“The day I launched the campaign I was crying because it was just so powerful,” says Masha Badinter, founder of Golden Hour Grocery in Kingston. “It’s not only about the dollar amount. It’s that people believe in your idea. They’re trusting that you will open—that you will do what you say.”

Badinter had never opened a brick-and-mortar store before. She didn’t have a customer base, and her business plan was still taking shape. But when the opportunity arose to open a small grocery store in Kingston, she jumped—and turned to crowdfunding to help make it real.

Across the Hudson Valley, crowdfunding has become an increasingly popular path for small businesses to access capital outside of traditional loans or investors. What began 25 years ago with ArtistShare’s founding as a fundraising tactic for musicians has grown into a mainstream financial strategy for growing, expanding, and even saving businesses. Fueled by the proliferation of platforms like Kickstarter, IndieGoGo, Fundable, GoFundMe, and newer players like NuMarket and increased use by entrepreneurs, the global crowdfunding market is projected to grow by $873.9 million between 2024-2029 according to Technavio.

For small businesses, these platforms have become an indispensable resource for raising capital directly from their local communities. Outside of the financial benefits, the public nature of crowdfunding makes it a powerful tool for community building—but it also requires careful messaging to avoid confusion about the business.

Here’s how three local entrepreneurs used crowdfunding platforms to launch, expand, or stabilize their businesses—and what their experiences reveal about the evolving role of community-sourced capital.

Launching a New Business

Badinter raised over $17,000 to open Golden Hour Grocery on NuMarket, a crowdfunding platform founded in 2020 to help food and beverage businesses raise capital from their customers. Instead of offering tote bags or branded mugs as thank you perks, NuMarket has a one-size-fits-all model where businesses give contributors 120 percent back in the form of credits distributed over six months to help develop return customers.

Photo by Konstantine Fomin

Masha Badinter, founder of soon-to-open Golden Hour Grocery in Kingston, found crowdfunding success through NuMarket, a new platform for food and beverage small businesses.

In this case, Badinter will reward donors with the very thing she sought to bring to her community: groceries. “For me, it felt like the only honest way to crowdsource,” she says. “Asking for just a GoFundMe didn’t feel quite right because I’m a for-profit business, but offering people more than what they contributed back in something so important like groceries felt good.”

Badinter, a professional video editor and entrepreneur, began leasing the space at the corner of Wall and Pearl streets in Uptown and was quickly moved to transform it into a grocery store, which is expected to open in July. “I kind of went into it not knowing 100 percent what my plan was or how I would fund it, but I just knew that it had to happen,” she says.

She learned of NuMarket, which was also used last year by fellow Kingston business Fantyze Bagels, and was attracted to the transparency of its 120-percent-back model (which doesn’t include the company’s 12 percent commission). Badinter was attracted to the platform’s aesthetically pleasing off-the-shelf campaign website and step-by-step marketing plan.

Additionally, NuMarket offered valuable feedback on her campaign. “It was clear that they care who they work with,” she says. “It also helped me develop the way that I was talking about my business. It’s very helpful to have that when you are just one person. You’re getting direction, but you can make it your own,” she says.

With shelves filling up, Badinter feels the weight of community trust. “People have credit with me now,” she says. “To be honest, I feel that pressure. But that’s part of why I did it too, because it’s been helpful to motivate me to get this done.”

Building on Past Crowdfunding Success

Last month, Kate Murray, founder of Quick Brown Fox Letterpress, ran her third successful Kickstarter campaign—this time to help open her first retail space on Ulster Avenue in Saugerties. The campaign raised just over $5,000 and was fully funded in under a week.

“I’ve always tried to do business with no debt,” Murray says. “I have a business coach I work with right now and we went back and forth for months on whether we should do a line of credit.”

Ultimately, they decided to lean on Murray’s past successes and the community-building she had already done with Kickstarter. In 2015, she launched her first Kickstarter campaign to restore the antique letterpress machine that helped her start her printing business, and her second campaign helped her purchase another piece of equipment to expand operations.

The third Kickstarter helped cover two-thirds of the cost of opening the store and included the purchase of a risograph machine for screen prints and poco printing press. The shop, which opened in May, serves both as a showcase for her own line of letterpress products and other arts and crafts supplies, as well as a space for classes and community events.

