This article is part of the Artnet Intelligence Report Year Ahead 2024. Through in-depth analysis of last year’s market performance, the new edition paints a data-driven picture of the art world today, from the latest auction results to the artists and artworks leading the conversation.

How Much Fine Art Sold at Auction in 2023?

The reality check is here.

Source: Artnet Price Database and Artnet Analytics.

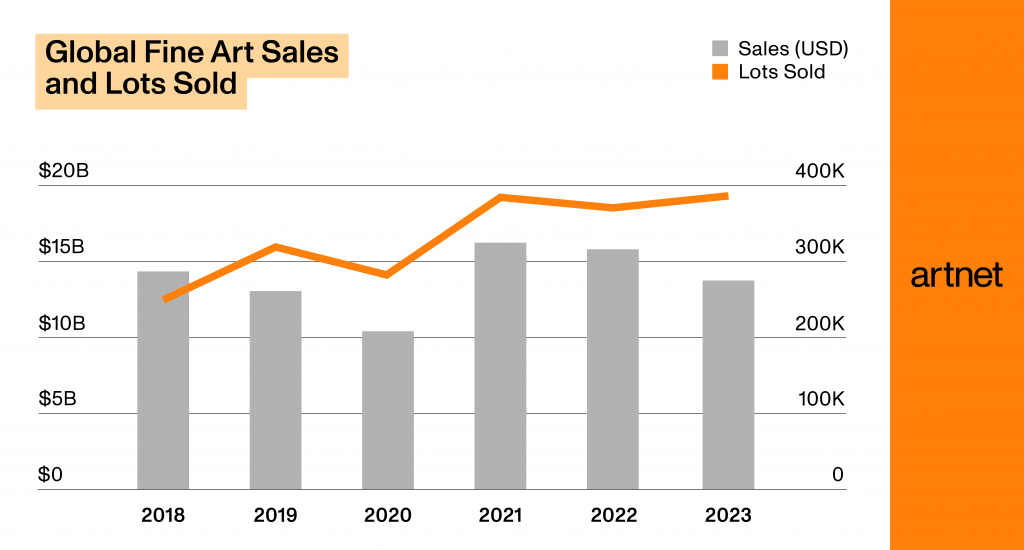

- Fine art sales at auction totaled just under $14 billion in 2023, down 12.7 percent year over year.

- The dip reflects a perfect storm of factors: interest-rate hikes, geopolitical uncertainty, and a wobbly stock market. Plus, the market largely worked its way through the ample supply of masterpieces that had built up during the pandemic in 2021 and 2022; last year saw far fewer fireworks.

- The contraction was most pronounced at the highest end of the market. Six works sold for more than $50 million each last year, compared with more than 20 in 2022.

- Still, there was plenty of business to be done: The number of lots sold hit a 10-year high in 2023. Combined with the decline in high-priced work, this drove the average price of art sold at auction down nearly 16 percent.

Which Country’s Art Market Came Out on Top?

America reigns supreme.

Source: Artnet Price Database and Artnet Analytics.

