Glitzy evening auctions, marked by lengthy bidding wars over multimillion-dollar artworks, tend to earn the headlines. But art insiders know that the morning and afternoon sales that occur the day after, with generally more modestly priced items, are at least as important for ascertaining the health of the market. Humbler though they may be, these events provide a major chunk of auction houses’ revenues and can provide valuable information about trends in the industry.

Many of the trappings are, of course, the same: an auctioneer at a rostrum and a salesroom filled with art dealers in business attire. At the evening sales, the auctioneer may don custom-fitted earpieces and eye-catching ensembles, and the bidders receive a complimentary pre-sale tipple, but the real distinctions between the two types of sales are in the numbers. Evening sales typically wrap in less than two hours, feature between 50 and 70 lots, and, for historic affairs like the 2022 sale of the collection of Microsoft cofounder Paul G. Allen, can total $1 billion or more.1 By contrast, daytime sales may stretch as long as five hours, include hundreds of artworks, and rack up relatively minute totals without much fanfare.

Evening sales, because of the higher stakes on so many of the lots, are much more highly choreographed by the auction houses.2 Lots that have attracted little interest may be withdrawn discreetly before they hit the block, and guarantors are lined up to ensure that works sell. That careful stage management can be costly for houses, which vie to secure consignments. One example: To win mega-collector Peter Brant’s Jeff Koons Balloon Dog (Orange) in 2013, Christie’s New York reportedly waived its usual seller’s commission and gave him “a large share” of the successful buyer’s fees.3 And in 2024, Christie’s backed Brice Marden’s Event (2004–07) with a house guarantee, subsequently pulled the work from auction because of lackluster reception, and thus became the owner of the abstract painting.4

Day sales typically don’t include as many works that are guaranteed, so while there may still be negotiations with sellers, the houses can earn a higher percentage fee.5 If evening sales are where trophy hunters fight for prized masters, day sales are where connoisseurs, bargain hunters, mid-tier collectors, and workaday art dealers converge, setting prices for a great deal of art. Because of their more modest prices, they also tend to attract many more first-time clients to the auction houses, providing essential new blood to the art market. A day sale can additionally be a proving ground where demand for a hot (probably young) artist is first gauged; a strong showing can move that artist into the rarefied realm of the evening sale. (See Morgan Stanley and Artnet’s “From the Studio to the Auction Block: How the Path Between These Two Poles Shrank in the 21st Century—and What It Means for the Art Market.”)6

How have day sales fared, and how have they changed? The art market has had some wild ups and downs over the past decade, we observed, in part due to the pandemic and macroeconomic trends. First, we look at the broader performance of the day-sale market, focusing on the industry-leading New York market, followed by micro developments in how these sales are structured and how they relate to their evening-sale peers.

Let’s go to the numbers.

Methodology

Artnet analyzed data from marquee evening sales, and their accompanying day sales, that occurred in May and November in New York at the three major auction houses—Christie’s, Sotheby’s, and Phillips—during the past decade, 2015 to 2024. New York offered the largest and most standardized set of relevant sales. To ensure consistency, sales were only included if they focused on categories that repeated every year in those key May and November auctions: Impressionist and Modern (for artists born between 1821 and 1910), Postwar and Contemporary (artists born between 1911 and 1974), and Ultra Contemporary (artists born after 1974). Categories without standard day-evening divides like Old Masters, Latin American, and American—were excluded. Single-owner sales were included when the majority of their lots were from the Impressionist and Modern, Postwar and Contemporary, and Ultra-Contemporary categories. To avoid doubt and to provide clarifying examples: “Visionary: The Paul G. Allen Collection” (2022) was included, though it featured some Old Master works, while “An American Place: The Barney A. Ebsworth Collection Evening Sale” (2018) was not, since it was devoted to classic (albeit major) American art. When auctioneers dropped a historical lot into a Contemporary sale—a not entirely uncommon occurrence (e.g., Leonardo da Vinci’s Salvator Mundi, ca. 1500, at Christie’s in 2017)—it was included in sales totals.

All sale records come from the Artnet Price Database, as do all other figures cited in this report, unless otherwise noted. And unless noted, prices include the buyer’s premium.

