As the art world returns to its full rhythm this season, most market conversations have centered on the notion that “the market is slowing down” and “we are no longer in a pandemic.” While some glimmers of optimism appeared during Frieze Seoul and the Armory Show, the first auctions between Hong Kong and New York signaled a new normal across regions, with more modest estimates and, at times, lower hammer prices than the peak periods when ultra-contemporary artists enjoyed a frenzied rise. In this buyer’s market, collectors are hunting for deals and quality while grappling with the reality that what they overpaid for in the past may not yield the same returns now.

Artnet’s The Intelligence Report Mid-Year Review 2024 recently revealed that every category has shrunk significantly in the past year, with values for the ultra-contemporary segment dropping by 39 percent from 2023 to 2024. Even so, this category still accounted for a notable $164.8 million in total sales for works by artists born after 1974. Although this is a substantial figure, it falls below previous highs, reflecting the broader trend: a 29 percent decline in total sales for the “big three” auction houses compared to last year. The cooling of the secondary market was underscored by recent sales in New York and Hong Kong, where previously in-demand, blue-chip names experienced declines. Yet, the season still had its share of surprises, record prices and active bidding—especially for fresh-to-market pieces and auction debuts.

Observer conducted a cross-region analysis of key results and trends from the recent auctions in New York and Hong Kong, just as the art world braces for the upcoming London Evening Sales, the art week in Paris and fall’s major European art fairs.

The mid-season sales in New York

The first signals on the state of the American market, particularly for contemporary and ultra-contemporary art, emerged from Phillips’ New Now: Modern & Contemporary Art sale, which brought in $7.5 million with a modest sell-through rate of 78 percent and 87 percent sold by value. However, several names struggled to match their past prices. A telling example was Josh Smith’s Still in the Garden (2018), which, despite a high estimate of $30,000, landed at a very moderate $19,000 before going unsold. This result aligns more closely with the lower-end prices seen for his works in 2020’s salon-style installation at Zwirner New York and marks a steep decline compared to more recent primary sales at the gallery’s Paris show and Eva Presenhuber.

Other results reflected recalibrated market expectations. A work by Loie Hollowell, whose auction prices have seen consistent growth, sold for $53,350—just slightly above its $50,000 low estimate. The outcome was more severe for Nate Lowman’s bullet-hole silkscreen, which hammered at only $28,000 against its estimate of $20,000 to $30,000, translating to a staggering 86-percent loss from the $197,000 originally paid at Sotheby’s.

SEE ALSO: Phillips’ Specialist Patrizia Koenig On What to Expect This Season

Despite these sobering results, bright spots emerged for in-demand young artists who are often sold out in the primary market. Yuan Fang’s Expanse (Three Figures) from 2022 exceeded expectations, selling for $35,560 against a $20,000 high estimate, while a Sara Anstis work fetched $53,340 from a $20,000 high estimate. Etel Adnan’s Forêt continued its upward trajectory, selling for $95,250.