Murray likes how Kickstarter, with its all-or-nothing funding model, helps create urgency. “People are more likely to donate if it’s less open-ended and nebulous,” she says.

About half of the funding came from Murray’s friends and family, but the rest came from longtime customers and followers on social media. “More than raising funds, crowdfunding really raises awareness of what we’re trying to do, and I think more people feel excited to be a part of something like that,” says Murray. “They really want to make sure it succeeds because it’s something they helped fund.”

As part of its model, Kickstarter requires projects to provide contributors with rewards based on the amount they give—a good fit for a business like Murray’s. Rewards for the third campaign ranged from a virtual high-five ($5) to a set of handprinted greeting cards ($25) to a private printing party at the shop for four people, complete with pizza and drinks ($850). “I just tried to make sure that what I offered I could turn around in the time that I said I would,” she says. “The biggest thing is just making sure the rewards were kind of doable and didn’t take away from the business.”

Her other advice to first-time crowdfunders? “Make it a reasonable goal. You can always add a reach goal or ask for more money later after you get that initial pledge,” she says. “Remember, that money takes a while to hit your account, so make sure if it’s something you have to pay for right away that you have the cash to fund it.”

The Public Relations Part of Crowdfunding

This spring, seventh-generation Hepworth Farms, after being denied its usual seasonal loan by Farm Credit East, launched a GoFundMe campaign that raised over $32,000 to cover operating expenses. The reason: cannabis.

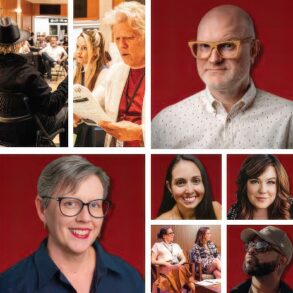

The Milton farm run by sisters Amy and Gail is renowned in the Hudson Valley for its organic produce and longstanding role in the regional food system. In recent years, the Hepworths expanded into cannabis cultivation, which despite the legal status in New York, has made bank financing harder to secure. To make up the shortfall that would prevent them from starting the planting season, the sisters’ daughters urged them to let them launch a GoFundMe.

Courtesy Hepworth Farms

Sisters Gail (left) and Amy Hepworth (right), seventh generation owners of Hepworth Farms. In April, their family launched a GoFundMe to help raise money to start the 2025 farm season.

“We weren’t at risk of going out of business,” says co-owner Gail Hepworth. “We were at risk of not growing as much food. But it’s very hard to control the messaging.”

Because of the farm’s high profile and GoFundMe’s association with urgent causes, many saw the campaign as a distress signal—even though it raised significant support.

“People jumped to conclusions,” Hepworth says. “The upside was that there was an incredible amount of community support. Most of the money came in small amounts from a lot of people, and it was helpful. There were a few people who contacted us privately because of the campaign and offered significant financial help,” she says. “But I had to manage the negative effects with our other businesses.”

“Amy and I would probably say no if asked to do it again,” she says. “It was a generational thing. The younger folks on the team felt it was the right move, and we went along.”

While Gail says the campaign generated enough support to help them start their season as usual, financing agriculture has never been easy. “A farm is never rolling in dough. And we share our profits with our employees,” she says. “So every year, we don’t have money left over because of that. And that kind of woke us up a little bit because we were so used to the banks. Maybe we should have a little more rainy day in there.”

Despite the difficulties that arose from the GoFundMe campaign, the Hepworths continue to take a farmer’s attitude of rolling with the elements that come their way. “We just bear down and keep going. That’s what we do,” says Gail. “Rise every single morning, no matter what. Even when it gets really weird.”

Beyond the Funding Goal

For small businesses, crowdfunding offers more than just a financial bridge to the next phase of growth. It’s an exercise in the power of community. For those who pursue it, however, the process can invite increased scrutiny and it’s a vulnerable position for many small business owners to operate from. “When we’re in a down position that’s manageable, we don’t wear it on our shoulders,” says Hepworth.

In the Hudson Valley, where creativity and resilience so often define the success of a small business, crowdfunding campaigns can offer an invaluable return: the emotional investment of the people who support them. “It’s about the capital, but it’s also about starting those relationships,” says Badinter. “That’s really the point of a business anyway, right?”

This post was originally published on this site be sure to check out more of their content