1. Trending Topics

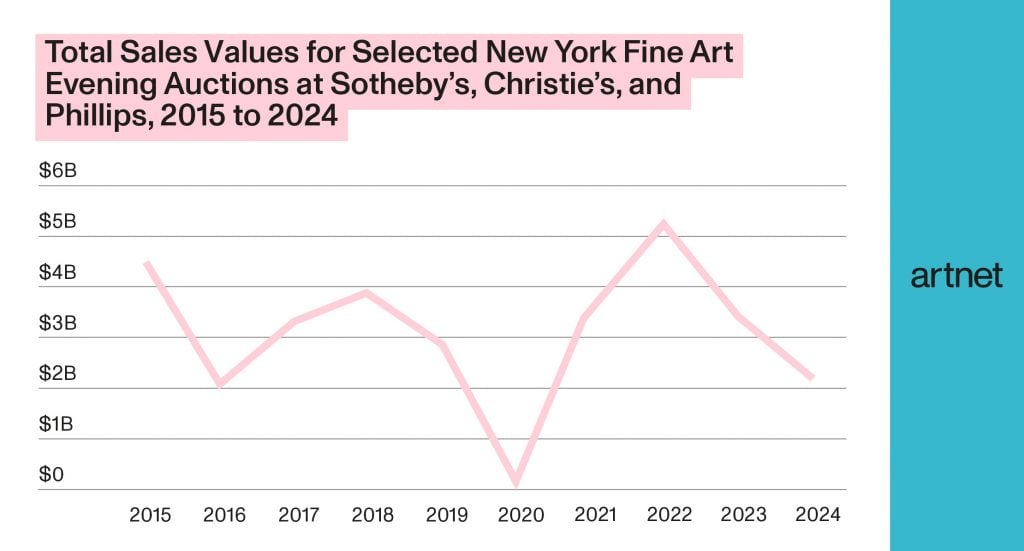

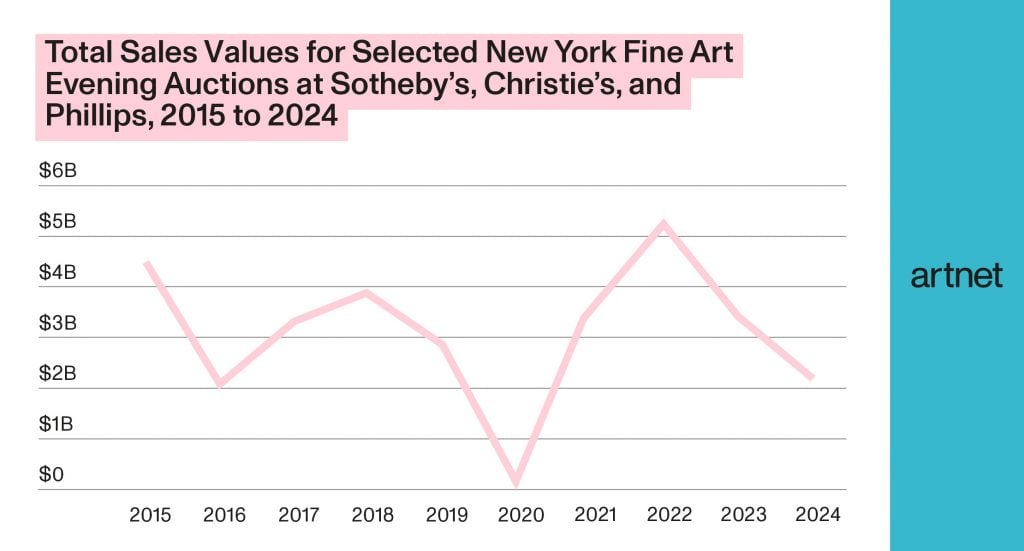

The total sales values and average prices in these select marquee New York day and evening sales over the past decade have followed remarkably similar trajectories, with one seismic, shared drop. Due to the arrival of the Covid-19 pandemic on U.S. shores in early 2020, there were no traditional marquee evening sales that year and limited day events.

But while these day and evening sales shared a general trend line, their movements have differed dramatically, as seen in the charts below.

Notably, while total New York sales volume for observed evening auctions in 2016 was down a remarkable 53.3 percent year over year (with U.K.’s Brexit vote and the U.S. presidential election creating global uncertainty7), day sales fell by just 36 percent for the examined data set. And when the market roared back in 2022, after the pandemic, evening sale totals advanced by 46.2 percent as day sale totals popped by 52.5 percent.

Overall, day sales proved to be intriguingly impervious to the widespread declines seen elsewhere in the art market in 2024. While the totals at the 2024 evening sales in question plummeted by 35.2 percent from 2023 (and a whopping 50.9 percent from 2015), day sales dropped by only 5.8 percent year over year, and were off a considerably more modest 21 percent from 2015 numbers.