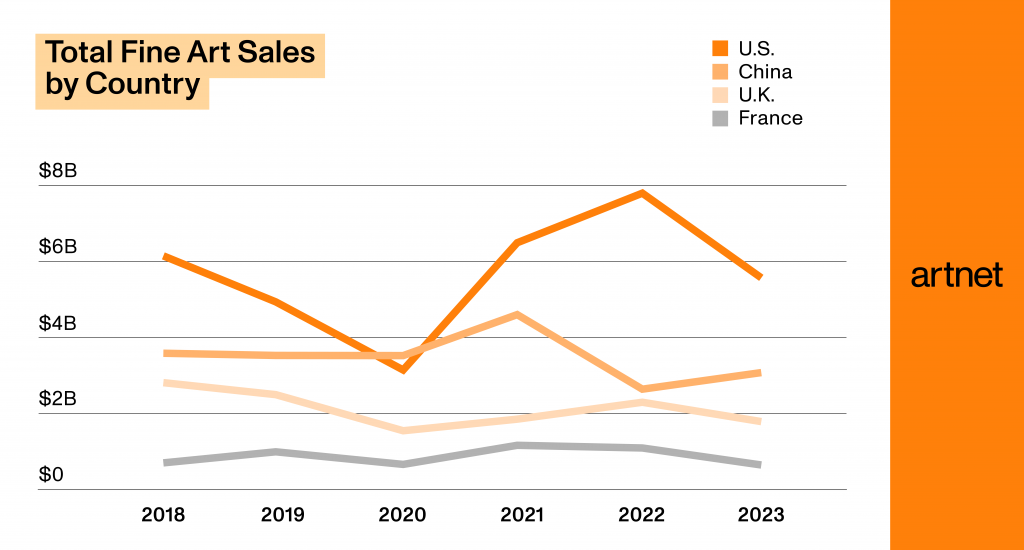

- Fine art auction sales in the U.S. generated $5.7 billion in 2023, down 27.5 percent year over year. Much of the decline can be attributed to the extraordinary $1.6 billion generated by the Paul Allen collection in 2022. Last year’s total is smack in the middle of the country’s annual results over the past decade.

- China trailed the U.S. last year but rebounded a bit from 2022, when its auction sales hit a 10-year low amid Covid shutdowns. The country’s $3.1 billion total represents a 13 percent bump year over year.

- The U.K. market—which continues to be dogged by the impact of Brexit—contracted 15.6 percent year over year, notching $1.8 billion in sales.

- Sales in France fell 19 percent, to just under $900 million, after two record-setting years. Despite auction house investment in the region, France’s challenging regulatory climate may have slowed its growth, experts say. Part of the drop can also be attributed to a change in the Artnet Price Database, which stopped covering several French auction houses because of complications with their catalogs.

Which Auction House Led the Pack?

Sotheby’s takes the crown from its rival.

Source: Artnet Price Database and Artnet Analytics.

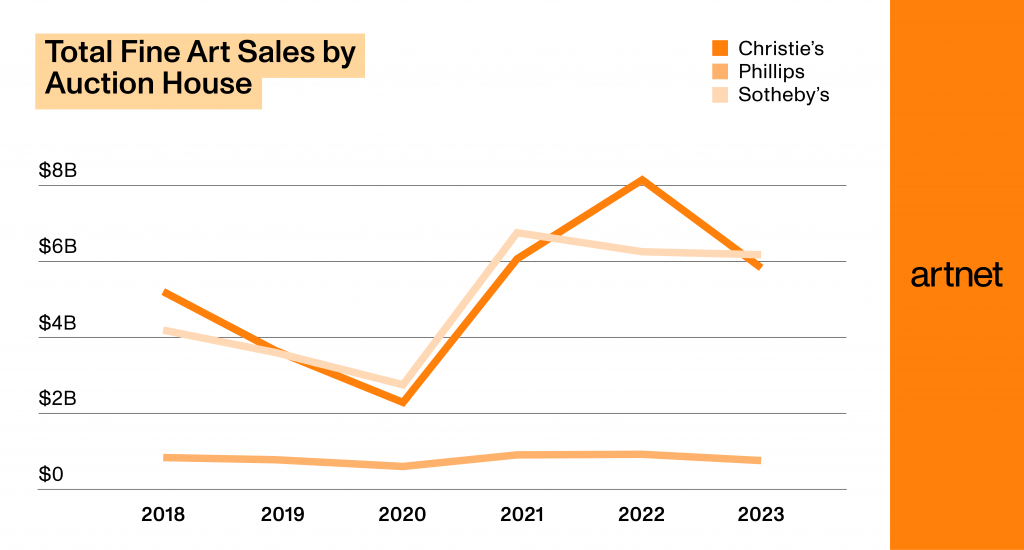

- Sotheby’s edged out Christie’s in the race for revenue, generating almost $160 million more in fine art sales in 2023. The winning house’s total represents a dip of 4 percent year over year.

- Phillips fell further behind the Big Two houses with $595.9 million in fine art sales last year, down 20.1 percent from 2022.

- Crucially, these figures do not include private sales and indicate total revenue rather than profit— which means they don’t reveal any erosion of the auction houses’ margins caused by deals they may have struck with consignors like Fisher Landau’s estate.