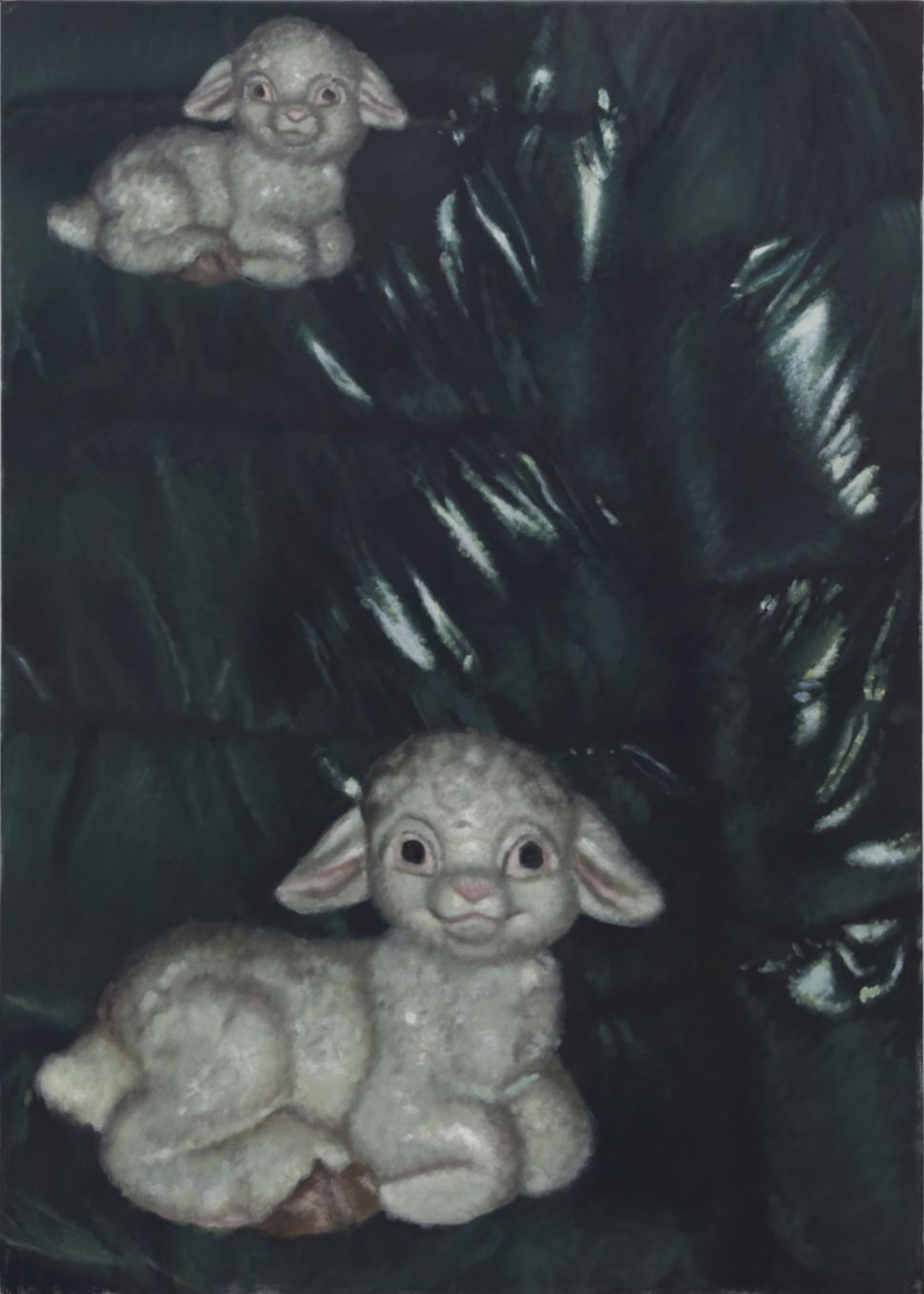

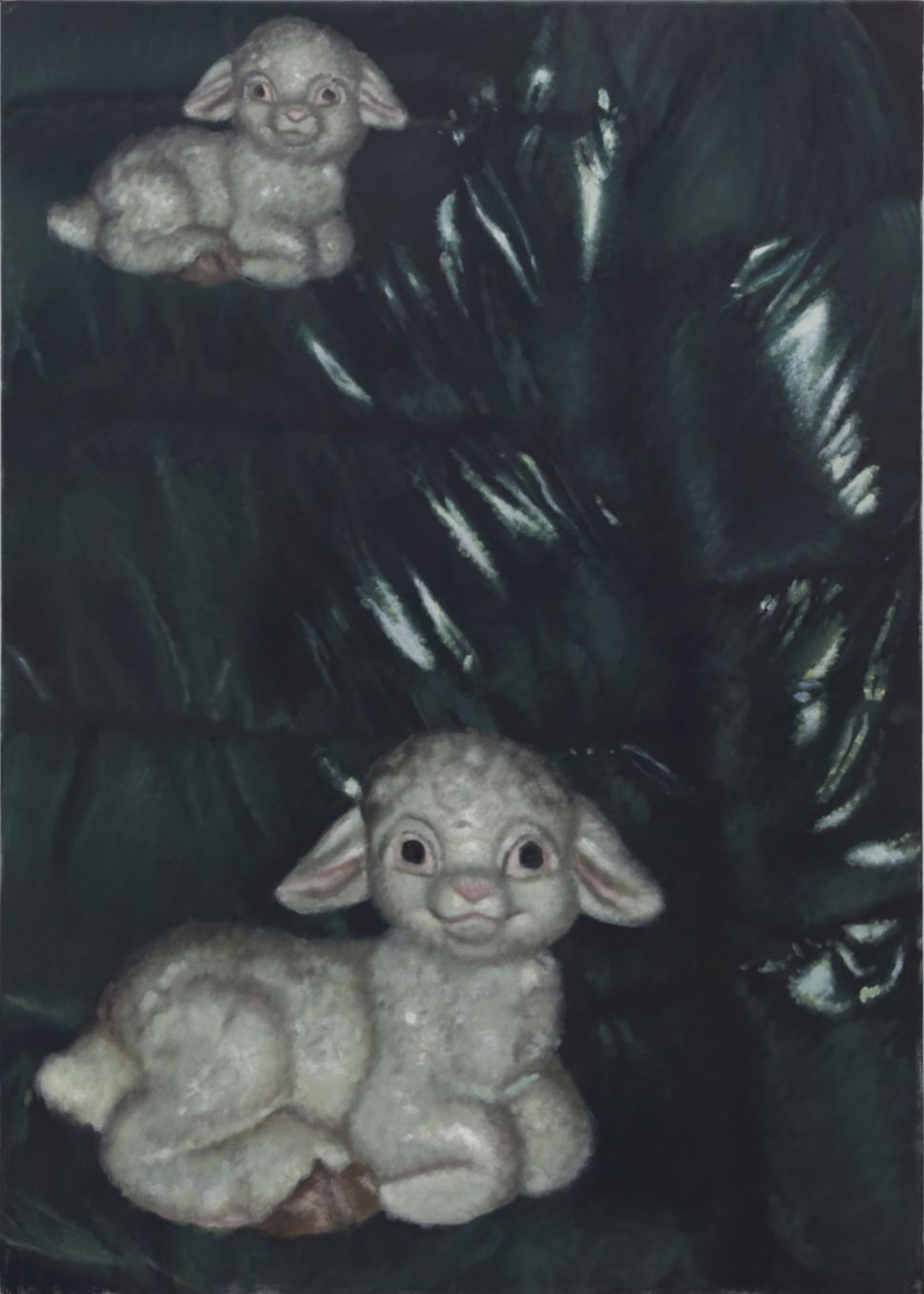

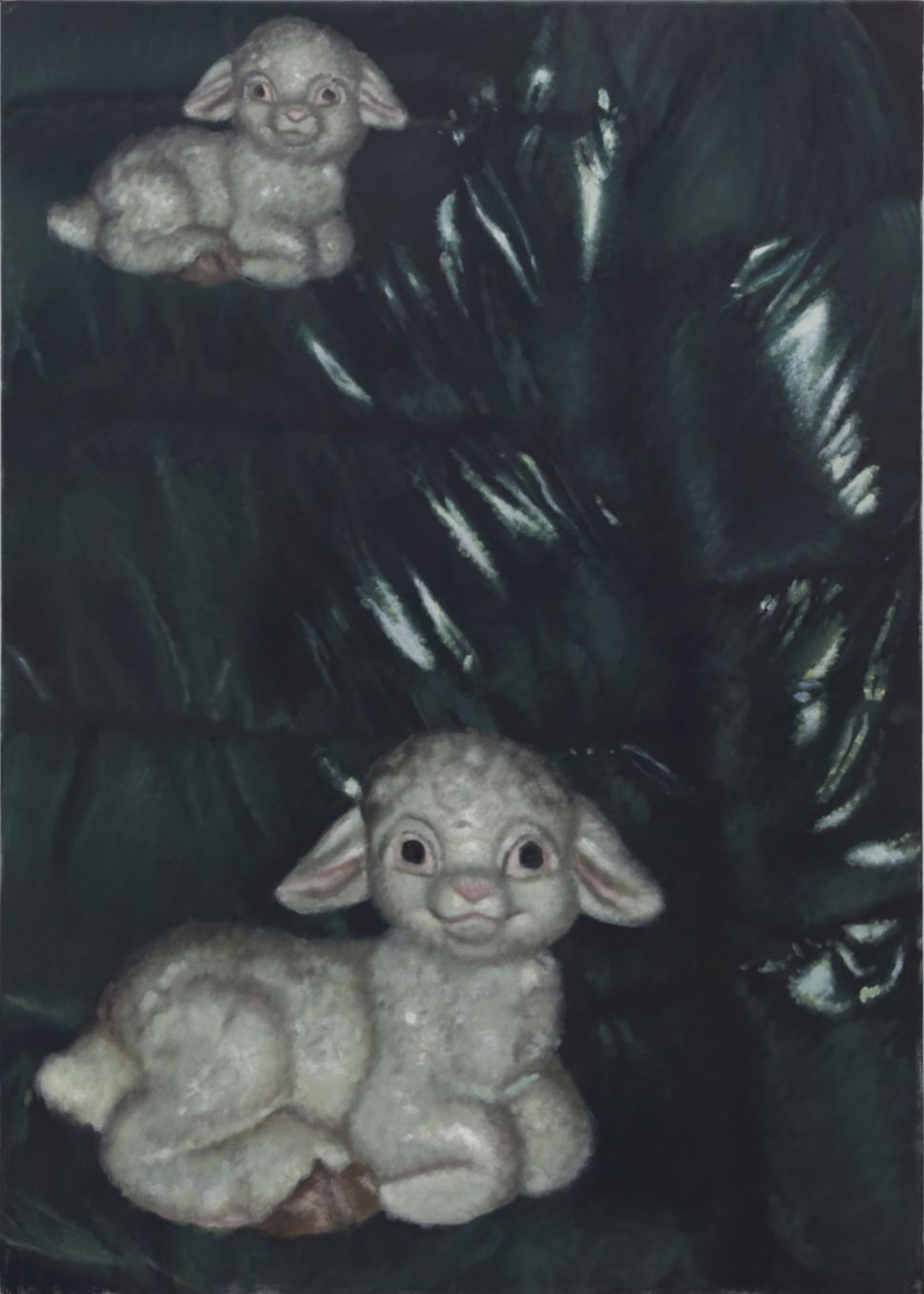

A record price was achieved for Daisy Parris’s large abstract painting, I’d Rather Get No Sleep Next To You, which sold for $254,000—well above its $20,000-30,000 estimate, showing that space still exists for standout results. Other highlights included strong performances from Theaster Gates and Alfred Leslie, with works by both exceeding high estimates, and Brook Hsu’s satyr family (2018), which set a new record at $25,400. Overall, the auction saw six new records, with noteworthy mentions for Richard Nonas ($44,450), Deana Lawson ($40,640), Peter Cain ($107,950) and Moira Dryer ($39,370). Despite mixed signals, there are still bright spots and reasons for cautious optimism in the market.

Passing the hammer, Sotheby’s held a series of curated auctions in New York in late September that reportedly achieved the highest sell-through rate of the past four Contemporary Curated sales with an impressive 98.5 percent and an aggregate total of $1.5 million—exceeding its high estimate of $1.3 million.

One standout was the Abrams Family Collection sale, which brought in $13.1 million against a presale high estimate of $14.1 million, with a robust 96.3 percent sell-through rate and nearly half of the works surpassing their high estimates. The success can be attributed to the freshness of the material—98 percent of the pieces were new to the market, with nearly 90 percent making their auction debut. A key highlight was Isamu Noguchi’s Study for Energy Void, which sold for a remarkable $4.7 million. Additionally, pioneering female artists saw renewed interest, including Mary Bauermeister’s Trichterrelief, which achieved $264,000, marking the second-highest price for the artist at auction, and Marisol’s The Bicycle Race, which fetched $456,000. New records were also set for works by Lee Bontecou, Edward Avedisian, Lynn Leland, Mario Yrissary and Iqbal Geoffrey.

