The Renaissance died four hundred years ago in the glittering light of the Dutch Golden Age, as the Netherlands became the economic and cultural center of Europe. An epoch defined by the paintings of Michelangelo, the philosophies of Montaigne, and the scientific discoveries of Copernicus had run its course by the late 1630s, when Amsterdam added a booming art market to its merchant empire. The Dutch Republic’s population never exceeded two million people, but something like ten million paintings were produced during the golden age. Even butchers collected paintings, which hung in their market stalls above the meat.

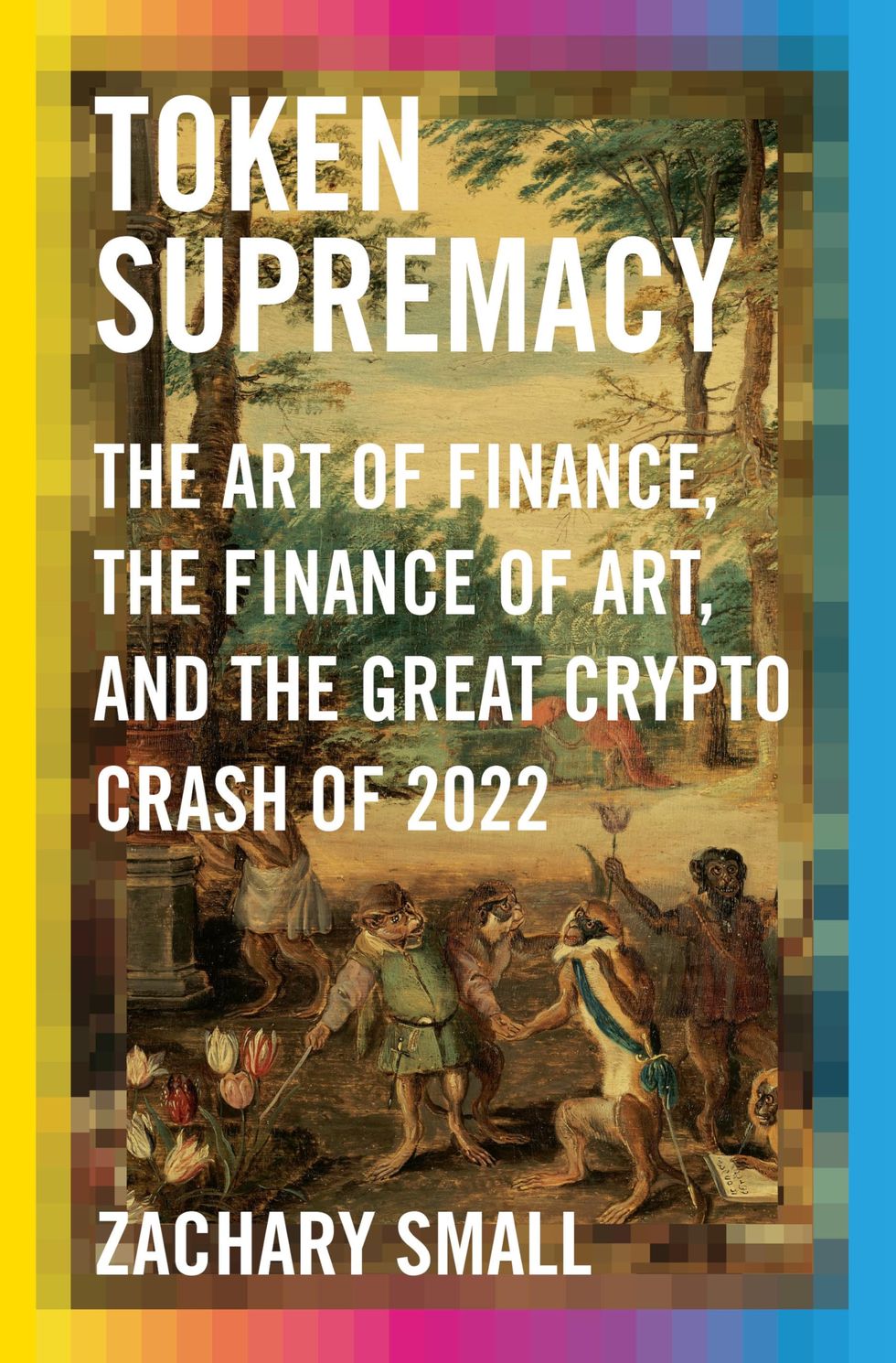

But symbols of a flourishing economy gilded a wicked reality. Plague ravaged the Netherlands between 1635 and 1636, with cities losing 20 percent of their populations. Death brought new purpose to the living, and survivors found comfort in the beauty that came with money. The tulip market developed alongside the art market to satisfy that demand for beauty; however, the flower merchants were better salespeople than the visual artists, emphasizing the speculative potential of the tulip bulb. The uncertainty of the bulb’s viability and the randomness of reward when it bloomed became an addictive draw for buyers. Soon, merchants were recommending that collectors purchase bulbs on contract so they could trade their stock even before receiving any flower shipments. Prices spiked, and even a single bulb could sell for thousands of guilders or dozens of sheep—the equivalent cost of a large townhouse. Demand rose through the beginning of 1637, when buyers were acquiring their bulbs by weight. The reduction of the tulip market into what critics described as “pound goods” meant that investors no longer required any botanical knowledge to succeed; all anyone needed was a sense of the going rate. It was bad algebra from the start, and the slightest decrease in bulb prices forced the entire economy to collapse, as investors defaulted on loans they had made based on the inflated value of tulips. Everyone from the chimney sweeps to the wealthy noblemen lost their life savings. Priests who had denounced the tulips as symbols of vanity and greed used the market’s demise for their fiery sermons. Artists found new subject material, caricaturing the speculators in paintings where they appeared as ill-mannered monkeys destroying palatial estates cluttered with their wilting bouquets. Jan Brueghel the Younger’s 1640 interpretation of the fiasco graces the cover of this book.