2. Nothing Average

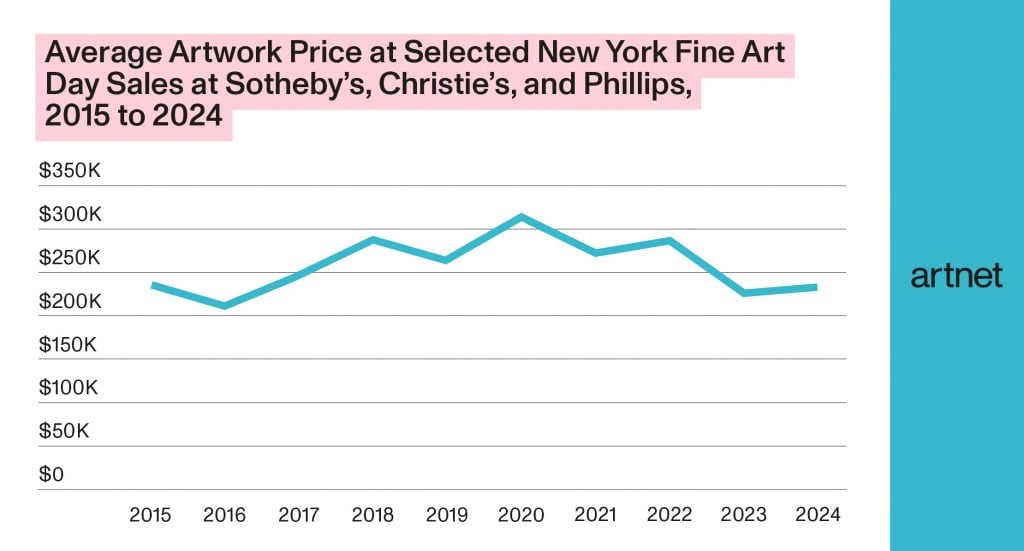

The average prices for lots at these key New York day and evening sales took remarkably different paths over the decade.

In the day sales, the decade started out with works averaging $236,803 in 2015 and ended with them down just 1.1 percent, at $234,308, in 2024.

In the evening sales, meanwhile, there were much more dramatic swings. The average price per lot was $6.9 million in 2015, dropping a stark 28.4 percent, to $4.9 million, in 2024, when the overall art market softened considerably from its 2022 high of $8.6 million per lot (which was driven by historic sales like that of Microsoft cofounder Paul G. Allen).

But note well: Those 1.1 percent and 28.4 percent drops (for day and evening New York sales, respectively) were far better than the broader auction market’s performance. For the same lookback period, 2015 to 2024, the average price of a fine art lot across all categories on the block fell a gobsmacking 48.2 percent, from $50,714 to $26,293, according to Artnet’s data. (See “Data Dive,” on p. 37, for more on macro movements in the market.) This suggests a stark truth: While these key day sales may involve business at a lower price point, they are operating in a fairly rarefied realm, at something of a remove from the churn of the wider auction world.

During the day, sell-through rates were generally softer than at evening events, but they held steadier. They averaged 82 percent and spanned from a low of 77 percent in the contracting market of 2016 to a high of 87 percent in 2021, as buyers returned after the Covid-19-darkened months of 2020. They ranged more widely in the evening auctions, despite careful orchestration, from a decade low of 83 percent in 2015 to an extremely robust 96 percent in 2021’s rally, with an average sell-through rate of 89.3 percent.

3. The Size of the Pies

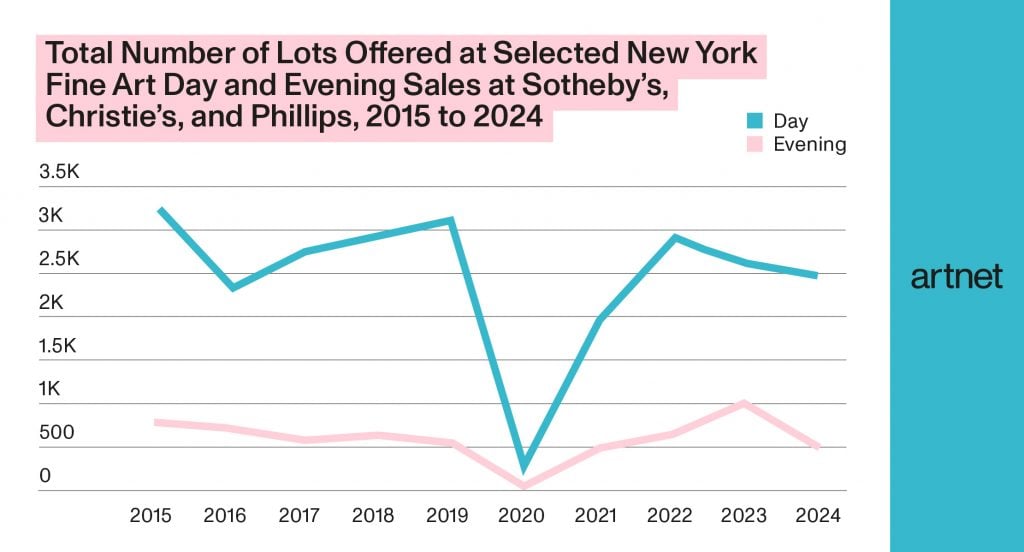

Daytime sales saw dramatically more works offered in the lookback period—that is no surprise—though the numbers declined notably over the decade, starting at 3,243 in 2015 and falling to 2,455 in 2024, a 24.3 percent drop. One possible explanation for this, with the improving sell-through rates in mind: Even in day sales, the big three houses were increasingly careful about what they offered, and, perhaps, at what estimates (more on this below).