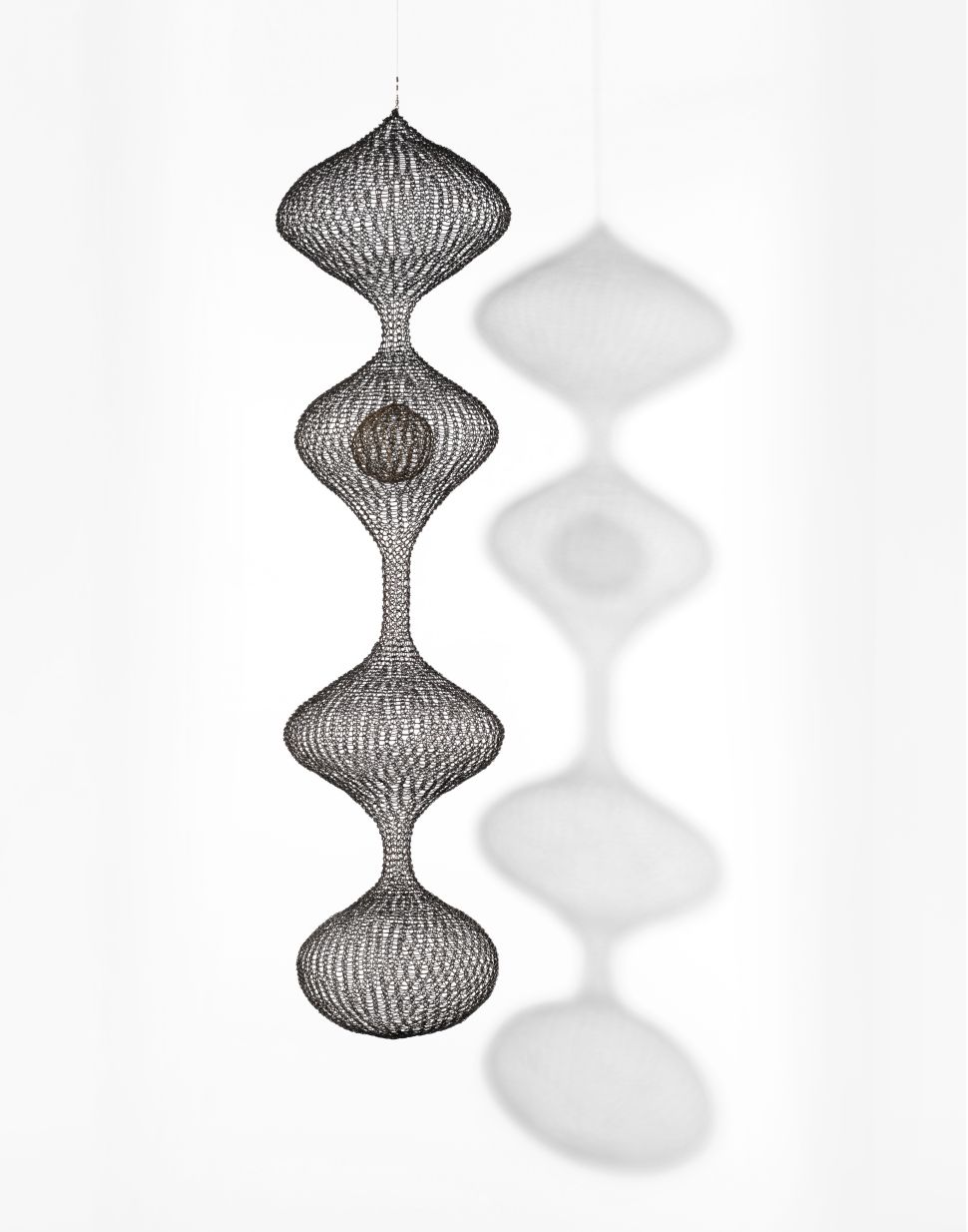

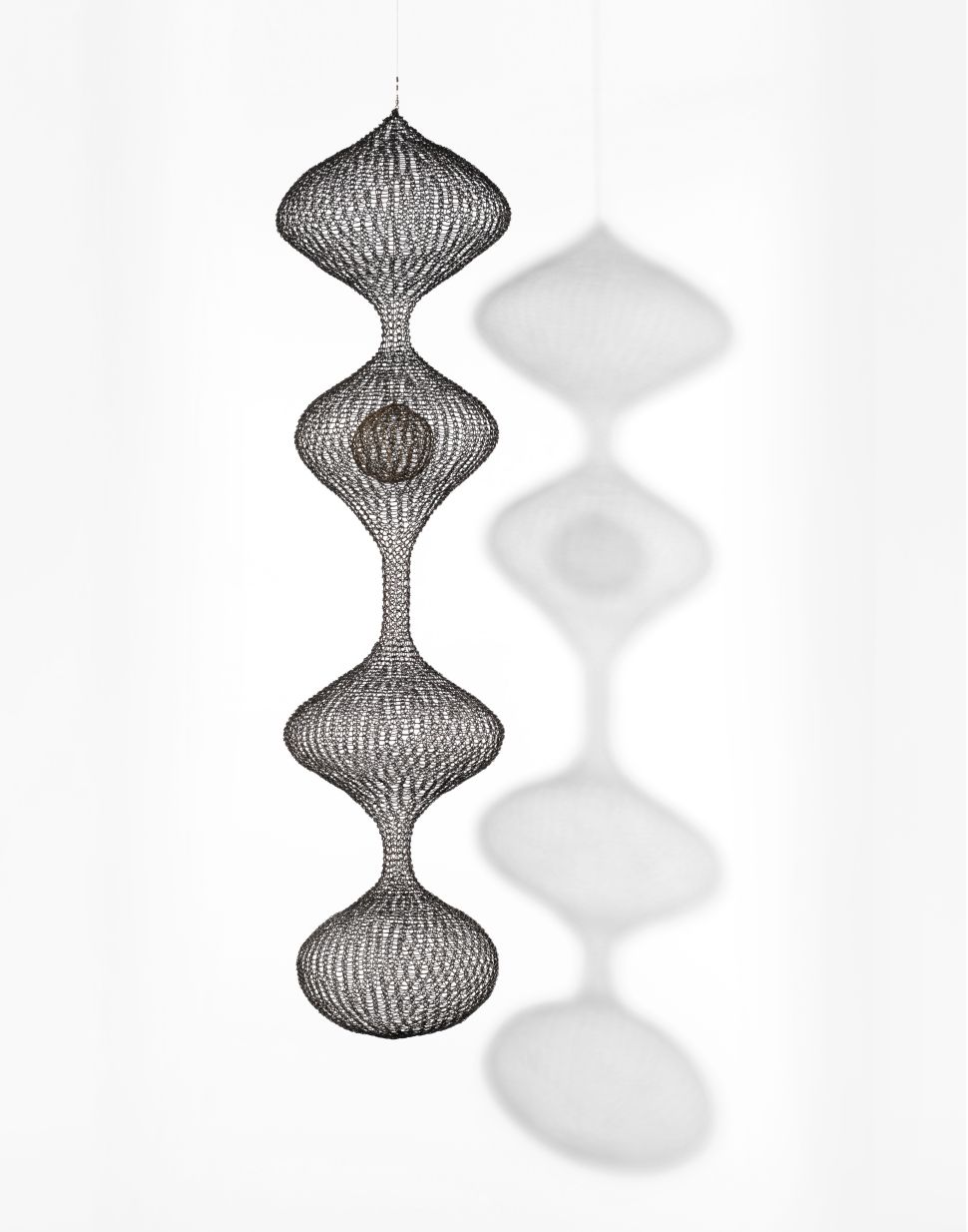

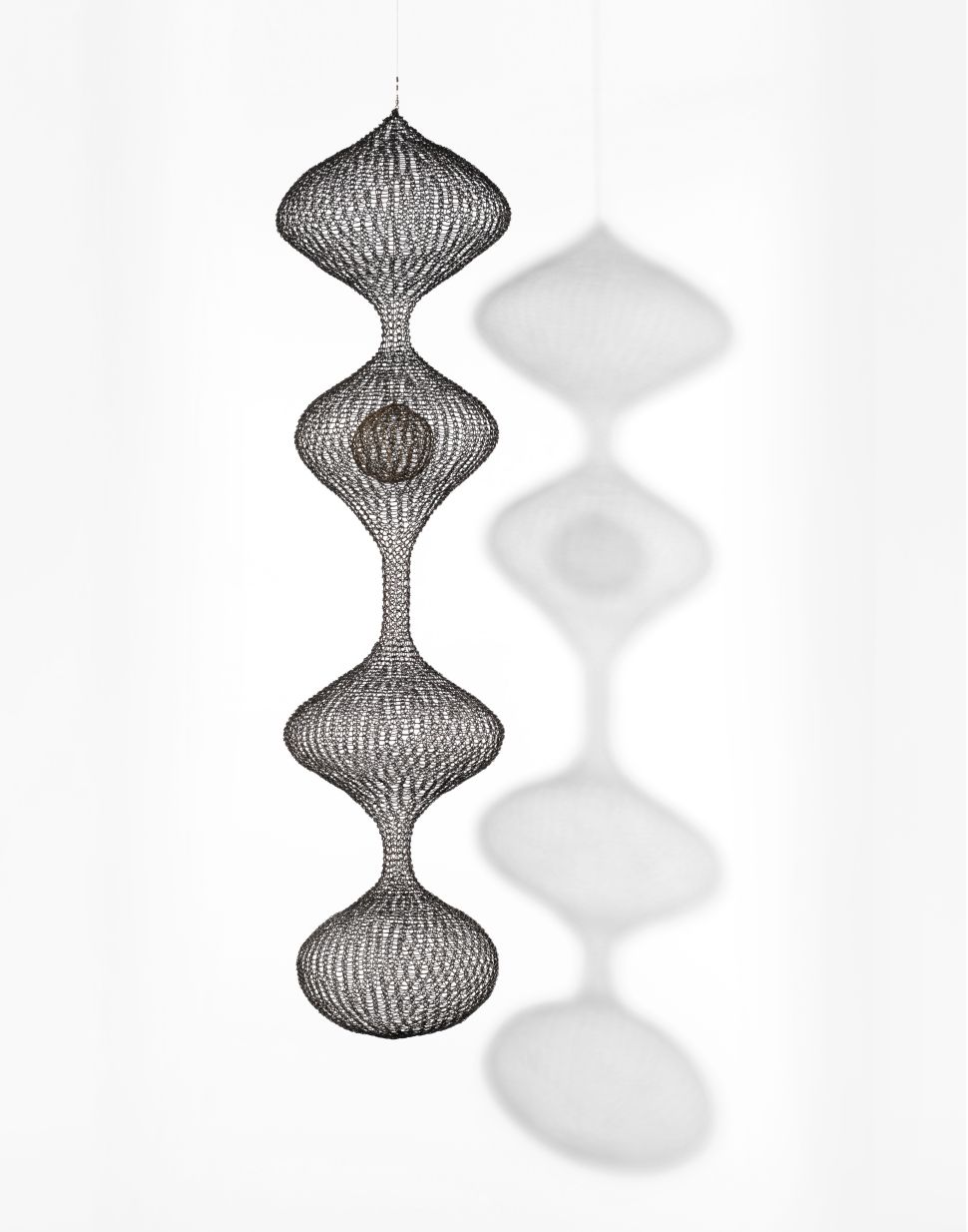

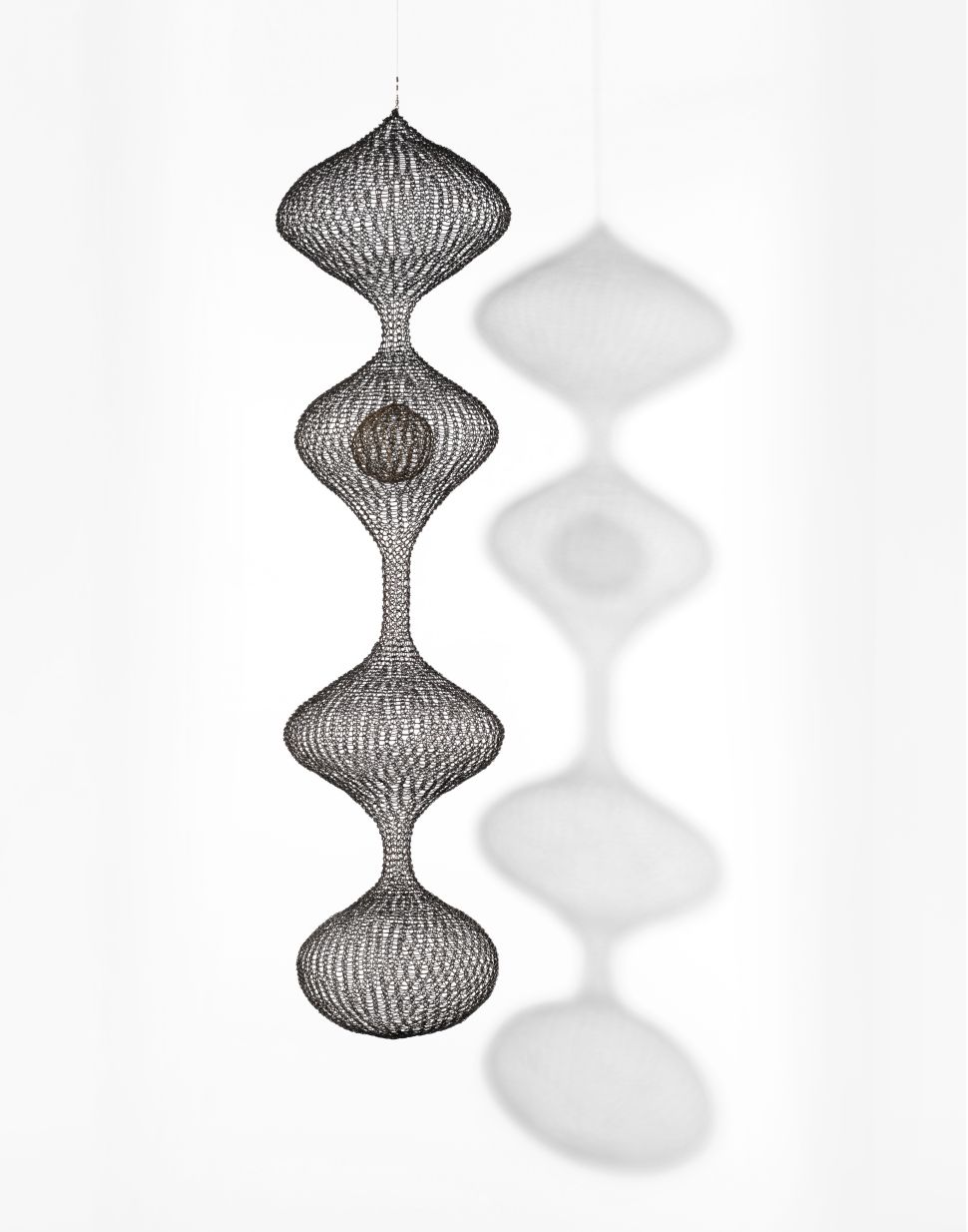

Sotheby’s noted that this auction had the highest number of new buyers for this type of sale since 2000, demonstrating strong engagement from emerging collectors. Meanwhile, the sale curated by powerhouse sports agent Rich Paul totaled $20.5 million after an estimate of $17-25 million with a solid 84 percent sell-through rate. Top lots included works by women artists such as Ruth Asawa’s Untitled (S.467, Hanging Four-Lobed Continuous Form with a Sphere in the Second Lobe), which achieved $4.1 million.