Rationalism prevailed over the escapism of tulipmania, disproving the theory that one could attach value to seemingly valueless objects—though history hasn’t stopped succeeding generations from retesting the hypothesis. From the prospectors of the 1848 California Gold Rush to the computer whizzes behind the 2000 Dot-Com Crash, the promise of infinite gains from the uncertainty of financial speculation has driven the decision making of powerful men and women whose failures often sprout the next generation of successes. These stories suggest that the importance of market bubbles has less to do with the economics of idiocy and more to do with the social structures that encourage their growth.

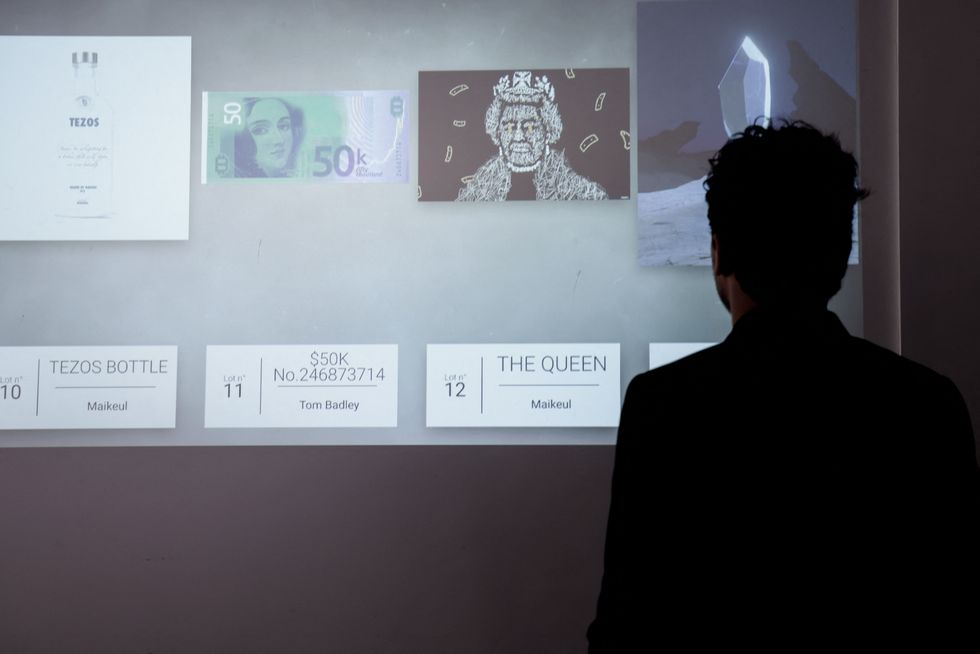

The hallmark of tulipmania reappeared only a few years ago with the arrival of NFTs. Nonfungible tokens were a relatively simple technology for tracking ownership of digital assets, but financial speculation had transformed them into a $40-billion industry, anchoring the broader $3-trillion market for crypto-currencies in the prestigious art world. That relationship between cultural producers and the market seemed to afford NFTs another layer of value. But how special were these digital tulips? And what made them such powerful economic tools? Years earlier, a relatively small collection of digital artists and tech entrepreneurs had conspired to improve the internet through blockchain technology. The original pitch was simple. NFTs could solve two fundamental problems with the online economy by recording transactions for digital goods and providing creators with access to resale royalties. Then it some-how morphed into an ideology of cultural renaissance and economic revolt. NFTs were about creating a decentralized society, where users traded digital artworks like money, and about bankrupting the toxic business model of social- media platforms that siphoned their personal data for profit. And, finally, NFTs reached their apotheosis as icons of an inscrutable religion. This last metamorphosis into babble—investors ranting online about how their digital collectibles had trans-formed them into “human gods”—demonstrated the full psychological tilt of speculation. Had the twenty-first century simply replaced tulip bulbs with another arbitrary form of investment? Most critics said yes. It seemed obvious that the cartoons of bored apes and pixelated punks that were being traded for millions of dollars would soon wilt like the Dutch flowers. However, closer inspection revealed an elaborate financial system being developed through NFTs, which sought to capture the volatility of tulipmania, combine it with the economic potential of the art market, and create a perpetual money machine. It was a moon-shot gamble by the millennials who dominated the digital world, looking to recapture a sense of the financial security that had disappeared in the years following the 2008 financial crisis, when they were young.