- As usual, the battle came down to who won the most lucrative estate. Sotheby’s sold philanthropist Emily Fisher Landau’s $426.7 million collection last year; Christie’s sold Paul Allen’s in 2022.

- Christie’s total represented a 35.7 percent decline year over year; if you remove Paul Allen from the equation, the dip would have been a more modest 12.2 percent.

How Much Art Sold Online in 2023?

Online-only sales are settling into a new normal.

Source: Artnet Price Database and Artnet Analytics.

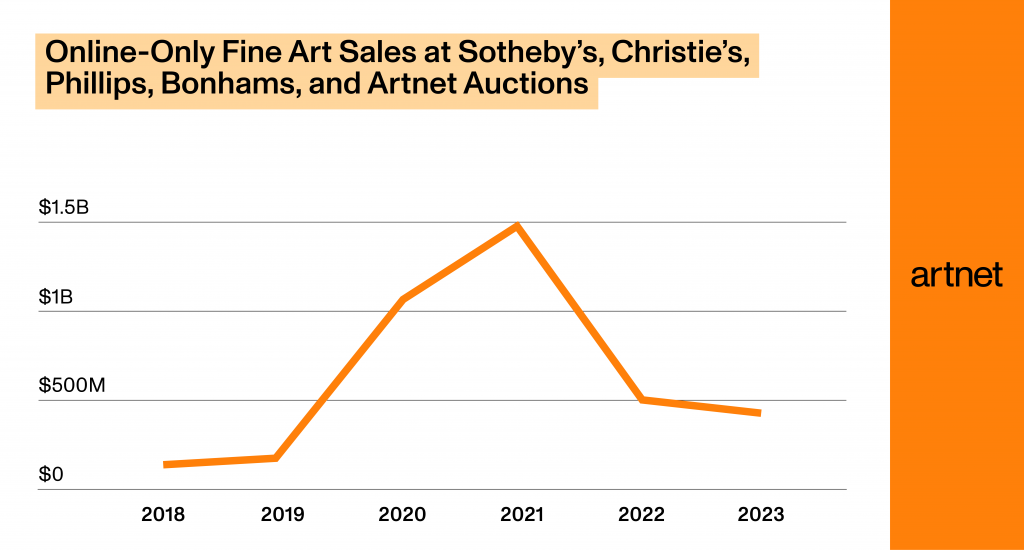

- A total of $440.3 million worth of fine art sold in online-only sales at Sotheby’s, Christie’s, Phillips, Bonhams, and Artnet Auctions in 2023.

- Total online sales in 2023 were almost triple pre-pandemic levels, and more works sold online last year than ever before (including during lockdown). This suggests that both buyer and seller behavior around transacting virtually has changed for good.

- The result represents a 12 percent dip from 2022, in line with the market’s overall decline, and a nearly 70 percent drop from 2021, when many major sales had not yet returned to being held in-person.

- Price points for online sales continued to descend from their pandemic-era high. The average price of a work of art sold online dipped by almost 25 percent year over year.

