This article is part of the Artnet Intelligence Report, The Year Ahead 2025. Our analysis of the second half of the year’s market trends provides a data-driven overview of the current state of the art world, highlighting auction results and trends, and spotlights the evolving tastes in a turbulent market.

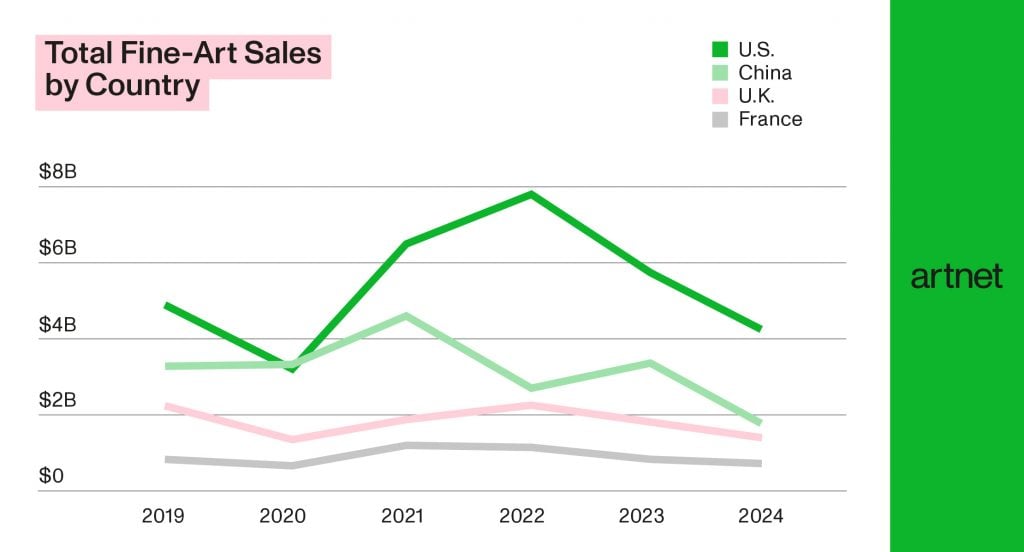

The U.S. remained the largest art market globally, with fine-art auction sales generating $4.3 billion in 2024, down 25.5 percent year over year. Inflation remained high for most of the year, driving costs up and sales down, while few high-value single-owner sales—which buoyed totals in previous years—went under the hammer. Although this is the third-lowest U.S. sales total in a decade, it is still around $1 billion above pandemic-altered 2020.

China’s $1.9 billion total represents a whopping 46.1 percent dip from 2023. The country saw a downturn-defying 13 percent bump in 2023, as material hit the market after extended pandemic restrictions eased. China experienced a slowdown in GDP growth in 2024, which has been attributed to a struggling property sector and weakened consumer demand.

Even as Christie’s and Sotheby’s launched new Hong Kong headquarters last year, a few Chinese auction houses, like Beijing Hanhai, declined to report some sales, presumably because of poor performance, and Beijing ChengXuan ceased operating in October. Although these small firms may not have contributed meaningfully to China’s total sales figures, their struggles could signal distress in the country’s auction market.

A crowd armed with camera phones captures auctioneer Adrien Meyer selling Claude Monet’s Nymphéas at Christie’s inaugural evening sale at the Henderson in Hong Kong in September 2024. Courtesy of Christie’s.

The U.K. market contracted by 20.5 percent year over year, notching just $1.4 billion in sales, the lowest total in a decade. Dogged by Brexit-related downturn, the size of many major auctions in London have shrunk in recent years and, last summer, Christie’s scrapped its summer sales in U.K. capital due to lack of demand. Consumer confidence also fell sharply late in the summer as the newly installed Labour government introduced the biggest tax-raising budget in decades.

Sales in France fell by 16 percent, to just under $745.3 million, despite ongoing auction-house investment in the region, including the opening of Sotheby’s new sale room.

This post was originally published on this site be sure to check out more of their content