Since around 2013, Jonathan Mann’s sole job has been writing and posting a song online each day. With titles ranging from “Yeah, I’m Rocking a Headband” to “Joe Biden, Retire” (posted July 1), his pop tunes are at turns whimsical and topical. Some go viral.

Still, says the Connecticut-based Mann (aka “Song a Day Mann”), monetization was a “slog.” Sales from distribution platform Bandcamp and advertising revenue from YouTube “never amounted to much.” Conference performances and jingle contests filled the gaps. Then came NFTs, which let Mann attach one-of-a-kind blockchain-based tokens to his songs so buyers could easily purchase unique copies online. The tech transformed his music-selling game.

“NFTs are a simple way to capture the monetary upside of [viral] attention,” he says. He could sell his songs directly to buyers without involving third parties that would take cuts, like a record label. Plus, he could program the NFTs so that he’d earn additional revenue through secondary sales. In 2018, his NFT “B-U-I-D-L” (the title is crypto industry slang) was the first tokenized song on the blockchain network Ethereum, he claims, and sold for 2.56 ETH (at time of writing worth more than $5,600). His more popular songs have since sold for the US dollar equivalent of five figures.

Then the game changed again. In August 2023, the US Securities and Exchange Commission announced a settlement of more than $6 million with Impact Theory, a media entertainment company that sold NFTs containing digital graphics. About a month later, the SEC said that it had done the same with a project known as Stoner Cats, which involved celebrity couple Mila Kunis and Ashton Kutcher and sold NFT cartoon cats to finance the production of an animated web series by the same name. (Both Kunis and Kutcher voiced characters, and Kunis’ Orchard Farm Productions helped produce.) Stoner Cats agreed to pay a $1 million fine.

Both projects had, per the SEC, conducted “an unregistered offering of crypto asset securities in the form of purported nonfungible tokens.” In other words, the SEC, which had never provided clear rules surrounding art or NFT sales, had in short order designated some NFT-connected digital art pieces as securities, meaning they’d have to be registered with the commission. Its decisions could shake up how the centuries-old art business operates, argues Mann.

On July 29, Mann and the conceptual artist and lawyer Brian Frye filed a lawsuit in a Louisiana federal district court against the SEC, which begins by asking a simple question: “Should art be regulated by the SEC?”

“We’re not libertarian or anti-government,” Mann says. “What the SEC has done directly affects my ability to make a living and, by extension, many other NFT artists. That’s what it’s about to me: protecting our ability to experiment and make a living on the internet.”

Mann and Frye, represented by the attorney Jason Gottlieb, are seeking a “declaratory judgment” from the SEC that, by releasing two specific NFT art projects, they “do not violate US securities laws,” per the lawsuit. Mann wants to sell 10,420 NFTs, for roughly $800 each, of remixes of “This Song Is a Security,” a track referring to the SEC’s 2023 actions. Meanwhile, Frye’s Cryptographic Tokens of Material Financial Benefit project, which will include 10,320 NFTs minted on Ethereum, has economics “literally identical to Stoner Cats on purpose,” he says.

The essence of the case, Frye adds, is about NFT art writ large and “using NFTs the way most people are—to sell them.” The point is to get SEC regulators to have a “long, hard think” about what’s in their purview, he says.

Security vs. Art

In 1946, a US Supreme Court ruling about the Howey Company, which sold citrus groves to buyers who shared in their profits, cemented the test for determining what a security is. The “Howey Test” defines securities as “an investment of money in a common enterprise with the expectation of profits from the efforts of others.”

In other words, Gottlieb says, it makes an investment contract a security. That can be tricky to apply to art, analog or NFT-affiliated. “When you sell a certificate, what you’re really doing is essentially selling art collectors an interest in your art,” Frye says. That means buyers are investing in the expectation “that you’re going to get more famous.” That fame, in turn, makes the art more valuable.

If you look at it that way and apply the Howey Test, Gottlieb says, it can look very much like art buyers are investing in a common enterprise and expecting to benefit from the artist’s efforts. The difference, Gottlieb says, is that “artists don’t owe you anything.” You may hope that your purchase of an autographed Brat album will go up in value as Charli XCX keeps selling out concert venues, but that wasn’t promised with the record’s sale. Same, the suit argues, goes for a digital cat cartoon tied to some blockchain-based code.

Plus, people aren’t only buying art NFTs to resell them at a profit. They buy Mann’s work, Gottlieb says, “for all sorts of reasons,” like just enjoying the music itself. But based on the SEC’s Impact Theory and Stoner Cat rulings, Frye argues, “not only the entire NFT market but the entire art market itself is a security.”

Through a spokesperson, the SEC declined to comment. Though the agency’s past actions don’t necessarily indicate that the SEC views all NFTs as securities, it hasn’t provided a clear stance on how artists using the technology for sales should proceed with selling their work, either. Mann’s work “might be different enough” from the two projects that paid fines to the SEC, says attorney Michael Rinaldi, partner at Duane Morris in Philadelphia. If owners hold onto an NFT because it’s “collectible or unique … or for enjoyment, as opposed to being an investment, that wouldn’t be a security.”

Mann and Frye’s lawsuit aims to get some answers from the SEC. “Other than [Impact Theory and Stoner Cats’] digital nature, there was little conceptual difference between those series of artworks and, say, Andy Warhol’s 1962 series” of 32 Campbell’s Soup Cans, the lawsuit states. The Stoner Cats NFTs funded an animated series, but what does buying art do for artists if not fund their future work?