A similar anxiety pervaded the Amsterdam of tulipmania, where an artist named Rembrandt Harmenszoon van Rijn walked among the wretched of Holland. He carried around his copperplate like a sketchbook, tracing the anxious anatomies of Amsterdam’s vagrants with baggy clothes and hunched backs. His fortunes rose alongside the tulip’s, which marked the beginning of his own personal renaissance, when he could afford to purchase a family home in the city center.

Rembrandt etched himself into the costume of beggars, replacing their features with his own unmistakably broad nose and frizzy hair. Those self-portraits seemed to foreshadow his later years of financial ruin, and history would remember this older version of the painter, who defaulted on his mortgage payments and brought ruin upon himself.

Through his fascination with poverty, Rembrandt was summoning a pathology that has been stubbornly ingrained in the cultural subconscious for centuries. He was drawing upon the paradoxical realities of pursuing an artistic life in the seventeenth century, which, as today, required artists to operate between the extremities of wealth and poverty. The decisions of a few powerful patrons could make or break careers, and the debt required to become a certified, professional artist was immense. That made an artist like Rembrandt (someone unwilling to ingratiate himself to clients, often declining their requests for better chins and bigger hands) especially vulnerable to the pitfalls of pursuing creative genius.

Cruelty bookended his career, separated by midlife accomplishments like his 1642 painting The Night Watch, which featured members of a civic militia responsible for patrolling Amsterdam’s streets—a group that likely cleared the alleyways and canals of the beggars whom the artist once sketched.

Rembrandt shot into the stratosphere of European society after The Night Watch. He could have lived comfortably on the acclaim and commissions, but the artist had a money problem: Rembrandt liked spending his wealth on rarities—even bidding on his own paintings. A court arrangement in 1656 helped him narrowly avoid bankruptcy, though he needed to sell most of his paintings and antiquities, his house and printing press. The Amsterdam painters’ guild was so embarrassed by the famous artist’s dissolution that they instituted a new rule: nobody in Rembrandt’s financial circumstances could trade as a painter.

Message received: starving artists are unwelcome, because their financial ruin could delegitimize the market. Rembrandt only stumbled after this decree, struggling in the 1660s to hold on to commissions while his romantic partner and son died. Before the end of the decade, he too had passed away and was buried in an unmarked church grave.

We love Rembrandt because of his painful story. Auctioneers are quick to mention his tortured life when pitching his portraits to their wealthy clientele, because it evokes a pity that seems to justify the insane prices that the artist’s work now commands. Even during the worst months of the pandemic recession in 2020, a collector still found $18.7 million to acquire one of Rembrandt’s self-portraits; it was a record price.

The contemporary art world has learned from Old Masters like Rembrandt how important mythology is to selling paintings. Artists spin their personal narratives into sales pitches that might reassure collectors that they are worth the investment. Not everyone takes the starving-artist approach, because it typically requires the artist to be dead. Jeff Koons embodies the commercialization of the art world and embraces banality. Banksy hides his identity and uses street art to make political commentary. NFT artists have workshopped their own stories, retrofitting the starving artist into a tech guru leading the next stage of the creative economy. Even the world’s richest gallerist, Larry Gagosian, dutifully practices the art of first impressions; he carefully builds mythologies around his artists and seeks to control the narrative through the museum-quality exhibitions he arranges at his dealership.

But the greatest mythology is the art market’s own exceptionalism. The perception that culture is somehow above the economy has allowed the industry to exist outside the normal rules of the economy. Wealthy collectors have turned this gray market into a tax haven, an investment opportunity, and a platform for illicit activities like money laundering where their identities are easily concealed from the public record. Those backroom deals have determined so much of the culture that we consume, and the details of those financial arrangements have remained secret. Until those transactions started showing up on the blockchain.

From Token Supremacy: The Art of Finance, the Finance of Art, and the Great Crypto Crash of 2022 © 2024 by Zachary Small. Excerpted by permission of Alfred A. Knopf, a division of Penguin Random House LLC. All rights reserved. No part of this excerpt may be reproduced or reprinted without permission in writing from the publisher.

Zachary Small is an investigative reporter on the dynamics of power and privilege in the art world for The New York Times. Small has a master’s degree from The Courtauld Institute of Art in London and a bachelor’s in art history and political science from Columbia University. They live in Manhattan.

This post was originally published on this site be sure to check out more of their content