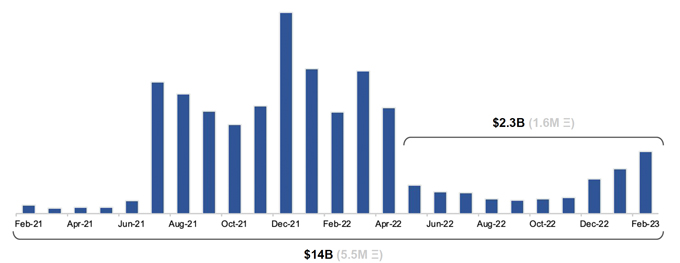

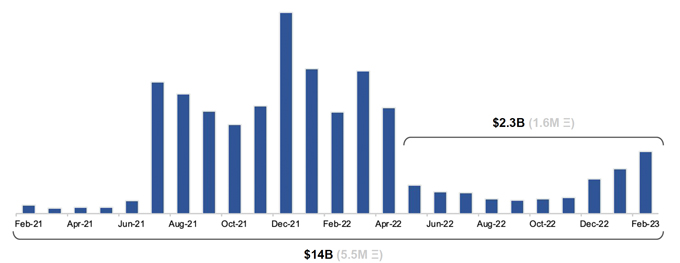

Sales volume of digital art. (Click on the graph for a larger view. Image: Dune Analytics)

However, investing in digital art and NFTs carries risks closely linked to the volatility and unpredictability of the crypto market. Although blockchain technology provides certain security in terms of authenticity and proof of ownership, the question of long-term value remains open.

Volatile Market in Its Infancy

The pricing of digital art, like traditional art, is subjective and influenced by factors such as rarity, the artist’s reputation, and market demand. However, the value of NFTs can fluctuate abruptly, fueled by speculative investments and the general market dynamics of cryptocurrencies.

It should be kept in mind that the digital art market is very young and still in its formative phase. This means increased risks for investors, but also exciting opportunities. Grail Capital is relying on a selective investment strategy (stock-picking approach) as it is common when investing in new markets.

This post was originally published on this site be sure to check out more of their content