The selected evening sales offered 780 works in 2015 and a far lower 487 works in 2024, reflecting a much more drastic 37.6 percent drop.

Over the decade, in the sales under review, evening sales generated about $30.8 billion, while day sales brought in $5.1 billion, for a total of $35.9 billion, with evening sales accounting for 86 percent of that tally, and day sales constituting just 14 percent. But those totals resulted from very different types of work. Established artists contribute mightily to the totals of evening events, while younger (i.e., Ultra-Contemporary) artists are spread a bit more evenly between day and evening.

Impressionist and Modern sales in the relevant auctions over the lookback period tallied $18.9 billion, with evening sales accounting for $17.1 billion of that amount and day sales accounting for only $1.8 billion, or just 9.5 percent of the total. Postwar and Contemporary sales, day and evening, tallied $15.6 billion. Evening sales in the category added up to $12.5 billion, day sales at $3.1 billion—a more substantial 19.7 percent of the total.

It’s in the Ultra-Contemporary realm that things get truly interesting. Total sales amounted to $582.7 million, with evening sales accounting for $371 million and day sales ringing up at $211.8 million, a strong 36.3 percent of the total. In the coming years, auction houses are hoping to build demand in this category. (See “New Money, New Tastes,” p. 14, in this report, for more on efforts to draw in new buyers of Ultra-Contemporary art.)

4. Categorical Action in Daylight

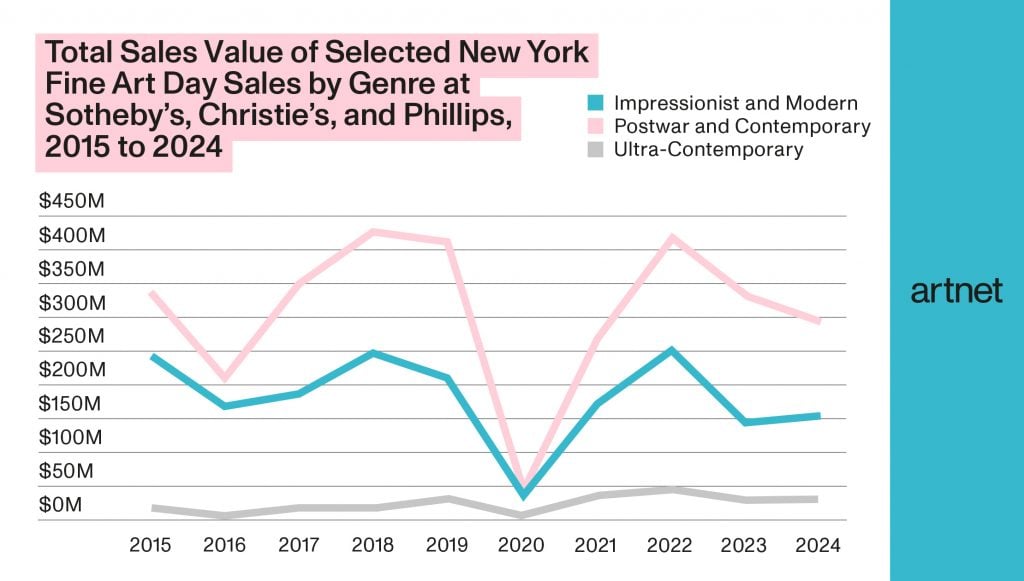

Sales totals in daytime auctions for the three genres in question diverged considerably over the decade.

Impressionist and Modern art showed the starkest drop, with day sale totals starting at $244.3 million in 2015 and falling by 36.7 percent, to $154.6 million, in 2024. In contrast, Postwar and Contemporary art showed far less drop-off over the lookback period, starting at $335.8 million and falling by just 13 percent, to $292.2 million, in 2024.

Ultra-Contemporary art was—perhaps unsurprisingly, given its untested status—far more volatile. In 2015, work by these artists generated $14.6 million at day sales; in 2024, in contrast with overall downward art market trends for the year, that number had climbed an eye-popping 91 percent, to $28 million. The Ultra-Contemporary total has been as low as $1.6 million, in 2020, and as high as $43.9 million, in 2022.