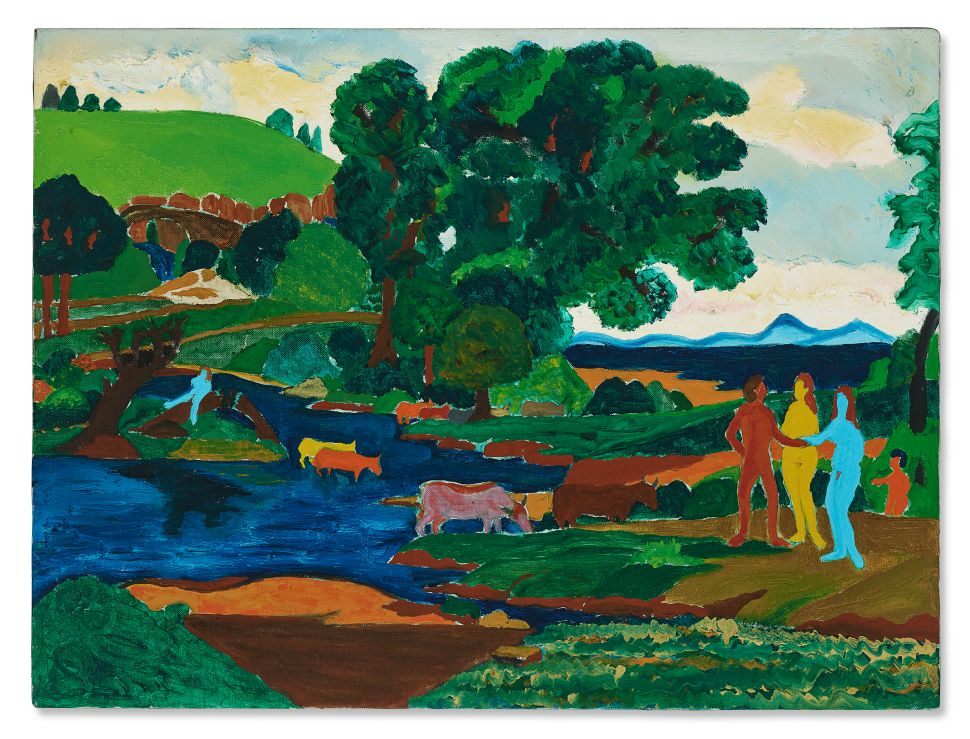

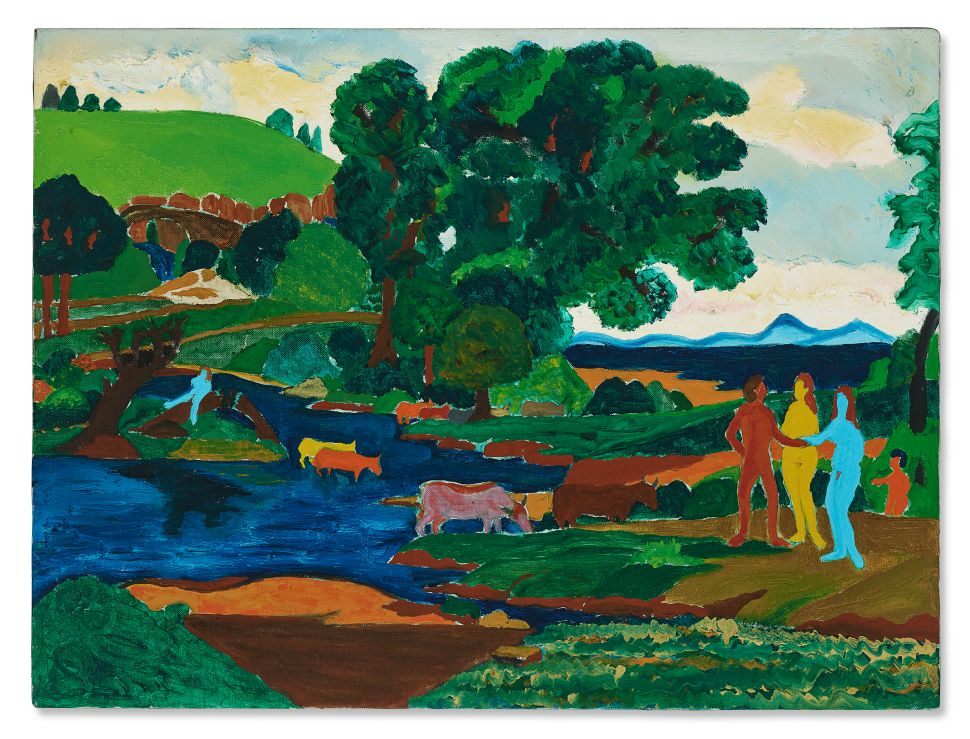

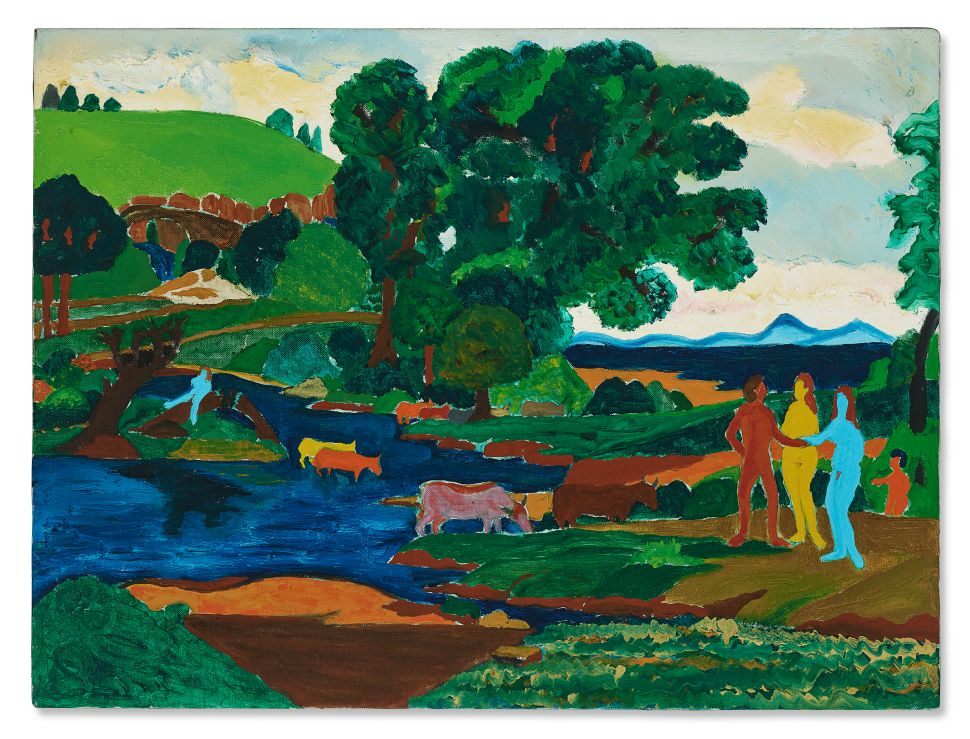

The last to take the auction stage in New York was Christie’s with its Post-War to Present sale on October 1, achieving $30.5 million and selling 85 percent by value. Leading the sale was a monumental untitled Ed Ruscha canvas, which achieved $2.6 million. Notable results followed, including Ruth Asawa’s Untitled (S.864, Wall-Mounted Tied-Wire, Open-Center, Six Branched Form Based on Nature) from 1951, which soared to $403,200 against its $100,000-150,000 estimate, and Gerhard Richter’s Abstraktes Bild, which fetched above $2 million. Alex Katz’s Springtime also made a strong showing at $1.6 million, while Bob Thompson’s The Recreation of Cephalus and Procris, fresh to market, achieved $529,200, well above its $200,000-300,000 estimate.

The sale was marked by high-quality consignments from the collection of the 21c Museum Hotels by Laura Lee Brown and Steve Wilson, which alone brought in $2,172,492. Fresh-to-market works from contemporary stars like Lynette Yiadom-Boakye’s 11 am Monday, which realized $567,000, and Simone Leigh’s Meridian at $403,200, drew considerable interest. Museum-quality pieces, such as Nick Cave’s Soundsuit, sold for $170,100, while Titus Kaphar’s An Icon for Destiny achieved $226,800. Bisa Butler set a new record with The Storm, fetching $151,200 from an estimate of $50,000-70,000.