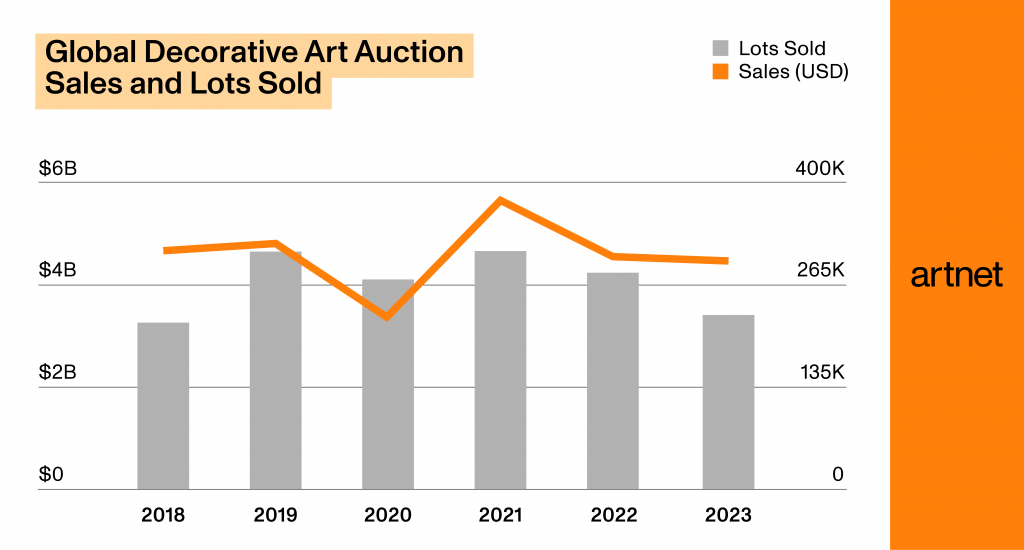

How Much Decorative Art Sold at Auction?

The industry is hoping decorative art becomes a gateway drug.

Source: Artnet Price Database and Artnet Analytics.

- The decorative art category—which includes design objects, furniture, jewelry, watches, and more—proved more stable than fine art last year. It generated $4.4 billion in sales, down 6.8 percent from 2022, compared with the 12.7 percent decline for fine art.

- The average price of a decorative artwork at auction climbed 13.2 percent year over year, to $18,401.

- Experts say the sector is key for bringing new buyers into the fold.5 “A younger generation is coming into the market through luxury and decorative art purchases and not through fine art,” said the advisor Michael Plummer.

- In the decorative art sector, Sotheby’s and Christie’s are neck and neck. The former edged out the latter by just $54 million in 2023.

- Although North America was the largest market for fine art in 2023, it came in third for decorative art. Europe took first place, with $1.8 billion in sales, and Asia came in second, with $1.6 billion.

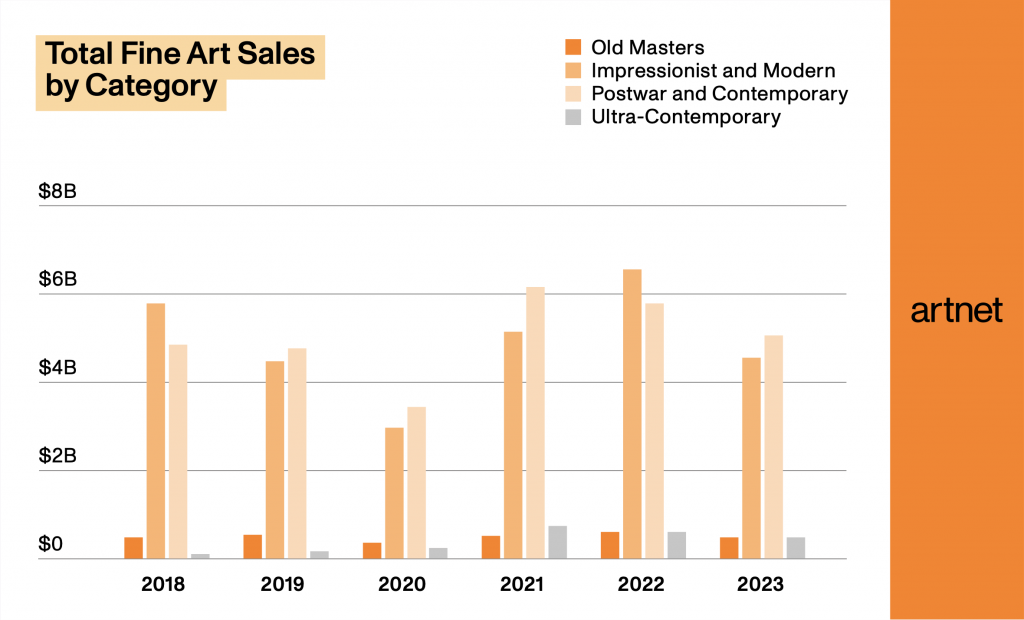

What Category Was the Most Lucrative?

The postwar and contemporary sector takes the cake.

Source: Artnet Price Database and Artnet Analytics.

