Work of the Week is excerpted from The Back Room, our lively recap funneling only the week’s must-know art industry intel into a nimble read you’ll actually enjoy. Artnet News Pro members get exclusive access—subscribe now to receive this in your inbox every Friday.

Sotheby’s “Origins” sale in Diriyah was more than just the house’s first auction in Saudi Arabia—it was also the first event to accept cryptocurrency payments for all lots.

While the total number of crypto transactions remains unclear, the buyer of Refik Anadol’s Machine Hallucinations, Space / Chapter II: Mars intends to pay with crypto. It marks the A.I. artist’s third-most-expensive work sold at auction and was one of the top lots of the Sotheby’s sale on Februrary 8, which featured art, luxury handbags, and other collectibles like sports memorabilia.

The work hammered for $750,000, slightly below the presale estimate, which does not include fees. It sold for a total of $900,000 after fees to the Bity Foundation, a newly established philanthropic initiative focused on art, blockchain, and community engagement. The organization was created by Gian Bochsler, a Swiss tech entrepreneur and art collector, and is managed by advisor Romain Sabah.

Executed in 2021, the generative A.I. painting, which embodies Anadol’s signature aesthetics from the artist’s Machine Hallucinations series, was inspired by a collaboration with NASA. “Based on over a million photographs captured by the MRO telescope, a custom algorithm was created and programmed to hallucinate synthetic landscapes of the Martian surface,” noted Ashkan Baghestani, head of sale for fine art at Sotheby’s. “The work invites the audience to reflect on the relationship between technology, A.I., humans and space exploration.”

Anadol’s auction record was set in 2021, when the NFT Machine Hallucinations – Space : Metaverse (2021) sold for $2.3 million at Sotheby’s Hong Kong.

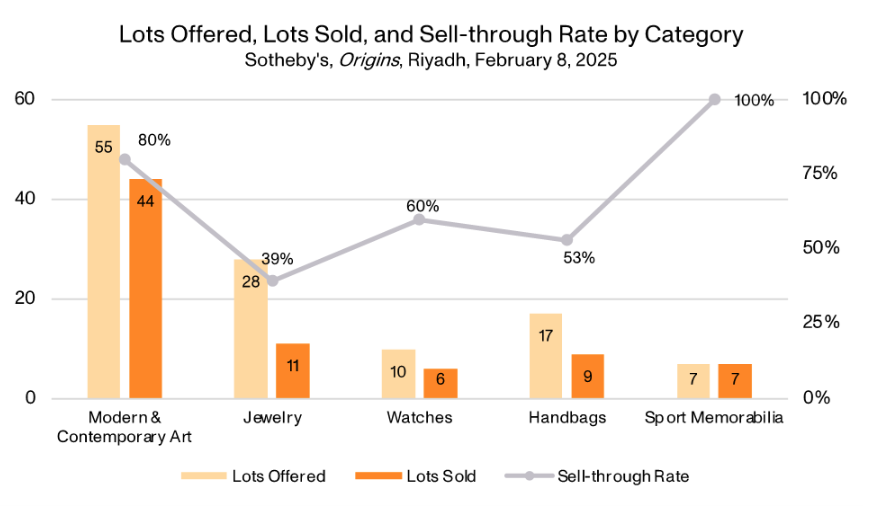

The house’s highly anticipated Saudi debut was a full-house event, achieving a hammer total of $14.4 million, in line with its presale low estimate (excluding fees). With fees, the total reached $17.3 million. The 117 lots, featuring Modern and contemporary art alongside luxury items like jewelry, watches, and handbags, had an overall sell-through rate of 66 percent. Modern and contemporary art performed well, with an 80 percent sell-through rate, contributing $12.7 million (74 percent of total sales).

Graph: Xuanyi Chen, Art Market Analyst, Price Database. Source: Artnet Price Database. © 2025 Artnet Worldwide Corporation.

Other highlights included René Magritte’s work on paperL’État de veille and Banksy’s Subject to Availability, each of which sold for $1.2 million with fees. Fernando Botero’s Society Woman, from the artist’s son’s collection, fetched $1 million from a bidder in the room. James Turrell’s light installation The Light Underneath drew seven bidders, ultimately selling for $660,000. Pablo Picasso’s work on paper, Fleurs, and Salvo’s landscape painting Il Mattino each sold for $204,000, with Salvo’s work surpassing its low estimate of $60,000 by more than three times.

Middle Eastern art outperformed Western works, reflecting a preference for local artists. Of the 28 Middle Eastern lots, 25 sold, or 89 percent. The auction set records for modern Arab art pioneers Abdulhalim Radwi and Louay Kayyali, with Kayyali’s Then What?? selling for $900,000 after intense bidding. Four works by Saudi artists exceeded high estimates, totaling $1.1 million. Notably, Mohammed Al Saleem’s painting sold for $600,000—164 percent above its high estimate, according to the Artnet Price Database.

Yet jewelry, watches, and handbags achieved surprisingly low sell-through rates of 39 percent, 60 percent, and 53 percent respective, according to Artnet’s analytics. The lukewarm response was unexpected to many observers as the affluent region has been seen as a growing market for luxury goods.

The house reported that bidders from over 45 countries participated, with nearly a third of the lots selling to buyers in Saudi Arabia. The auction also attracted a younger demographic, with over 30 percent of bidders aged 40 or younger.

“The results that we have achieved here during our inaugural sale is a clear signal of the depth of appetite that exists for art, and the thirst that is ready to be unlocked, of which tonight was a successful next step,” Baghestani noted in a statement.

Last November, Sotheby’s leaders said the firm was officially incorporated in Saudi Arabia at the end of 2023. The auction house plans to open an office in the Riyadh landmark Al Faisaliah Tower, which was designed by Norman Foster.

This post was originally published on this site be sure to check out more of their content