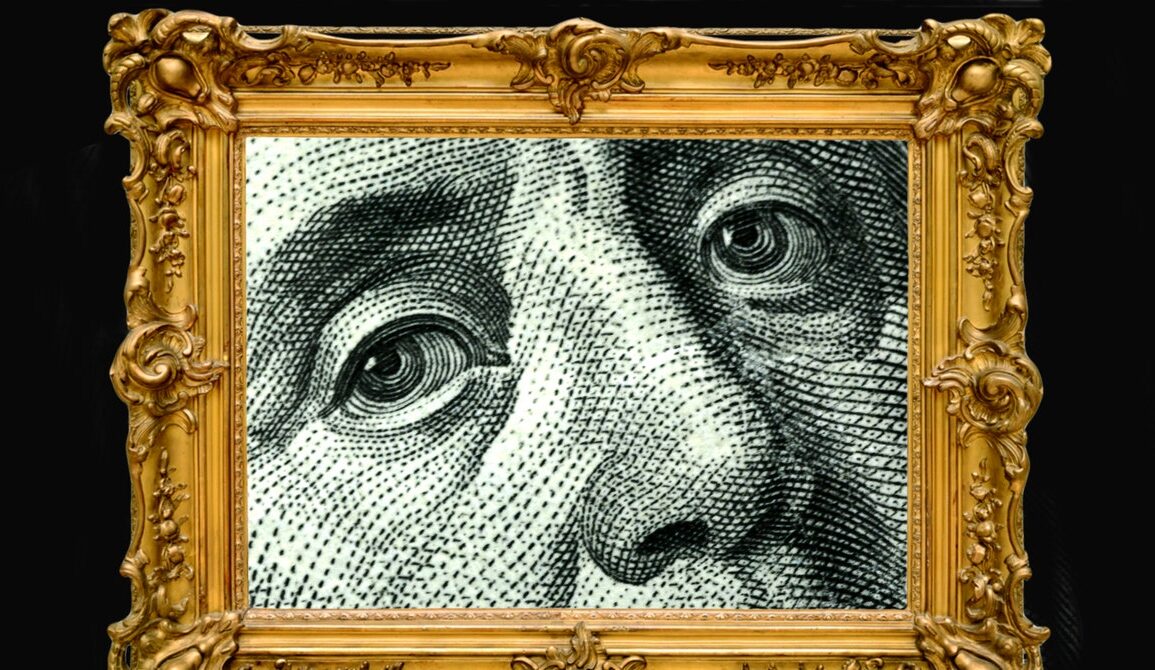

Then again, NFTs have a fundamentally money-related nature that other artistic media don’t. “Canvas is not a financial layer,” says London-based Ben Gentilli, who creates blockchain-related art under the name Robert Alice. NFTs, he says, are like “if art was made with bank notes.” When NFT art sales took off in 2021, exemplified by the $69 million Christie’s sale of a work by digital artist Beeple, the market highlighted the medium’s investment potential. “You could see that creep into the language of people marketing NFT projects,” Gentilli says.

The stakes of the suit are potentially so high as to touch the First Amendment, says Gottlieb. Since the SEC ordered both Impact Theory and Stoner Cats to destroy the yet unsold NFTs associated with their projects, the regulatory body could be seen as demanding that an artist burn their art. “That’s an incredibly dangerous and oppressive thing for the United States government to tell artists,” Gottlieb says, “just because they’re working in this new, digital medium.”

What’s Next

While a couple of other NFT artists who spoke with WIRED cite the “chilling effect” the SEC’s past actions have had on the NFT art market, others don’t worry about drawing the commission’s attention. “Personally, the SEC’s actions so far haven’t had a major impact on my digital art practice,” NFT artist Bryan Brinkman says.

Plus, the regulatory body stands to change depending on the 2024 election. Former President Donald Trump has promised to fire SEC Chair Gary Gensler—who historically has ruled against the cryptocurrency industry—if elected. The two commissioners who dissented in the Impact Theory and Stoner Cats settlements, Hester Peirce and Mark Uyeda, are Republicans. Vice President Kamala Harris has yet to speak publicly on these issues.

At the very least, artists want the lawsuit to get the SEC’s attention. “I hope the outcome will bring clearer and more transparent rules for releasing digital collectibles and art,” Brinkman says. Fellow digital artist Gentilli, however, isn’t optimistic. He calls the suit an interesting “artistic gesture,” but points out that the SEC hasn’t even offered clear rules on cryptocurrency, let alone NFTs, which “are much further down the list.”

The SEC has 60 days from the date the lawsuit was filed to respond. Gottlieb says the agency can either come back with a motion to dismiss or an answer in which they’ll probably “deny the allegations and plan to contest.”

Regardless of what happens next, the issue won’t be cut and dry. “Software is as limitless as human imagination,” Gottlieb says. He adds that blockchain-based tokens can be “the object of investment contracts,” but they can also be commodities, payments, concert tickets, and art pieces, or all those things at once—“like Schrödinger’s software.”

For Mann, this whole experience feels like the domino effect meme, in which a man is poised to strike a tiny white rectangle at the start of a chain that ends with one the size of a tombstone. The first domino would be Mann learning about NFTs at a conference in 2017; the last, him suing the SEC.

“Prior to like, 2021, I did not know what a security was,” Mann says. In “This Song Is a Security,” Mann pleads with SEC Chair Gensler: “Hey Gary/Give me a call, baby/And we can settle this/Once and for all, maybe/Because it’s so confusing/I don’t know what you’re doing.” Perhaps, if things go his way, Mann will get at least a little bit of clarity.

This post was originally published on this site be sure to check out more of their content