Despite these strong results, some prominent lots struggled. Works by Derrick Adams and Mickalene Thomas, two names still maintaining market momentum, failed to find buyers.

Other significant collections included that of Robert Shimshak and Marion Brenner, which achieved a total of $1,428,210, led by Ed Ruscha’s Skytown, selling for $693,000, and Felix Gonzalez-Torres’s Untitled (Still Life), which brought in $270,900. Meanwhile, the Rosa de la Cruz collection sale saw strong interest, with two Ana Mendieta works, Untitled ($27,720) and Untitled (Body Tracks) ($32,760), selling above their estimates. Given the significant number of Mendieta pieces from this collection, Christie’s plans to distribute these strategically across future sales to avoid disrupting the artist’s market.

The sale concluded with a series of auction records, including Lois Dodd’s Reflection of the Barn, which sold for $378,000, and Cynthia Hawkins’s Currency of Meaning #9, which achieved $119,700—further testament to the evolving dynamics and shifting interest in both established and rediscovered artists.

Hong Kong vs. New York

In the same weeks, Christie’s and Phillips held their auctions in Hong Kong, offering a chance to compare the performance of these two key market hubs and gain a clearer view of the global art market’s trajectory. Notably, Sotheby’s decided to delay its highly anticipated evening sale at its new Hong Kong headquarters until November, where the event will be headlined by a $30 million Rothko. Over the past few years, the three major auction houses have been ramping up their presence in the Asia-Pacific region, particularly in Hong Kong. Phillips opened its headquarters in 2023, and Christie’s and Sotheby’s followed suit this year with new, high-end offices in Central, signaling a fierce commitment to capturing the region’s deepening pool of collectors.

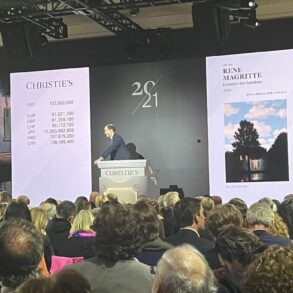

Despite extensive promotion of its new location and its seasonal evening sale, Christie’s 20th and 21st Century Art Evening Sale on September 27 fell just short of expectations, totaling HK$1 billion ($133.2 million)—just below the lower end of its presale estimate. However, the solid sell-through rate of 92 percent by lot was a positive sign. This performance was already an improvement from last year’s HK$694 million ($89 million) total, when fifty-seven lots were offered and the sell-through rate was a lower 81 percent, including several withdrawals.

The evening was anchored by a Van Gogh landscape, which sold for HK$250 million (approximately $32 million), and an early Claude Monet Water Lilies painting, which hammered at HK$180 million ($23 million) against a low estimate of HK$200 million ($25 million). Despite these being the most anticipated lots, both ultimately sold below their presale estimates—though they did set new Asian auction records for these Western masters. The outcome indicates that while demand for Western Modern art is growing in the region, buyers there are not yet willing to match the prices seen in established Western markets.

Some blue-chip Asian names also landed below expectations, such as a work by Zao Wou-Ki that hammered at HK$80 million ($10.3 million) and another by Kim Whan-Ki that sold for HK$56 million ($7.2 million), including fees. These results reflect a market that is still strong but cautious as collectors recalibrate their expectations in the current environment.

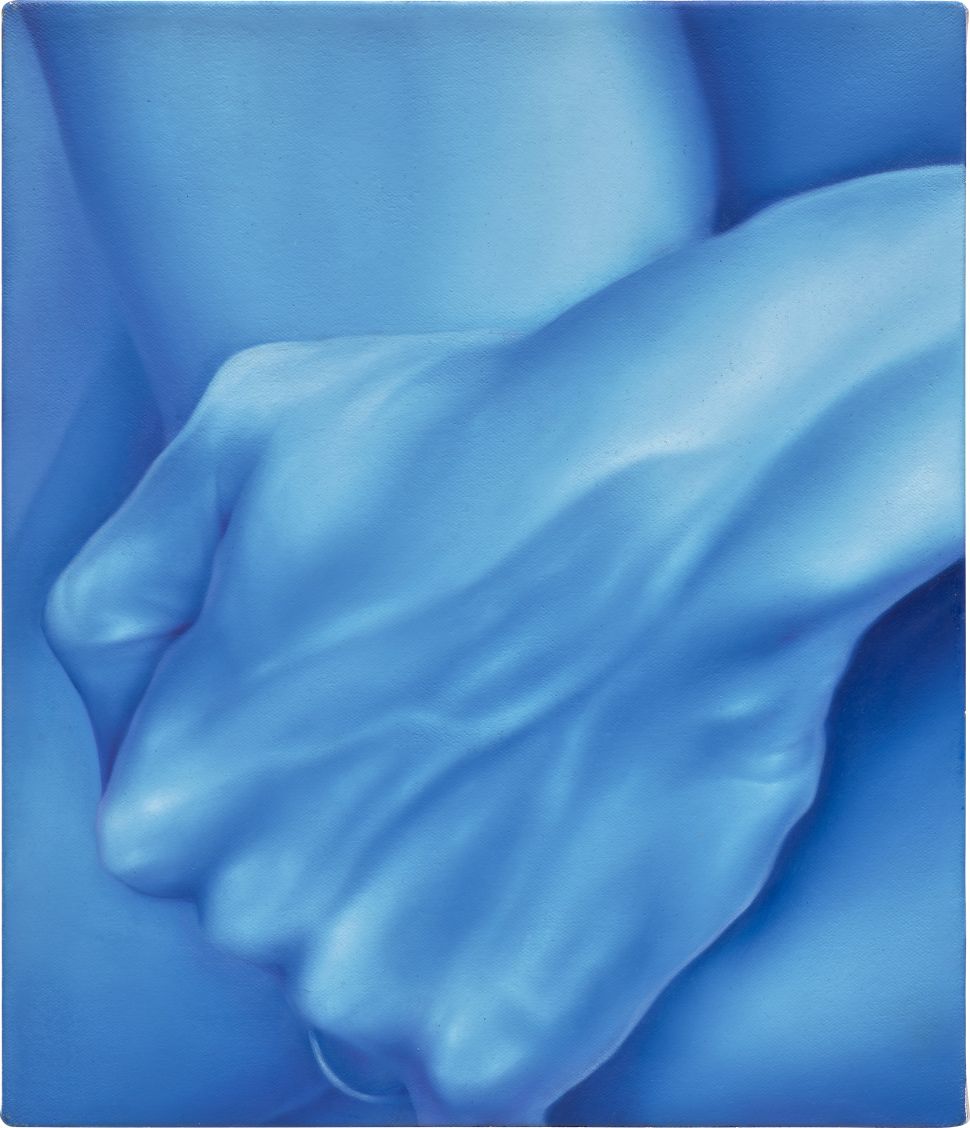

Performing notably better in Christie’s Hong Kong sales were several ultra-contemporary names, led by rising star Lucy Bull, who set a record for the region by achieving a stellar HK$15 million ($1.93 million before fees)—three times her pre-sale estimate of HK$5-8 million. Another standout was Filipino artist Robert Ventura, whose market had been relatively quiet after a meteoric rise a few years ago. His intricate painting State of Bloom, featuring cartoonish figures set in a post-apocalyptic landscape, sold on the phone for HK$36.6 million ($4.7 million, before fees) to a Singaporean collector, underscoring the growing strength of the Filipino contemporary art market.