5. Categorical Action After Nightfall

5. Categorical Action After Nightfall

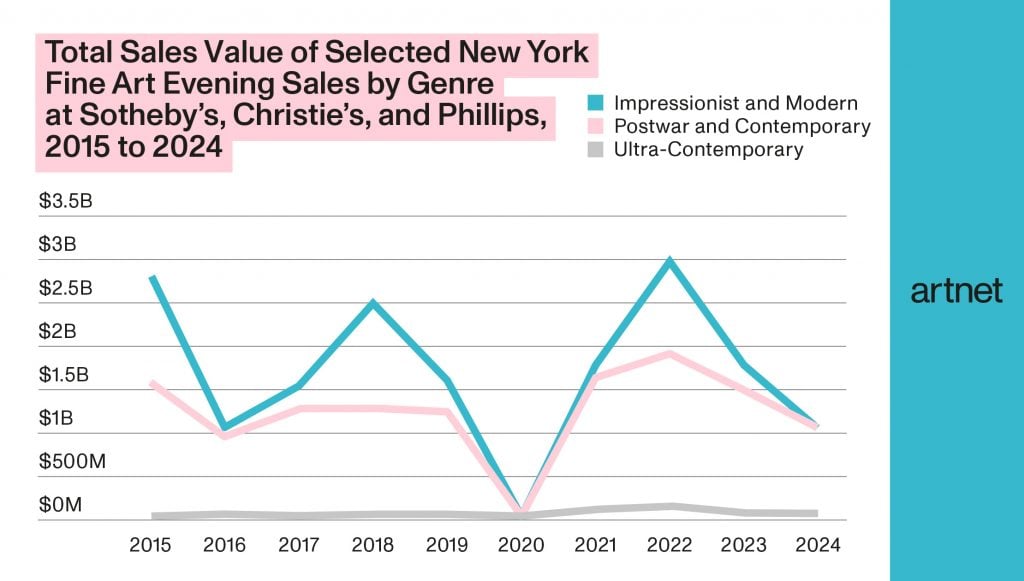

Evening auction totals for the three genres also saw highly distinct trajectories.

Impressionist and Modern art showed the largest drop. In 2015, the total in this category was $2.8 billion. That fell a staggering 62.3 percent, to $1.1 billion, in 2024, but not before it reached an impressive high of $3 billion in 2022 (again, largely due to the success of Paul G. Allen’s collection). Evening Postwar and Contemporary art, as in the day sales, dropped by less, starting at $1.6 billion in 2015 and receding 34 percent to $1.1 billion in 2024 (down from a $1.9 billion high in 2022).

Ultra-Contemporary art in evening sales, as in accompanying day sales, bucked larger trends, rising 267.4 percent over the decade, moving from $12.7 million in 2015 to $46.5 million in 2024. The annual total reached its peak, at $109.8 million, in frothy 2022. Overall, the evening auctions tell a tale of volatility compared with their more tempered daytime counterparts.

