As a market analyst with years of experience navigating the turbulent waters of cryptocurrency, I’ve learned that timing is everything. One of the most sought-after skills in this space is the ability to identify a “dip”—a temporary price decline that presents a potential buying opportunity. Today, I’m examining three cryptocurrencies—$ONT , $DEXE and $STG —that have recently experienced notable downturns, prompting the crucial question: are these temporary setbacks or signs of deeper trouble? More importantly, could this be the perfect dip we’ve been waiting for?

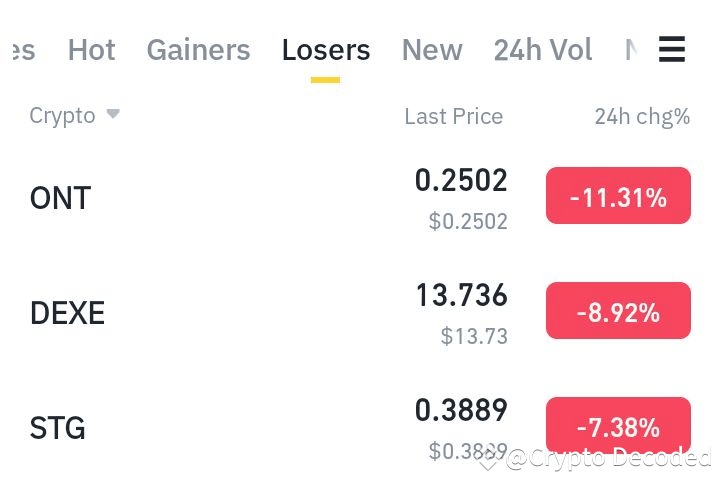

The image you provided shows these assets experiencing losses in the past 24 hours. ONT is down by a considerable 11.31%, DEXE by 8.92%, and STG by 7.38%. It’s understandable that such declines might trigger concern. However, I’ve learned that knee-jerk reactions based solely on short-term price movements can often lead to missed opportunities. I recall an instance early in my career where I panicked and sold an asset during a dip, only to watch it recover and surge to new highs shortly thereafter. It was a painful but valuable lesson in the importance of careful analysis.

The core idea behind “buying the dip” is based on the principle of mean reversion. This concept suggests that asset prices tend to gravitate towards their average value over time. Therefore, a significant drop below this average could indicate that the asset is undervalued and poised for a rebound. However, it’s essential to distinguish between a healthy correction within a broader uptrend and a decline driven by fundamental issues with the project itself.

So, how do we determine if ONT, DEXE, and STG represent genuine buying opportunities? A thorough investigation beyond the immediate price action is required. We must consider several crucial factors:

First, what is the overall market sentiment? Is the entire crypto market experiencing a downturn, or are these declines isolated incidents? A broader market correction can create temporary dips even for fundamentally strong projects.

Second, what are the specific reasons behind these price drops? Are there any negative news or developments related to these projects? Or is it simply a case of profit-taking after a period of growth? Understanding the “why” is crucial for assessing the potential for recovery.

Third, what are the long-term prospects of these projects? Do they have solid fundamentals, a strong team, and a compelling use case? A temporary price decline shouldn’t overshadow the long-term potential of a promising project.

It’s important to emphasize that I am not offering financial advice. Investing in cryptocurrencies is inherently risky, and past performance is not indicative of future results. However, by understanding the concept of “buying the dip” and conducting thorough research, investors can potentially identify valuable opportunities in the often-volatile crypto market. The recent declines of ONT, DEXE, and STG warrant further investigation to determine if they represent just such an opportunity.

This post was originally published on this site be sure to check out more of their content