Positive results also came from Asian-region contemporaries like Mehdi Ghadyanloo, whose recent exhibition at the Long Museum likely fueled demand. His piece sold for HK$2.52 million ($324,459) against a pre-sale estimate of HK$800,000-1,200,000. Liu Ye’s charming painting of a bunny painter and model also performed solidly within its estimate, reaching HK$13.08 million ($1.68 million). Huang Xiang’s psychedelic landscape Boundless Ocean – Vast Sky, coming fresh from the studio, fetched HK$4.78 million ($616,600), slightly below its estimate but still reflective of strong market interest.

However, some international contemporary stars underperformed. Christina Quarles’s piece landed at HK$1.26 million ($162,233) against an estimate of HK$2-4 million, indicating a cooler reception. In contrast, George Condo’s Stepmonk’s Diary (1996) reaffirmed the artist’s popularity, selling for $279,400 (including fees). Similarly, Marina Perez Simão—a new Pace Gallery favorite among young Asian collectors—saw her Untitled, acquired directly from the gallery, sell for HK$1.64 million ($210,925), significantly above its HK$700,000-1,200,000 estimate.

Despite Christie’s focus on presenting Modern gems from both regional and Western masters, it was the contemporary and ultra-contemporary segments that drew the most active bidding, likely pointing to the preferences of a new generation of collectors. This trend was mirrored in Phillips’s Hong Kong sales just days later, reinforcing the shift in collector interest.

On October 4, Phillips hosted its New Now: Modern & Contemporary Art auction, featuring a diverse mix of renowned artists like Yoshitomo Nara, Takashi Murakami, Ayako Rokkaku, Issy Wood, Miriam Cahn, Zhao Zhao and Edgar Plans, alongside emerging names such as Kenichi Hoshino and Nguyen Quoc Dung. Despite the anticipation, many top lots didn’t produce the expected fireworks. Takashi Murakami’s Flower of Hope (2019), a fresh-to-market piece, sold for HK$1,143,000 ($147,000), falling short of its high expectations. Similarly, Ayako Rokkaku’s Untitled (Wooden House), a unique hand-painted wooden installation created live at Museum Jan in Amstelveen, Netherlands, achieved HK$698,500 ($89,942), indicating lukewarm interest.

However, stronger results were posted by rising regional artists. Mehdi Ghadyanloo’s Untitled doubled its HK$120,000-180,000 estimate, selling for HK$406,400 ($52,000), while Atsushi Kaga’s Practising a Magic with Robert (2008) flew past its HK$35,000-55,000 estimate, reaching HK$241,300. Japanese artist Chiharu Shiota also saw her Endless Line achieve HK$381,000, surpassing its HK$200,000-300,000 estimate, reflecting a growing demand.

Yoshitomo Nara, who recently had a museum survey at Guggenheim Bilbao, proved his market resilience. His Untitled (2002), a painting of one of his iconic girls, sold for HK$1,651,000 (estimate: HK$800,000-1,200,000), and his small sculpture Hand Searching fetched HK$406,400 ($52,330) despite being part of an edition of 150. Issy Wood also performed within expectations, with Mozzarella / The Confidante (2020) selling for HK$304,800 and Unsprung (2020) fetching HK$889,000.

Newer names like Japanese-American artist Chelsea Ryoko Wong and Vietnamese artist Nguyen Quoc Dung drew attention as well, both achieving prices above their low estimates and primary market values, signaling emerging strength in the ultra-contemporary segment.

The top-down analysis

While bidding has been more restrained across recent auctions, Hong Kong has shown greater dynamism and room for surprises, particularly in the ultra-contemporary segment, whereas New York remains a stronghold for Postwar and contemporary art, especially at higher price points.

These patterns align with the findings of the Morgan Stanley report cited in The Intelligence Report Mid-Year Review. Although New York continues to dominate the market, recent auction successes and figures have been heavily dependent on the availability of high-caliber private collections and fresh-to-market quality material. However, the ultra-contemporary segment (artists born after 1974) has been hit harder by the departure of short-term market speculators who once drove up prices for many of these names. In contrast, new and emerging artists, both regional and international, continue to inspire healthy bidding in the latest Asian-Pacific market hub, often spurred by a new generation of collectors looking for art that resonates with their taste, lifestyle and cultural zeitgeist.

According to the Morgan Stanley report, New York and Hong Kong have both distanced themselves from their competitors in the ultra-contemporary category, recording $269.4 million and $206.1 million, respectively—figures that are twelve and twenty-four times higher than their 2013 totals. While Hong Kong has faced headwinds from China’s property crisis since 2022 and tightened regulations that threaten the city’s status as a global business hub, galleries and auction houses continue to invest in it. As noted in the report, total sales in Hong Kong from 2013-2023 outpaced those in London, despite market turbulence.

The challenge across regions, however, is securing true masterpieces that can achieve six-figure results. While New York remains the primary hub for top-market sales, this segment has slowed significantly. In 2022, the city saw $3.76 billion out of its $7.33 billion total come from lots priced over $10 million, yet the number of such high-value lots has notably declined since then. Conversely, Hong Kong’s growth appears more stable; in 2013, it generated just $90.6 million from this price bracket, and by 2021, that number had more than quintupled, stabilizing even as Western Modern and Postwar masters now face a more tepid reception in New York due to both regional and generational shifts in taste.

The upcoming London Evening Sales remain a sensitive point for the market, but the real test for New York and the broader global Modern and Contemporary art market will come in the November sales, which are likely to be influenced by both election outcomes and shifting interest rates.

As market expert Marion Manaker noted, the broader picture is not as bleak as some have portrayed. Results in both New York and Hong Kong were often stronger than last year, with new records, doubled estimates and solid sell-through rates. As buyers have become more discerning, auction houses have adjusted their strategies and estimates accordingly, responding to a global economic and geopolitical landscape that has been evolving rapidly in the post-COVID era.