6. Meeting and Exceeding Expectations (or Not)

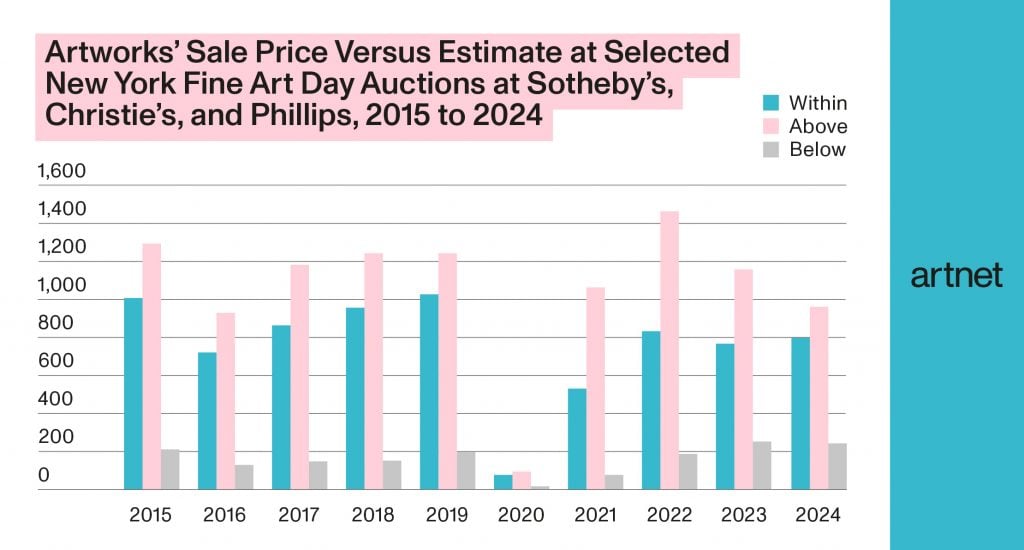

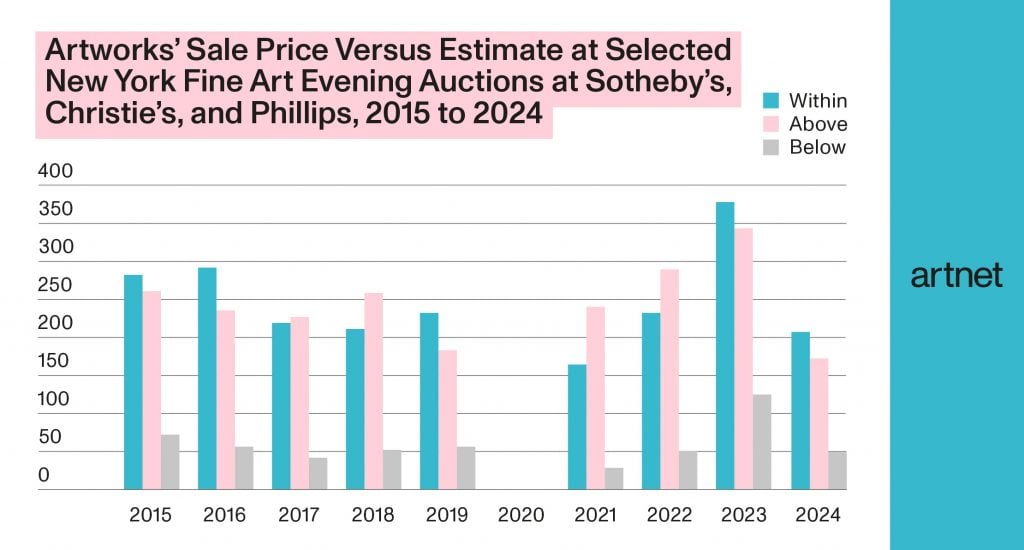

Auctioneers take the temperature of the art market when placing presale estimates on artworks, while also using data from the past performance of comparable works on the secondary market. How artworks’ final sales compare with presale estimates can give indications about how bullish collectors are feeling about the art market—and how accurately the houses have read that market. (Nota bene: Final sale prices include the house’s fees on top of final bids, or “hammer” prices; presale estimates do not.)

As seen below, day and evening sales had disparate results versus their estimates over the decade.

At day sales, the number of works that sold for above their estimates always exceeded the number of works that sold for within or below estimates in the examined data set. As the market rebounded in 2021 and 2022,

this was particularly pronounced: In 2021, 1,068 of 1,711 lots (or 62.4 percent) sold for above their estimates, while 546 (31.9 percent) finished within them; in 2022, some 1,464 of 2,505 lots (or 58.4 percent) sold above their estimates, while 840 (33.5 percent) finished within them.

In the evening, by contrast, in half the years under review, the number of works sold within estimate outstripped the number of works selling for above their estimates. In the robust markets in 2021 and 2022, however, buyers dug deep to bid works up above their estimates a considerable number of times, with 244 of 446 works (54.7 percent) exceeding their estimates in 2021, versus 168 (37.7 percent) selling within their estimates, and 291 of 579 (50.1 percent), exceeding their estimates in 2022, versus 236 (40.8 percent), selling within estimates.

One takeaway: Estimates at day sales tend to be more conservative, perhaps to induce early bidding, while estimates at evening sales are more aggressive, perhaps responding to the ambitious expectations of sellers.