- Postwar and contemporary overtook Impressionist and Modern last year as the most lucrative art-market category. The former generated $5 billion in sales; the latter, $4.5 billion.

- Imp-Mod sales tumbled by almost 30 percent from their all-time high in 2022, when a staggering five works from the Paul Allen estate commanded more than $100 million each.

- Every sector contracted in 2023. The most pronounced decline, after Imp-Mod, was in the ultra-contemporary category, which shrank by 26 percent. Speculators who gambled on the work of young artists during the pandemic have begun to slow down or back away, experts say. The category saw minor growth only in the lowest price brackets (under $10,000 and $10,000 to $100,000).

- The more historic the category, the more results are determined by supply rather than demand. Most of the best Old Masters and Imp-Mod works are in museum collections, but strong examples that do surface generate strong prices. Last year was a relatively unremarkable one for Old Masters supply; sales shrunk by 14.1 percent.

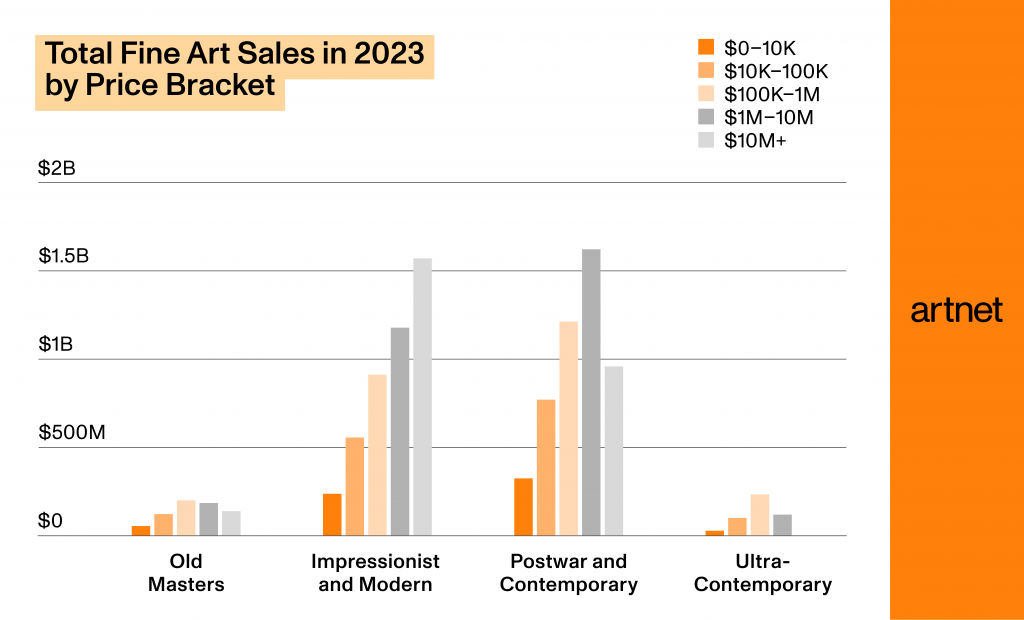

What Price Point Was Most Popular?

The $1 million-to-$10 million range delivered the big bucks.

Source: Artnet Price Database and Artnet Analytics.

- For seven of the past 10 years, the $1 million-to-$10 million price range has been the most lucrative segment of the market. Last year was no different.

- Sales of art in that range declined by a modest 5 percent year over year, compared with the dramatic nearly 40 percent drop in sales of art worth more than $10 million. (By this point, you can probably guess that the absence of an estate like the masterpiece-heavy Paul Allen collection had a lot to do with the dip at the highest end of the market.)

- The market’s lower end, meanwhile, saw modest growth: sales of art in the $10,000-to- $100,000 range increased by 3.1 percent year over year, while art priced between $100,000 and $1 million grew by 2.2 percent. Some of this segment’s resilience may be due to enhanced opportunities to buy art online, where price points tend to be lower.

Follow Artnet News on Facebook:

Want to stay ahead of the art world? Subscribe to our newsletter to get the breaking news, eye-opening interviews, and incisive critical takes that drive the conversation forward.

This post was originally published on this site be sure to check out more of their content