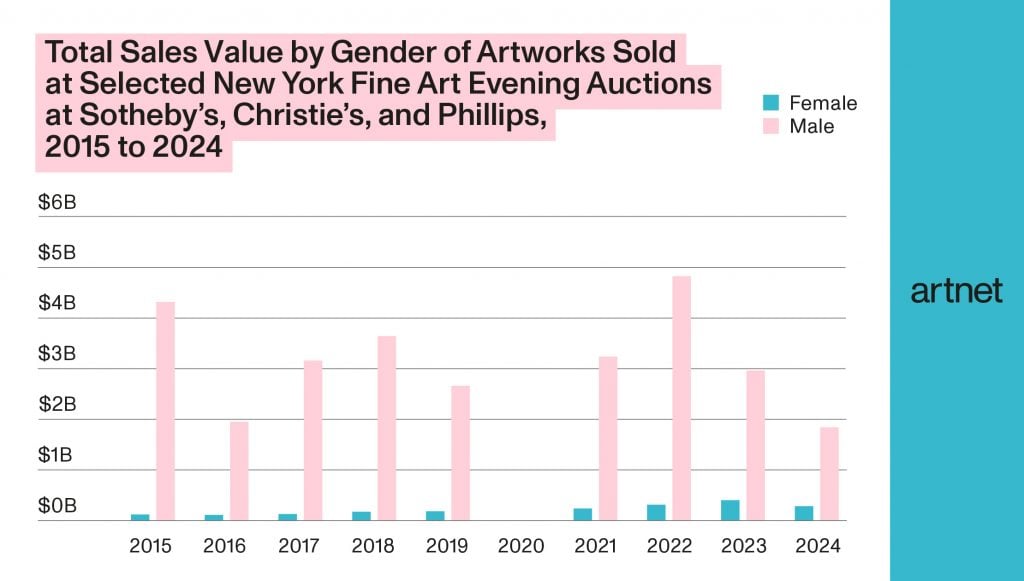

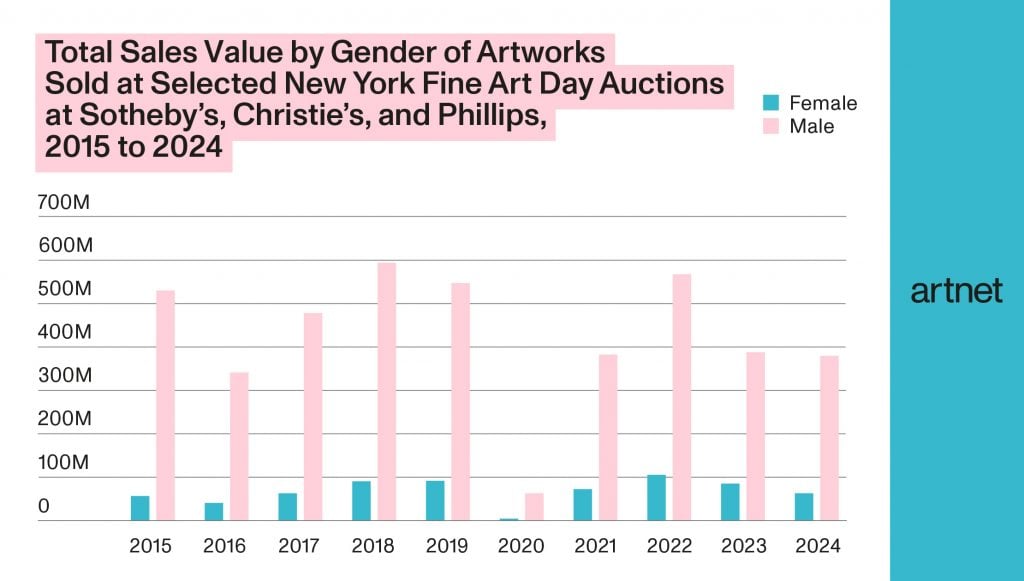

7. Mixed Progress for Gender Equity

A disparity in pricing between artworks by men and by women is the industry standard, even as many in the art market have avowed to be working to rectify this.8 Evening sales in the current data set do show some progress; while the tallies for sales of art by women at these marquee events never exceeded $200 million between 2015 and 2019, averaging 4.4 percent of sales during this early period of the decade, they have beaten that figure every year since 2021, peaking at $408.9 million in 2023, or 12.2 percent of that year’s $3.3 billion total.

As seen in the above chart, women artists are more prominent in the more modestly priced day sales, where they represent a greater proportion of total dollar sales amounts. Sales of women artists at evening auctions totaled about $2 billion over the decade, just 6.4 percent of the $30.6 billion total. At day sales, by contrast, women artists sold for a total of $687.5 million, amounting to some 13.9 percent of the $4.9 billion total.

8. Who Are the Top Artists at Day Sales and Evening Sales?

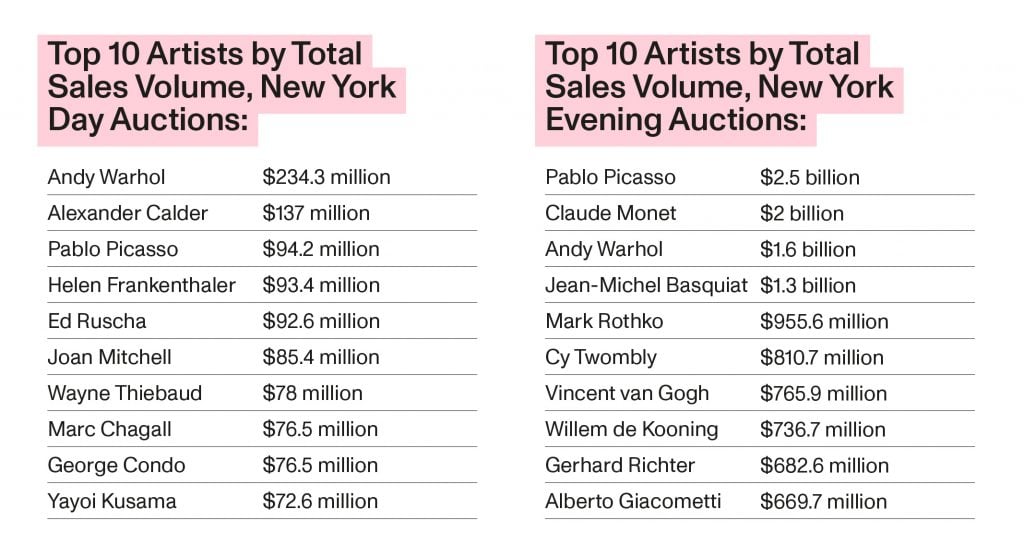

The top 10 lists for artists by total sales volume over the decade in the day and evening sales have some overlap. Pablo Picasso and Andy Warhol, two of the established (and prolific) engines of the art market, appear in both.

The two lists also reveal a distinct gender divide: The day sales include three female artists (Helen Frankenthaler, Joan Mitchell, and Yayoi Kusama), whereas not a single woman charts in the top 10 for the selected evening sales under review.

Conclusion

Big-ticket evening sales will always grab the spotlight,

but data for the past decade in New York from these sales, and their little siblings during the day, yield significant insights. Works at the daytime auctions consistently sell more often for above their estimates, average lot prices are far more consistent at morning and afternoon sales than at their evening counterparts, and the sell-through rates for day sales remain remarkably steady over the decade, suggesting that this segment in the art market is, in some senses, more predictable and consistent than headlines indicate of the art auction market overall. On a final, lighter note: Day sale previews are the place to go if you want to see art of varying quality, en masse. The artist Alex Katz once said, “If we only wanted to look at masterpieces, we’d spend all our time at the Frick.”9 He could just as well have been discussing the great divide of evening and day sales.

Endnotes

1. https://news.artnet.com/market/paul-allen-sale-report-2207858

2. https://news.artnet.com/market/state-of-the-market-auctions-art-market-theater-2442524

4. https://news.artnet.com/market/brice-marden-marron-withdrawal-2494620

5. https://news.artnet.com/market/five-reasons-auction-houses-day-sales-interesting-360386

6. https://news.artnet.com/market/from-the-studio-to-the-auction-block-morgan-stanley-2202991

7. https://www.nytimes.com/2017/02/09/arts/christies-sothebys-phillips-2016-auction-sales.html

8. https://news.artnet.com/art-world/full-data-rundown-burns-halperin-report-2227460

9. David Bourdon, “A Critic’s Diary,” Art in America, Summer 1977, p. 67.

Disclosures: This material was published in March 2025 and has been prepared for informational purposes only. The information and data in the material has been obtained from sources outside of Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley makes no representations or guarantees as to the accuracy or completeness of the information or data from sources outside of Morgan Stanley.

This material is not investment advice, nor does it constitute a recommendation, offer or advice regarding the purchase and/or sale of any artwork. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. It is not a recommendation to purchase or sell artwork nor is it to be used to value any artwork. Investors must independently evaluate particular artwork, artwork investments and strategies, and should seek the advice of an appropriate third-party advisor for assistance in that regard as Morgan Stanley Smith Barney LLC, its affiliates, employees and Morgan Stanley Financial Advisors and Private Wealth Advisors (“Morgan Stanley”) do not provide advice on artwork nor provide tax or legal advice. Tax laws are complex and subject to change. Investors should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trusts and estate planning, charitable giving, philanthropic planning and other legal matters. Morgan Stanley does not assist with buying or selling art in any way and merely provides information to investors interested in learning more about the different types of art markets at a high level. Any investor interested in buying or selling art should consult with their own independent art advisor.

This material may contain forward-looking statements and there can be no guarantee that they will come to pass.

Past performance is not a guarantee or indicative of future results.

Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies. Diversification does not guarantee a profit or protect against loss in a declining financial market.

By providing links to third party websites or online publication(s) or article(s), Morgan Stanley Smith Barney LLC (“Morgan Stanley” or “we”) is not implying an affiliation, sponsorship, endorsement, approval, investigation, verification with the third parties or that any monitoring is being done by Morgan Stanley of any information contained within the articles or websites. Morgan Stanley is not responsible for the information contained on the third party websites or your use of or inability to use such site, nor do we guarantee their accuracy and completeness. The terms, conditions, and privacy policy of any third party website may be different from those applicable to your use of any Morgan Stanley website. The information and data provided by the third party websites or publications are as of the date when they were written and subject to change without notice.

This material may provide the addresses of, or contain hyperlinks to, websites. Except to the extent to which the material refers to website material of Morgan Stanley Wealth Management, the firm has not reviewed the linked site. Equally, except to the extent to which the material refers to website material of Morgan Stanley Wealth Management, the firm takes no responsibility for, and makes no representations or warranties whatsoever as to, the data and information contained therein. Such address or hyperlink (including addresses or hyperlinks to website material of Morgan Stanley Wealth Management) is provided solely for your convenience and information and the content of the linked site does not in any way form part of this document. Accessing such website or following such link through the material or the website of the firm shall be at your own risk and we shall have no liability arising out of, or in connection with, any such referenced website. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

© 2025 Morgan Stanley Smith Barney LLC. Member SIPC. CRC 4317277 03/2025

This post was originally published on this site be sure to check out more of their content